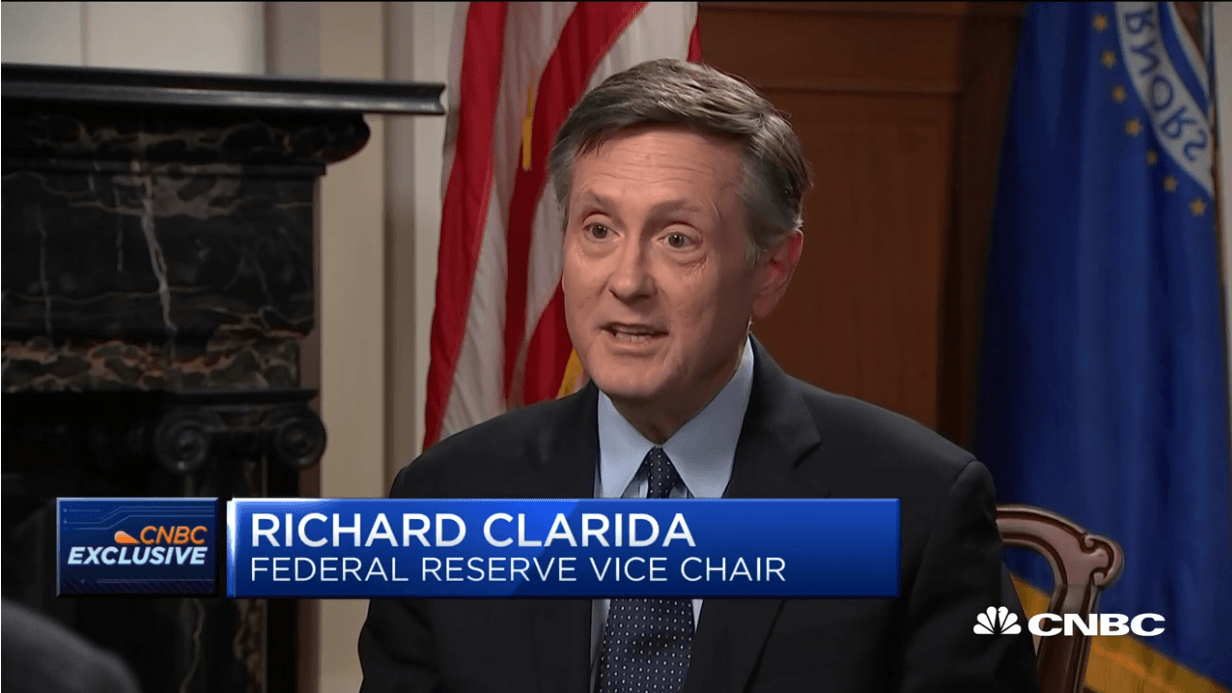

CNBC Excerpts: CNBC Exclusive: CNBC’s Steve Liesman speaks with Federal Reserve Vice Chairman Richard Clarida on “Squawk Box” today, on Q3 rebound, the Main Street Lending Program, Fed review and more.

Q2 2020 hedge fund letters, conferences and more

Federal Reserve Vice Chairman Richard Clarida On Economic Outlook, The Main Street Lending Program

Clarida On Q3 Rebound

My own personal forecast is that we’ll see a rebound in economic activity in the third quarter data. As we said, including in our statement, the course of the economy is going to depend upon the course of the virus and mitigation efforts. So, it’s a complex picture. But my baseline view is we’ll get a bounce back in the Q3 data, but it'll take some time I believe before we get back to the level of activity that we were in in february before the pandemic hit.

Clarida On Uncertainty

My baseline view is we could get back to the level of activity perhaps towards the end of 2021. But there are a lot of moving parts here with the virus and global outlook. And so I think there’s a pretty big range of uncertainty. But I do think economic activity did begin to pick up in may and in june and my personal forecast is that will continue into the second half of the year.

Clarida On The Long Term

The economy was in very good shape in February. The fundamentals of the economy were great. It took an enormous hit, but you are correct. The longer this drags on the greater there is the risk of that, which is why chair powell of the fed is focused with all our energy and effort on doing what we can to support the economy, build a bridge and support robust recovery on the other side of this.

Clarida On Fed Review

The world today looks a lot different than it did in 2012 when the last time the fed did a serious review. And in particular, there are very powerful global disinflationary forces and there are also very powerful forces holding down global rates. If you put those two together it does suggest there could be ways we can define our strategy so that we’re better able to achieve our objective with a national plan and price stability. I’m not going get into where this may end up, but what I will say this is an ambitious review.

Clarida On Main Street Lending Program

We've set up no fewer than 11 new facilities as a result of the pandemic. The Main Street Lending Program was just launched in early July. As chair powell has indicated, this is a complex program because of the nature of sustaining the full credit to individual companies. I do expect that the size of the program will grow over time.