Initiation of Cubic Corporation (NYSE:CUB) with a Target Price of $17.80 (54% downside) by Glasshouse Research

Cubic Corporation’s suspect percentage-of-completion accounting infers that CUB has continued to miss milestones regarding their major projects. This is while management has obfuscated its financials by prematurely recognizing revenue in prior periods. Exacerbating our concerns, COVID-19 will massively amplify these milestone delays in major metropolitan cities with shutdowns.

Q4 2019 hedge fund letters, conferences and more

- Cubic Corp’s unbilled receivables have dwarfed its customer advances, surpassing historic levels at the firm. Surging contract assets and declining deferred revenues lead us to believe the company prematurely recognized approximately $108.5 million in TTM sales ($173.9 million in FY2019).

- Contrary to sell-side analysts’ initial comments, the COVID-19 Virus and ensuing “shelter-in-place” laws will materially impact CUB’s major projects in New York, Boston, San Francisco, and Chicago. We believe this will exacerbate CUB’s already weak balance sheet and push milestone delays into massive losses for the firm.

- Both reported and “adjusted” free-cash-flow figures provided by CUB management remain abysmal. If not for the company’s sale of its real estate assets ($44.9 million), factoring of its receivables ($31.1 million), and delaying of payments to suppliers ($50.2 million), we calculate that FCF has been cosmetically enhanced by $126.2 million in FY2019; for a true FCF value of –$162.2 million (vs management adjusted figure of +$14.1 million).

- Cubic has needed to restate its financials in 8 of the last 13 fiscal years due to revenue recognition errors. Based on our analysis herein, we suggest that CUB’s earnings quality is in an even worse state now. As a result, GHR predicts Cubic may need to restate financials based on the magnitude of these ominous trends.

Cubic’s Dubious Past Gives GHR Cause for Concern

Management of Cubic Corporation (CUB) has been recently patting themselves on the back for a job well done reaching their Goal 2020 targets set back in late 2015. However, when our analysts looked under the hood, we found a management that has moved goalposts, changed the way they calculate performance metrics, and obfuscated their original targets to appease investors/analysts.

Since the time when the original Goal 2020 was announced, CUB replaced their Chief Financial Officer, divested their Defense Services segment, ramped up their acquisition activity, and changed performance target metrics from GAAP EPS to Adjusted EBITDA and Adjusted EPS. We believe all of this has played a major factor in reaching their “targets,” rather than from organic sources, as we will detail throughout the report.

Our investment thesis revolves around 1) management has prematurely recognized revenue on significant projects, 2) a large portion of awards have come from extremely low margin project wins and 3) the COVID-19 Virus and aftermath will hamper CUB’s business drastically over the next year and beyond. Moreover, where the Transportation Systems (CTS), Mission Solutions (CMS), and Defense System (CDS) segments have enjoyed substantial bookings/backlog gains in FY2018, these balances have cratered in FY2019 with no replenishment in sight. While the major projects in New York, Boston, San Francisco and Chicago have buoyed the stock price in 2018 and 2019, we opine that not only were these projects of low margin, but that management has been less than forthcoming with missed milestones and delays with these major projects.

After going through countless filings, earnings calls and presentations, we believe that Cubic management has been using a variety of accounting gimmicks to turn around a company that previously reported depressed margins and earnings. Based on our extensive experience researching accounting frauds, we take issue with both the quantity and scope of financial engineering used by management over the recent years.

When we analyze Cubic’s unsavory past, contract assets/liabilities diagnostics, and lackluster cash flow, we find a company that we believe has been manipulating its accounting for significant gains to the income statement. However, in our experience, the manipulation of all these balance sheet accounts points to share price degradation in upcoming periods as these issues tend to violently reverse.

