In the global financial world, with a highly interconnected economic dependence, commodities, energy, materials, and in particular, currencies play a pivotal role in the stock market’s heterogeneity and connectivity. This applies to gold as well as the world’s busiest precious metal marketplace.

Q2 2020 hedge fund letters, conferences and more

The Inverse Relationship Of Gold And The US Dollar

Under normal conditions, gold and the US dollar are in an inverse relationship. Due to its worldwide denomination in USD, any USD weakness pushes gold prices up, and vice versa. Therefore, as far as the USD Index piece of the puzzle is concerned, the situation is not what it appears to be at initially, as we’ve witnessed something genuinely perplexing.

Namely, the index invalidated its breakout, which is a bearish sign. The USDX was quite visibly above the declining resistance line, but it failed to hold these gains. In July, a failure to rally above its resistance meant another significant downturn, causing higher gold prices.

So, does the USD Index and gold await the same faith soon?

Not necessarily.

The USD Index is a weighted average of several currency exchange rates. The biggest weight (over 50%) is attributed to the euro exchange rate, and the second biggest weight is attributed to the yen exchange rate. So, let’s see how the situation looks like in both currencies.

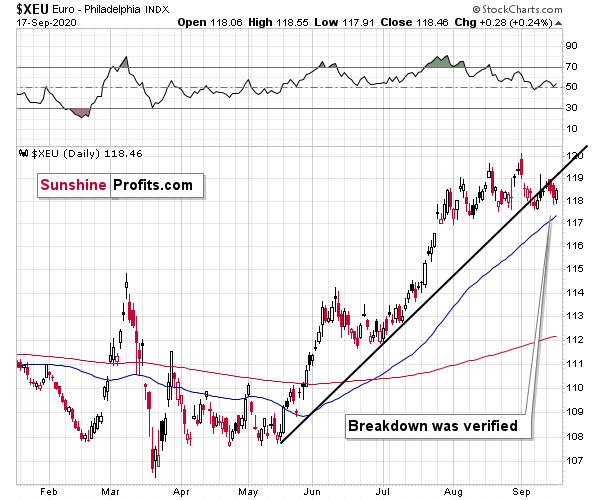

The euro is after a breakdown and a verification thereof. This is a very bearish situation, but bullish for the USD Index. Because of that, the situation with the euro is bearish for gold, at least in the short run.

The Japanese Yen vs Gold

And what about the Japanese yen?

Well, the situation is not that different as far as the implications are concerned, but the direct reason for it is.

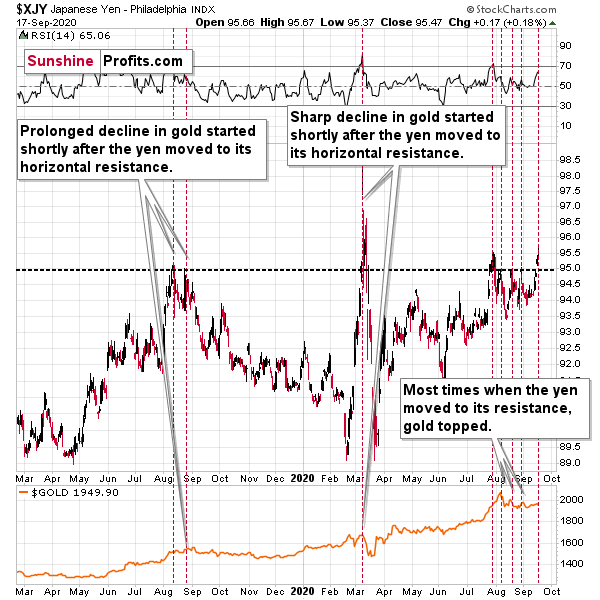

As you can see on the Japanese yen index chart above, in the past 1.5 years, whenever the yen tried to rally above the 95 levels, it topped briefly and reversed its course.

In the mid-2019, this resulted in a prolonged gold decline, and by early 2020, it resulted in a sharp and deeper decline.

In recent weeks, we’ve detected the signal above (the yen index trying to break above 95) 4 times: once it was just before the final top in gold, and in all the remaining (3) cases, these were local tops in gold.

The implications of the current yen situation are bearish for gold, and they are bullish for the USD Index, as the Japanese currency is likely to have invalidated the breakout once again. History tends to repeat itself, after all.

USDX's Breakout Invalidation

Given the tips that the individual currency exchange rates give us, should we really expect a USD Index’s breakout invalidation to lead towards lower values? Definitely not. The respective currency exchange rates are more “basic”, and their outlooks outweigh the index chart that is essentially based on them.

This means that the legitimacy of USDX's invalidation's bearish implications is suspicious, to put it mildly.

In other words, the bearish outlook for gold didn’t really change at all, even though we admit that it is not as bearish as it was before the USDX’s breakout’s invalidation. While we continue to predict lower gold prices, in the next several weeks (possibly months), based on the USDX action, we agree that the outlook is slightly less bearish than it was in the previous days.

