VW: Tell our readers, what is Qplum?

Qplum is an AI-driven investment management firm. We manage money for individuals, families, and institutions. We actively manage investments using machine learning and deep learning technology.

Our three product lines are:

- Wealth, servicing the financial needs of individuals and families via separately managed accounts.

- Alpha, for institutional clients only, where we offer different products like GTAA (Global Tactical Asset Allocation), managed futures program, etc. and

- Solutions, where we work on customized tactical asset allocation solutions for pension funds and family offices to target a dual loss-aversion and return-seeking investment mandate.

Q2 hedge fund letters, conference, scoops etc

Across all our product lines, the aim is to bring more transparency and efficiency to the investing process and reduce costs for the client through the use of A.I.

VW: Why did you start Qplum?

Before starting Qplum, I was in High-Frequency Trading.

I completed my Masters in Computer Science from the University of Pennsylvania, and my first job out of college was at Tower Research Capital. I became the youngest partner at Tower and I was able to set up one of the most profitable groups there. That journey convinced me that A.I. works if implemented well.

VW: There’s a lot of buzz around AI these days. How can one tell what’s real and what’s hype?

That’s true. Everyone wants to look smart. So companies generously use the terms “A.I.” and “machine learning” in their marketing materials. The good thing is, it’s easy to spot what’s real and what’s hype. You are either an A.I. driven firm or not – there is no middle ground. And the reason for that is the upfront costs along with a completely different system architecture needed to apply this technology in asset management.

An A.I. focused company will typically have these four things going for them:

- Strive to solve smaller problems as compared to a big-bang-solution. E.g., instead of trying to predict the market, at Qplum, we try to summarize the market and put systematic processes in place should things go wrong.

- Infrastructure that has the ability to run lots of simulations at a fast speed.

- Have a dedicated team for data support that works closely with the infrastructure team. Any machine learning strategy requires vast amounts of data and that means a lot of investment goes into data sourcing, aggregation, validation and eventually making it available to the quantitative research team to run studies.

- Have at least 100 failure stories because they’d have run 1,000s of experiments on possibly dozens of data sets to find one opportunity.

VW: How can we trust a system where a machine is making all the trading decisions? Isn’t it all a black-box?

Transparency is indeed a big concern. A BNY Mellon study of 450 large institutional investors reiterated the need for transparency. However, I feel that A.I. systems can be more transparent than discretionary portfolio managers.

Allow me to explain.

The fundamental disconnect investors often have with A.I. is that they do not know how A.I. will behave. That’s often the case with a human manager as well. But we tend to trust humans more than machines.

So an A.I. strategy has to work harder to be more transparent and gain investor confidence.

