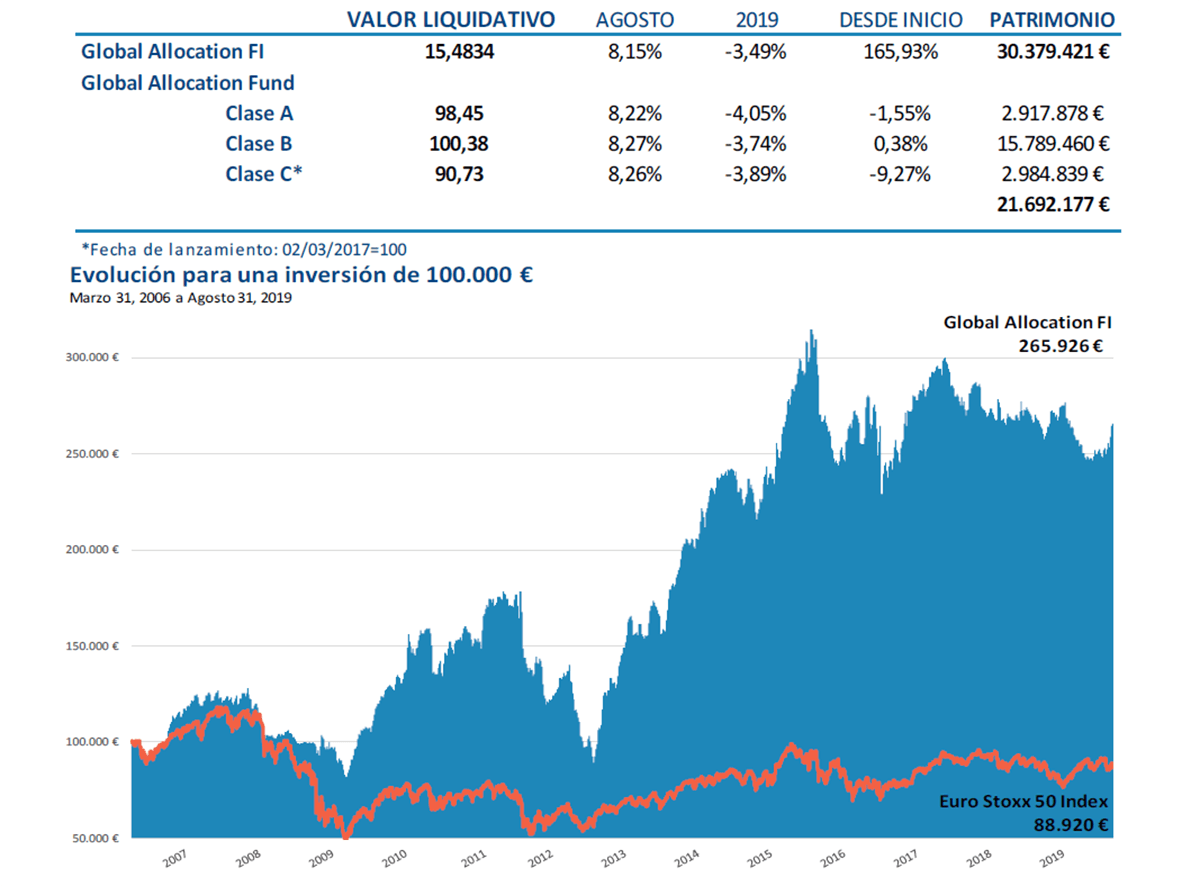

Global Allocation Fund commentary for the month ended August 31, 2019. This commentary is originally in Spannish and has been translated to English using Google Translate.

