Perhaps the best stock market insights you can find is JPMorgans guide to markets because it has beautiful intelligence on short term data that function as stock market insights also for 2020 but also builds that info into long-term investing trends which is key for successful investing.

Q3 2020 hedge fund letters, conferences and more

Investing in stocks is definitely not easy, but by applying common sense, one can reach his investing life goals. That is what we are about here.

Best Stock Market Investing Insights (2020 & Outlook)

Transcript

Stock Market Intro

Good Fellow investors. Today I want to share perhaps the best stock market economy and investing outlook overview that's out there, JPMorgan's Q4 2020 guide to the market is out. And they really want to go over what they say about the markets, their data about the economy, the comparison between what's going on in the U.S., globally, fixed interest, and then also the investment outlook and perspective. Before we start, if you feel that you get value from this, if you like what we do here, please click that like button, subscribe and click that notification bell. Thank you very much. It means a lot for supporting the channel. Let's start. A lot of people work on this with probably the best market intelligence out there, which is the intelligence that investment banks have. If you look at what is there in this guide overview is just google JPMorgan guide to the markets and you will get the PDF, you have 76 slides, beautiful charts about equities, the economy, fixed income, international situation, investing alternatives too, if you are interested and also investing principles and long term returns. We're focused mostly on equities.

Stock Market Situation

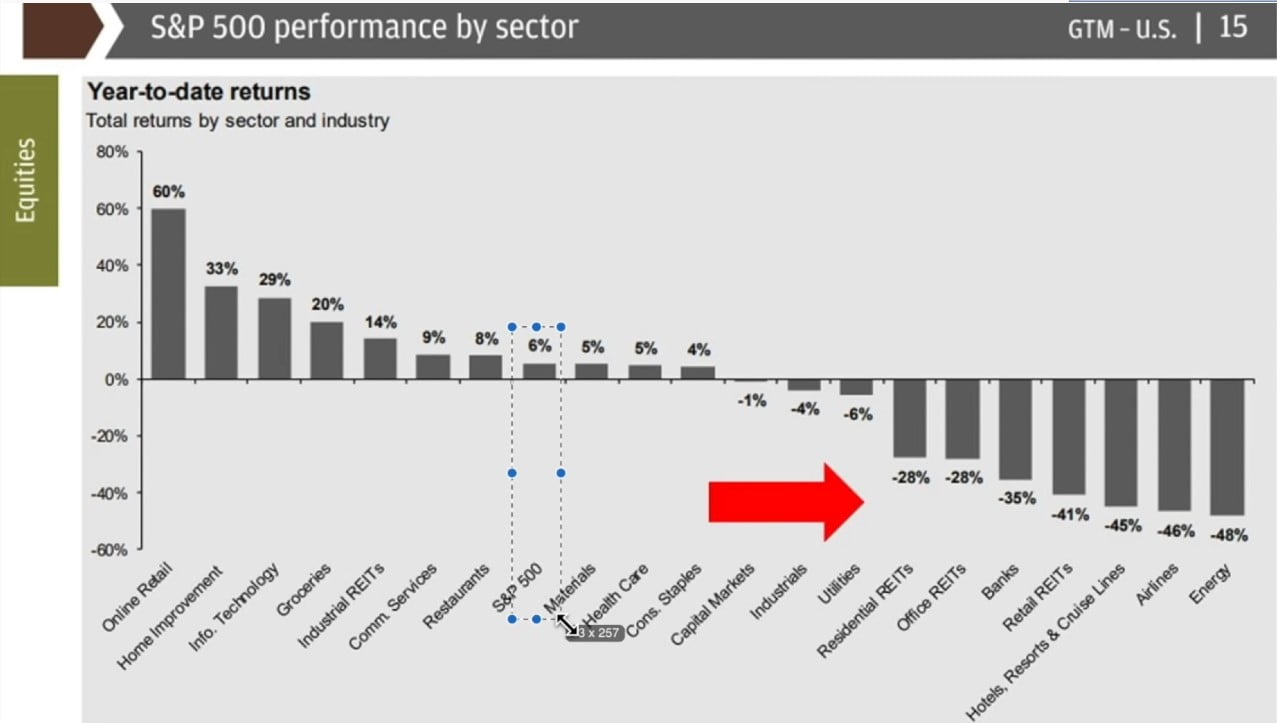

So let's start immediately with the topics from valuations from returns. And then we'll see what can we think about what's next for the markets from the inputs that we get from JPMorgan. The S&P 500, of course, with valuations, you see that we are on a high historical level and that usually means lower historical returns. Also five year annual returns on average from current levels can also be 8-9-10 percent, but on average, you are at 0 percent over 5 years. So the markets from a fundamental perspective are overvalued, those from a historical perspective. But you never know what will happen next. Let's try to figure that out. First, when you say about the markets, this is a beautiful chart. When you say the market, the market is the market, the market is the s&p 500 which returns to date of 6%. But the market is made of a lot of different sectors, you have online retail where the returns to date are 60% Home Improvement 33% technology 29%.

