Crescat Capital update for the month of February 2020, titled, ‘Only The Beginning’, in which they discuss that we are headed into a serious global economic downturn.

Q4 2019 hedge fund letters, conferences and more

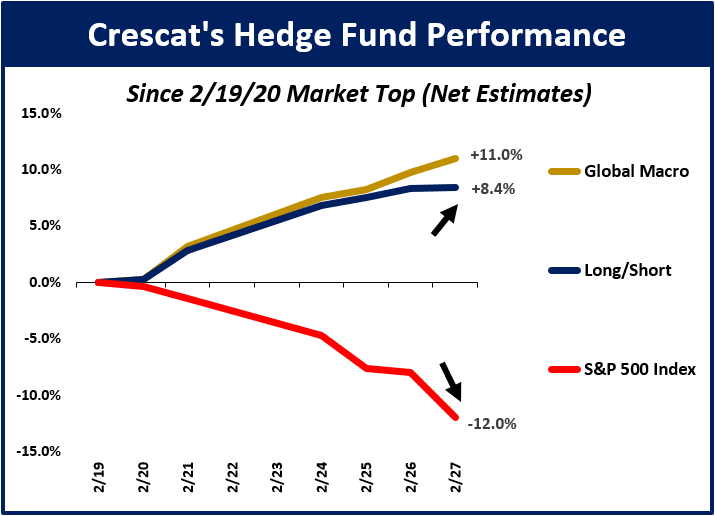

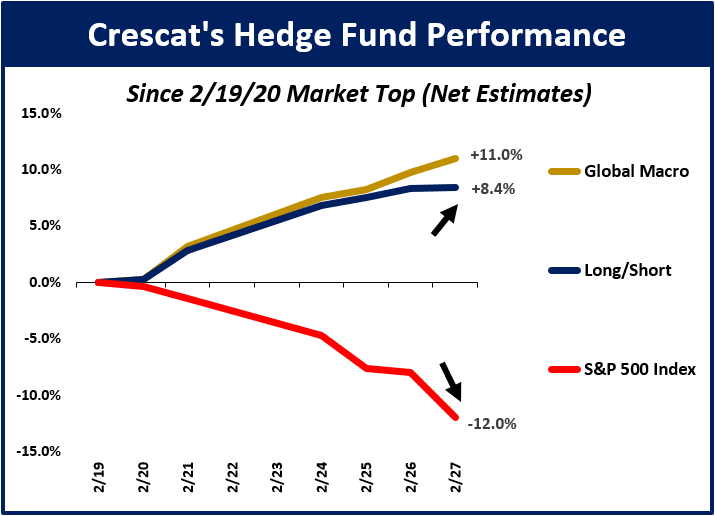

We have good news! The chart below shows how Crescat’s hedge funds have been performing since the probable euphoric market top in the S&P 500 Index last Wednesday. Since then, Crescat Global Macro Fund is up 11.0% and Crescat Long/Short Fund is up 8.4% based on estimated net performance. The selloff started from record valuations, higher than 1929 and 2000. It arrived at the likely peak of the most extended business cycle ever.

The Coming Global Economic Downturn

Our performance since the top has been generated mostly from our equity short positions. We have been tactically committed to these shorts based on our valuation and macro timing models. Our precious metals equity longs have been pulling back as we address below. Otherwise our recent gains would be even greater. We believe there is so much more to play out in our favor now that the stock market has finally, almost certainly peaked. We believe we are headed into a serious global economic downturn from record global debt to GDP levels. There is a truly historic banking and currency bubble in China that we believe will soon burst. We haven’t seen anything yet on the currency front there. We remain determined to tactically capitalize on the coming global economic downturn for our clients. Recessions are perfectly normal. We are not perma bears. We plan on getting tactically bullish at the depth of the oncoming recession. Until then, we believe there is so much more to play out by positioning for a significant downturn.

