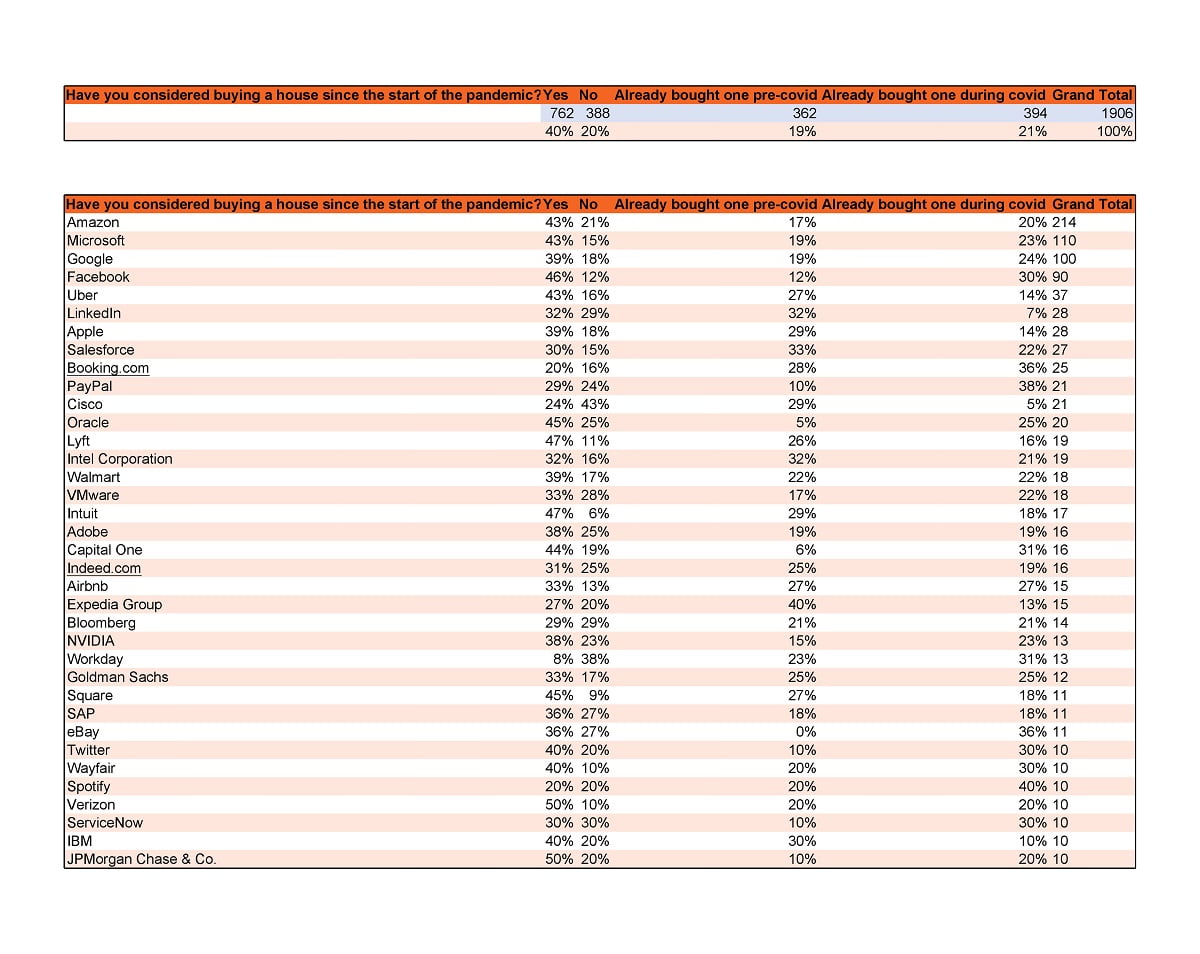

40% Of Professionals Have Considered Buying A House Since The Start Of The Pandemic

Q4 2020 hedge fund letters, conferences and more

Home prices in 20 U.S. cities are climbing fast due to low-interest rates and lack of inventory.

Professionals Have Considered Buying A House Since The Pandemic Started

According to data gathered by Blind, the largest anonymous professional network, 40% of professionals have considered buying a house since the start of the pandemic. Another 21% say they have already purchased a home during the pandemic.

The anonymous app ran these three questions from 2/24 - 2/25/21 and gathered responses from nearly 2,000 professionals:

- Have you considered buying a house since the start of the pandemic?

