Peter Lynch, one of the best investors of all times has written the book One Up On Wall Street where he explains how he turned $1,000 into $28,000, or better to say millions into dozens of billions as a fund manager from 1977 to 1990. In order to learn about investing from him I’ll summarize the book for your. Peter Lynch’s investing advice is the best!

An In Depth Summary of Peter Lynch’s Book, One Up On Wall Street

Transcript

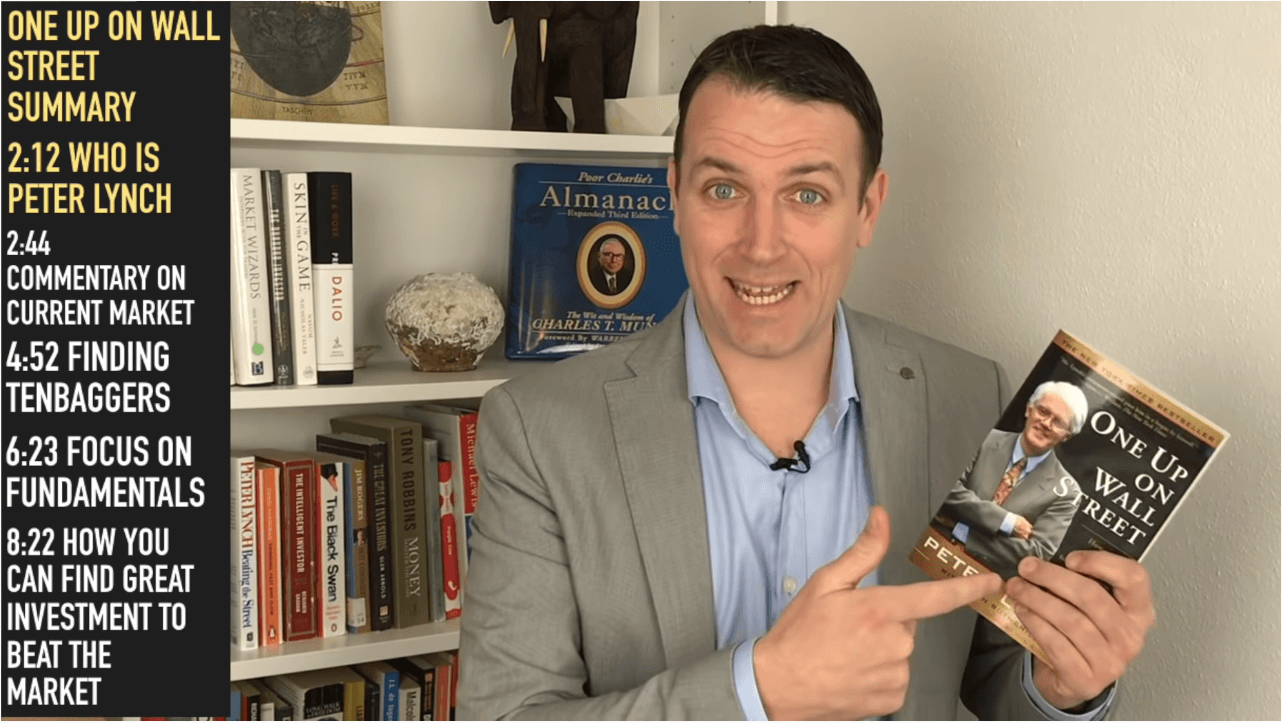

Good day fellow investors. Peter Lynch turned $1,000 into 28,000, over 14 years when he was the fund manager at Magellan. When he retired in 1990. He was asked to write a book about how he did it. And this is the book, One Up On Wall Street. This is probably the best book and a book that every investor should have on his bookshelf. And that’s why for this Christmas, I decided to reread it again. And in the process, I decided, Okay, I’ll write notes and I’ll make videos and summarise the book so that you can read the book and then also look at the videos and have all the knowledge that Peter Lynch writes here explained systematised and structures so that you can use it forever and understand the book better.

So the first two videos will discuss the introduction what is who’s been through What is he doing and how to behave in stock market crashes that is a very hot topic and also discussed here. It’s a little bit all over the place the introduction, the first 43 pages, so I decided to split it in two videos, take the important pieces from the pages and structure them into two lessons. The first lesson that I’m going to discuss in this video, we’ll discuss Peter Lynch’s summary on the current market. Yes, I know the book was written 40 years ago, this is the millennial edition, but it’s very very similar to the conditions we are currently in the especially the 1990 commentary. Then we are going to discuss how to find those great stocks, what is the key when it comes to investing and how to invest even in the current market? Each page of this book is a gem. There is so much to learn. So I really hope you enjoyed this series. Don’t forget to like this video, subscribe and click that notification bell so that you get notified and see whether a video is interesting for you or not, as we do a lot of stock market videos from education to real indepth sector analysis and stock analysis. Thank you.

So let’s first start who is Peter Lynch. He was the investment manager of the Magellan fund from 1977 to 1990, where he turned $1,000 into $28,000, over 14 years for a yearly return of 29.2%. He delivered the return that was more than twice what the s&p 500 did in the period. And he tells us that we can do this too. And he tells us how in his book, the book is really a gem so we better start with it. Let’s start with his commentary on the current market. The millennial book edition that I’m reading now and that I’m summarising was written in 2000, at least the introduction, commentary about the book and we are in a similar market situation. The 1990s were extremely positive for stocks. It was all about dotcoms, the internet and people were paying whatever price to own parts of those businesses. However, there were also other great businesses that were relatively cheap. Similarly, today, the s&p 500 did amazingly over the last 10 years, there are some exuberantly priced stocks, stocks that have no fundamentals while there are good stocks that are reasonably priced.

Comparing 1999 to today. In Lynch’s words, there were stocks that had no profits, no profits and would reach a billion dollar in market capitalization for Lynch that was something crazy, but if we look at today’s market, there are stocks with no profits that reach $50 billion in market capitalization. So the billion dollars aren’t really relevant anymore. But Uber for example, has $50 billion market capitalization without profits. And then you have to think, okay, if I’m Peter Lynch, I want to invest in businesses that are able to deliver 10 x returns over the next 5-10 years. And for that to happen for Uber, the market capitalization needs to go to $500 billion. And then when investing, you have to see, okay, what’s the likelihood for Uber to go from 50 billion to 500 billion? What has to happen to their earnings to their business model? Let’s say they have to reach $25 in $25 billion in stable yearly earnings. And then on top of that have a 20 price to earnings ratio to give you 10x returns over the next 10 years and then you have to estimate the risk and reward of that actually happening. So Lynch is famous for his 10 baggers for stocks that go up 10x.