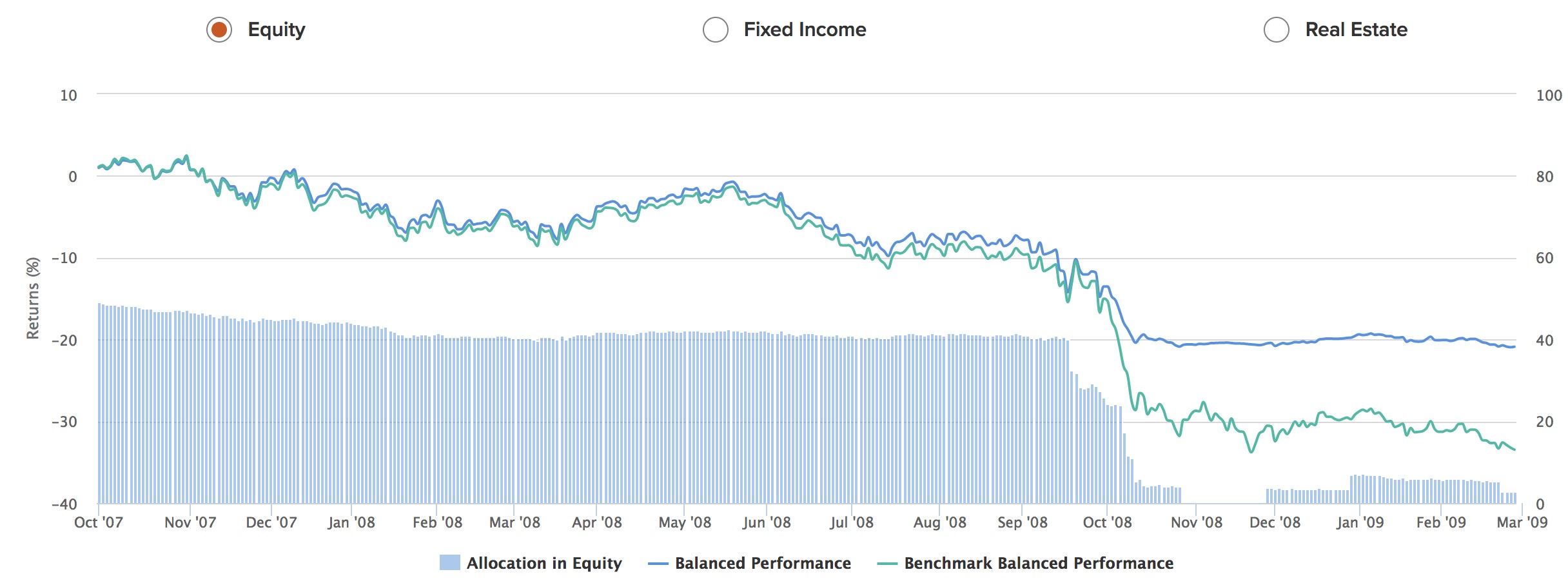

Can you tell how a portfolio manager would have performed during the 2000 dot-com bubble? How about the more recent 2008 financial crisis? In most cases, the answer is no. However, an A.I. strategy can demonstrate how it would have performed through proper back-testing methods.

Source. Backtested performance of how Qplum’s Balanced portfolio would have performed during the 2008 financial crisis. See important disclaimers at the end of this article regarding the limits of backtested performance.

But past performance does not necessarily mean similar future performance – both for A.I strategies as well as human portfolio managers. An A.I. strategy, however, can go one step further and run thousands of simulations and show you what could happen in various future scenarios.

VW: Does this mean an end to discretionary traders?

Eventually, yes.

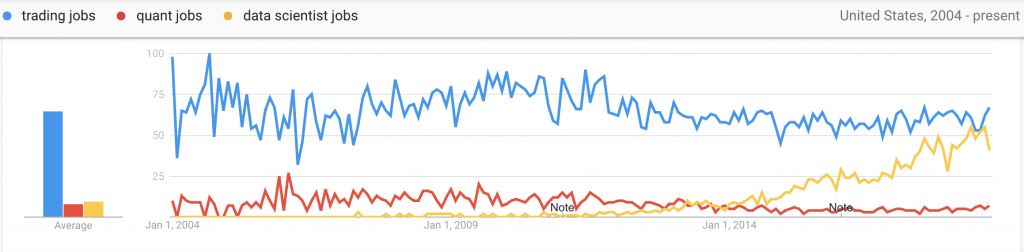

Source: Google Trends.

Looking at the Google trends timeline above, it’s clear that trading (in blue) and quant jobs (in red) are dwindling. “Data scientist jobs” seem to have skyrocketed in popularity recently.

This data corroborates with the jobs data we obtained from Indeed, a job site, last year. Trading jobs are down by more than a sixth and quant jobs are down by more than 30% compared to the demand in 2012.

Data is already the new oil. Social media firms in Silicon Valley have built multi-billion dollar businesses using consumer data. Finance will follow suit.

A.I. based systems will have the upper hand over discretionary traders. With the ability to crunch massive amounts of data in a matter of seconds and dynamic decision-making capabilities, A.I. investment strategies will make it next to impossible for humans to compete in liquid markets.

In a way, this is better. Human capital can now be deployed in more productive areas.

