Cleveland Fed’s Systemic Risk Indicator is Reliable, Timely, and Valid When Predicting Stress

The Cleveland Fed’s systemic risk indicator (SRI) was developed in response to the financial crisis of 2007-2009 in the hope that it could provide regulators with advance warning of conditions that might warrant a corrective response.

Q3 2020 hedge fund letters, conferences and more

In this Economic Commentary, Cleveland Fed researcher Ben Craig provides a review of the SRI’s performance from 2001 to 2020, a period that predates and includes the financial crisis, to see how well it signaled times of known stress.

“I find that the index is reliable, timely, and valid,” says Craig. “It signaled each of the stressful periods that occurred over the period, and provided good ongoing information during the financial crisis.”

The reason that the SRI works well is that it combines measures of balance-sheet strength, volatility, and correlation of the asset values of the major banks with the forward-looking characteristics of option prices.

The Cleveland Fed’s systemic risk indicator can be computed daily and has the additional advantage of being relatively free of false positives, where an indicator can predict stress that is not there.

Read More: How Well Does the Cleveland Fed’s Systemic Risk Indicator Predict Stress?

In case you missed it:

The Cleveland Fed has launched a Program on Economic Inclusion. Visit the program’s website for research, analyses, and upcoming events on issues that support economic opportunity for all.

How Well Does the Cleveland Fed's Systemic Risk Indicator Predict Stress?

by Ben R. Craig

A number of financial stress measures were developed after the financial crisis of 2007–2009 in the hope that they could provide regulators with advance warning of conditions that might warrant a corrective response. The Cleveland Fed’s systemic risk indicator is one such measure. This Commentary provides a review of the SRI’s performance from 2001 to 2020 and finds that it has performed well, providing a reliable, valid, and timely signal of elevated levels of financial system stress.

An important tool for monitoring financial stability is a stress index, a constructed measure that indicates whether the banking or financial sectors are “under stress.” A number of such indexes were developed after the financial crisis of 2007–2009, and their primary purpose is to alert the attention of policymakers to conditions that may warrant taking actions. How well these indexes perform can be evaluated along several dimensions. An analogy is a sophisticated burglar alarm system: A good system is reliable in that it will give a clear signal when attention is needed. It is timely in that it will give enough advance notice so that corrective action can be taken. It is straightforward in that the alarm buzzes to get the observers’ attention and then activates other systems to assist observers in making decisions about what actions to take. A good system is also ongoing in that it continues to function during a break-in and will turn off once the threat has disappeared (while retaining a record of when the attack occurred). Finally, the alarm gives valid signals in that it rarely gives a warning of an attack if an attack has not happened.

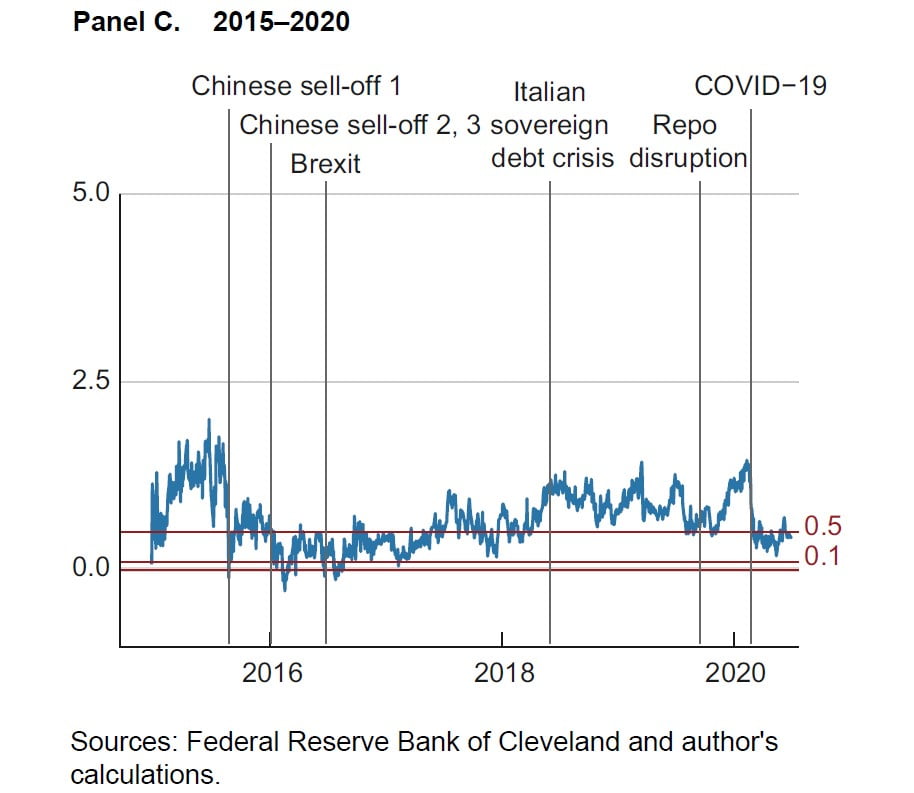

This Commentary provides a retrospective, narrative analysis of one such index, the Cleveland Fed’s systemic risk indicator (SRI), as a tool for monitoring stress in the financial sector. My approach is to examine the SRI’s daily index values from 2001 to 2020, a period that predates and includes the financial crisis, to see how well it signaled times of known stress along the dimensions above. I find that the index is reliable, timely, and valid. It signaled each of the stressful periods that occurred over the period while signaling only five “false positives,” times when the index predicted stress that did not materialize. Furthermore, those false signals lasted only one day, with one exception that was two days, after which the index went back to normal. Finally, it provided good ongoing information during the financial crisis.