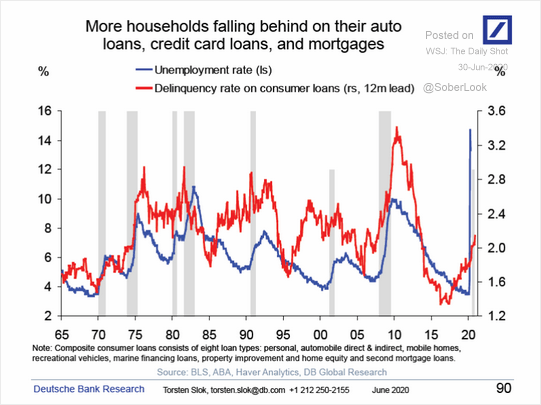

Without question, the economic impact caused by COVID-19 has rocked companies and consumers across the globe. Big companies are drawing heavily on credit lines. Mom and pop shops are struggling to stay afloat, despite the government funding small business loans to the tune of $659 billion, of which $130 billion is still unclaimed. Companies are now trying to figure out how they can proactively address high risk borrowers to avoid massive defaults that will inevitably putting banks in an even stickier predicament.

Q2 2020 hedge fund letters, conferences and more

With more than 40% of the economy living paycheck to paycheck, this is not a time for people to turn a blind eye to credit risk – this is a time for real concern. Banks are prudently reserving for credit risk, but it’s hard to ascertain if they have a good handle on what they need to reserve versus what is outstanding.

The key to avoiding this risk is centered on data and technology. Leveraging technology and data we have the ability to create models. Similar to modeling a portfolio, this instance creates a credit risk dashboard, and includes a heat map with 10 key variables. An at-risk person or entity is flagged as a risk when one of the 10 tracked variables starts to touch a certain level, turning yellow to red. The incumbency then lies on the bank to contact the person or corporation to discuss options to alleviate default on their mortgage, credit card, student loan, etc.

Real-Time Data

Alternate data sources are becoming increasingly crucial for banks to start to leverage within their AI models, coupled with the need to be ethical on how they use this data for decision making. There cannot be a bias pertaining to race, gender, etc., which needs to be factored in, and is epitomized by the fact that these banks can be facing huge penalties if not adhered to accordingly.

There are several key indicators where banks and credit unions should classify as high/medium/low risk customers using real-time data. Below are a few indicators as an example:

- For businesses: Tracking pre and post COVID - recent cash flow statements within deposit accounts, recent bill payments to utilities and to suppliers, recent trend in missed payments.

- For individuals: Tracking pre and post COVID - recent pay statements within deposit accounts, recent bill payments to utilities and household bills, recent trend in missed payments, accumulated household debt, tracking unemployment claims/visits against cell-phone calls.

In order to be able to do the above, Publicis Sapient uses proprietary datasets (superior pseudonymous consumer identity graph, historical transactional data, media impressions), geo-spatial mobility data, which allow us to be in a power position to help banks match against their existing customers against this graph, and identify delinquent candidates using AI/ML using the above examples.

Another example that stands out are Commercial real estate properties. Almost all commercial buildings have been evacuated over the past 3+ months. There is a good chance that most corporate businesses might not need such a large office space even post the pandemic as we are getting used to a new normal, which is working from home. Corporate businesses are starting to question if they actually need the amount of office space previously occupied, that was at one point a given, post the COVID-19 world. This might have a massive impact on real estate investment companies. Mobility data is starting to become very prevalent to track impact of COVID-19 on individual businesses within these commercial properties to track impact to their businesses.

Firms can add new segmentation and behavioral data to improve understanding of trends in specific customer segments, and they can enhance existing insight delivery platforms with real-time data ingestion and analytics capability. Banks and credit unions can look at these data points to see who incurring late charges, which could signal delinquency. Mobile and utility bills can also be used as indicators of a red flag or default scenario.

Post COVID-19, banks are unable to identify who is creditworthy. At Publicis Sapient, while working with certain banks, we’ve noticed that where the focus has historically been on bigger corporations as opposed to small businesses when it comes to credit risk, which is just a byproduct of the amount of budget at hand that the bank historically invested on credit loss prevention. However, with COVID-19, there is increased importance to identify and manage credit loss across small businesses in order to manage risk appropriately.

As an example, a small business administration/owner (e.g. a local quick service restaurant, dine-in restaurant or bakery) is the most adversely hit by this pandemic. The biggest dilemma for the banks begins with the government’s stimulus package provisioned, compounded by lenders deferring debt payments for borrowers, which they cannot legally report to the credit bureaus as delinquent in near future. This leads to an unknown amount of unaccounted debt, which may or may not be recovered, which lenders aren’t able to quantify themselves.

Liquidity Management

Prior to COVID-19, almost 80% of America’s were already living paycheck to paycheck, coupled with the enormous rise in unemployment over the last three months, it is causing the perfect storm. For many, there is a time gap between when an employee receives a check, deposits it, and when their bills are due.

We are seeing banks beginning to collaborate with fintech’s to find solutions that appease customers as well as regulators. Further, for corporate banking operations, the ability to virtualize accounts represent a fundamental transformation in the service model to support cash management operations. Virtual account management ensures increased treasury agility by setting up virtual account hierarchy based on emergent business needs and liquidity structures.

Generally, banks must design their cash management solutions with the customer journey in mind. Even today, the corporate channels of many banks have silos – for liquidity, for payments, for supply chain finance, etc. Customers would much rather go about their daily journey using a unified interface, meaning corporate banking channels must be fully integrated at the front end in order for the customer to have one seamless experience.

Banks are undergoing legacy transformation. The banks who are partnering with fintechs are getting ahead by using open architecture, adopting real-time payments, and actively working to create seamless user experiences. We are also seeing co-innovation with fintechs in emerging technologies such as AI, machine learning, and blockchain to create better services and solutions.

Some fintech’s, such as Current, create services where they front you money, and collateralize how they extend credit to the borrower. The difference here is that the customer is not incurring late fees as one would with a traditional bank, and people are able to get their money into their accounts sooner, avoiding an influx of late fees and penalties.

Startups Detecting Credit Risk

Fintech start-ups are an interesting area to watch. These companies are using tools to proactively detect credit risk and creating data scenarios, which help companies identify and mitigate default situations. There are some they can use to essentially monitor both corporate and customer credit, allowing the company to see the full picture of the borrower history. Here are a few examples of start-ups to keep an eye on:

Anagog is revolutionizing the way we understand consumer behavior, their context and ability to predict future behaviors in the physical world. By utilizing the first-of-its kind patented Edge-AI technology, JedAI, Anagog is able to provide companies with the ability to provide highly-personalized and contextual offers, while achieving unmatched privacy control. Anagog helps banks to develop a deep understanding of individual customers in real-time through JedAI, including tailored offers and products as part of a rewards/loyalty program and banking.

BeeEye is a company focused on helping lenders achieve a deeper view of their consumers through its full data span and adds additional data layers, data processing, customized feature creations and advances machine learning modeling optimizations. BeeEye has created EyeOnRisk, a patented credit modeling and scoring platform designed to improve consumer lending portfolios by enabling banks and lenders to develop and deploy scalable risk models, resulting in few false rejections of good applications and lower overall risk. This platform continually learns and verifies to ensure credit risks calculations are the most accurate scores available.

Explorium is a startup addressing the pain of data enrichment and feature discovery by automating the process from A-Z. Their platform dynamically integrates a customer’s internal data with thousands of external sources and extracts the most relevant features to power superior machine-learning models. Explorium’s clients are using the platform to automatically discover the most relevant predictive variables from a wide array of new data sources, providing their risk of propensity models with financial, geographic, personal and commercial context. By using Explorium, teams are able to improve predictive models within days rather than months.

Finscend created an AI-powered Bank Dispute Platform (BDP), upon analyzing feedback they received from more than 700 international banks to identify the shortcomings that generate enormous losses due to the credit card dispute process, which costs the top fifteen American banks over $3 billion annually. The BDP is the most technologically advanced solution for automating and streamlining the credit card dispute process and enables consumers to submit their disputes to the banks themselves via their smartphones. Simultaneously, BDP services as an end-to-end workflow tool for banks and other financial institutions as it allows for real-time reporting, fraud monitoring and the ability to provide all relevant bank personal with a full array of real-time analytics. Finscend’s clever use of AI replacing subjective criteria with objective criteria has allowed a solution which overcomes service gaps, cuts dispute processing costs by 40% all while improving customer satisfaction.

It is clear there is some potential for risk exposure by many of the banks and Fortune 500 companies recover from lack of business during COVID-19. It is critical that banks pay attention to credit risk and lean into how to mitigate any potential risk. And it will be important for firms to not repeat the mistakes of 2008 by being more proactive around credit risk situations and using tools around data and technology tech to help them detect a deteriorating situation. Unlike 2008, we know have access to increased data and analytics, and firms would be wise to capitalize on those assets.