If one word could describe the U.S. stock market of 2020, it would be “improbable.” The S&P 500, for example, has risen about 14.14 percent this year despite a pandemic that is deadly to both people and corporate profits. Yet even after witnessing this year’s string of unprecedented developments, investors might be shocked to learn what lies behind the recent muscular share price growth of Freedom Holding Corp (NASDAQ:FRHC). This Las Vegas–incorporated bank and securities brokerage has its principal office in Almaty, Kazakhstan, and a major presence in other cities of the former Soviet Union.

Q3 2020 hedge fund letters, conferences and more

In Freedom Holding’s most recent quarterly filing of Nov. 19, management attributed the company’s earnings success to customers undertaking a higher volume of trades as a result of “the unique market characteristics surrounding the COVID 19 pandemic.” In other words, quarantined or marooned investors are day trading to pass the time as disease spreads across the world. And thus Freedom Holding’s astronomical revenue growth has seemingly made it the fastest-growing financial services company on Earth.

So why aren’t the big brokerage operations of the U.S. and Western Europe replicating this model? A clue as to why they are not can be found in Freedom Holding’s Securities and Exchange Commission filings. The Foundation for Financial Journalism has found that Freedom Holding serves up gaudy growth figures with few disclosures or incongruous explanations at best — and accompanies them with an operations structure akin to that of a penny stock company.

Despite the fact that Freedom Holding is incorporated in the States and its shares are traded on Nasdaq, nothing about its actual U.S. presence should give American investors any confidence. LinkedIn lists only one U.S.-based Freedom Holdings employee. And the company has situated its U.S. headquarters inside a Regus coworking space. The company’s auditor, Salt Lake City–based WSRP LLC, has just 16 partners and only four publicly traded clients, according to a Public Company Accounting Oversight Board filing. Similarly Freedom Holding’s outside legal adviser, the law firm Poulton & Yordan, has merely two licensed attorneys and no website. All the while, most of the company’s operations — taking place in its trading and retail brokerage division, Freedom Finance — are carried out thousands of miles away in numerous jurisdictions, mostly in Russia, Ukraine and Kazakhstan, but also Europe, and quite actively in Cyprus.

