I just saw Seth Klarman’s letter to shareholders and enjoyed it so much to even make a nice video. His rational is essential when it comes to assessing the current stock market so it is the best possible news you can get. Also, he calls the current economic situation surreal.

Q2 2020 hedge fund letters, conferences and more

- the crazy stock market

- the bad economy

- the debt, FED's intervention, absence of market pricing

- likely volatility ahead

- the stock market is a casino

- But also 8 possible COVID-19 impacts on the world we live and invest in!

Seth Klarman: The Current Economic Situation Is Surreal

Transcript

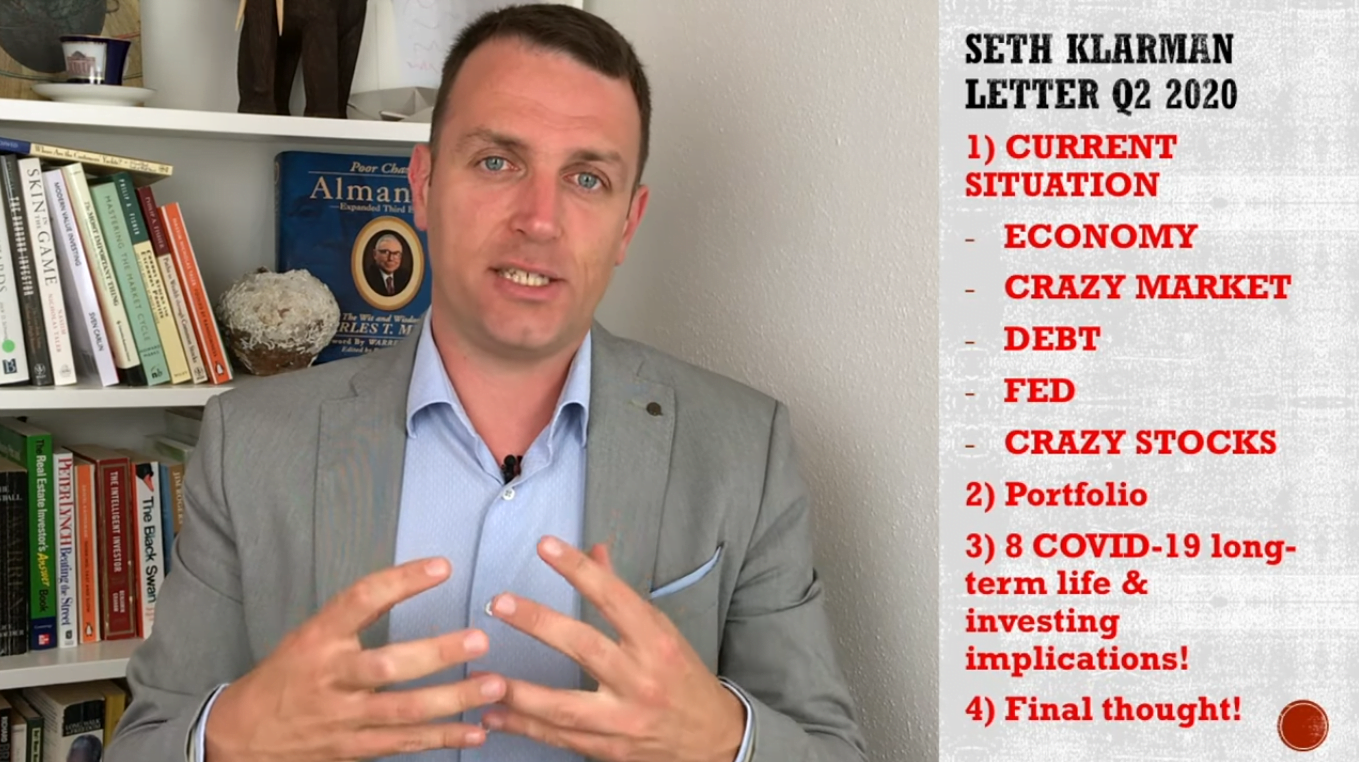

Good day fellow investors. Seth Klarman is perhaps my favourite investor. And recently I saw his latest letter to his investor. I can talk about the all the points that he mentions there. And I'm sure because he is so smart, and he has a very specific margin of safety perspective on the world. I'm sure this video will give you a lot of value, at least part of all the value that he gives in his letters.

