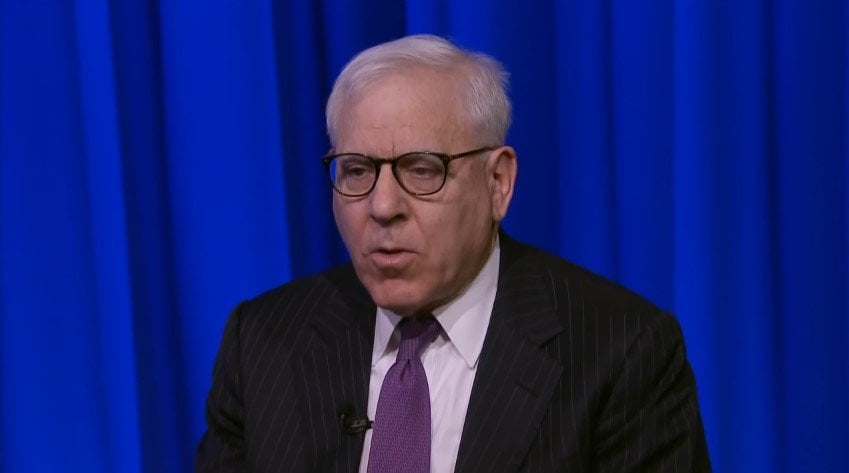

Partial audio and transcript of Carlyle CEO David Rubenstein speech at the 2018 Delivering Alpha Conference.

Q2 hedge fund letters, conference, scoops etc

See our coverage of the 2018 Delivering Alpha Conference.

Carlyle CEO David Rubenstein 2018 Delivering Alpha

Transcript

The data about 7500 has been a big growth business and people have done pretty well. The people that have done the best though are not just the sponsors but the general partners. But the people that invest in the funds the pension fund they've done extremely well they've gotten very high returns a higher highest rate of returns of pension funds or less 20 years that come from private equity funds. I love a lot of it. I agree that the markets are at this point too. And I think back to 2007 when Chuck Prince infamously said that as long as the music is you've got to get up and dance and you were much more circumspect. Around that same time I think in 2006 you said something like right now we're operating as if the music's not going to stop playing and it is going to stop. So what made you think about that. What did you see that maybe you didn't see him. If you're Jewish you always think something bad is going to happen. So it was kind of that you know you just know something that's going to happen eventually so I thought eventually something bad won't happen because he can't keep going on forever. And I have been concerned now. We've been in what is now the second longest growth period since World War II. At some point it will slow down as Herb Stein the former head of the Council Economic Advisers once said If something can't keep going on forever it won't. Some point there will be a slowdown. I don't know what will cause it. I can speculate.

I don't think it's imminent now. I don't see it coming at some point of slowdown at that time. I think people are paying very high prices. The deals are really highly leveraged and I think there was basically a view that nothing could go wrong and that was probably a bad attitude that you are opportunistic at times where you think you need to just say it's the easiest thing you've ever seen to raise money. Right. How would you take all your concerns that when things are going too good and how to set up right now and in a situation of musical chairs right now or not. There's no doubt that when you look at an investment committee memo and you see what the projected returns are and you see that there is no projection for a recession or slowdown over a next five or six years. Those returns are probably too optimistic. So when we look at fields we do assume that there'll be some slowdown is gonna have to be a great recession but that will be a slowdown. They are going to be very cautious. You have to assume you can have some slowdown in the next five or six years and that point be prepared for it. Now one of the things that makes it a little bit easier is that the debt terms are much more favorable to general partners than they used to be and the sponsors. So before the Great Recession got 70 percent of that debt was was Covenant's 30 percent did not. Today it's probably the reverse. Maybe only 30 percent of that debt has come and it's maybe 70 percent is not.

