The Broad Market Index was up 2.16% last week and 70% of stocks out-performed the index. Our third quarter financial statement update for U.S. companies is about 90% now complete. Retailers and other companies with fiscal quarters ended October will file in coming weeks.

Q3 2020 hedge fund letters, conferences and more

Margin Pressure Across The Board

Corporate growth continues to fall. Gross profit margins are the most reliable indicator of recovery and the average gross profit margin is down for the sixth consecutive quarter. There is more than virus going on here. This period 52% of companies achieved a rising gross profit margin. Better than last quarter but in capital value terms only 40% of companies had rising gross margins; which is near the lowest in the 25-year record.

Cost Containment Efforts Under Way Even As Sales Growth Falls

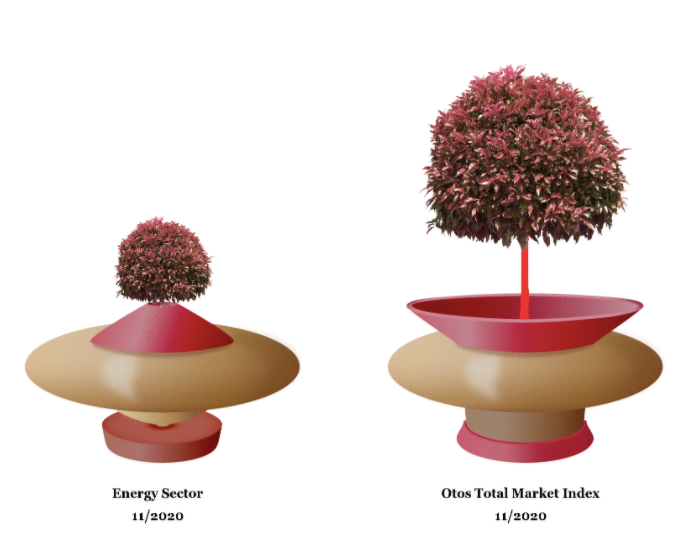

Among Industrial and Energy sector companies, gross profit margin improvements were more frequent despite negative and lower sales growth. This is evidence of aggressive cost containment pushing companies in crisis mode. As sales shrink and cash flow drops companies are forced to reduce costs mostly through layoffs. This was delayed in the second quarter this year due to government incentives. With these incentives now expired, costs are being dramatically reduced at companies with negative sales growth as a last-ditch effort to avoid negative cash flow and ultimately insolvency

Debt service holidays are also expiring and a surge in bankruptcies is underway. Capital expenditures are lower even as sales growth falls. This is a sharp reduction in dollars spent with projects delayed and cancelled.

Technology Sector struggles

The most important development was the persistent growth weakness in the Technology sector where gross profit margins continue a two-year drop both on average and more frequently. Technology stocks have been the dominant performers since the pandemic began (much stronger than Healthcare). Of particular concern are Semiconductors companies. This is a highly cyclical industry with broader evidence of a growth peak.

US Industrial Recovery?

The increase in the frequency of sales growth improvement in the Basic Industry and Consumer Cyclicals (Autos & Housing) suggests that a traditional U.S. Industrial recovery has begun. If so, this will be supported by the recent encouraging COVID-19 vaccine news and broader stimulus from the new administration.

What to BUY?

With share-prices broadly extended, it is too early to buy most Industrial companies. Search for high and rising sales growth companies with improving profit margins and preferably trading at depressed share prices. Sectors to look at are Consumer Growth (Healthcare) and Consumer Cyclicals (Retailers) where top-line fundamentals are improving.

Review your holdings now and sell falling profit margin companies trading at premium prices.

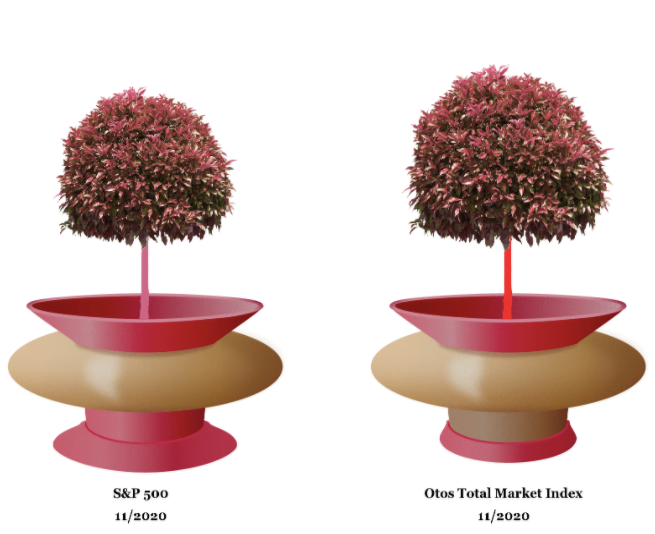

Q3 Review in Pictures

The more stable the pot appears, the better the attributes. Green and gold are great. Red is bad and the more intense the red the more urgent the call to action.

Visit www.Otos.io for details on the Components of the Otos MoneyTree Avatar.

Components of the Otos MoneyTree Avatar: