Are you starting to feel like the world is finally getting safer and you can resume your normal life? That’s a completely normal reaction to prolonged stress. The fact of the matter is the virus is still out there and more people are infected today than were a couple of months ago, meaning that you are more likely to catch it now than you were when social distancing began. The infection rate for COVID-19 is exponential, and humans generally can’t wrap their heads about exponential math. What’s more, when you are in a persistent state of worry and stress, eventually your brain adjusts to the “new normal” and you begin to feel at ease in danger. The psychology of isolation fatigue is complex and it’s affecting every single person differently.

Q1 2020 hedge fund letters, conferences and more

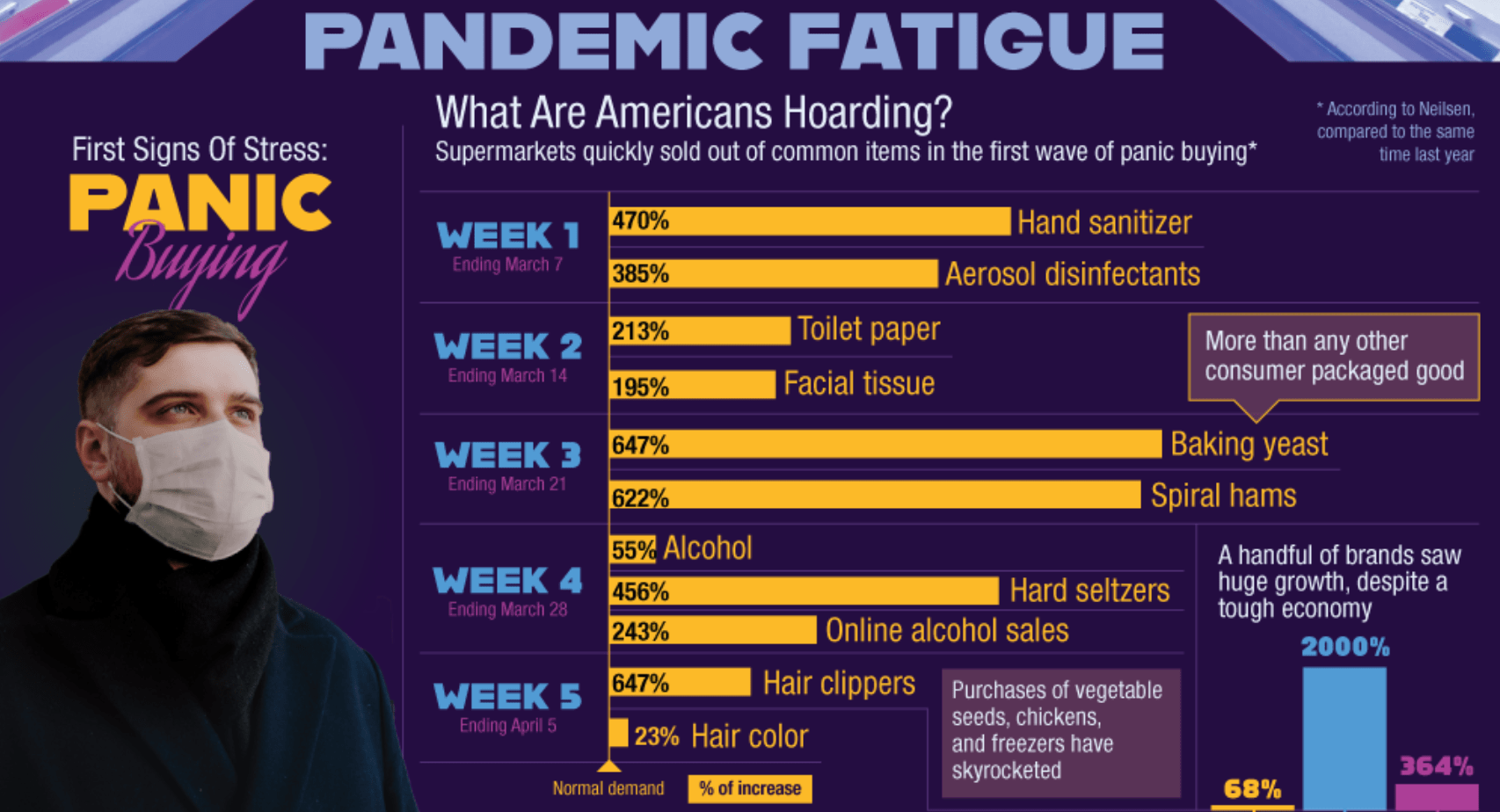

Isolation Fatigue: People Engaging In Panic Buying Activities

A lot of people have been engaging in "panic buying" activities. The most famous example thus far is with toilet paper, which has been in sustained short supply for months now. Basically the way our brains work is different under stress. Under normal circumstances we ask ourselves whether we need toilet paper, do some mental calculations of how much we have already, how long it will last, and when we plan to return to the store again to determine whether we need it. Under the pandemic, there is so much uncertainty that our rational brain centers are overridden by our survival instincts, which tell us we should go ahead and buy it because we don’t know when we will see it again or when we will be able to go to the store again.

In short, we have too much to process right now to make repeatedly rational and sane decisions. There’s a lot of bad news in the world and our stress levels continue to climb. It’s important to think hard about interpersonal interactions and social media posts right now because you are more likely than ever to overreact or make poor decisions right now because of the amount of stress we are all under.

Telemedicine Therapy Options

If you need help dealing with your stress, there are options available. Telemedicine therapy options have become widely available and are covered by most insurance plans right now because of the circumstances. There are also hotlines like the disaster distress hotline you can call.

If you find yourself with extra time on your hands, taking up a new hobby can help you cope. People are baking more bread than ever, but you can also take up gardening, crafting, home improvement, and more.

Learn more about the psychology of pandemic fatigue from the infographic below.