Logos LP letter to investors for the first quarter ended March 31, 2019.

“All great truths begin as blasphemies.” – George Bernard Shaw

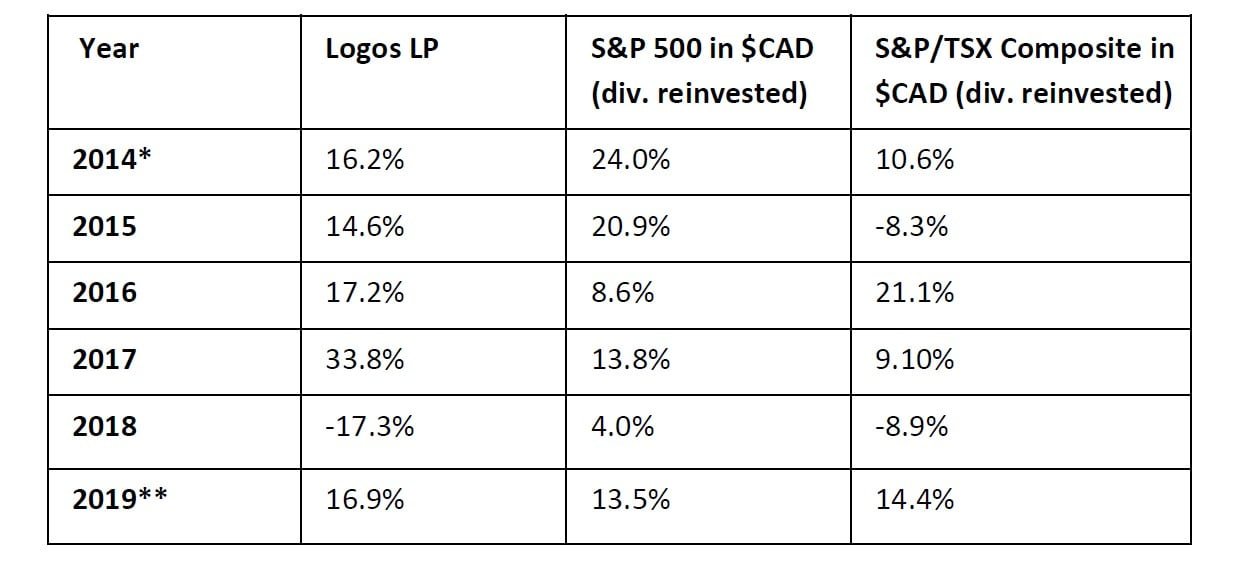

The following table represents Logos LP’s YTD return compared a basket of relevant indexes.

The price per unit as of April 5th, 2019 is $24.67 compared to $21.11 as of December 31st, 2018:

*From March 26th, 2014 to Dec. 31st, 2014

**YTD as of April 5th, 2019

Q1 hedge fund letters, conference, scoops etc

Coming off a tough 2018, the fund was able to increase its compound annual return to 14.47% while its cumulative return since inception now stands at 97.04% as of April 5th, 2019. Currently, there are 29 names in the portfolio with our top 10 making up 68.09% of the fund’s net asset value. 72% of those assets are in the U.S., 27% are in Canada and a little over 1% are international. Although 2018 was a disappointing year, we believe we have positioned the portfolio to capture long-term upside while maintaining below average downside risk. This belief is rooted in our accumulation of companies during the Q4 rout with the following characteristics: strong long-term earnings growth potential, dominant market share, high and consistent returns on capital, management with superior capital allocation capabilities and most of all: fair prices.

We did not make any significant purchases in the first quarter of 2019, but we did add a few peripheral positions. These new positions include Kinaxis Inc. (TSX:KXS), Domino’s Pizza (NYSE:DPZ) (well after the February earnings miss), Hardwood Distributors (TSX:HDI) and Blackbaud (NASDAQ:BLKB). Moreover, we finally nibbled on MTY Food Group (TSX:MTY), which is a name that we have mentioned in previous letters and has been on our watchlist for some time. An earnings miss and slight decline in same-store sales disappointed investors, forcing the market to punish the stock with a +20% decline late in Q1. We have seen this kind of price action (and report) before in 2018 and in 2016 and we believe this created a unique opportunity for us to purchase a very high-quality business with significant operating leverage, high returns on capital as well as disciplined management at a reasonable price. We believe MTY’s continued focus on strategic acquisitions, brand innovation and multi-brand international expansion is still in its early days, leading to above average compound returns.

We have been monitoring a few other peripheral positions that we purchased in late Q4 that were oversold given fundamentals at the time. These positions include Mettler-Toledo (NYSE:MTD), Acuity Brands (NYSE: AYI) (one of the most undervalued names in the portfolio), Churchill Downs (NASDAQ: CHDN), LeMaitre Vascular (NASDAQ: LMAT), Cerner (NASDAQ:CERN), Tyler Technologies (NYSE: TYL) and NetEase (NASDAQ: NTES) (same camp as Acuity Brands). We will continue to monitor whether the continuing trade war will have an impact on Q1 earnings as many of these companies have large and growing segments in APAC, but we are pleased that there has been no shift in fundamentals despite drastic price declines.

Thoughts on Church and Dwight’s Acquisition of FLAWLESS

In late March one of our core positions, Church and Dwight Inc. (NYSE: CHD), acquired FLAWLESS Finishing Touch Brand which is the #1 manufacturer of electric razors within the ‘touch-up’ hair removal category for women. CHD purchased the company from Ideavillage for $475 million plus another $425 million if certain targets are met. Ideavillage will assist CHD in selling the product while CHD controls all earnings and cash flows derived. It is estimated that the company will grow revenue by 15% annually over the next 5 years with operating margins in the 30% range, which is well above CHD’s current 23% operating margin. We believe this a textbook acquisition that will be highly beneficial to current shareholders as CHD only paid 11x EBITDA and the newly acquired unit will benefit greatly from CHD’s operating leverage.