That ain’t workin ‘that’s the way you do it

Money for nothin ‘and your chicks for free

Dire Straits Money for Nothing

Q2 hedge fund letters, conference, scoops etc

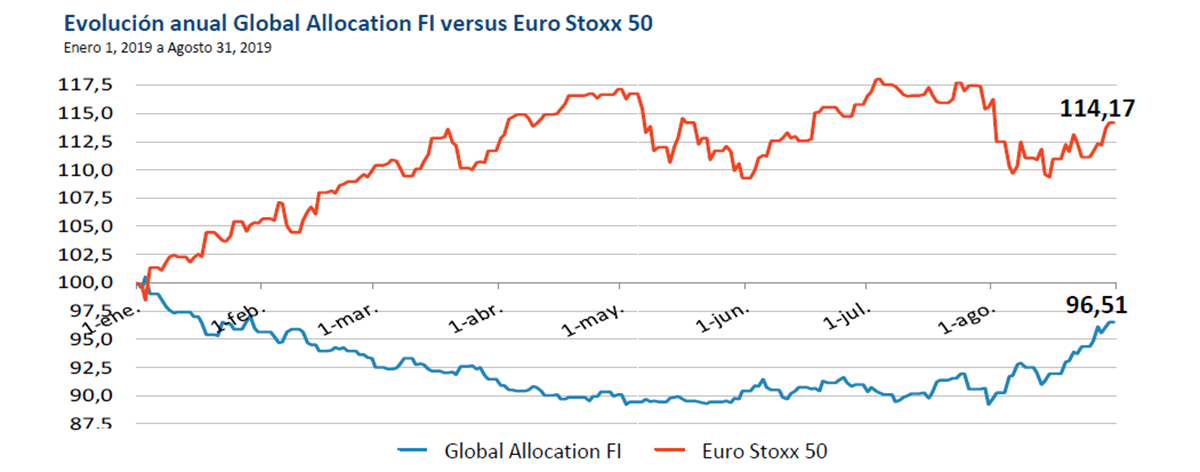

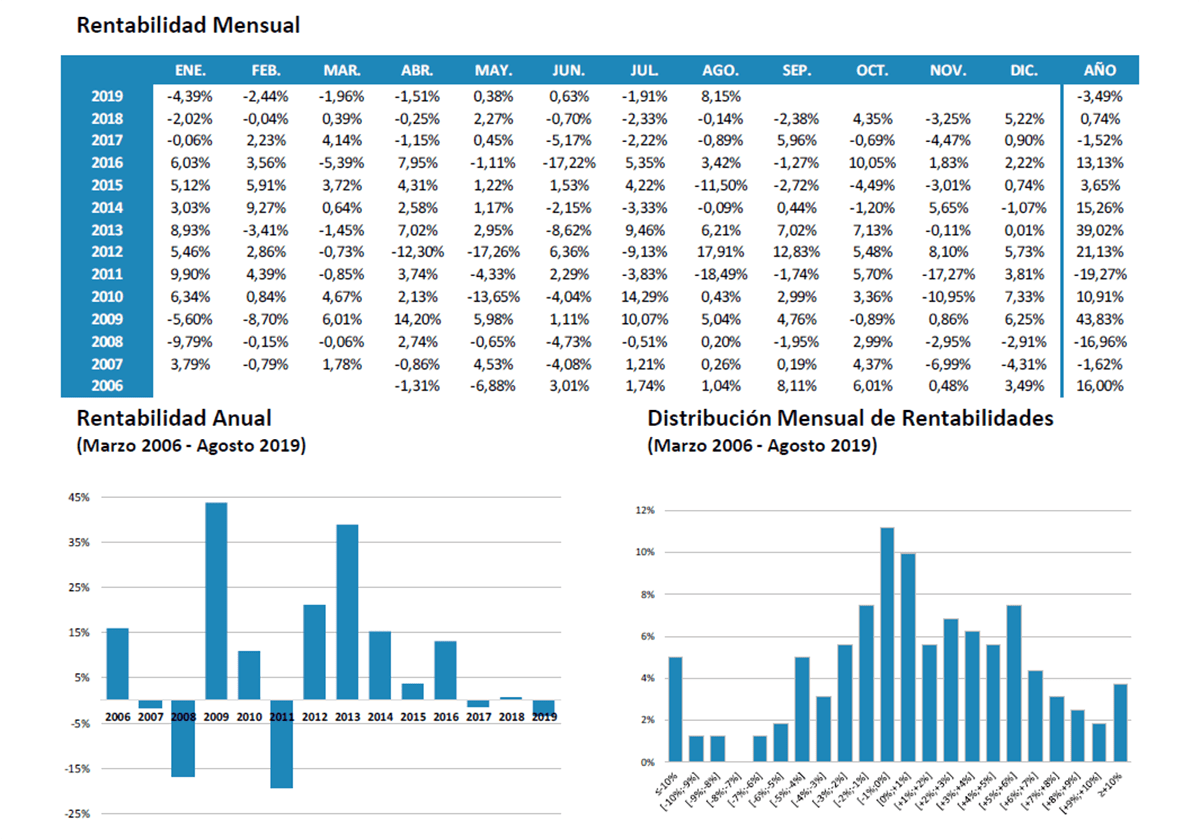

The month of August, as usual, has been violent movements in the financial markets.

