More Americans are using their credit cards purely because of rewards loyalty programs, according to Finder’s second annual Chasing Points study.

An estimated 87.1 million (39%) of American adults admitted to spending on a credit card just because of a loyalty program – a 21% increase from last year’s 71.7 million.

Q4 hedge fund letters, conference, scoops etc

The average amount people spend is $1,814.75 per person, which amounts to $158 billion nationally. That’s about a 10% drop from last year’s spend of $175.8 billion.

So when are we spending? The research found people are most likely to chase points when buying groceries (28.1%), dining out (23%) and on hotels (16.9%).

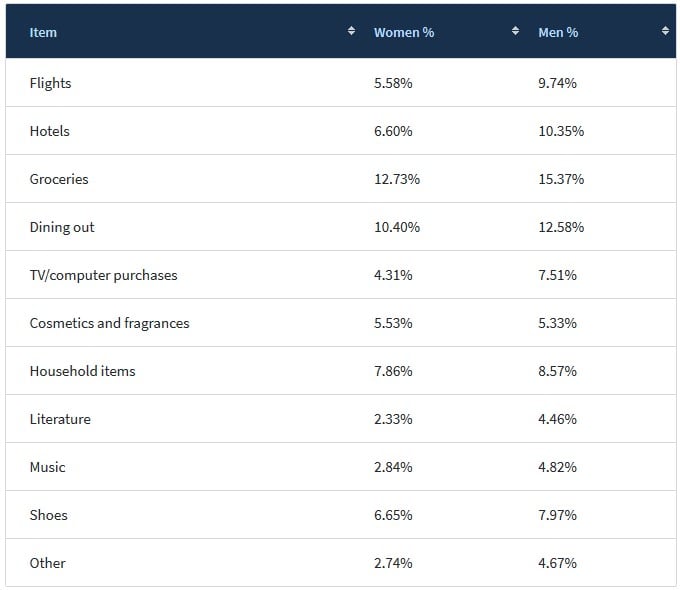

Interestingly, men are more likely than women to have purchased something on their credit card just for the loyalty program. Some 21% of men admitted to spending this way, compared to 18% of women.

Men are also likely to spend more. Men spent an estimated $1,979.82 on average, while women spent just $1,573.63. However, when chasing points, women outspend their male counterparts in 5 of the 11 categories, including flights, hotels, household items, cosmetics and fragrances and other.

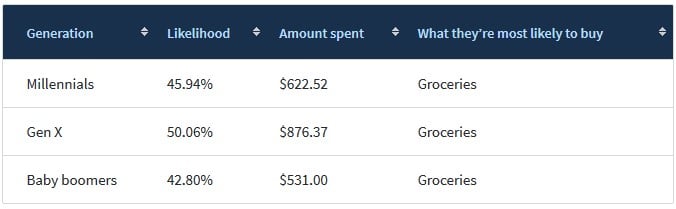

The generation most committed to racking up loyalty points? Millennials, with 35.06% admitting to using a credit card for points, compared to baby boomers (30.27%) and Gen X (23.03%). However, Gen X are the biggest spenders, having spent an average of $1,750.47 per person, followed by millennials ($1,355.05) and baby boomers ($1,240.69).

Commentary from finder’s Consumer Advocate, Rachel Dix-Kessler:

"Considering Americans have spent an estimated $158 billion chasing points, it seems loyalty rewards programs can have a massive impact on spending habits."

"While there can be advantages to earning rewards, these programs can lead to debt-related results if not careful. With the number of people using credit cards just for rewards rising, it’s more important than ever for consumers to do their homework."

"When choosing a credit card, make sure you get one that fits with your current financial situation. You’ll want to look into a variety of factors, with annual fees and APRs topping the checklist. And while it can make sense to receive points for money spent, consumers should weigh the pros and cons of every rewards program and always compare their options."