Broad Market Index was up 1.58% last week and 48% of stocks out-performed the index. The upcoming annual financial statements will give us insight on the overall growth trend. The recent SEC filing update is 28% complete. The volume of SEC filings will continue to increase in coming weeks. Honeywell International Inc. could be a big beneficiary of the latest trends.

Q4 2019 hedge fund letters, conferences and more

Honeywell International Inc. $180.81 BUY this rich company getting better

Honeywell International Inc. (NYSE:HON) has been a profitable company with inconsistently high cash return on total capital of 13.8% on average over the past 20 years. Over the long term the shares of Honeywell International Inc have advanced by 89% relative to the broad market index.

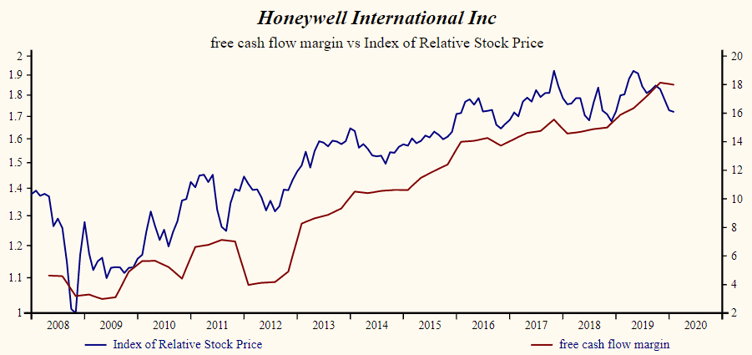

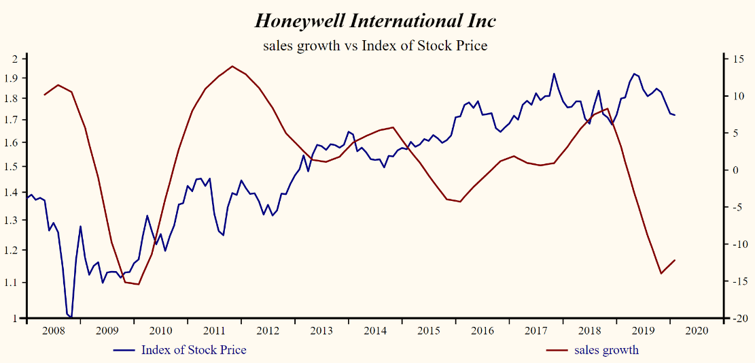

The shares have been very highly correlated with trends in Growth Factors. The dominant factor in the Growth group is Net Shareholder Wealth which has been 98% correlated with the share price with a two-quarter lead. Although not correlated with the share price sales growth remains negative but turned upwards in the most recent quarter. Free cash flow margin continues to show a strong upward trend despite being slightly down last quarter from its highest point in the company’s record.

The current indicated annual dividend produces a yield of 1.9%. Five-year average dividend growth is 0.1%. Current trailing operating cash-flow coverage of the dividend is 2.9 times.

The shares are trading at lower-end of the volatility range in a 14-month rising relative share price trend. The current depressed share price provides a good opportunity to buy the shares of this accelerating company.

Not investment advice

Industry Overview - Conglomerates

The share price index of the Conglomerates Industry has advanced by 6% relative to the Otos Total Market Index since the June 2018 low. Current relative price to sales is about mid-range in the record of the Industry.

Last week the share price index of the Conglomerates Industry fell by 2.4% compared to a 2.2% decline for the Otos Total Market Index. Gaining stocks in the Conglomerates Industry numbered 2 or 10.5% of the Industry total compared to a 9.9% gaining stocks frequency across the 3979 stocks in the Otos U.S. stocks universe.

The Industry capital weighted average sales growth rate is -4.8%. The proportion of Industry market capital accounted for by rising sales growth companies is up to 10.8%, compared to 0.4% last quarter. Currently, sales growth is low in the record of the Conglomerates Industry and lower than last quarter.

The proportion of total market capital accounted for by rising gross profit margin companies is down to 73.9% compared to 74.6% last quarter. The Industry is recording a rising gross margin. Inventories are down, improving the chance of a further increase in the gross margin. SG&A expenses are low in the record of the industry but falling. Higher gross margins and lower SG&A expenses are producing a leveraged acceleration in EBITDA relative to sales. Interest costs are low in the record of the Industry and rising. Higher interest costs not only slow the free cash flow growth rate of the industry but are often associated with lower valuation.

The more stable the pot appears, the better the attributes. Green and gold are good. Red is bad and the more intense the red the more urgent the call to action.