Whitney Tilson’s email to investors discussing his readers’ comments on: Glencore PLC (LON:GLEN)’s Mutanda Mine closure could cripple or kill Tesla Inc (NASDAQ:TSLA).

3 readers’ comments:

Q2 hedge fund letters, conference, scoops etc

1) Tesla batteries already lowest cobalt % and going to 0% so could be considerable competitive advantage for Tesla.

Always take short info with big grain of salt.

2) So one thing to look at here is that a lot of the new copper mines in Zambia have large cobalt byproducts. I’ve been out of that space for 5 years, but those mines may not have been processing the cobalt if it was in oversupply (the mind costs are covered by the copper). If they have unprocessed dumps of cobalt it won’t take much to get that into the supply base.

Same thing happened with Uranium in South Africa - it’s a byproduct of the gold mining there and was never processed. It’s all above ground and waiting to be processed.

Again, I haven’t been in that space for 5 years but could be worth looking into.

3) It’s not the kill shot, it’s a mild it’s just another negative to lump on. Cobalt jumped 10% on the news - https://www.lme.com/en-GB/Metals/Minor-metals/Cobalt#tabIndex=2 but Cobalt is still down a ton over the past year and a half. The forward contracts for Cobalt are only 10% above current levels, so I think the article is mostly BS, unless he knows something the market doesn’t.

Tesla has done a great job of reducing the amount of Cobalt needed in its batteries (by 70% or so) but that’s also what makes them more volatile. But think about that – Panasonic and Tesla are both losing money when a major cost in the batteries has dropped 70% in the last 18 months.

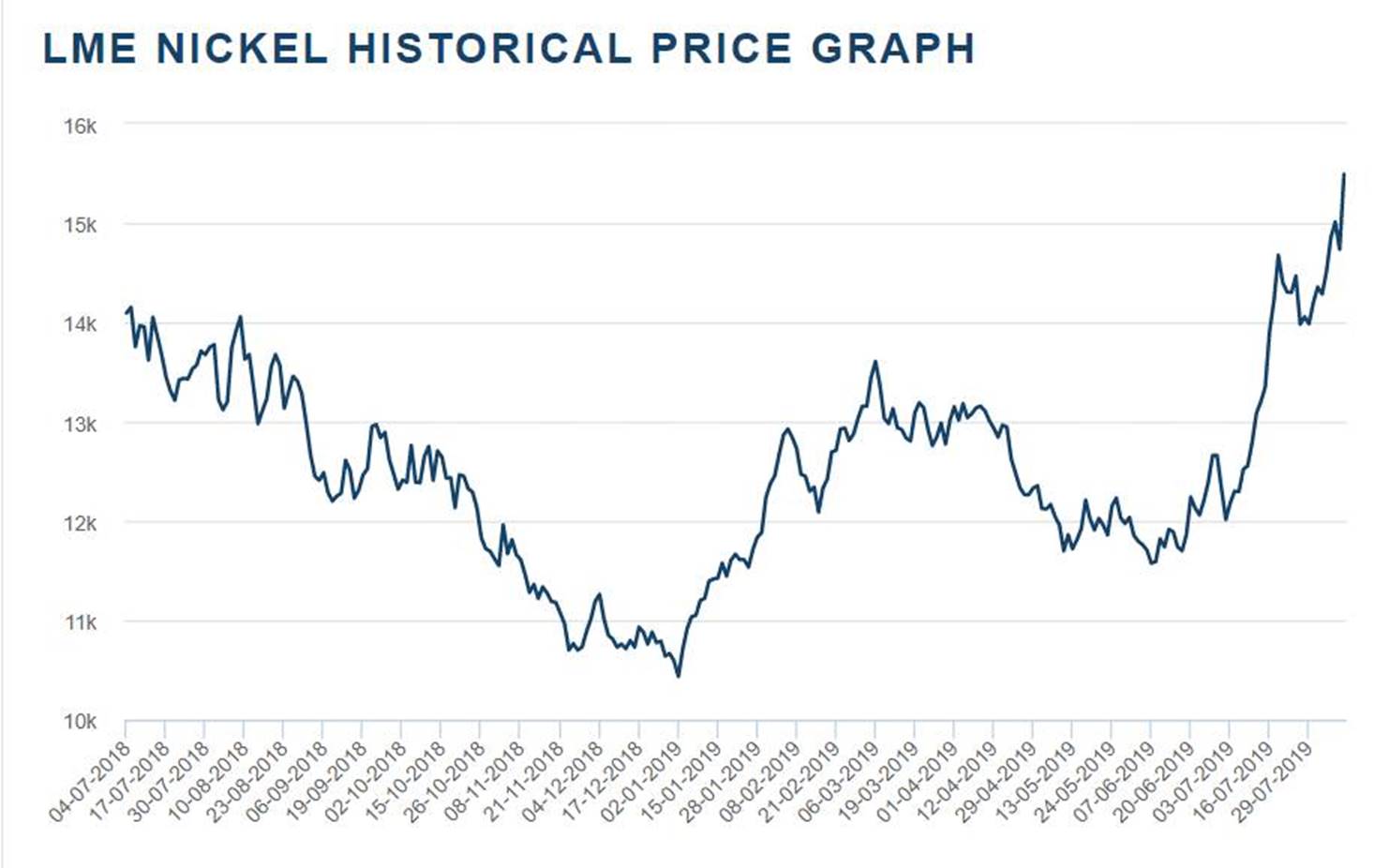

The bigger problem for Tesla and Panasonic is Nickel. NCA batteries in Tesla are 80% Nickel – a high purity nickel that is priced more than the below. If Nickel keeps rising it’s going to be another major negative going forward for Tesla/Panasonic.