So there's a lot of covenant light debt out there so that if something goes down the economy slows down. I think you have a chance to work through the debt problems. Why is that. Well I think lenders have felt that private equity people are pretty responsible and they're likely to make these deals work and I guess there's competition but generally very little money has been lost. Relatively speaking when buyouts by banks and said I feel fairly comfortable with the sponsors also the sponsors are different that used to be the old days they were investment bankers who knew a little bit but not that much about operating companies. Over the last 20 years the private equity firms have an enormous amount of operational experience. And so it's not investment bankers or people like me who are former lawyers really running these companies and overseeing and their people have real operations. So the banks are much more comfort is part of what the Federal Reserve has done with interest rates being around so much money sloshing around here. Well I wouldn't say I'm an expert on the Federal Reserve though I hired somebody years ago to join the Carlyle. I was a very talented person leaving the government and his name was a POW and he worked in our firm for a number of years. I was a very good private person when one of the team I sent the highest calling of mankind is private. Why would you want to do something else. But he decided he wanted to do something in public policy.

And now the chairman of the Federal Reserve he testified the other day that right now he doesn't see any reason not to continue the program that they have which is basically probably have interest rates go up two more times this year 25 basis points apiece and probably get interest rates up to the Fed funds rate of about two point four percent next year. So that if this slowdown does come they can lower interest rates. But right now I think he feels the economy is doing reasonably well and we don't see any evidence of a slowdown. We have 275 companies the current owns around the world and we get every quarter their numbers and we correlate them with what we see GDP trends to be. And we don't really see any slowdown right now. Now this will happen at some point this year and next year we don't see any signs of a slowdown. Neither does the market if you look at stocks but there's always been a craving for buying control of the company. That's right. And I heard from a lot of investors recently that they think buying control of the company that premium you pay is higher than that just about ever seen. I think if you go back over the last 10 years it used to be about seven times that are now closer to 13 times almost doubling over the last 10 years. For that reason many of the private equity firms do a lot of minority stake deals the highest area of growth actually is minority stake transaction by private firms growth capital. You see much more growth capital and or minority stake deals in mature companies. So you can't buy control a time where the premium you have to pay is not worth it in some cases.

So you would agree with your buying buying buying control of the company is pretty it's harder to do than before and it's not something you don't want to do. It's better to have control and you can make the changes you want but very often you're taking a minority stake. You do negotiate to have certain rights to change management or make sure certain you have impact on management changes and the ability to sell when you want to sell so a minority stake is not completely a passive position. Let's just talk about Wall Street's views on private equity companies the ones that are publicly traded. David Favre and John Gray earlier Blackstone asked him why has the stock not appreciate it more. What gets it there are so many wonderful things why doesn't Wall Street freefall I tell you look there are three great mysteries in the world. One is what existed before the Big Bang. Nobody knows. Second is there an afterlife and what it's like if there is nobody knows. And third why do private firms not trade at a higher price. To me those are the three great mysteries of the world. Now the answer to the first two I'm not sure I'm going to come up with those answers but I can tell you why they probably don't trade as well as we would like them to get private equity where it is basically in a business where you say to your investors when the business first started paying us a small management fee to cover our costs. But give us 20 percent of the profits. That was an enormous change the world of money manager for 200 years.

If you manage people's money you've got to be when the money was managed and you didn't get a piece of profit. Private if the people came along in the 60s and 70s they said give us 20 percent of the profits. So that's how our business has really grown and why people give us money because they want us to be incenses to make this 20 percent high because they're 80 percent will be high as well. When you're a publicly traded company the people that follow stocks the analysts they want to know not when you're going to sell a company might get a carried interest because it's very hard to predict that because you don't know when you going to sell. They want to measure your management fees. How much money you're making when fees that are very predictable so they can say to their customers or clients in next quarter Carlaw or black that will earn X and when next year they were on Y and therefore they put a big premium on management fees which are investors don't really want us to earn too much. There's a little premium on carried interest which is what our investors want so there's a bit of a dichotomy there. And we're all sorting our way through it. Clearly a lot of people have commented as I have it's not really fair in some ways because we have built these gigantic cash cows money machines but they aren't valued as highly as we think they should be. So why do you bother going public in the first place. All right we're going to pull out of that courageous thing here. Thank you. That way. Oh.