Preqin is the leading supplier of data, analysis and intelligence services to the alternative assets industry.

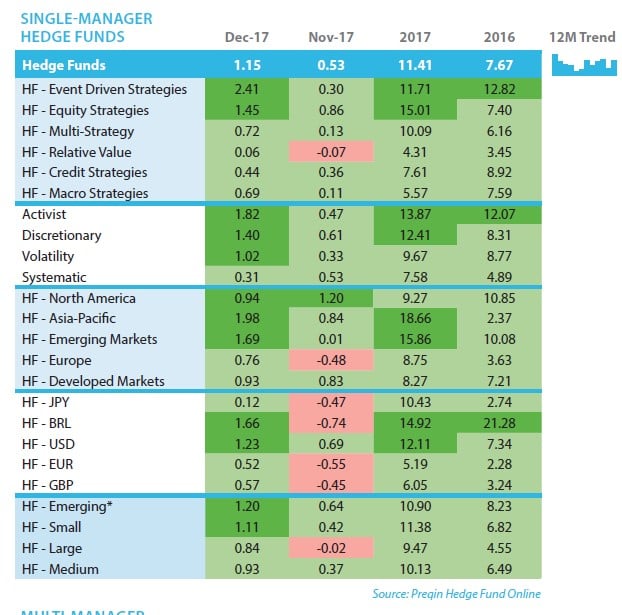

- The Preqin All-Strategies Hedge Fund Benchmark generated 1.15% in December. In addition to pushing the benchmark’s annual return to its highest level since 2013, the positive end to the year also marks the first time the Preqin All-Strategies Hedge Fund benchmark has recorded a positive return during every month of a calendar year.

- Funds focused on the Asia-Pacific region were the top performers of 2017, with the region delivering its strongest annual performance this decade (18.66%), up from the 2.37% generated in 2016.

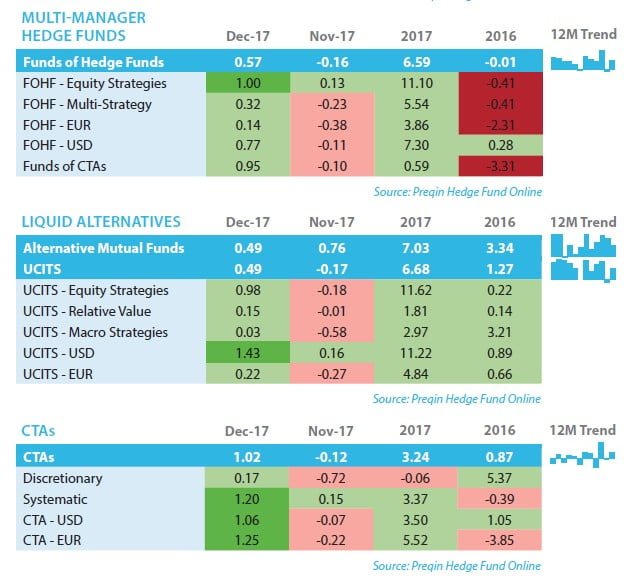

- Funds of Hedge Funds bounced back from a negative November to record a positive end to 2017, up 6.59% for the year.

- Liquid alternatives also produced a better full-year performance than they did in 2016, with Alternative Mutual Funds and UCITS up 7.03% and 6.68% respectively.

Article by Preqin