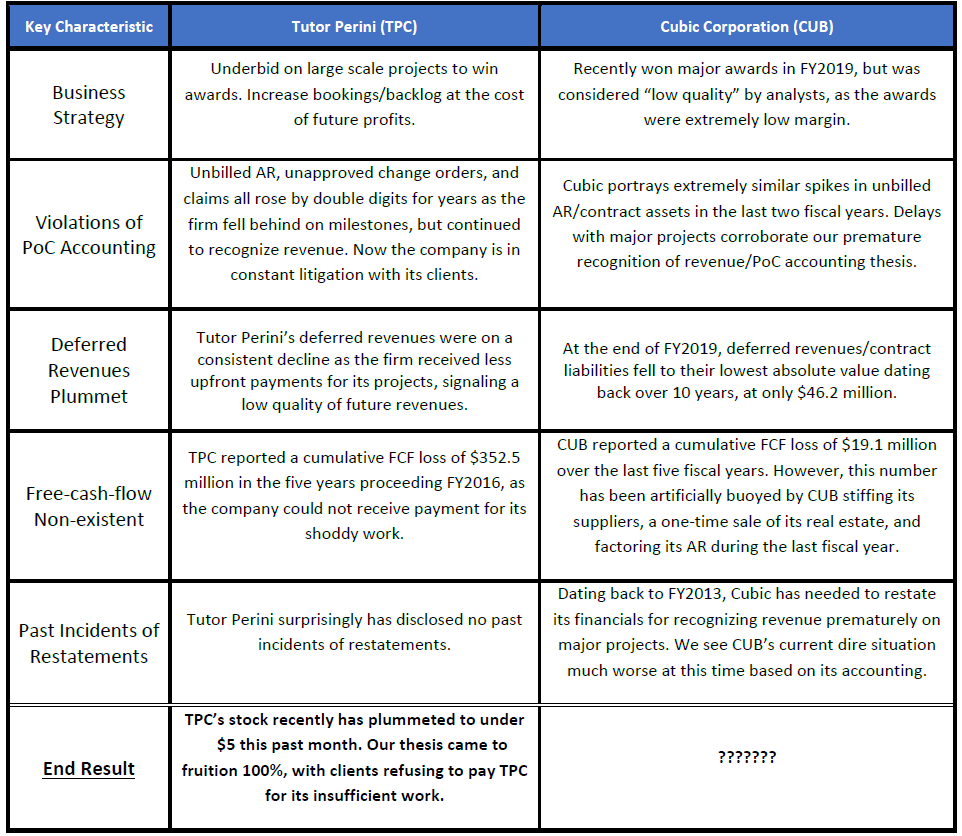

Key Similarities Between Cubic Corporation and Tutor Perini

GlassHouse juxtaposes both Cubic Corporation and the past transgressions of similar construction company Tutor Perini (TPC) which we wrote on 03/17/16. We believe CUB has eerily similar PoC accounting red flags as TPC. The end result for Tutor Perini is not a pretty one. Litigations, claims, and unapproved change orders have decimated the company, but most importantly the stock price dropped over 80% as a result of management’s malfeasance.

Cubic’s PoC Accounting Infers Missed Milestones and Delays

When analyzing past long-term contract companies such as Tutor Perini (TPC), a crucial harbinger in determining their future demise lies within its percentage-of-completion (PoC) accounting. When costs in excess of billings surge and inversely billings/deferred revenues decline relative to historical norms, we as analysts/accountants can predict: 1) future shortfalls in sales and earnings, 2) delays and missed milestones are encumbering certain projects, and/or 3) management may be recognizing revenue prematurely.

As such, we find that CUB’s receivables and deferred revenues1 trends all suggest that the company has been less than forthcoming regarding its future outlook. Furthermore, based on restatements made by Cubic due to these exact accounting errors in the past, we currently believe that the company is now in a much worse state than it was prior based on current accounting metrics. While there are new fresh faces at Cubic since its last announcement of restatements, we believe management is up to its same old financial engineering, as its poor earnings quality appears to have intensified.

Consider the software company Transaction Systems Architects, which became increasingly aggressive at picking up ever larger portions of its revenue at the front end and smaller portions at the back end. One sign that helped me discover this behavior was that new accounts began appearing on the balance sheet. The is not a good sign. Such accounts as unbilled receivables show up on the balance sheet… a telltale sign of accounting tricks. - Detecting Accounting Gimmicks that Destroy Investments, CFA Institute

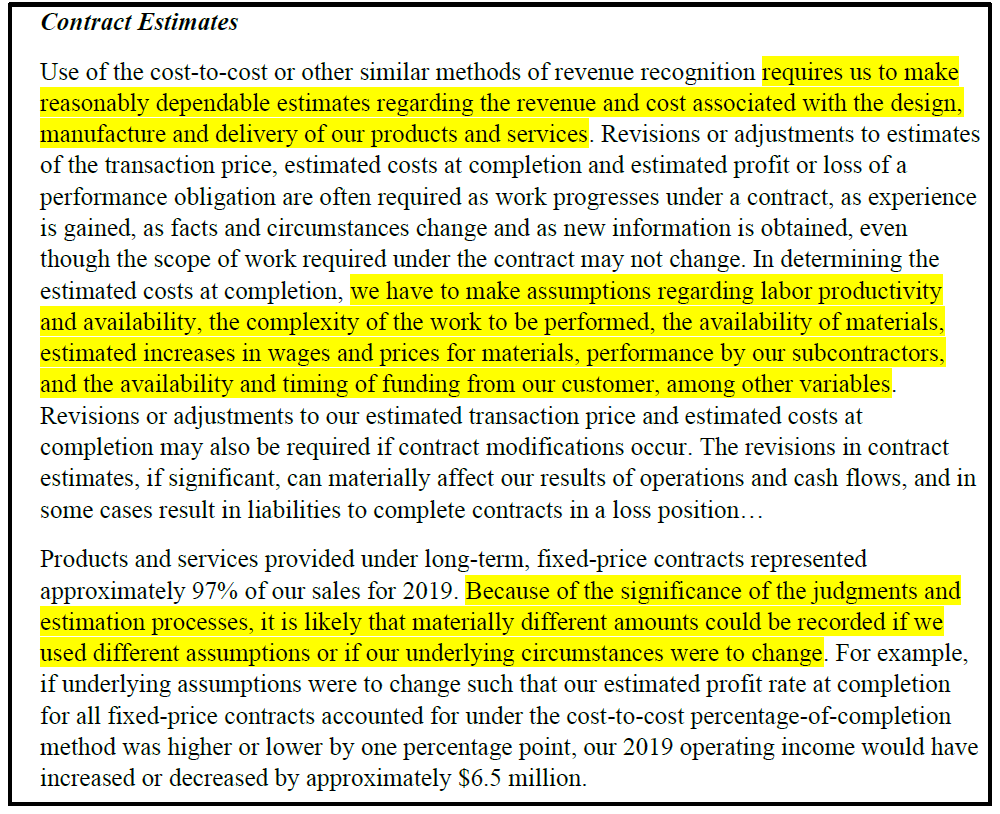

Earnings quality and PoC accounting go hand-in-hand in determining future sales/earnings, as we can turn to balance sheet metrics as a future indication. Furthermore, when dealing with PoC accounting, there is a large emphasis on management subjectivity, estimates, and assumptions when compiling reported results. Focusing on these factors within Cubic’s most recent 10K, we highlight the following which pertains to our thesis:

Based on our expertise within this sector, our analysts understand that these 10K excerpts are fairly boilerplate for companies with long-term contracts. However, eerily similar to Tutor Perini (TPC), we believe that Cubic is exhibiting significant adverse trends regarding its percentage-of-completion accounting. Due to the high influence of management (not outside auditors) in determining its own revenues and profits for each period, we believe there is high motivation for Cubic managers to game the system for their benefit, similar to what has happened in the past. Thus, we intend to show in our analysis why we believe the C-Suite at Cubic have been overly sanguine in recognizing recent revenues and profits; all at the expense of future earnings and potential restatements as in the past.

Unusual Growth in Contract Assets Pose a Significant Risk to Future Earnings

The adoption of ASC 606 by Cubic in Q1 2019 caused several changes to the company’s income statement and balance sheet, which we will detail throughout this report. With respects to the balance sheet and unbilled receivables, this account basically changed its moniker to “contract assets” from Q1 2019 onward. Therefore, we tracked these amounts over the past five years to find an inauspicious trend, which suggests missed milestones and delays that management has been less than forthcoming with. Again, we point out that this is not a collections issue, however, we believe this is a scope/overruns issue. Thus, our focus is mainly on unbilled receivables rather than billed. Because this is a revenue recognition concern, it bodes much worse for Cubic and its investors in the long run.

For our enthusiast readers, we do not have to emphasize how much our analysts loathe to see unbilled AR growing on the balance sheet of a company. If unbilleds/costs in excess of billings continue to grow and customer advances/billings in excess of costs continue to decline, this creates a cash flow problem, but it also means the following:

1) The company is spending faster than they are billing on their projects

2) The project managers are behind in getting their bills out, and/or

3) The company has costs on the balance sheet that are actually losses such as job overruns or change orders that are not or will not be approved.

In layman’s terms, unbilled AR represents revenue that has been recognized by management on the income statement which has not been invoiced or agreed upon by the client yet. Below, GHR lays out Cubic Corporation’s adverse contract assets trends, which we believe are a threat to CUB’s future persistence of earnings:

