Majoring in Money: How college graduates and other young adults manage their finances.

This study examines the money management skills, payment behaviors, and financial literacy of college students, completers, and non-completers.

[REITs]Q1 hedge fund letters, conference, scoops etc

College graduates – Key messages:

- Young adults feel confident in their money management skills and demonstrate responsibility by paying bills on time, tracking their spending, and not spending more than they have.

- They are also eager to establish credit and expand their financial literacy; when put to the test, results show more education on managing finances might be necessary. We are all lifelong learners, especially true when it comes to financial literacy.

- There is a tangible difference in behavior and perception of financial skills between college students, college graduates, and those who started college, but didn’t complete it.

- Further, those who have a credit card, whether they’re college students, non-completers, or college graduates, tend to have greater awareness of the benefits of credit and be more knowledgeable about money and credit than those without credit cards.

Young adults are optimistic about money management, and college graduates are the most confident in the way they’re doing it.

- College graduates are the most confident, with seven in 10 (71%) rating their money management skills as good or excellent while six in 10 college students are (59%) rating themselves the same way. Forty-two percent of those who did non-complete college, however, rate their skills as good or excellent.

- Nine in 10 (91%) of college graduates, eight in 10 (84%) of non-completers, and seven in 10 (72%) of college students pay their bills on time and more than half of each group say they track their spending and never spend more than they have. More than half of graduates report never overdrafting to avoid fees (52%), compared to 43% of non-completers.

- Three in five (62%) of college graduates and half of college students and non-completers are saving money every month.

- Four in 10 (41%) college graduates say they have an emergency fund compared to 22% of college students and 31% of non-completers.

- 8 in 10 graduates know their credit scores (82%), while two-thirds of non-completers (67%), and about half of students (56%) do.

- They are significantly more likely to say they pay off their high interest debts first (43%) compared to non-completers (30%).

College Graduates And Financial Literacy

Financial education begins at home, with parents acting as a major source of influence, but young adults are exposed to a variety of resources to help continue their learning.

- Parents are the most influential resource when learning how to manage finances, though fewer non-completers report learning from their parents (56%) compared to students (68%) or graduates (70%). Of those who didn’t complete college, nearly two-thirds (63%) report having a parent who also began, but did not complete, their studies.

- Nearly 7 in 10 students (68%) report their parents as the most influential resource when learning how to manage finances.

- One in four students (23%) learned from a high school class, while grads and non-completers are the most likely to use online research as a learning channel (34% and 31%, respectively).

- Non-completers also the most likely to report not having anyone to teach them about money management (6% compared to 3% students and 4% completers).

College students are confident in their skills, and they’re eager to learn more.

- Nearly 60 percent of students typically rate their financial management skills as excellent (20%) or good (39%), but only one in ten (11%) answered 4 of 4 questions on basic financial topics correctly.

- Nearly nine in ten students (87%) recognize that paying bills on time is positive behavior, and two in three students (66%) agree that opening multiple credit cards or loan accounts at the same time can have a negative effect on credit scores.

- Students are the most likely to want more information about various financial management topics (84% compared to 77% of grads and 69% of non-completers), and they’re most interested in strategies to help them save, student loan repayment options, or options to pay for college or graduate school.

