Self storage has proven to be a fairly recession-proof industry in the past, but is it pandemic-proof? According to STORAGECafe’s most recent analysis, the hit that self storage has taken has been somewhat lighter than the impacts other real estate sectors have experienced. Oversupply has been putting downward pressure on street rates since last year, but COVID-19 has only made it worse. The national average now sits at $112, down 4.3% y-o-y.

Self storage stats

Q1 2020 hedge fund letters, conferences and more

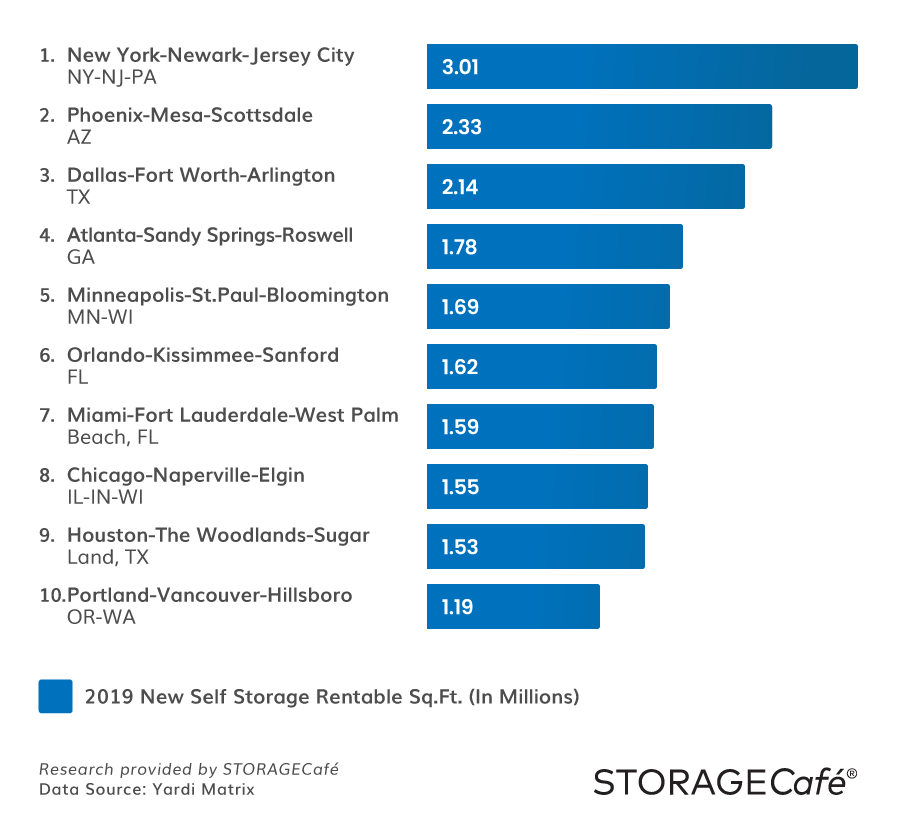

To see where this 1-2 punch hit the hardest, we went through data from our sister division Yardi Matrix and zoomed in on the 10 markets with the most self storage space delivered in 2019. These 10 metro areas are diverse in terms of the historical evolution and delivery of these sectors, but one thing they have in common is lowering rental rates.

Here are a few highlights on New York–Newark–Jersey City:

- New York–Newark–Jersey City is the champion of self storage construction, with as much as 3 million square feet of storage space delivered in 2019 — more than twice the size of Yankee Stadium.

- Even though one of the most active in terms of square footage additions, Metro New York is also the one with the least units per capita, making it the third priciest self storage market in the U.S.

- Even so, continuous building brought forth a decrease in street rates, and the average rent in May 2020 was $165, down 4.6% from 2019.

- Nationally, approx. 51.9 million rentable square feet of self storage space was completed in 2019, an area that would comprise the whole of Central Park or six Grand Central Terminals.

Despite the lower rents, the development market is still active as demand is holding strong. The industry has proven resilient in hard times before. Closely related to life events, self storage covers a whole array of needs — from owning surplus items to having to quickly relocate and from downsizing to storing business goods.