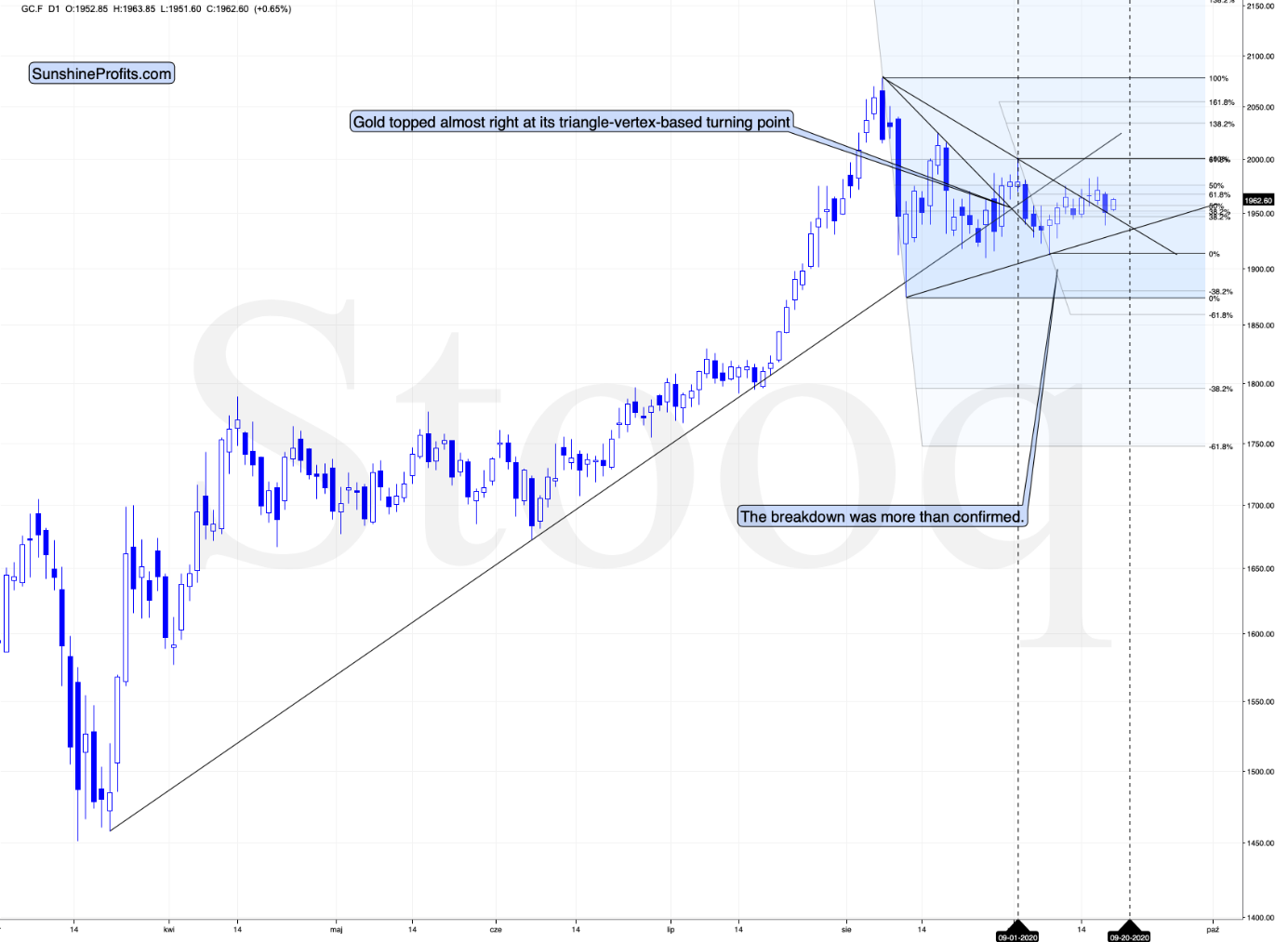

Please note that gold has yet another triangle-vertex-based reversal that is just a few days away. Perhaps the yellow metal will move slightly higher once again and then start its plunge on Tuesday or Wednesday. During this time, the USD Index could regain its strength and attempt to break above its declining resistance line once more. Only this time, the breakout would be successful.

All in all, the outlook for the precious metals market remains bearish.

Thank you for reading today’s free analysis. Please note that the following is just a small fraction of today’s full Gold & Silver Trading Alert. The latter includes multiple details such as the interim target for gold that could be reached in the next few weeks.

If you’d like to read those premium details, we have good news. As soon as you sign up for our free gold newsletter, you’ll get 7-day access of a no-obligation trial to our premium Gold & Silver Trading Alerts. It’s really free – take advantage of the opportunity and sign up today.

Przemyslaw Radomski, CFA

Editor-in-chief, Gold & Silver Fund Manager

Sunshine Profits: Analysis. Care. Profits.

All essays, research and information found above represent analyses and opinions of Przemyslaw Radomski, CFA and Sunshine Profits' associates only. As such, it may prove wrong and be subject to change without notice. Opinions and analyses are based on data available to authors of respective essays at the time of writing. Although the information provided above is based on careful research and sources that are deemed to be accurate, Przemyslaw Radomski, CFA and his associates do not guarantee the accuracy or thoroughness of the data or information reported. The opinions published above are neither an offer nor a recommendation to purchase or sell any securities. Mr. Radomski is not a Registered Securities Advisor. By reading Przemyslaw Radomski's, CFA reports you fully agree that he will not be held responsible or liable for any decisions you make regarding any information provided in these reports. Investing, trading and speculation in any financial markets may involve high risk of loss. Przemyslaw Radomski, CFA, Sunshine Profits' employees and affiliates as well as members of their families may have a short or long position in any securities, including those mentioned in any of the reports or essays, and may make additional purchases and/or sales of those securities without notice.