And then you have energy -48 Airlines, 46, Hotels, of course, REITs, banks, more REITs, more REITs, that are at the lowest of returns. So this is very negative, this looks great. And the average is then a positive for the market. So when somebody says the market, it's not just the market, that's the average is. The average is made of very, very different days. And now the question is okay, what's next for the market and you see here 120 years of returns, you have flat, then it goes up the market down flat returns for 10-15-20 years up for two decades, flat for 15 years, up for three decades, flat for 12 years, up for now we are at 11 years. And what you might be thinking is what's next for the market? Will stocks go up or will stocks go down? And the answer is nobody knows not even JP Morgan knows.

But if you look at the long term history, stocks go up. So as investors, what can we do with certainty, we can invest in good things that will be there over 10-20-30 years, so that we take advantage of the tailwind that's within the investment environment. Despite of the ups and downs and exuberance is that are offered by the rational market. And by the end of the video I'll show you one tailwind that few think about because most focus on the headwinds, but one day when that might be the game changer for all of us over the next 10 years. So stay tuned. Of course, nobody knows well, the market will go but as investors so we can you have to think not where the market will go. But where will our portfolio go? If we have 15 years of flat markets, especially in real returns, what are we going to do is that in line with our goals? That's a possibility, also with a high probability given the historical situation. So it's always good to think about okay, what are my goals? How am I going to reach those goals in light with what's going on. Let's continue with the economy.

The Economy

On the economy, the current recession is the third biggest recession, historically in the United States, but a very, very short duration. Post World War II, of course, that was the logical recession on less production. But okay, we are not in a great depression. So financial crisis was a little bit longer, but the decline in real GDP was much lower. So great overview of where we are, which is very important when it comes to investing. Then something very important for me is okay, what is making the economy 67.1% of the economy is consumption, 20% government spending, 15% of that with real money, 3-% with debt, and then we have investment and housing and this is something very important for me. So we have consumption as 67% of GDP, which tells me that, okay, there is so much marketing, there is so much everything around there that bombards you that makes you think that you are happy if you consume more, more and more. If you buy more and more things. So this is not related to JPMorgan, but just my thinking, perhaps the best investment is just simply to forget about what we think that other people think that is the right way to live, lower that consumption, you have plenty of money, others will not do that you have plenty of money to invest, to have a great life.

So perhaps the best investment is to simply lower consumption. I live in the mountains, nobody's bombarding me that I have to have that car, bigger car, better this, bigger house, 14 bathrooms or something like that, which makes my life easier, simpler, and much more financially healthier. Just think about that with 67% of GDP on consumption. It's something very smart we can do. Also, you have a great short term economic activity chart, you see how travelling is really bad, still, it will be hit even worse now with the second COVID wave. Diners also locked down, we are now in a lockdown. Everything is closed here in Europe, Slovenia. So travel, okay, hotels are recovered a little bit. But perhaps still going down later, after the summer, consumer credit/debit card transaction almost recovered the real levels. And given the low interest rates, everybody's rushing to buy a house. Very, very interesting.

Long Term Economic Outlook

But what uninteresting is the long term. Long term drivers of economic growth, and the United States is even better than Japan or Europe or something like that. So if we look at working age population, that is very bad compared to the great growing years in the past, and drivers of GDP growth forecast is not that positive. So we are in for lower GDP growth over time, just of natural causes, like demographics. Further, a beautiful chart on what's going on with the government borrowing will be 3.3 trillion, and the forecast federal deficit will be much bigger than over the last 30 years. And that's to GDP goes higher. And this is also something when you look at this economic overview is that you're thinking okay, how long can it last, and then again, something that as an investor, you might want to be prepared for. Nobody knows when it will turn, but it's more and more likely that one day it will turn and therefore you just have to be ready. Also something that might turn somewhere in the future, especially with the money brain thing. People are forgetting about inflation, so very low inflation over the last 30 years, you practically don't hear it as an issue anymore. Unlike it was the case from 30 to 50 years ago. When it comes to interest rates, low inflation allow for low interest rates to stimulate the economy for longer.

We are now at what 11-12 years of very, very low interest rates that push asset prices higher, financial instruments, so we already see inflation in financial instruments, homes, real estate, etc. We'll see whether it will trickle down into other fields or no or will just stay in continuing markets. That's something also we cannot predict I wish we could. If we could predict, of course, everything would be easy, then I will tell you do this, do this, do this. And we will make five times our money every year. And that's investing we cannot predict most people look at the rear view mirror and they say, Okay, this is going up this going up, tech stocks are cool. Now everybody's rushing to solar stocks. When we did an analysis of solar stocks in 2018, and everybody was all bad environment. China is lowering subsidies to solar, not good, not good.

