Alluvial Fund commentary for the month ended February 29, 2020, providing a company profile on Detroit Legal News (OTCMKTS:DTRL)

Dear Partners and Colleagues,

Q4 2019 hedge fund letters, conferences and more

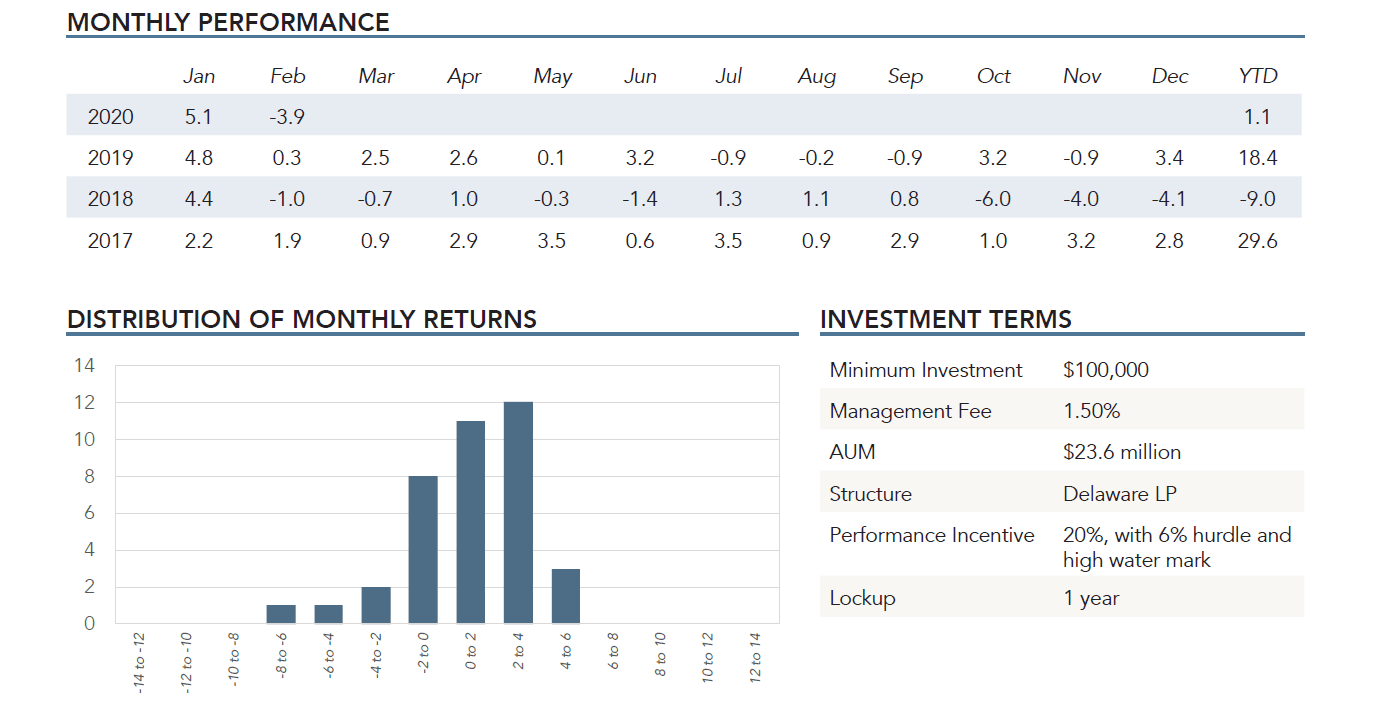

Alluvial Fund, LP returned -3.9% in February, compared to -8.2% for the S&P 500 and -8.4% for the Russell 2000. Year-to-date, Alluvial has returned 1.1% versus -8.3% for the S&P 500 and -11.4% for the Russell 2000. Since inception, Alluvial Fund, LP has returned 41.2% compared to 40.5% for the S&P 500 and 13.3% for the Russell 2000.

Alluvial Fund, LP is a value investing partnership with a focus on small companies and obscure securities, both domestic and international.

In addition to the monthly tearsheet, we are pleased to present a brief profile describing an interesting holding of Alluvial Fund. These write-ups allow us to provide a quick look at holdings not mentioned in our quarterly letters.

Company Profile: Detroit Legal News

This month's profile is on Detroit Legal News, a dark company long-known to Walker's manual aficionados, whose operations include commercial printing and legal news publishing. The full profile can be read on OTC Adventures. Enjoy!

If you are interested in learning more about Alluvial Fund, LP, please do not hesitate to contact Alluvial Capital Management, LLC at (412) 368-2321 or [email protected]. We welcome inquiries and would be happy to arrange a call or meeting.

Finally, I plan to make the annual trip to Omaha for the Berkshire Hathaway shareholders meeting the first weekend of May, subject to any public health-related schedule changes, of course. If anyone else plans to be there, please let me know. I would enjoy the chance to catch up in person.

While in Omaha, I will again be participating in an event hosted by Willow Oak Asset Management, LLC, which will be held on Saturday, May 4th from 5:00 to 8:30pm. Full details will be announced soon, but please use this link to register.

Regards,

Dave Waters, CFA

Alluvial Capital Management, LLC