One area where we see humans complimenting A.I. strategies is in financial advisory. Sure, an A.I. system can potentially make better asset allocation decisions. However, only a human being can show real empathy and handhold the investor during turbulent times and help the clients make strategic, long-term decisions.

VW: What is the topmost question that you get from clients?

Clients frequently ask us – Why do you use A.I. for asset allocation over security selection?

We believe that spending time on asset allocation decision is worth more than trying to pick the right securities. Global Tactical Asset Allocation(GTAA), a strategy that dynamically allocates your investments across various geographies, asset classes, and sectors, was our first product for this reason.

Our research shows that since 2004, a systematic and data-driven approach to GTAA could have potentially yielded about 10 times more alpha than the usual security selection model. With GTAA, you are not taking any concentration risk. The additional alpha primarily comes from two aspects:

- You have a constant stream of data. Using this data, you can make tactical asset allocation decisions as often as you need.

- Typically limited downside through risk management.

VW: What if everyone starts using A.I. in trading? Does that mean there will be crowding of the same trade? Could it lead to another crisis if we have machines doing all the trading?

If everyone starts using A.I. for trading in an ideal world, it’s true that there will be some overcrowding. The markets will become more efficient and it will be harder to extract alpha.

However, I do not believe that everyone using A.I. to trade will create a crisis. Even if you assume that all the A.I. strategies are equally competent, it’s close to impossible for everyone to trade based on the same logic. Different people have different goals, preferences, and risk tolerance.

Just like being the tallest player on a basketball court does not mean that you will score every time, simply having access to A.I. as a technology that your organization can leverage does not mean you get to win every trade.

Gaurav Chakravorty is the Co-Founder and CIO of Qplum, which he co-founded with a firm belief that investing can be approached as a science by utilizing the power of Artificial Intelligence and Deep Learning.

Disclaimers: The views and opinions expressed are those of the author and are current as of the date written. This Q&A is general in nature and should not be construed as investment advice. Opinions are subject to change with market conditions. Information presented is for educational purposes only and does not intend to make an offer or solicitation for the sale or purchase of any specific securities, investments or investment strategies.

Important information relating to qplum and its registration with the Securities and Exchange Commission (SEC), and the National Futures Association (NFA) is available here and here. The performance information presented in certain charts or tables represent backtested performance based on simulated results during the dates shown. Backtested performance is hypothetical (it does not reflect trading in actual accounts) and is provided for informational purposes only to indicate historical performance had the portfolio been available over the relevant time period. Qplum did not offer the portfolio until 2016. Prior to 2016, Qplum did not manage client assets.

Backtested performance does not represent actual performance and should not be interpreted as an indication of such performance. Actual performance for client accounts may be materially lower than that of the portfolio shown. Backtested performance results have certain inherent limitations. Such results do not represent the impact that material economic and market factors might have on an investment adviser’s decision-making process if the adviser were actually managing client money. Backtested performance also differs from actual performance because it is achieved through the retroactive application of model portfolios that can be designed with the benefit of hindsight. As a result, the models theoretically may be changed from time to time and the effect on performance results could be either favorable or unfavorable.

As with any investment strategy, there is potential for profit as well as the possibility of loss. Qplum does not guarantee any minimum level of investment performance or the success of any portfolio or investment strategy. All investments involve risk and investment recommendations will not always be profitable.

Past performance does not guarantee future results.

DISCLAIMER: THERE ARE NO WARRANTIES, EXPRESSED OR IMPLIED, AS TO ACCURACY, COMPLETENESS, OR RESULTS OBTAINED FROM ANY INFORMATION PROVIDED HEREIN OR ON THE MATERIAL PROVIDED. This article does not constitute a complete description of our investment services and is for informational purposes only. It is in no way a solicitation or an offer to sell securities or investment advisory services. Any statements regarding market or other financial information is obtained from sources which we believe to be reliable, but we do not warrant or guarantee the timeliness or accuracy of this information. We shall not be liable for any errors or inaccuracies, regardless of cause, or the lack of timeliness of, or for any delay or interruption in the transmission thereof to the user.