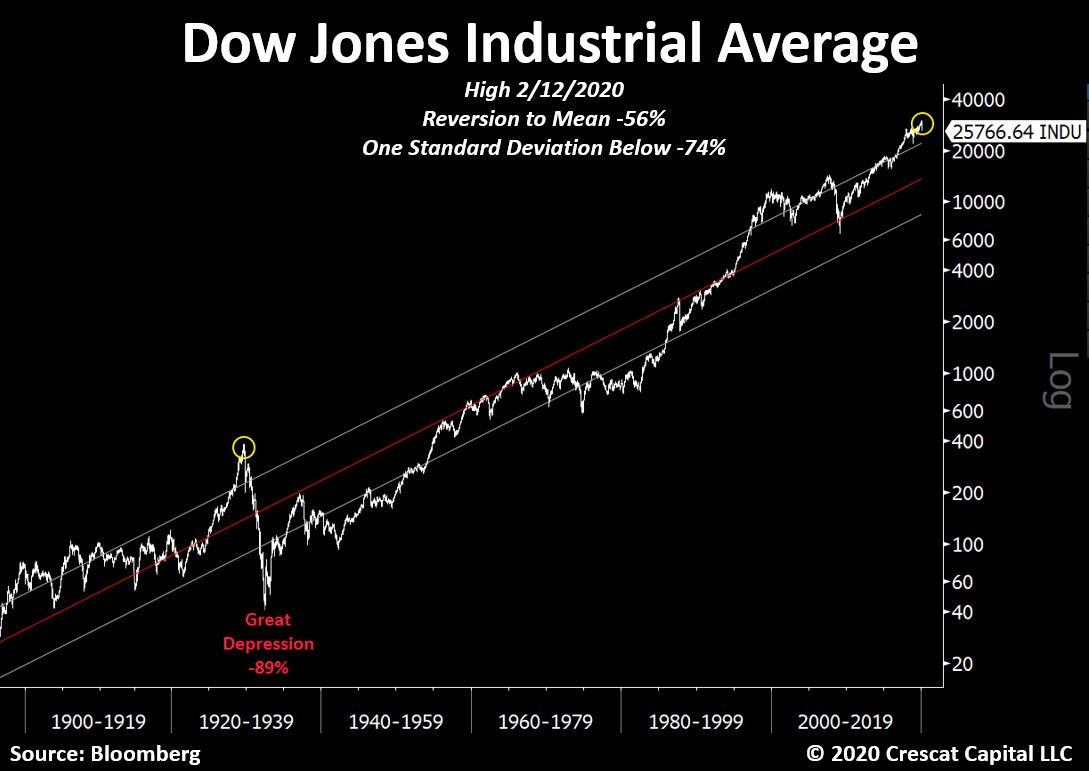

Let’s put the recent 12% downward blip in the US stock market into perspective. We recently reached almost two standard deviations above the mean, like in 1929 and 2000. Corporate fundamentals are already turning down. The average investor has way too much exposure. The downside risk is substantial. We think most investors could benefit from Crescat’s strategies as a part of their overall allocation mix.

A Look At The Precious Metals Market

We love precious metals here. Gold has been holding up fairly well in the recent market selloff, but the miners and silver have pulled back with the market. They represent excellent buying opportunities here. We own an in-depth researched portfolio of the best gold and silver in the ground in our Crescat Precious Metals and Large Cap separate account strategies. Many investors are concerned that it will be like late 2008 with respect to precious metals stocks when they were battered along with the broader stock market. It is really important to understand that in 2008 the industry was coming off a big 8-year bull market run up. Today looks totally different. We think we are in the early stages of a major new bull market after a 6-year bear market that bottomed in early 2016. This industry has only just started to break out to the upside in our strong view after a great year in 2019. The Philadelphia Gold and Silver Index was up 53% last year, strongly outperforming the S&P 500. The pullback in precious metals mining stocks today is understandable, but relative to gold itself, it has already been too much. We are convinced there are many deep-value stocks today in this industry. Opportunistic investors should be buying them today and Crescat’s strategies are a great way to do that. The Fed should be coming back in soon, and in a big way, and that should be all that we need to get the precious metals longs performing incredibly well.

Here is the link to the macro webinar that we did last Friday for the public after doing the same for clients only a few days before. It starts at minute marker 1:25:

The slides can be downloaded here:

https://www.crescat.net/wp-content/uploads/Macro-Preso-YouTube.pdf

For anyone, looking to add money to our hedge funds for a March 1 start, the deadline for initiating wires is today. Please contract Linda Smith right away at 303-228-7371, 303-271-9997 (Main Office) , or email [email protected] if you are interested.

Sincerely,

Crescat Capital

Kevin C. Smith, CFA

Founder & Chief Investment Officer

Crescat Capital LLC

Tavi Costa

Partner and Portfolio Manager

Crescat Capital LLC