So let's start. For those that don't know who Seth Klarman is, he is he's the founder of the Baupost Group. A value investor really, real value investor he has done approximately 20% since he founded the Baupost Group in 1982 till 2008. Since then, his fund is really huge 30 billion, he didn't find such great investments uptil this March. So his return is a little bit lower. But he's always focused on risk. So he'll probably do well in all environments in all cycles. And that's what makes him a Great Investor, and one of the best investors of all time. Therefore, it's always extremely important to listen what he has to say. Of course, from a bottom up approach to investing, looking into the details. He's also the author of margin of safety, and you can buy that book on Amazon for about 1000 bucks, if you want to do that investment.

Also, what's very interesting, he also returned capital to shareholders this March, so very, very timely, he looked for more investments, and he asked investors to invest because of the great historic buying opportunity, and look how patient he was. So let's see what Seth Klarman has to say, he is of course, value investing, margin of safety, long term trends, focus on risk, earnings, cash flows, that kind of mindset. If you have that kind of mindset. Please also subscribe to this channel, because that is what we try to do here. We do our best to learn and follow that investing long term mindset. We're going to discuss his view on the current economic situation, how he calls it surreal, the issues with that the Fed the crazy stocks, the crazy pricing environment that's going on. Then he also gives eight points of how it's likely that the world will change both COVID-19 and that will impact not only your finances, but also your life. So extremely important video and extremely important thoughts.

The first thought of the letter is that he calls the economic situation, current economic situation surreal. We could say that the economic development And markets look something like this. The market is on very, very thin legs pushed by the Fed, but the fundamentals ain't really there. So we'll see how it will end over the long term. And such things as this last crash, flash crash or COVID crash that rebounded immediately in the S&P 500 is almost it's above previous high level. So that's really crazy. Usually such things happen over cycles over years over decades. But now it all happened in what a few months, however, the economy still didn't recover. And if we look at the economic situation, compared to the market situation, you really think the investment world is totally surreal. GDP decline from the Bureau of Economic Analysis expected to be above 30% in Q2 2020. 30% GDP decline, that's a huge decline, you would expect the stock market to be down. But it's not, and even more surreal is that every stock in the S&P 500 posted a gain since March. That's really, really surreal.

If we look at NASDAQ, the situation is even crazier. Three stocks accounted for 60% of NASDAQ's gains, and the index almost doubled over the last five months. The situation is simple. The Fed is printing money, ECB globally low interest rates, huge fiscal stimuluses so they all need more buyers to keep the market up, because we'll see later during this video, the market and everything the economy is based on endless financial engineering. That is the world we're living in. And that's why stocks and everything, real estate prices have to stay up. Without that the world would have to change and everybody is scared to see it change, therefore financial engineering, endless financial engineering is the solution. We'll see how we'll it will end up, hopefully, we'll live to see.

And Klarman's warning is how things really are escalating and those things usually don't end well. He's mentioning one pension fund. He doesn't name it, but it's probably CalPERS where the top U.S. pension fund aims to juice returns via 18 billion leverage plans. So they're going to take 18 billion on leverage to invest in private investments, because they need to reach their 7% return target with zero interest rates. Conservative investing approach, you can't reach 7% and on their 400 billion in assets and 7% is what they need to pay future benefits to 1.9 million members, they are not there, so they are planning to use leverage. And government is saying how that's very risky for the market because they instead of accepting lower returns and telling people how their pensions will be lower, they are going to do whatever they can to reach those 7%. Suddenly, also, two days ago, the Chief Investment Officer resigned. So we'll see how does that story develops. But pension funds save investments, save institutions, taking on more debt to juice up returns is something extremely risky. It is a two edged sword and there are already down they don't have enough money to meet future liabilities on a 7% expected returns. So if you are one of the 1.9 million CalPERS teachers and everything, you should start thinking about creating a second stream of retirement by doing on a weekend jobs or renting something out or who knows what. You see what fits you but you can count on that your pension will be much lower than expected in real terms. That's a given.