The stock exchanges have generally fallen, although they recover almost all the falls in the last half of the month. The bonds have gone crazy at all, and we already have negative rates so huge that it starts to scare Or at least it should scare those They have metals, fired It is supposed to serve as a refuge for negative types...

Sorry, this can't be...

We are going to have to investigate a little. The level of nonsense is so monstrous that the investigation has led us to have a level of investment between the portfolio and the derivatives of the 190 of the fund's assets.

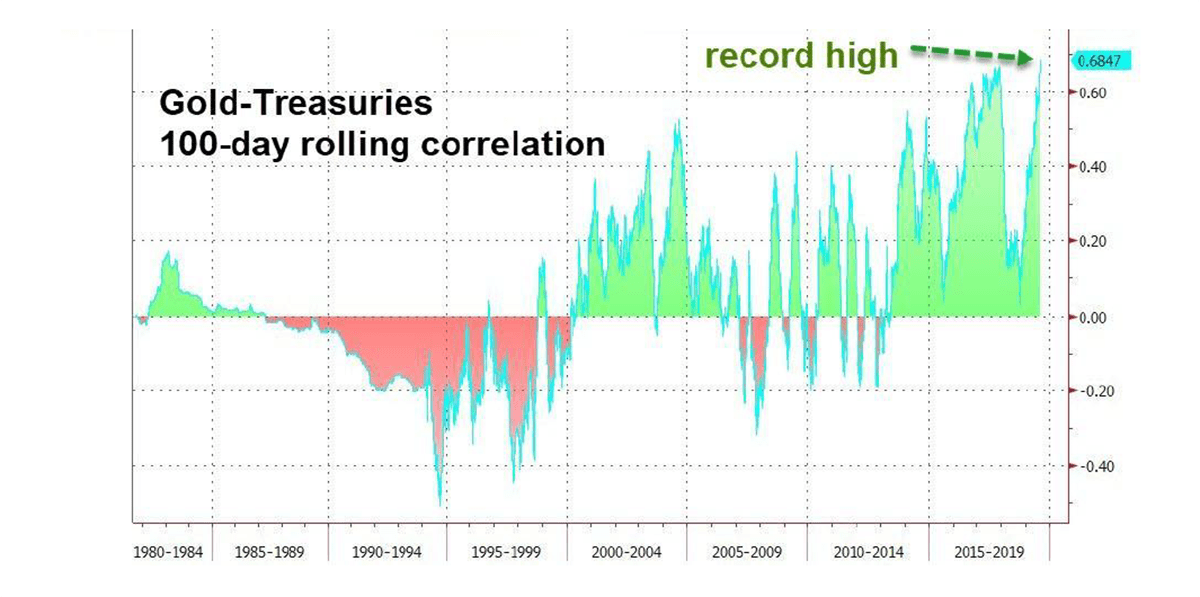

The conclusion is none other than the most logical negative types do not work and continue to create a series of distortions of cosmic proportions, how can it be that what is supposed an active refuge needs an active refuge? The answer is that bonds have obviously ceased to be an active refuge, although many people have not yet noticed. Only some who are buying gold are, of course, how is it possible for someone to lose money by lending their money to another, Maybe he doesn't even give it back? Is there no longer any credit risk? The answers are also quite obvious.

The truth is that the 10-year interbank is at 0 30 German bonds at that time at 0 70 and even buying Spanish bonds we have positive returns at 10 years.

Negative types, make the value of things in the future lower (or today higher Backwardation Of all We intend to confuse with the justification of a tax on anyone who has money whose sole purpose is to protect governments and zombie companies do not go bankrupt, perpetuating a vegetative state of the economy in which no one wants to recognize reality This ends up generating a deflation by its own effect of reducing the future value of goods.

We show you an example of the implicit deflation in the Euro Stoxx 50 index. First we ask for a 10-year loan and with the dividends that the market is currently quoting (there are futures contracts on dividends for up to 10 years, which would allow us to secure those charges futures), reduce the capital we owe, apart from what we earn in the credit !!! From a price of 3400 today, the price for 10 years would be 2300. Obviously, dividends deduct less and less benefits. While for this year they would imply a payment of 120 over the principal, by 2028 they would only mean 80. of more than 30 The fault is not that the market discounts a crisis of this size, are the interest rates.