And these cycles of doing the opposite of what investors think. But keeping in mind the positive long term tailwinds that just push things higher might be an investment advantage that we all have. And it's my investment focus. And that's why I like to look at all this ideas and overviews because I like to see okay, where is a tailwind? No matter what tailwind? Which means that no matter what happens, I'll do good. If I have luck, I'll do great. If not, I'll do good, which is still okay. Do I need to beat 50% up or Tesla stock five times up? No, that's never my goal. Because I'm just a normal investor. Of course, this Federal Reserve balance sheet has exploded with the debt that we mentioned. I see, of course, currency issues, perhaps not next year, perhaps not in 2024, perhaps in 2027, which is something we as investors have to think about. And this beautiful charts really tell us, okay, what is changing, and what will likely change down the road.

Fixed Income

On fixed income as we already said, interest rates are lower. This is I think, 2013. So look, somebody investing in 2013. In the 30 year Treasury was getting almost 4%. Now we are at 1.46%. This will have huge repercussions on pension funds, returns pensions, and I'll do also a video on pensions just got an email that my Dutch pension will likely be lowered, which is very, very interesting. And these are the reasons why. And we have to see how to navigate this. That's the most important thing. Corporate debt. We live in a debt world. Over the last 50 years, it went significantly up not just corporate debt, but government debt, household debt, non financial corporate debt went up. And if we look at emerging markets also debt going up but as they grow developed markets, we are now the debt market is $120 trillion, which is something very interesting and four times what it was just 20 years ago, I don't think that global economy improved four times. So that will also be an issue when the stimulus when discovered things stop worrying us, then these will be the issues over the next coming years. And therefore I love looking at okay, what's reality. This is a great overview, as I said, and tells you okay, what will be the future issues.

Emerging Markets

But then let's also look at the International, United States has 58% of the market capitalization, emerging markets just 12, Europe 14 and other countries much less. But also look at this, Tech is 30-28% of the S&P 500, 34 is cyclicals emerging markets of Europe, Middle East, and Africa is 80%, emerging markets 63%, also some technology probably mercadolibre and all those stocks that went up. But a big difference between this and the rest of the world. But this cyclical sectors, are what you buy using that technology. So it's very interesting the differentiation in valuation and when you're investing not speculating, you want to invest in certainties, as I said tailwinds and again, emerging markets growth, everything good earnings growth, the index, all country world index, except the US is relatively flat compared to the boom of the S&P 500 also makes you think about where we are. If you look at earnings, if we exclude the tax jump for US companies, earnings are relatively close to emerging market growth over the last 15 years. But we have seen emerging market stocks didn't enjoy the same jump as the s&p 500, which means emerging markets are relatively cheap. Plus, if we look at COVID-19, the situation, North Asia, Southeast Asia, so much, much better than what we in Europe, Latin America, and US did and experience so very interesting perspective on how things work, how things are dealt with, and where to look for the future.

Also emerging market economic growth. You see here the spreads much higher than developed markets. So very interesting. And then perhaps the most important chart here today that tailwinds in the middle class population will explode over the next 10, perhaps 15 years. Indonesia, China, steel growth there, Brazil, Mexico, these are billions of people entering the middle class population. And we discuss a lot of headwinds fear. But this is the most positive tailwind that I'm seeing when it comes to investing. Also, for businesses, all of these people will be customers, for Apple phones for all those things that are interesting. So I don't think that tech sector will do badly, it might be risky with high volatility, but these businesses will still be around so the value might be justified. It's just that I'm seeing not the crash in the tech stocks, I'm just seeing value in emerging markets, which as a value investor, I like to look for investment opportunities. Especially I'm looking now at commodities on my stock market research platform, just did the top 12 for now. And I'm going down the list of all copper miners, which is interesting. And if this explode, plus electrification plus Tesla, I'm now bullish on Tesla, not on the stock on the copper. So that's very interesting. And those are huge tailwinds that might prevail over everything else, at especially if currencies are played with.

Investing Principles

And then perhaps the best chart of all, investing versus everything else, timing the market, speculating, looking that the stock will go up my favourite chart from JP Morgan, the average investor of the last 20 years, they'd want 2.5, S&P 500 is 6.6. So always think, Okay, how can I do 6.6-10%, just invest. And I think it's much easier to do 6-7%, constantly 10-15-20 on average, on average, between five and 15, rather than doing what everybody else is doing. Fear and greed, let fear and greed, fear of missing out driving you, which leads to bad returns. Investing makes things simple. And if you like that, subscribe, and we'll discuss more on mentality in the next video. Something very short, but I hope you will enjoy it. Thank you. Any questions, please send me an email or put them into the comment section. I look at all comments. So thank you for that. I'll see you the next video.