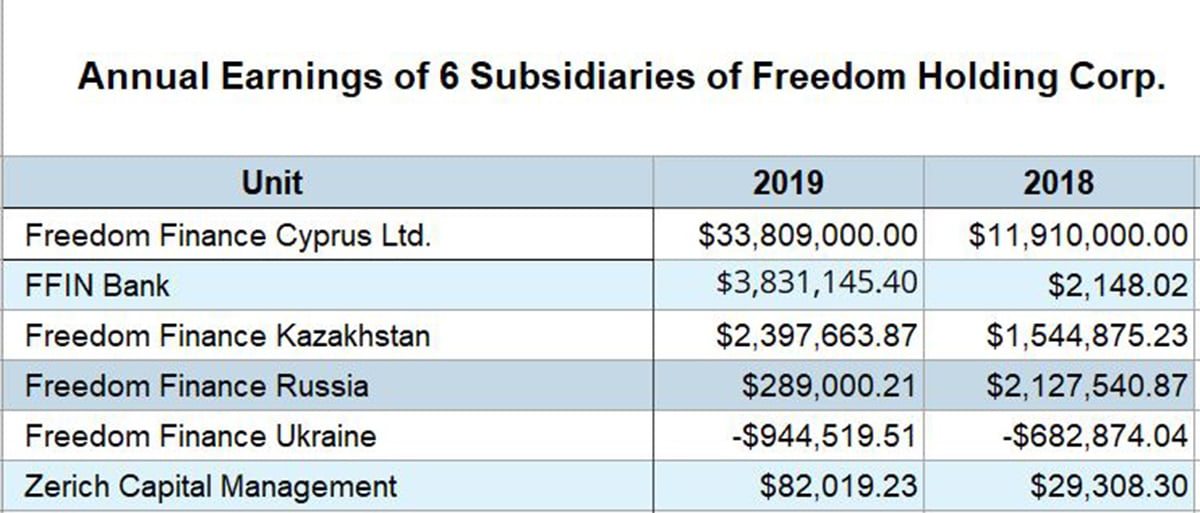

Although Freedom Holding’s SEC filings do not reveal how it is making its great fortune, its subsidiaries’ audited financial statements do. These filings reveal that the company’s Cyprus unit is staggeringly profitable, having earned more than $33 million last year following a $30,000 loss in 2017.

Additionally, Freedom Holding has a highly unusual relationship with a company based in Belize that’s owned by Timur Turlov, Freedom Holding’s founder and CEO. While little is disclosed about it in Freedom Holding’s SEC filings, this Belize entity, FFIN Brokerage Services, appears to have access to the funds of Freedom Holding’s clients for as long as 93 days, a major deviation from typical brokerage industry practices across the globe.

Reporting Earnings That Might Be Too Good To Be True

Analysts reading Freedom Holding’s most recent quarterly filing will be hard pressed to explain its earnings growth. In the first six months of its financial year that ends on March 30, the company had its net income rise to $47.83 million, nearly triple what it reported for the same period a year ago — and more than double the $22.1 million it earned in all of fiscal 2019.

How unique is Freedom Holding’s almost 38 percent net profit margin? Goldman Sachs — long Wall Street’s most profitable company — managed only a 25.3 percent net profit margin in 2006, during the manic run-up to the global financial crisis.

Freedom Holding’s filings suggest that its managers have apparently solved an enduring mystery of the business world: figuring out how to turbocharge revenue growth without triggering a concurrent spike in expenses or risk.

Growing a business typically requires managers to invest in new hires, technology or plant improvements in the hopes that each $1 spent will net $1.50 before taxes in three to four years. But Freedom Holding’s income statements imply that its management can spend 75 cents to realize a return of $3 in just a few months, all without having to sell stock or take on a mountain of debt.

The universe of companies that claim to do this is limited to Freedom Holding. Even profitability and capital efficiency superstars like Google and Berkshire Hathaway cannot approach that performance.

Another factor that sets Freedom Holding apart is its apparent efficiency and productivity. A business in an aggressive expansion mode typically registers a depressed revenue-per-employee figure as it assumes front-loaded costs (adding head count, paying for technology updates) that do not immediately result in new revenue.

Not so for Freedom Holding, though. In fiscal 2019, it generated $81,649 in revenue for each of its 1,343 full- and part-time employees; in 2018 that figure was $65,105 for every one of its 1,141 employees. Adding only 202 employees in fiscal 2019 led the company to triple its net income.

Marketing materials in English on the European version of Freedom Finance’s website present a simple proposition: Tap Freedom Finance to invest in U.S.-listed initial public offerings for a golden ticket to profits. (The website’s Russian text translates into this English prose with Google Translate.)

To whet investors’ appetites, a brochure posted on Freedom Finance’s website declares that since 2012, a set of 107 seemingly randomly picked U.S.-listed companies have reaped returns of 129 percent on average following their IPO.

And a YouTube promotional video for Freedom Holding’s Freedom Finance Europe claims that it secures 50 percent returns on IPOs (after a “three-month lockup” period ends).

Putting aside whether grandiose claims are true or not, Freedom Finance holds no U.S. securities industry registrations or licenses and cannot underwrite U.S.-listed IPOs or participate in the activities of syndicate selling groups. It must rely on other brokerage firms to execute trades on U.S. exchanges for its clients. (In Kazakhstan, Freedom Finance does, however, underwrite IPOs, according to a June 2017 Reuters article.)

Yet Freedom Holding’s clients are buying shares of companies’ initial public offerings – in large quantities.

Routing Transactions To A Turlov Outfit In Belize

The way these trades are apparently being accomplished is through a complicated maneuver: Freedom Holding’s clients send money to FFIN Brokerage Services Inc., a Belize City–based broker-dealer whose website promises “direct access to the U.S. market.” Yet FFIN Brokerage Services is not a subsidiary of Freedom Holding. Instead Freedom Holding CEO Turlov owns it, as clearly laid out in Freedom Holding’s July 2018 proxy statement.

Turlov’s ownership of FFIN Brokerage Services seems to be a detail that Freedom Holding is not keen to frequently share. True, the fine print of a 2017 prospectus also alluded to this fact, as did a 2019 Cyprus regulatory disclosure. And, yes, a June 2019 S&P ratings note once described FFIN Brokerage Services as Freedom Holding’s “largest counterparty.” But other Freedom Holding documents, especially its SEC quarterly and annual filings that more investors would regularly encounter, do not mention FFIN Brokerage Services or Turlov’s ownership of it.

And FFIN Brokerage Services is likely involved with Freedom Holding’s hefty number of related-party transactions. Numerous Freedom Holding’s brochures and contracts instruct clients to send their funds to FFIN Brokerage Services. A Freedom Holding marketing document in May 2017 apparently referred to FFIN Brokerage Services as having “conducted a series of [IPO] deals this year,” per a translation offered by Google Translate.

Yet, apart from FFIN Brokerage Services’ holding a license to trade foreign currencies in Belize, the company lacks regulatory approvals to execute trades in any other countries. Despite this, a disclosure by Freedom Holding’s Cyprus subsidiary about its top brokers cited FFIN Brokerage Services as handling as much as 9.12 percent of its equity orders in 2019. And Freedom Holding’s 2017 prospectus referred to FFIN Brokerage Services as “a placement agent” for its share offering.

Perhaps the strangest aspect to FFIN Brokerage Services’ involvement is that Freedom Holding’s clients must abide by an unusual 93-day lockup provision, per a FFIN Brokerage Services document. (At other U.S. brokerage companies, a client order for buying or selling public securities, even as part of an IPO, can be canceled at any point until the order is transacted — without any lockups or restrictions.)

Nothing in Freedom Holding’s documents — in English or Russian — explains how clients might benefit from the 93-day lockup of their capital. This arrangement, however, could give FFIN Brokerage Services access to plenty of cash for three months, with the sole obligation of delivering the newly issued shares at the end of the period.

Blurring The Lines

In its 2019 annual report, Freedom Holding disclosed 12 different types of related-party transactions with Turlov-owned entities. And during the six months that ended Sept. 30, the value of commissions that Freedom Holding earned from its business with Turlov entities amounted to 57 percent of its $126.12 million in sales — or almost $72 million.

Because Turlov’s related-party dealings with Freedom Holding are so extensive, one can ask if this company has a strong future doing any business unconnected to Turlov.

And cash is going out the door to Turlov-linked affiliates as well: Through Sept. 30, more than one-third of Freedom Holding’s commission payments, or $10.38 million, went to entities owned by Turlov.

While related-party transactions are legal, savvy investors often closely scrutinize them to ensure that executives are not misusing shareholder assets for private gain. To that end, the SEC requires public companies to disclose such relationships in their annual proxy statements. And when public companies have not been forthcoming in describing their role in handling a CEO’s or a board member’s private investments, the SEC has been aggressive in filing claims against such companies and their executives.

Michelle Leder, the founder of Footnoted, described Freedom Holding’s related-party dealings as “more than a bit dizzying.” Her subscription service analyzes public company filings for evidence of potential transactions or misleading data.

“I almost felt like I needed a flowchart to figure [the related-party transactions] all out — lots of money going back and forth between different entities with Turlov being the common link,” Leder said.

One possible explanation offered by Leder for the high volume of self-dealing is that the board of directors of Freedom Holding can’t operate as a counterweight to Turlov since it is a controlled company, according to New York Stock Exchange guidelines. More than 50 percent of its shares are held by one person or entity and thus it’s exempt from SEC requirements for having independent directors.

