ESG funds outperform S&P 500 amid COVID-19, helped by tech stock boom

Q2 2020 hedge fund letters, conferences and more

Many large investment funds with environmental, social and governance (ESG) criteria have outperformed the broader market during the COVID-19 pandemic, buoyed in part by the funds' heavy weighting in large technology company stocks that have seen their own strong performance, according to an analysis by S&P Global Market Intelligence.

ESG Funds Outperforms S&P 500 During COVID-19

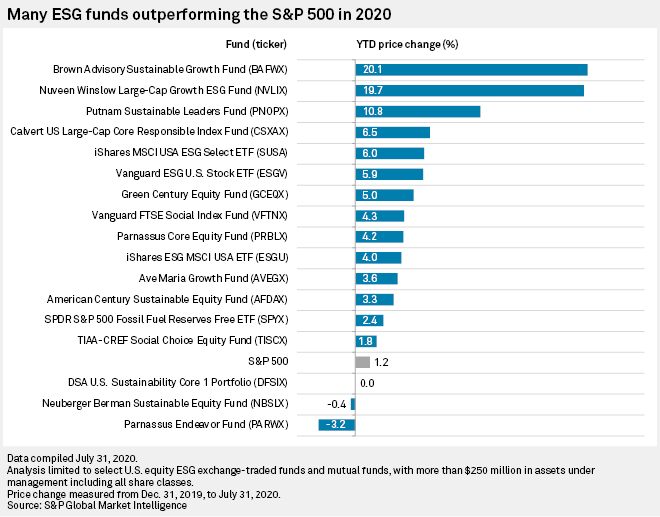

S&P Global Market Intelligence analysed 17 exchange-traded and mutual funds with more than $250 million in assets under management that select stocks for investment based in part on ESG criteria. The analysis found that 14 of those posted higher returns than the S&P 500 in 2020 through July 31, with those outperformers rising between 1.8% and 20.1%. In comparison, the S&P 500 was up 1.2% as of July 31. An analysis of the same group of 17 ESG funds in May 2020 found that all but two had lost value in the year to date.

Critics of ESG investing often question whether the strategy can deliver premium returns. But ESG fund managers have said their focus on non-traditional risks led to portfolios of companies that so far have been resilient during the COVID-19 downturn.

The top performer in the latest ESG fund analysis by S&P Global Market Intelligence was the Brown Advisory Sustainable Growth Fund. The fund, managed by Brown Advisory Inc., gained 20.1% in the year to date. The second-highest performer in the group was Nuveen Winslow Large-Cap Growth ESG Fund with a price increase of 19.7%. That fund is co-managed by Nuveen Fund Advisors, LLC and Winslow Capital Management, LLC. The Putnam Sustainable Leaders Fund managed by Putnam Investment Management, LLC, came in third place with an increase of 10.8%.

The only two ESG funds in the group with negative returns in the year to date were Neuberger Berman Investment Advisers LLC's Neuberger Berman Sustainable Equity Fund, with a price down 0.4%, and Parnassus Investments' Parnassus Endeavor Fund, down 3.2% for the year, which was still better than those funds were performing in May.

An analyst at S&P Global Market Intelligence commented, “Information technology stocks comprise at least 20% of the holdings for each of the funds reviewed, according to S&P Capital IQ data. As of July 31, technology stocks accounted for about 36% of the Brown Advisory Sustainable Growth Fund and about a 47% equity share of the Nuveen Winslow Large-Cap Growth ESG Fund. Tech stocks, in comparison, made up about 28% of the S&P 500 at that time.”