What's going on? Of course, the Fed is pumping money into the system. So from 4.5 billion they started lowering a little bit, but we are already close to seven sorry, trillion. I'm still wired on billions, but our depth to 7 trillion probably will go higher with next budget deficits and ugly situations. What Carmen says is that the Fed considers the market like a little kid that can't rationally set price prices so it has to intervene. As soon as the market falters. The Fed immediately intervenes to keep prices up because the whole economy is focused and based on that, and this huge liquidity and make stocks have crazy moves, stocks that are going bankrupt can jump five times in one two days because of new liquidity that's coming in and ways to reorganise what their goal is that he's calling that a Schrodinger's Cat because we don't know whether it's dead or alive.

So AMC theatres, the business model is broken, people are not going there, but the stock price was even higher than pre COVID levels in June due to all the liquidity and acting. There also hurts other stocks or AMC theatres also pretty high level when he was writing the letter in much higher than it was at the COVID crisis. So crazy stock environment really absent market pricing, it's more all a gamble and he compares it to a casino with no true price discovery. This is what we are investing. This is what Seth Klarman says we are investing in. And this is what we have to watch very carefully when it comes to our money because you know, gambling works until it doesn't. And then we hit trouble.

The conclusion is that we are in an environment of endless attempts of financial engineering and you can try to make that cat live for cat we know has nine lives. But at the end also the nine lives mere will expire. We have been seeing lower interest rates for the last the last 40 years. We have seen intervention, ECB, Bank of Japan, the Fed, so the value of money is declining. Therefore value investing, real assets is probably the way to go and will be the only way to go over the next 10-20 years, when it comes to Klarman's investments, the biggest position is PG&E, not Procter and Gamble, sorry have to correct this, PG&E and this is a position where he is also in the debt of the company, he says how they will get 80% of the value of the debt now, so huge cash injections for them.

Klarman is a very, very complex investor looking for those investments where nobody other is looking understanding the legalities around those. So things that we as retail investors can't do all the time. But we can, for example, see learn about his investments in eBay, Liberty Global then there is the Steinhoff reorganisation, private portfolio, which real estate developments but he is now focused on mortgage and credit markets. Because what he says and what's something very interesting to learn from his letter. There was always a lag between private markets dropping compared to public markets. Public markets have crashed in March and rebounded already. But the real repercussions in the economy, the real opportunities in the economy will come in the next month and a few years and that is what he is waiting for. For those distressed opportunities like Buffett and there is always a lag there. So don't accuse Buffett or Klarman for having a lot of cash now.

Then he concludes his letter with eight covet long term impacts on life and investing. Let's quickly go through them one by one. The first one is the acceleration of digitalization. We are not going to the store that often so that new habit will stay in perpetuity. And no part of retail is immune and the pandemic really accelerated the disruptive impact. Of course, the stock that benefited a lot is Amazon. Also, the second impact new ways of working, learning, healthcare, perhaps even dressing to go to work, stocks like Zoom, businesses like Zoom are really changing the way we live. Three, reversal of globalisation, certainty of supply perhaps is more important than cost of supply. So America has been running short on masks, gowns and gloves again. So if this changes, there might be more supply chains, more production in countries that need to cater to demand there but also more focused on certainty of supply rather than cost of supply. We'll see how the world develops there. But that is very, very interesting. This would perhaps increase wages, which would be a positive we'll talk a bit later about that, and therefore increase or cost competition perhaps inflation but will lead to more certainty of supply with within strategic sectors of national importance, not only in the United States but also globally.