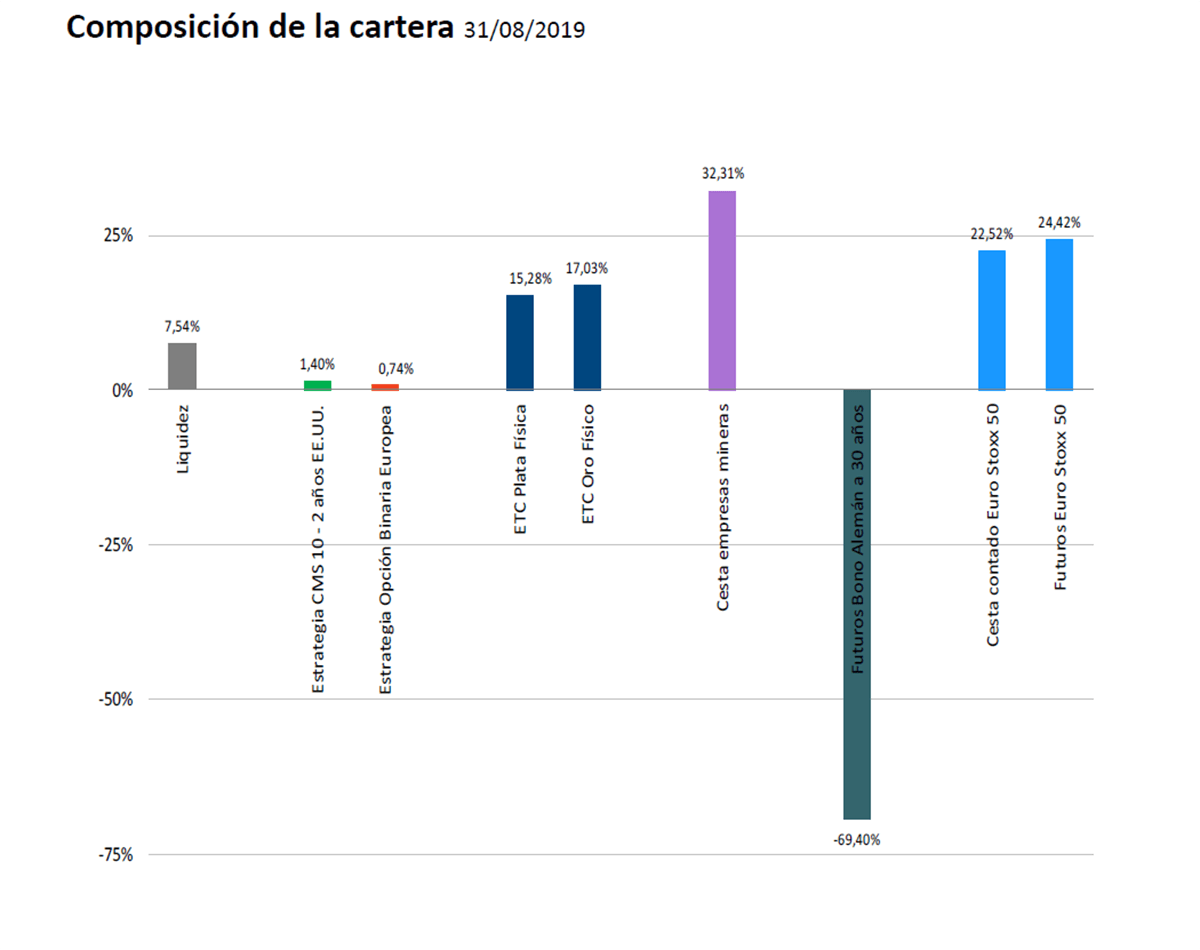

These differences (performance of Euro Stoxx 50 and interest rates) are, so far, the largest we have ever seen. These differences are what have made us buy 50 of the portfolio.

Obviously, we have done so by securing interest rates, but within 30 years. This is achieved by selling German bonds, which we do not have, but which can also be sold in the futures market. They close the month at 0 18 to do this , it was only enough to sell the Austrian bond that we had incorporated last month against the 30-year German bonds As we explained then, this joint strategy meant that we could win regardless of interest rate movements, thanks to convexity At the end of the month we have a position sold of approximately 70 of the portfolio in futures on German bonds at 30 years.

After all, the stock market is a perpetual bond, although thanks to its higher yield on the bonds, they also make their duration (term equivalent to the time required for “the investment) to be much shorter now than the longer bonds. convexity when changing the asset for another of greater “and term (this for the economists).