Raking In Capital In Cyprus

Deeply buried in a regulatory filing of Freedom Holding’s Cyprus subsidiary is a curious detail: The subsidiary, Freedom Finance Cyprus Limited, does not need much capital to generate a lot of revenue.

Put on the green eyeshade briefly: European Union regulations require that financial institutions set aside 10.5 percent of their tier 1 capital (or the sum of their retained earnings and established reserves) as insurance against unexpected losses. Freedom Holding’s European operations, which consist primarily of its Cyprus subsidiary, reported $42.6 million in tier 1 capital at the end of last year. Thus, as of the end of December, the amount of capital that the company’s European operations (known as Freedom Finance Europe) needed to hold in reserve was a little more than $4.47 million. As a result, the Cyrus subsidiary ended up with $38.13 million in ready capital in its coffers.

To be sure, holding additional cash in reserve for various contingencies is prudent for a company. And given stock markets’ volatility, extra liquidity could mean the difference between life and death for a financial services company like Freedom Holding.

The Cyprus subsidiary’s regulatory filings also reveal a rather remarkable profitability. For fiscal 2019, the subsidiary earned $33.80 million, more than fiscal 2018’s $11.9 million and a considerable improvement over its $30,000 loss in fiscal 2017. As the chart below shows, Freedom Finance Cyprus Limited’s total 2019 income was far greater than the combined incomes of Freedom Holding’s other subsidiaries.

Sources: audited income statements

Straining For Cash In Other Parts Of The Organization

Yet while a pile of cash sits at its Cyprus subsidiary, Freedom Holding is showing signs of being desperate for cash in virtually all other corners of its organization. Freedom Finance Europe is offering money market interest rates that are four to six times higher than what U.S. institutions are promising. Banks usually attract depositors for their money market funds by paying a few extra basis points in interest — but not multiples of what a rival does. U.S. regulators often scrutinize banks whose money market interest rates are outliers within the marketplace on the view that management may want to quickly inject cash to conceal previous losses. In fact, the parent company’s main division, Freedom Finance, is paying its brokers a 15 percent commission if their clients deposit 1,000 euros in cash, according to an “agent agreement” posted on its website.

Furthermore, the way Freedom Holding funds its operations is not congruent with the typical practices of a company that can readily access $38 million in cash. The company’s banking and brokerage subsidiaries in Russia and Kazakhstan, operating under the Freedom Finance umbrella, are funding themselves through sales of short-term bonds with high interest rates — ones even as steep as 12 percent. Unless they have no other option, most corporate management teams would try to use available resources to reduce a drag on earnings from interest expense.

Exactly what is Freedom Holding doing in Cyprus to make that kind of money? The Cyprus subsidiary’s primary operation is offering Freedom24, an online trading platform it touts as “an online stocks store.” Until earlier this year, Freedom 24 used fraudulent credit card processor Wirecard for payments. Cyprus is also where Freedom Holding has based its nascent Freedom Finance Europe division that’s aimed at capturing business from day traders and individual investors in the Western European market.

Even though the customers targeted are individuals who are new to trading or investing, Freedom24 and Freedom Finance Europe are bare bones offerings in comparison with the mobile applications offered by, say, InteractiveBrokers or TD Ameritrade.

Partnering With A Troubled Company To Execute Trades

Furthermore, Freedom Finance Cyprus Limited is enlisting a brokerage that recently landed in regulatory hot water to carry out its trades: New York–based brokerage firm Lek Securities. The SEC alleged in 2017 that Lek Securities had improperly traded options for Ukrainian clients.

(In October 2019, Lek Securities’ co-founder Samuel Lek agreed to pay a $420,000 penalty and admitted to the SEC that he had broken federal securities laws. Lek Securities paid $1.52 million in penalties and disgorgement and also acknowledged a series of violations. FINRA, in conjunction with other U.S. exchanges, gave Lek a lifetime ban from the securities industry and fined Lek Securities an additional $900,000 for its supervisory failures.)