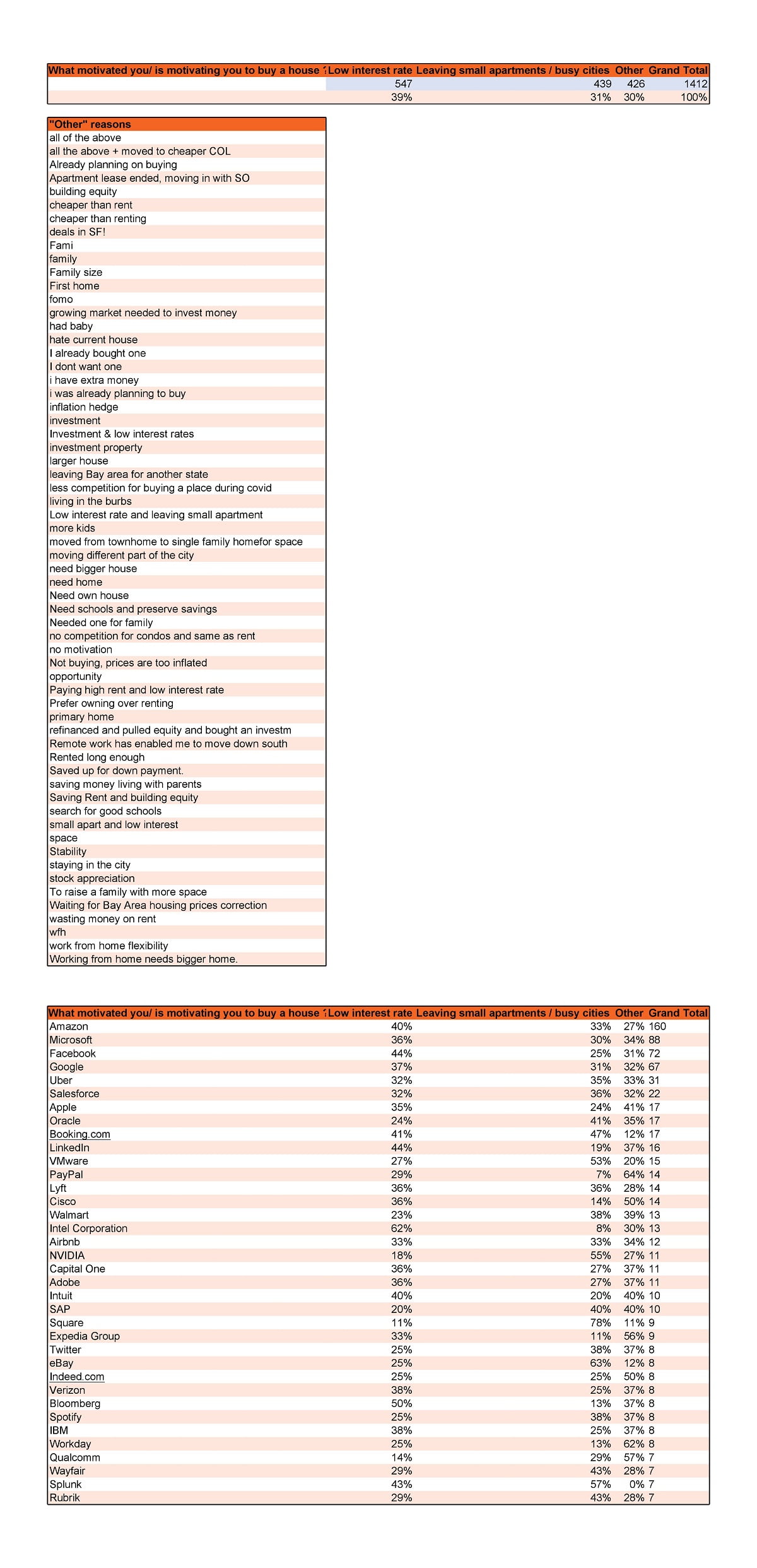

- What motivated you/ is motivating you to buy a house?