The following graph is the comparison of the evolution of the Austrian 2117 bond and the Euro Stoxx 50 It has been prepared on a 100 basis since the date we made the decision to leave the European stock market, November 2017 at 3600 price levels We have entered this month about 3350 almost a 10 discount, which must be added "what has not risen" by the effect of interest rates.

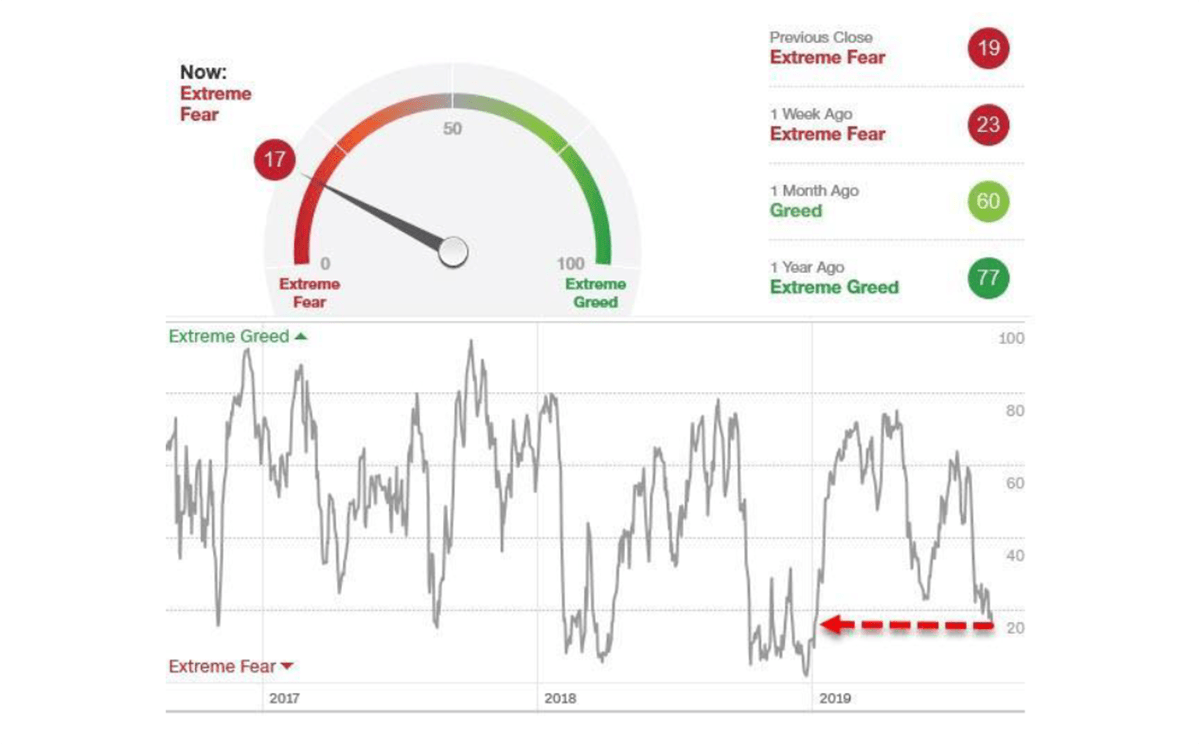

If the performance of the bags we understand that it could be stable, the behavior of the bags would have been similar, of course This makes us understand that “the recession” we talked about since the end of last year, and that no doubt appears look, or it will be devastating, or we have already had the falls that we expected Valuing for interest rates, we are talking about a “of a 60 that is not bad Also, the indicators of investor sentiment are in very negative territory and the liquidity level of the managers' portfolios at maximums, a symptom of a possible rise, at least in the short term.

This year the figures for 2008 have been exceeded with respect to the outflows / transfers of money from the variable income to the fixed income The credit at such low rates is to blame for the huge repurchases of shares that companies continue to do, which more than compensate this effect In fact, they are almost on the way to doubling it. Some European companies are starting to use it too.

This whole game of lies would be fine if we had the certainty that the Central Banks know what they do, which we doubt, and much more, this type of positions, buying in the stock market and selling bonds, usually has a short-term performance in the In the same sense, since still a lot of investors continue to think of bonds as an asset “and when the stock markets fall, bonds tend to rise in price, that is, lower profitability. The day we have fallen the most, that of the Brexit referendum, was with positions It is this sense, although it does not take long to recover. In the end, interest rates work miracles and are the ones in charge, until the Central Banks lose control of the situation.