And Freedom Finance’s tight relationship with Lek Securities goes back years. SEC correspondence shows that in 2015 Lek Securities sought to act as a prime broker for a planned Freedom Finance brokerage in the U.S. named FFIN Securities Inc., for which it would process and match up its trades, as well as serve as a custodian for its securities. (Freedom Finance dropped the project the following year.)

In addition, with Freedom Finance unable to execute its own trades on U.S. exchanges, London-based Lek Securities U.K. Limited last year handled 90 percent of Freedom Finance Cyprus Limited’s equity orders, after doing 99.5 percent of them in 2018.

Betting It All

Curious as to how such a sprawling operation, with units from Belize to Cyprus and from Almaty to Vegas, emerged? In 2008, while a 20-year-old university student, the Russian-born Turlov launched Freedom Finance in Moscow, and it catered primarily to Russian day traders. Turlov bought a small money management firm in 2013.

In November 2015, Turlov merged Freedom Finance’s assets with those of Salt Lake City–based BMB Munai Inc., a dormant oil and gas exploration company that had (unsuccessfully) sought to export oil from properties in Kazakhstan. BMB Munia had for a while listed its shares for public trading in the United States. Turlov renamed the newly merged company Freedom Holding Corporation and incorporated it in Las Vegas. In October 2019, Nasdaq listed it on the Nasdaq Capital Market tier of early-stage companies. And just this past August, the company’s Kazakh brokerage unit, Freedom Finance JSC, purchased Bank Kassa Nova JSC in Kazakhstan. This joined the Moscow-based retail bank (FFIN Bank) that Freedom Holding had bought in 2017.

In a September profile of Turlov, Bloomberg News noted that the financial services assets he had begun cobbling together in 2008 now amount to one of Russia’s 10 largest brokerage firms. A Bloomberg article from October 2017 is more illuminating: Turlov is revealed to have a riverboat gambler’s risk management practices.

Kazakhstan-based Freedom Finance JSC borrowed money using short-term repurchase agreements, pledging its (large) positions in the stocks of a handful of local companies as collateral. The Kazakh brokerage then used that money to expand its market-making activities (such as posting the prices it offers to buy and sell stocks) on the Kazakhstan Stock Exchange.

This was an incredibly risky strategy. Emerging market equities are frequently thinly traded and volatile. Had the price of Freedom Finance’s pledged stock declined, the firm’s repurchase-agreement counterparties could have either immediately demanded additional cash as collateral or seized (and sold) the pledged shares, threatening the company’s solvency.

Yet as a chart of the Kazakhstan Stock Exchange index shows, Turlov’s gambit worked: Freedom Finance, the exchange’s busiest trader, profited handsomely when the stocks it made markets for gradually increased in value. Freedom Holding’s fiscal 2017 10-K annual report shows a securities trading gain of $23 million, to $33.74 million, from $10.8 million in the prior fiscal year.

In the weeks prior to publication of this article, the Foundation for Financial Journalism sought comments from Freedom Holding. After Adam Cook, the company’s corporate secretary, declined to make Turlov available for a telephone interview, email questions were sent on Nov. 12 and again on Nov. 13. On Nov. 25, Ron Poulton declined to address them, citing the availability of information in its SEC filings and the company’s website.

Impressed by this article? Please share it with your friends and colleagues. Then help the nonprofit Foundation for Financial Journalism continue to tell its rigorously reported pieces about elaborate corporate deceptions and consumer scams: Make a tax-deductible contribution of your own or reach out to someone else who can. Founded in 2012 as the Southern Investigative Reporting Foundation, this unique independent journalism outlet relies solely on the contributions of individual donors and philanthropic groups.

Article by Roddy Boyd, Foundation For Financial Journalism