Arquitos Capital Management commentary for the third quarter ended September 2020, discussing how their historical holdings MMA Capital (MMAC), Westaim (WED.V), and Enterprise Diversified (SYTE) are historically undervalued.

Q3 2020 hedge fund letters, conferences and more

There is nothing noble about being superior to your fellow man; true nobility is being superior to your former self. - Ernest Hemingway

Dear Partner:

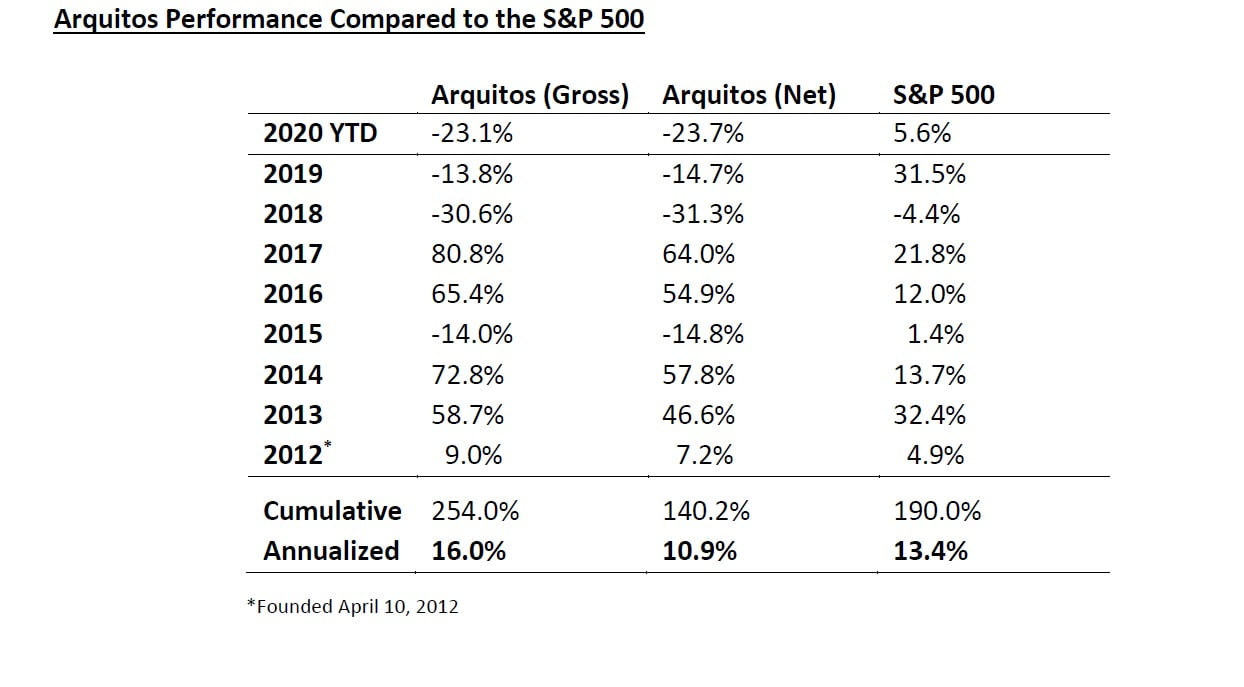

Arquitos returned 2.1% net of fees in the third quarter of 2020, bringing the year-to-date return to -23.7%. Please see page four for more detailed performance information.

There have been significant fluctuations in performance throughout the quarter due to the portfolio concentration. As I discussed at our virtual annual meeting in September, things can change quickly in this environment. While the year-to-date results have not been what we want, our post-third-quarter performance has been extremely strong, as all of our major holdings are up significantly.

Investing Concepts From Joel Greenblatt's Book

I recently listened to an excellent podcast interview of Joel Greenblatt by Barry Ritholtz. Greenblatt has written several books, but the best one is from the late ’90s called, “You Can Be a Stock Market Genius.”

In retrospect, the title of the book was too simple for the underlying concepts. Greenblatt introduced a variety of special situation-style strategies to a new generation of investors. This was after closing his hedge fund after 10 years and 50% annualized returns. The book is a foundational text for modern investors.

