The new year has been good for the price of bitcoin after a spectacular collapse of the cryptocurrency bubble in 2018. It’s up by about $800 since the middle of December and now trades above the psychological level of $4,000. After a brief pullback toward the end of 2018, the bitcoin price gained about $400, including a $200 gain in less than two days, so is this a sign that the crypto market is about to recover?

Of course, it depends on who you ask, but one analyst discovered a pattern which might point to a bottom next month.

[REITs]Q3 hedge fund letters, conference, scoops etc

A year after the cryptocurrency bubble popped

CCN pointed out that this past Monday marked exactly one year since the cryptocurrency bubble popped, leading to a tremendous crash in the bitcoin price throughout 2018.

Data from CoinMarketCap indicates that the market capitalization of all cryptocurrencies hit $835.7 billion on Jan. 7, 2018, making the cryptocurrency bubble market temporarily worth more than Facebook and Twitter combined. A year later, the crypto market cap is only $136.3 billion — even though the number of cryptocurrencies tracked by CoinMarketCap has increased significantly over the last year.

So exactly why did the bitcoin price surge suddenly? Citing a tweet from Whale Alert, a price tracker for bitcoin, a Forbes contributor traced the sudden movement to the sale of about 2,500 bitcoin for nearly $10 million on the Bitstamp exchange. The huge sale shifted the cryptocurrency’s daily volume over $5 billion. What makes it particularly interesting is that the bitcoin price is so far holding on to the key support level of over $4,000.

News on bitcoin ETFs could be lending support

One thing which could be helping support the cryptocurrency bubble and bitcoin price is the news that Japan’s financial regulator is reportedly considering approving the first exchange-traded fund for the cryptocurrency. Citing an anonymous source, Bloomberg said Japan’s Financial Services Agency (FSA) has decided not to allow bitcoin futures but is exploring potential demand for bitcoin ETFs.

Of note, the Securities Exchange Commission has delayed its decision on bitcoin ETFs in the U.S. until February. Meanwhile, U.S. regulators have allowed bitcoin futures, unlike their Japanese counterparts.

Key trend identified in bitcoin price movements

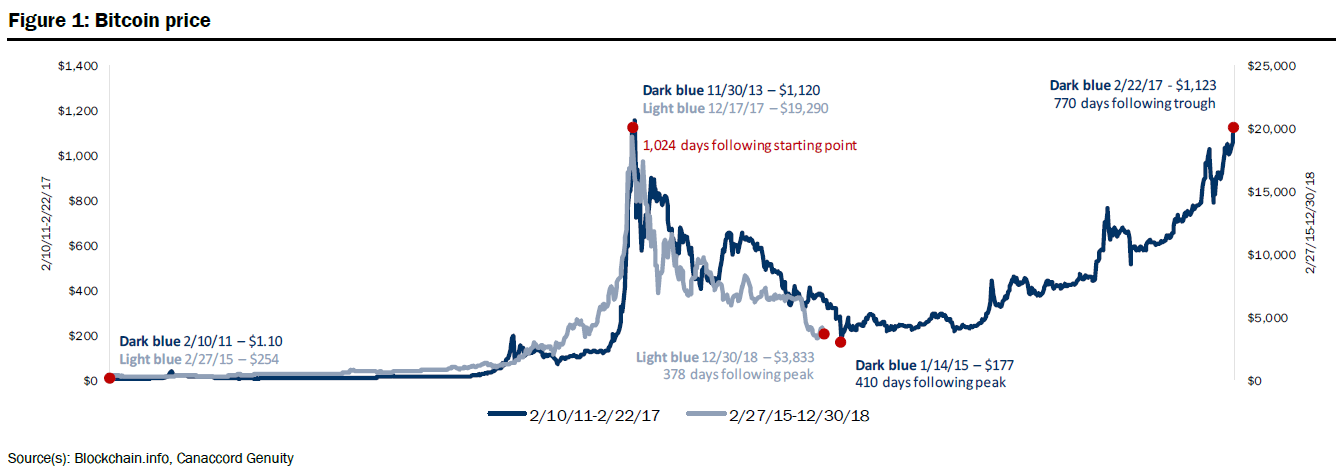

Crypto enthusiasts have long focused on technical indicators in an attempt to forecast where cryptocurrency bubble and the bitcoin price might go next, and Canaccord Genuity analyst Michael Graham recently identified an interesting trend on the price chart.

In his “Bitcoin Monthly” report for January, Graham pointed out that bitcoin’s price movements over the last three years were very similar to their movements between 2011 and 2014. He noted that it took a little more than 1,000 days for the bitcoin price to peak, and then it bottomed out about 400 days later after declining by about 80%.

He admitted that this repeated pattern “is missing any fundamental underpinning,” but he found it helpful to recognize it. He also said that if the bitcoin price follows a similar pattern between now and 2021, then it could bottom out next month and then march higher toward previous highs of around $20,000 two years from now in March 2021.

After the cryptocurrency bubble fall, is the gun loaded for future increases?

Graham also discussed what he described as a “loaded gun” dynamic for the bitcoin price. He explained that if the cryptocurrency bubble does indeed start to recover — which it has done since he wrote his note on Jan. 1 — then there could be “significant assets sitting on the sidelines” which could buy the cryptocurrency. He cited two major developments which could contribute to this dynamic.

The first is Bakkt, a startup launched by New York Stock Exchange operator Intercontinental Exchange in partnership with Boston Consulting Group, Microsoft and Starbucks. Bakkt aims to increase bitcoin used as a trusted currency around the globe. Although it was previously expected to launch this past November, it has been delayed even beyond the revised launch date of Jan. 24. The U.S. Commodity Futures Trading Commission has not granted the required approvals for the startup.

The other source of assets which could soon become available to buy bitcoin is Fidelity Digital Assets, which was announced in October. The firm will provide services such as “institutional-grade custody of digital assets, trade execution and dedicated client service,” Graham explained. When the firm does finally launch, it will make it much easier for institutional investors to “meaningfully invest in digital assets,” he added.