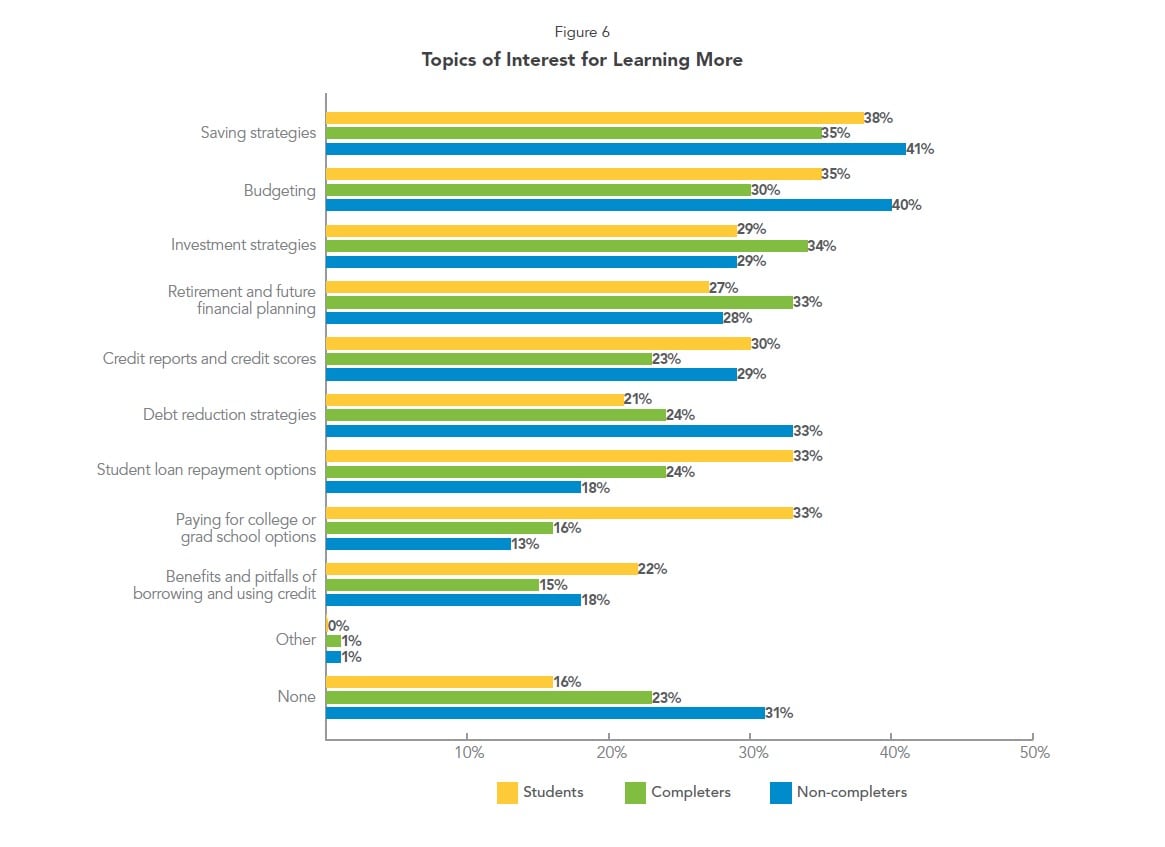

Across the board, young adults express a desire for more financial literacy, though the topics they’re most interested in vary from group-to-group.

- Graduates are thinking long-term, looking for investment strategies (34%) and retirement and future financial planning (33%).

- Non-completers express a need for more information on day-to-day money management, wanting information on topics like budgeting (40%), debt reduction strategies (33%), and credit reports and scores (29%).

Credit Cards

Young adults aren’t shying away from credit cards, and the majority have obtained one to establish credit.

- More than half (57%) of college students have at least one credit card, and 83% of graduates carry credit cards, while 61% of non-completers do.

- Students reported an average balance in 2019 of $1,183, a 31% increase over the average balance in 2016 of $906.

- Graduates’ average balance is $2,351 and non-completers report an average balance of $3,281. Non-completers are the most likely to carry a balance over to the next month, possibly resulting in higher average balances.

- The biggest reason given by all three groups for getting their first credit card is to build credit. (74% of grads, 77% of non-completers, 58% of students).

College graduates are the most likely to see credit cards as a tool for continued financial success, and they’re using them responsibly.

- Eighty-three percent of completers carry credit cards, a much higher proportion than non-completers (61%) and students (57%), and they’re most likely to pay their bill in full each month (64% of grads do vs. 60% of students and 32% of non-completers).

- Although more of them have cards and seem to use them more often, graduates appear to be more conservative about spending money they don’t have. Fewer grads say they frequently or sometimes charge items knowing they don’t have the money to pay the bill (27% vs 37% non-completers and 38% students), and more of them say they never charge items when they don’t have the money to pay for it (48% vs 29% non-completers and 38% students).

- Graduates expect to qualify for much higher amounts than either students or non-completers should they apply for a new card, with only 3 percent saying they wouldn’t qualify for a credit card. Nearly two-thirds expect to qualify for amounts great than $2,500. Non-completers are significantly more likely to say they would not qualify for a credit card today (13%). Six in ten non-completers say they wouldn’t qualify, or don’t know if they’d qualify, for more than $999 in credit.

Those who have a credit card, whether they’re college students, non-completers, or college graduates, tend to have greater awareness of the benefits of credit and be more knowledgeable about money and credit than those without credit cards.

- Those who do not have a credit card are more likely to rate their skills as ‘not very good’ or ‘poor’ (12% students, 9% completers, and 19% non-completers) than credit card users (6% students, 4% completers, and 11% non-completers).

- Across the three groups, those who do not have a credit card are more likely to say they do not know their FICO score (27% students, 26% completers, 29% non-completers) than those who have a credit card (22% students, 10% completers, 10% non-completers). Similarly, those without a card are more likely than those with one to say they don’t have a FICO score (36% vs 6% students, 13% vs 1% completers, and 19% vs 2%, non-completers).

- In each of the three groups, those who have a credit card scored better than those who do not on the financial literacy quiz.

Earning credit card rewards is a motivator for young adults, and rewards that could be redeemed through automatic repayment on loans is a desirable feature.

- After building credit, graduates second most cited reason for wanting a credit card was interest in earning rewards (34%).

- More than half of completers (55%) and 4 in 10 (39%) non-completers opened an additional credit card because they were interested in earning rewards.

- Nearly 6 in 10 college students (59 percent) would be interested in a credit card that offers loan repayment rewards.

Other payment methods

Young adults rely most heavily on mobile payments and debit cards for their day-to-day spending.

- While eight in 10 (81%) young adults still carry cash, most rely on debit cards and mobile payments.

- Nine in 10 college graduates and non-completers, (89%, 91%) and eight in 10 (85%) of college students, use debit cards.

- When young adults choose to use cash, they are more likely to use it to pay for in-store purchases less than $20 or for dining out.

- Nearly nine in 10 college graduates and students, (88%, 86%) and nearly eight in 10 non-completers (78%) use mobile payments, most often citing PayPal and Venmo. More college students are reporting the use of mobile payments than ever before. Nearly nine in ten students (86%) use mobile payments, followed by 85% who use debit cards. Only one in ten students write checks.

- In contrast, non-completers are less likely to use mobile payments (78%) than completers and students (88% and 86%, respectively). They are more likely to use debit than other payment methods, and are more likely than the other two groups to use debit for all purchase types.

- Completers are slightly more likely to say they use personal checks (15%) than non-completers and students (9% and 12%, respectively).

- Generally, both students and non-completers choose debit cards above other payment types to pay for any purchase and completers choose credit cards.