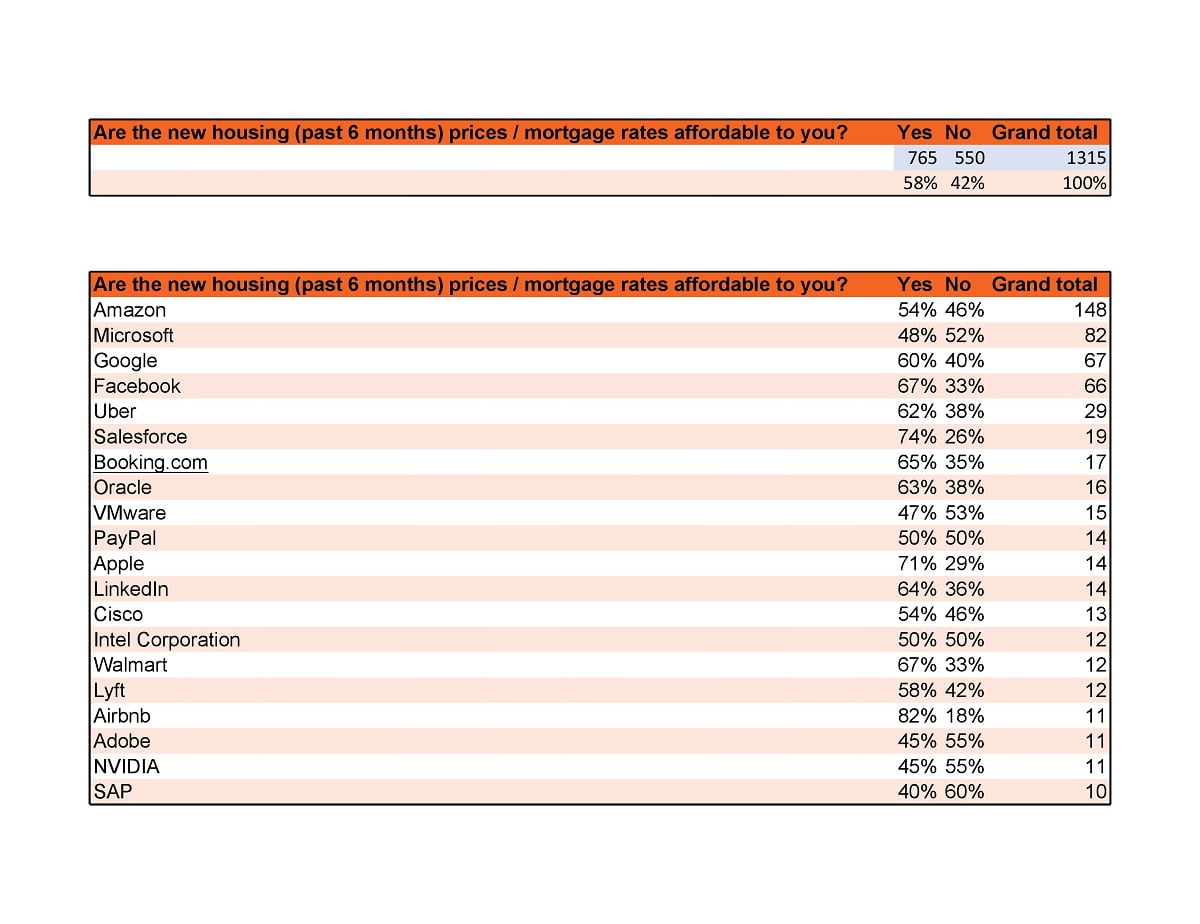

- Are the new housing (past six months) prices/mortgage rates affordable to you?

While 39% of survey respondents say the low-interest rates are what is motivating/ motivated them to buy a home, another 31% say they are fleeing small apartments in busy cities. One respondent shared they purchased a home because they had a baby, a different user shared they were “leaving the Bay area for another state.” Another user shared that “Remote work has enabled me to move down south.”

And while most users on Blind work in tech and have tech salaries, 42% of respondents shared that the new housing (past six months) prices/mortgage rates ARE NOT affordable.

Access some of the data here.

A Blind user at Microsoft shared, “I keep losing on house bids even when escalating the list price by 60-70k .. are people going nuts. Lost a bid again for a house in Lynnwood as I post this, seriously getting frustrated.”

A Blind user at Facebook shared, “ Just bid on a house. Beautiful, but far away if you need to commute. List as 1.25, slightly higher than its neighborhood, but sold at about 1.6. This is insane how people can afford it. For first-time home buyers, it sucks. Will the government control the price? Even the stock market will halt if the price goes ridiculous.”

San Jose, Honolulu, and San Francisco remain the least affordable cities in the U.S, and professionals on Blind are actively discussing the housing markets in these areas.