We are pleased to see CHD’s management execute diligently on its long-term roadmap and we believe the company can come close to its 10-year total shareholder return (TSR) rate (CHD saw its stock price appreciate by 20.5% on average for the last 10 years) over the long-run. We will remind investors of CHD’s core strategy and why we believe the business will continue to thrive in a world of disruption within the CPG space:

- CHD is an acquisition platform (some might say “rollup”) focused on acquiring small asset-light personal care/health care brands that: 1) hold dominant (or rapidly growing) market share and; 2) operate in an oligopolistic market with long tailwinds. For example, in 2011 CHD acquired Batiste Dry Shampoo for $64M (which at the time had annual sales of $20M globally). As of 2018, Batiste controlled 63% of the Australian dry shampoo market (~37% globally) and generated nearly $25M in revenue in Australia alone. The list of these kinds of acquisitions is long throughout CHD’s history: in 2016 CHD acquired the #1 and #2 UK, Canadian and South African hemorrhoid care brands for $130M (annual sales of $24M) and the #1 non-drug hair thinning supplement brand for men for $160M (annual sales of $44M). Their formula is quite simple: buy the right business in the right category at the right time and at the right price. Once acquired, CHD will then leverage their operational knowledge from other acquired “power brands” (i.e. OxiClean, Trojan etc.) to fortify or grow market share for that respective brand (i.e. new product innovation, innovative marketing campaigns, introduction of productivity or cost control programs, new distribution channels etc.). This acquisition strategy in search of new power brands coupled with fortifying current power brands through innovation should lead to 2-3% domestic revenue growth over the long run.

- The second part of CHD’s strategy is to use the cash flows from these power brands into international expansion efforts by exporting, acquiring and developing products for new international markets. The international story is a very long one, as the company previously had a very small international business: international grew 7.8% last year and 9% in Q4 alone, while the export business grew 16%. Recent partnerships in Asia (DKSH in SE Asia and Jahwa in China) will keep this story intact for decades, and we expect the export business to compound at double digits over that timeframe.

- The final piece of the puzzle for CHD is to use cash flows from their domestic and international businesses to build out the animal productivity business. We are optimistic on animals as a long-term theme, since humans are consuming resources faster than they are replacing them, especially within protein markets. By focusing on probiotics, prebiotics and microbial solutions in the short-term for the swine, cattle and poultry markets, we believe CHD has put the wheels in motion to develop a large animal pharma business which can expand beyond prebiotics and probiotics (picture using the power of microbes for genetic therapy) over the long term.

The CPG space is a highly competitive one that is constantly under siege by private label, newly funded upstarts developing new brand categories and other purely digital e-commerce companies. It is unclear how many of the large CPG brands that had dominant market share in the past will continue to fortify their market position and we cannot say for certain that brands which occupy the “middle of the grocery aisle” today will still be around in the coming decades.

While we continue to monitor the ongoing disruption and competition within all categories of the consumer staples segment, we believe there are a few unique pockets (particularly niche beauty, wellness and quasi-healthcare markets) with specific tailwinds which we think have a fighting chance of growing faster than GDP over the long-term.

Outlook

The fourth quarter of 2018 gave us a bear market that we believe reset and lengthened the current bull market. As stated in our April newsletter, earnings in the USA over the last 4 years have grown without commensurate growth in total shareholder return and thus equities are becoming cheaper, absent some material change to the trajectory of future growth or cost of capital.

Over the last four years, global equities have basically drifted sideways (absent the one-time Trump tax cut the effects of which will likely fade very soon); but pre-tax earnings have been increasing.

In the US, for example, S&P 500 pre-tax earnings have increased by 16 percent over the last four years. Said another way: global equity markets have actually become cheaper, or less risky (downside risk), over the last four years. As equity prices fall, the probability that they will be higher in the future rises. We maintain that being overly defensive now suggests opportunity risk at a time when downside risk appears less pronounced.

Furthermore, the constant drum beat of pundits calling for the next recession has become a form of entertainment. More shock and awe and less relevant insight. Let’s remember that recessions are relatively rare, so constantly forecasting them and positioning portfolios in anticipation can be a very risky proposition (opportunity risk). Instead, we believe the bull market has been extended by the selloff which closed out 2018 and the probability of further upside is now higher.

On the sector front, after much trepidation we have decided to monitor developments in the US cannabis market and believe there may be an opportunity to go long given the extended market cycle. Unlike previous bubbles or richly valued Canadian counterparts, the US story contains a few interesting twists: 1) a handful of “rollup” companies are pursuing acquisitions with the plan to become multi-state operators in a highly regulated and known market; 2) companies cannot hold long-dated leverage due to banking restrictions in the US, creating solid balance sheets; and 3) US companies are using the Canadian experience for eventual listing on the NASDAQ. While we believe this is a very fluid space that is incredibly difficult to value (and contains the necessary ingredients for a bubble), we wouldn’t be surprised to see significant returns over the next 24 months within this segment of the US equity market.

We would like to caution investors that we are likely in a late cycle bull market and thus expectations about future returns should be tempered. However, we believe a deep selloff in Q4 2018, lower interest rates for longer around the world, positive consumer confidence in addition to continued strength in corporate margins do provide a favorable backdrop for equities in the short to medium term.

We are grateful for your continued support and will continue to dedicate our time and effort on your behalf. In the meantime, if there are any questions please feel free to reach out to us and we would be more than happy to answer.

Sincerely,

Peter Mantas

General Partner, Logos LP

Matthew Castel,

General Partner, Logos LP

This article first appeared on ValueWalk Premium