This scenario of loss of control seems more than reasonable, and usually leads to a loss of confidence in fiat money, that is, the bills that the ECB prints without cutting a hair, with the justification of providing liquidity and credit to a system that does not lack it There are about 1 5 Trillion euros every day that return to the ECB of the banks, who do not know what to do with them every day, paying a succulent 0 40 and as it seems, with intentions to increase the tax If you do not break before The bank index has touched again this month the minimums in which it was even in the crisis of Lehman Brothers or that of 2012 A business in which either a little is lost, or a lot is lost is not good business As you continue on this path we will see interventions sooner or later in a few banks OR in all It would of course be the dream of more than one political leader.

The loss of confidence causes money to lose value, which makes assets “(gold, even stocks) rise in price. Depending on this fact, it can even lead to episodes of“ Venezuela, Argentina and Zimbabwe, or many other countries long ago, Europe included.

In any case, seeing that gold takes the reins as a refuge over an active refuge, we have increased the positions we had. If the collective madness in the bonds continues, the positions in gold and silver will protect us from that rise, but even more in the case of a failure by the Central Banks.

So we have about 70 of the portfolio between mining companies and physical gold and silver Half and half This makes, in proportion, our position is more sensitive than the nominal, on the one hand, since mining companies tend to rise or fall more in proportion than gold itself, apart from having a stock exchange component, and a dividend, which, however small, is more than the 0 that has gold and are quoted in dollars (see later).

Although the scenario of loss of control does not seem plausible at the moment, so gold for now is only a refuge against negative types. I say it does not seem plausible, since, in a scenario like this, we would first see how the curves of types of interest steep dramatically This month has been the opposite effect, reversal of the curves, the short sections pay more than the long ones, just opposite to our strategies in options This makes us that we have lost, at market value, a good part of the premiums that we have in options on the slope of the American curve, where we expect them to be positive This fact would remove, if it is due to sharp drops in interest rates by the Fed, the only Central Bank that can really lower them , some tension to the stock market Returning to a scenario of lower recessionary risk Although it could also happen at the same time, we enter into recession and the current deficit of the 7 that It has the US (which is allowing it to cling to anemic growth as a newborn monkey grabs its mother), becomes an absolutely unsustainable deficit and joins the debacle.

On this point, we warned at the beginning of the year that the greatest expenditure would have little impact, since, by financing it with a deficit, it would detract from what is known as the Crowding Out effect resources of the private system to the public. This fact is not isolated in a globalized world, these resources are not only from the Americans themselves Currently 95 of all public debt that has positive interest rates, is from the US This makes it a magnet for the capitals of the rest of the world, making this effect become global In fact, the dollar ends the month marking its historical maximum over the rest of the world currencies Our position in dollars is 35 if we only count the miners To the increases in gold and silver, we must add those that can have the currency, since our money is in euros.

This last effect is, of course, nothing good for balancing the major trade deficit that the US is holding and even less for the return of all dollar debt, mainly from those, erroneously, called emerging countries. Obviously these are deflating to a speed of vertigo or directly stop paying for the umpteenth time (Argentina this month).

The situation is far from easy. If there is something that is not well understood, I understand it. We face an absolutely unpredictable scenario, with some especially dangerous ramifications. Understanding why and how far some things can be carried is equally complicated, although we hope to have Successful in almost everything We were waiting.

In short, we have an especially aggressive position, but with very little danger. In fact, we think that we are quite well prepared for almost any type of scenario, however good or bad it is. And it is being noticed. It is costing us to have a negative day, regardless of that raise or lower the bag, raise or lower the metals, or raise or lower the bonds Obviously, this is not going to happen every day, but it is very complicated that we have a significant loss We have assets to give and take, risk assets that can serve as refuge assets and refuge assets that have ceased to be and that take refuge from a scenario in which interest rates skyrocket and take away the rest of the assets in which to take refuge Or simply that everything returns to normality That would be, on the other hand, the most normal And that, by the way, we could also do quite well Rarely have I seen a more uncertain scenario than the current one and I have been so sure I hope I have succeeded in the "Fine Tuning the Market Timing" for the experts.

The research he was talking about is rather private (and long, so for those of you who have come here https://www.youtube.com/watch?v=jQsGEjwwjt8 what Dire Straits would say on his album “Love Over Gold” In fact, I recommend listening to the song that I include you, this month with translation of the lyrics into Spanish.