I later learned that many of these concepts were first introduced and practiced beginning in the 1930s by an investor and writer named Maurece Schiller. My friend Tom Jacobs from Huckleberry Capital Management edited and reprinted five of Schiller’s books a few years ago. Tom solicited commentary for these reprints from modern practitioners of special situations strategies, including from myself and a variety of other portfolio managers with whom I am associated. I was happy to help fund the project as well and highly recommend the updated books.

Back to the Greenblatt interview. Andrew Kuhn from Focused Compounding pointed out one of Greenblatt’s comments from the podcast, “If you bought every company that lost money in 2019 that had a market cap over $1 billion—and so there are about 261 of those—and you bought every single one of those companies, you’ll be up 65% so far this year.”

This comment highlights the uniqueness of the current market. The income statement results were from 2019, pre-Covid, which is key. A lot of strong companies will lose money this year, and perhaps next year, because of Covid. But when you look at 2019, it is a different story.

For a basket of these money-losing companies to have astronomical gains in 2020 shows how government and Fed policies are propping up otherwise weak companies. Smaller companies with strong balance sheets that generate predictable free cash flow are obviously out of favor right now and have been for several years. That cannot and will not last, and our portfolio is in a position to benefit from the transition back to those low-risk type of companies.

We will stay disciplined and not chase companies whose stock prices are being propped up by stimulative government policies.

MMAC, WED.V, And SYTE Are Underavalued

Thank you to those who attended our recent virtual annual meeting. I discussed how our historical holdings, in particular MMA Capital (MMAC), Westaim (WED.V), and Enterprise Diversified (SYTE), are historically undervalued. Each trades far below its liquidation value. Their shares were cheap a few years ago and have gotten even cheaper today. This is exciting news even though it has brought pain over the last few years.

MMAC had an eventful last few months. The company reported excellent results from their solar lending fund and shares went from around $23 to above $28. Soon after the announcement of their second-quarter results, the company’s long-time CEO, Mike Falcone, announced his retirement. This was a surprise to investors and sent shares tumbling back down to $22.51 at the end of the third quarter.

I am not overly concerned about the change in leadership. After talking with the company, the retirement appears to be just that and nothing more. Falcone is staying on the board. The change may even provide an opportunity for the company to adjust their capital return policy, though their previous policy was nothing to complain about. Investors should appreciate all that Mike did for the company and for shareholders. We wish him well in retirement.

MMAC’s most recent book value is $37.37, adjusted to ignore their tax benefits. It will be higher in their next quarterly report. The company can easily return $3 to $4 per share to shareholders, but they also have significant internal reinvestment opportunities. Whatever the new leadership decides to do with the significant free cash flow they are generating, that gap between the current stock price and book value will contract.

We are also excited about SYTE. Its asset management subsidiary, Willow Oak Asset Management, recently brought on a new affiliate, SVN Capital. You’ll be hearing a lot more about SVN Capital’s founder, Shree Viswanathan, over the coming months. The team is excited to be working with him, and we see opportunities for significant growth in his firm.

SYTE trades for significantly below its liquidation value. Shares would have to advance more than 40% from the third quarter close to simply match Willow Oak’s investment in Alluvial Fund.

I expect shares to more appropriately reflect the company’s intrinsic value as the Willow Oak subsidiary strategy becomes more clear, as we continue to partner with new managers, and as we continue to streamline the business so the value of Willow Oak becomes clear.

Updates For The Fourth Quarter

I am approaching the fourth quarter with more nimbleness and a willingness to make changes to the portfolio. I have been researching a number of what appear to be attractive companies that trade at attractive prices, and I have opened up a few starter positions upon which I am looking to build.

Now that we are seven months into Covid, we can see the economic effects on the companies in our portfolio and on the watchlist. I am specifically looking for profitable companies that have opportunistically repurchased shares during this time period.

My friend, Jeremy Deal of JDP Capital, talks about looking for survivors and thrivers during this time period. I think that’s the right approach to take. These times of economic stress reveal a lot of things in companies. Who are the next generation of great corporate capital allocators? Which companies are actually strong, as opposed to just appearing to be strong? These are the types of companies we are looking for that can become long-term holdings.

I recognize that I was not nimble enough over the past few years. I’ll never be a trader, but I am looking to take advantage of unique opportunities in the near term. That may require some portfolio turnover despite the unusual discount to intrinsic value in our current holdings.

Thank you again for your investment in Arquitos. I look forward to keeping you updated.

Best regards,

Steven L. Kiel