The world is a very different place to what it was last year, never mind 10 years ago. The adoption and use of digital technology has been accelerated due to advances in AI and alternative data.

Q3 2020 hedge fund letters, conferences and more

This acceleration in growth has had a massive impact on the way we live our daily lives, but it’s also had an impact on how exposed our identities can be to fraudsters.

The Leading Risk For Banks

Bank executives and banking experts list cybercrime as the leading risk for banks. It is estimated that in 2019, criminals made $4.2 trillion from fraudulent activity worldwide and around half (54%) of fraudulent incidents were cyber-related.

According to Barclays Bank, there was a 66% increase in reported scams in the first six months of 2020 compared with the last six months of 2019. Fraud volumes also rose 61% between May and July this year.

There are a number of reasons fraud has risen, the global pandemic for one but mainly:

- A greater number of mobile transactions.

- More sophisticated synthetic IDs.

- And more goods and services are sold online.

- More cross-border transactions.

- More automated botnets.

These scenarios are more susceptible to online fraud and in the current economic climate, it’s never been more important to make sure your anti-fraud measures are up to scratch. More than 2 in 5 consumers worldwide have experienced a fraudulent event online, and according to PwC’s bi-annual Global Economic Crime and Fraud Survey, 47% of companies have experienced fraud in the last two years.

As anti-fraud professionals know, individuals who perpetrate fraud look just like everyone else. They are our coworkers, our acquaintances and even our friends and family members. Many appear outwardly honest and ethical, which makes it particularly difficult for us to suspect or believe that they would breach their employers’ trust. And yet, effectively preventing and detecting fraud requires us to do just that.

The Profile Of A Typical Fraudster

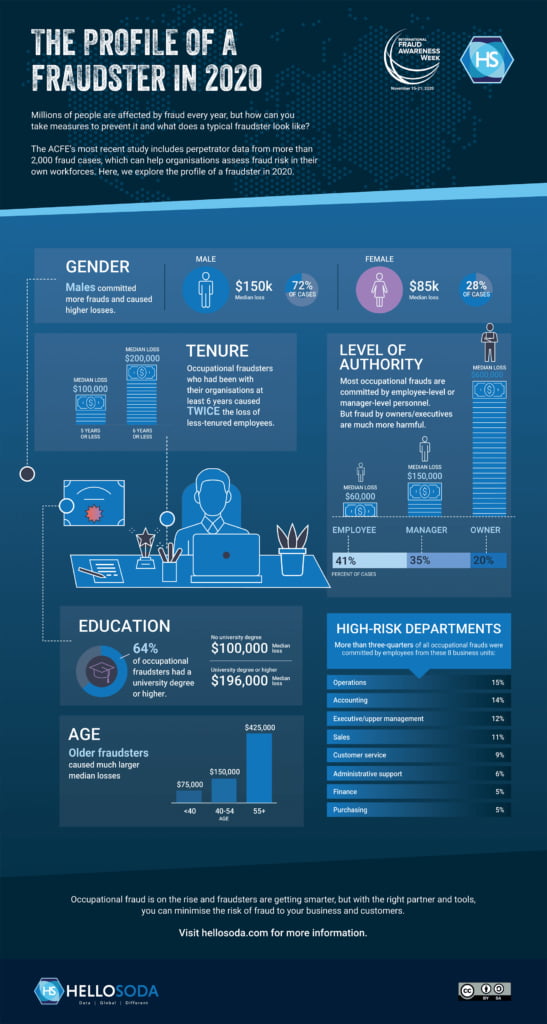

Millions of people are affected by fraud every year, but how can you take measures to prevent it and what does a typical fraudster look like? With criminals using more and more sophisticated methods of fraud, it’s never been more important to safeguard your identity.

The ACFE’s most recent study includes perpetrator data from more than 2,000 fraud cases, which can help organisations assess fraud risk in their own workforces. Hello Soda have explored the profile of a typical fraudster in 2020:

- Males committed 72% of reported frauds and caused higher losses, nearly three times more than females (28%).

- Occupational fraudsters who had been with their companies at least 6 years caused twice the loss of employees who had been in their roles for 5 years or less.

- Most occupational frauds were committed by employee-level (41%) or manager-level (35%) personnel. But fraud by owners/executives are much more harmful.

- More than three-quarters of all occupational frauds were committed by employees from 8 business units, with those in operations causing 15% of incidents.

- 64% of occupational fraudsters had a university degree or higher and the average loss caused by them was almost double.

- Older fraudsters caused much larger median losses, with those over 55 years old responsible for 65%.

Obviously, simply meeting the profile outlined by the data above doesn’t mean that an individual is going to commit fraud, nor should someone who falls outside the profile be immune from suspicion. However, examining trends in the characteristics of fraudsters can provide context and perspective to those charged with identifying high-risk areas and individuals.

Fraud is on the rise globally and criminals are using more and more sophisticated methods to steal personal information. Check out Hello Soda’s infographic below where we discover how the typical fraudster is not necessarily who you would expect:

Tips To Avoid Being A Fraud Victim

As more and more of us shop online over this festive season, we become more susceptible to cyber-crime. Here are five simple tips that might help you avoid becoming a victim of fraud over the Christmas period:

- Turn on alerts, if available, from your bank or card issuer. This can inform you when spending is taking place on your card or account.

- Check your accounts more regularly to make sure all the purchases are genuine. It’s easy to forget what you bought a few weeks later.

- Look at your privacy settings on platforms to make sure you’re only sharing payment information you want to share.

- Use your card for major purchases, because of the protection supplied on card purchases.

- Don’t fall for phone calls where the caller asks for your card details. If you didn’t make the call, you don’t know that it’s legitimate. See this advice from Action Fraud in the UK.

And of course, be wary of links to online sites or stores with great deals that simply don’t look trustworthy. If something seems too good to be true, it probably is! And if unknown people are calling or emailing for details, and it feels wrong then don’t oblige. Ignore it, or check for yourself and investigate.

The simple rule is to not give personal details or banking details to anyone or any site that you can’t be 100% sure about.

Occupational fraud is on the rise and fraudsters are getting smarter, but with the right partner and tools, you can minimise the risk of fraud to your business and customers. Visit hellosoda.com to find out more.