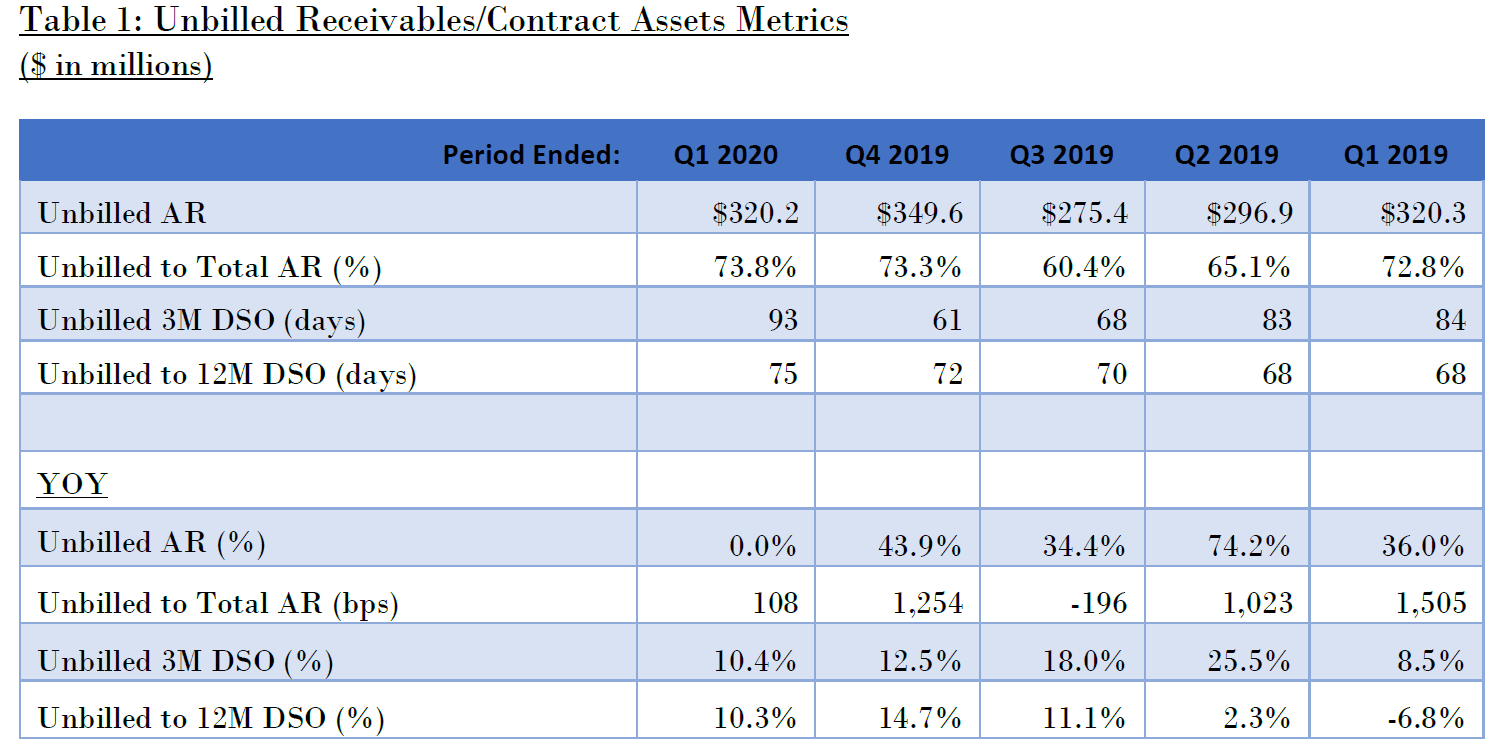

In the latest period (Q1 FY2020), 3M unbilled DSO2 rose by 10.4% YOY to a five-year high value of 93 days. Longer-term trends display 12M unbilled DSO rising by 10.3% YOY to 75 days, also representing a five-year high for the company (see Table 1, Page 8).

- Unbilled receivables now account for over 73.8% of current receivables at the end of Q1 FY2020. This represents the third-highest value reported by Cubic in the last five-years (max 76.1% in Q3 FY2015).

- When we analyze CUB’s balance sheet, we see a multitude of moving parts with the firm’s unbilled receivables and long-term contract receivables, due to ASC 606 in 2019. Therefore, we need to be cognizant of the higher risk long-term AR accounts as well in our calculations. When including all of the balance sheet accounts of Contract Assets, Long-term Contract Receivables, Long-term Contracts Financing Receivables (including VIEs), and Long-term Capitalized Contract Costs (including VIEs), Cubic’s earnings quality related to its PoC accounting continues to worsen.