He also touches on inequality how that always in difficult situation, also what Ray Dalio has been saying. In difficult situations, inequality comes out. And also we have been in a difficult situation and inequality is a very important topic. So he discusses from Hispanic, Black people, the inequality, the wealth gap from Dalio and how that might impact the world we live in, over the next decade, two decades from I don't know, going back to Dalio, high, higher taxes and things like that. So also something to think about but also try to contribute to a more equal world, especially in fairness, and I would say also equal opportunities.

Then real estate challenge retail, definitely no retail will be left out hotel, real estate, perhaps even office real estate might get hit. If the environment changes. The US in 2019 had already 5x more retail space per capita than Europe, that's huge. Hotels supplies likely to shrink in some places. Office demand might also possibly decline. Or on the other hand, there might be increased demand for warehouses. As we are seeing more and more online shopping. Talking about humanity priorities, costs and risk mitigation. The covered death rate was very low compared to other viruses. So this is just one single mutation. And I don't know the bubonic plague wiped out 50% of the Europeans population. So it's very interesting how we will grow, how we will live in the future also whether we will be prepared for new pandemics as Gates warned us a few years ago, nobody listened. But here we are, perhaps covered will be treated as a blessing if we learn to prepare for new viruses, because one single virus can be very, very lethal to humanity. So also something to think about.

Then he also mentions is the Fauci effect. This is he says, more has been aspirational than real, unfortunately, but the belief in science and needs for science and expert has been growing. Unfortunately, it's often used in politic, targets and goals, interests, economic interests, but if we all start to think more, listen more, learn rationally more, what value investors do. I think it will remain aspirational, but you never know we can all aspire. This will create a better world and hope. Hopefully you People will dedicate their lives to public health. And the eighth topic is the declining dominance of capital over labour. If we look at average hourly wages of all employees, in this case in the United States example, it grew from 22 to 29, over 10 years, you might see, okay, wages are growing, but that's 2.7% per year, that's not much, slightly above inflation in this case, and then depends on how you measure inflation. So wages are not growing, we can say, especially if we put that on 40 year perspective, 3.5% per year over the last 40 years forex in total 2.9% over the last 20 years, but if you want to buy, I don't know, a flat in New York, it's up seven times or 5% per year over the last 40 years. And that's a big difference. Education is up also something similar healthcare costs, all what you really need in life is up. Therefore, we might see how labour becomes more important, which would be also good to solve inequalities etc, over the predominance of capital. But for now we see the Fed bailing out Wall Street and not focusing that much on improving labour conditions or wealth.

So the conclusion from an investing perspective as always bottom up approach finding those investments that offer a margin of safety does lower risk with higher upside. Also ugly investments Klarman often do often does but then you have to be prepared for that know what you're doing and he is very skilled in doing that. Also, he says that that we are living in a world of high uncertainty. We don't know what will be the economic repercussions of the economic situation we are still in which is a very, very bad economic situation, everybody's high on the feds intervention, ECB pumping money. But that can be very ugly in the coming years if the currencies lose their value if we lose trust in the currencies that are printed at will. And that's something very important to think about. Also from an investing perspective, think about real assets.

And I want to conclude with the quote from the latter, I would rather have questions that can be answered than answers that can't be questioned. And that's also something he talks about other things but I would like to talk about investing. Investing is always uncertain. We don't know what will the world look like five years from now if somebody asked you a year ago what will the world look like? Very few would have predicted the situation we are in and farmer when it comes to investing value investing. He's a forever investor. He is Leaves he invested since 1982. With the bottom up approach in the margin of safety stock, people forget the 98% of his competition has been wiped out. In the last 40 years 1043 of the savings and loan associations went bankrupt 1980s, 1990s dotcom bubble, real estate bubble and we'll see whether this will be called the Fed bubble or not. Thank you for watching. please click the like button if you enjoy it and you gain value also subscribe to grow this channel of value investing and rationale, investing into uncertainty. And also just to mention, I've have analysed airport stocks, Australian stocks, you can check that all on my blog and you have the link in the description below. Thank you and I'll see you in the next video.