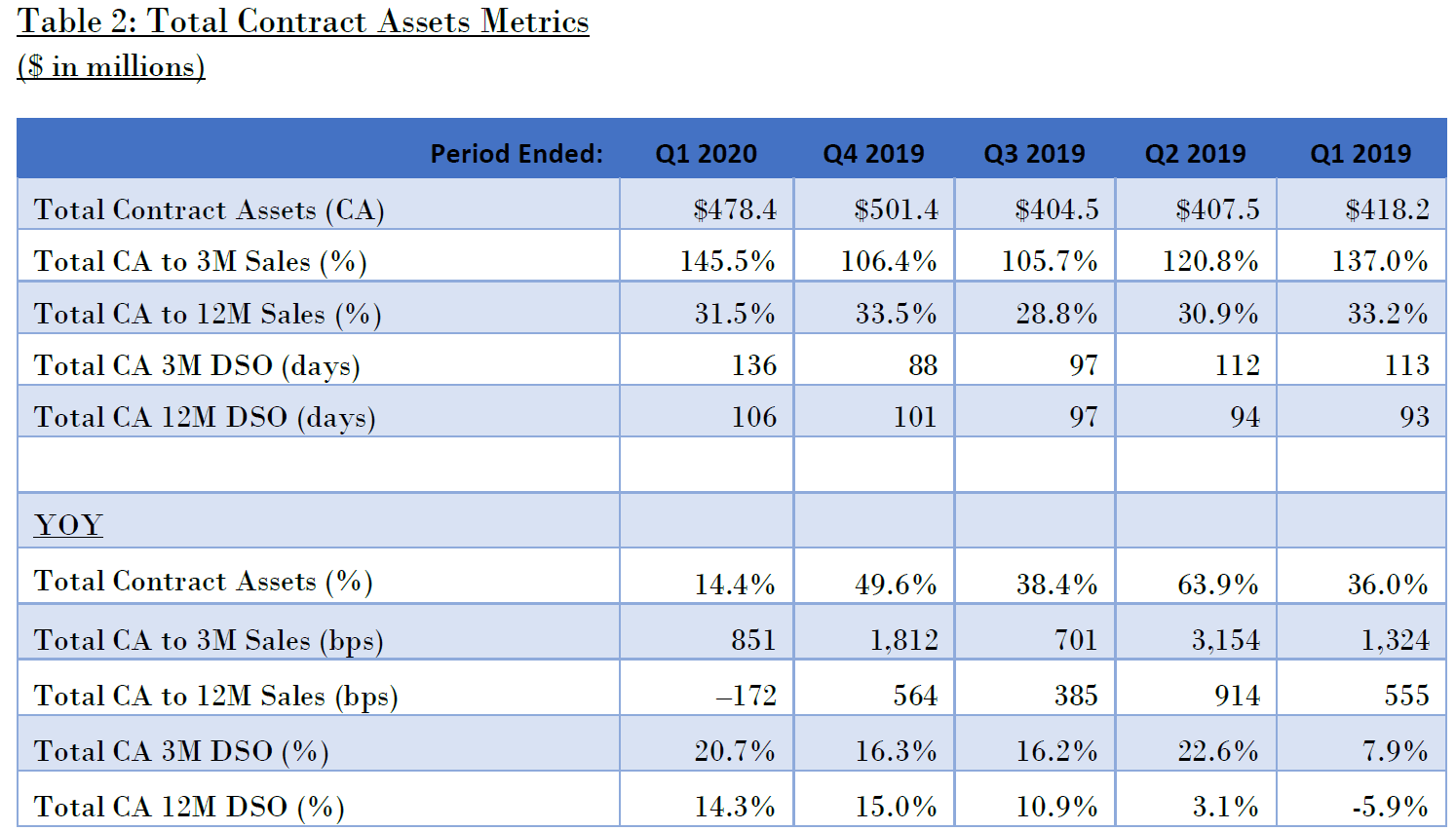

- Accounting for the aforementioned line-items (which we will label “Total Contract Assets” or “Total CA”), we calculate that total contract assets increased by 14.4% YOY to $478.4 million in Q1 FY20203 (49.6% YOY to $501.4 million at Q4 FY2019).4

- As a result, total contract assets increased by 851 bps YOY to 145.5%, relative to 3M sales at the end of Q1 FY2020. This value now stands 1,372 bps above the five-year seasonal average of 131.8% and reached a new five-year high in the quarter. Furthermore, total CA reached the third-highest value (31.5%) reported in any period relative to 12M sales in the past five years.

- When monitoring CUB’s total CA using the days-sales-outstanding (DSO)5 calculation, the unfavorable trends are the same. Currently, total CA levels have risen double-digits to 136 days and 106 days of 3M and 12M total DSO, respectively (see Table 2, below).

- Both these levels also stand at the firm’s five-year maximum. Sparking high concern, the last time Cubic reported a total CA DSO value over 100 was in 2014, when the company needed to restate its financials due to revenue recognition errors (as discussed later in our report).

Read the full article here by GlassHouse Research