Mergermarket, an Acuris company, has released its Global M&A roundup report for the Technology, Media and Telecom (TMT) Sector for the first quarter (Q1) of 2018.

Q1 hedge fund letters, conference, scoops etc

Key findings include:

- As Technology has continued to upend traditional business sectors, it also appears to be capable of disrupting society as a whole. Since the US election, currently the subject of an ongoing special counsel investigation, deals involving companies specializing in cybersecurity have increased. In Q1 2017, the first full quarter following the election, there were 19 transactions worth a total of US$ 437m. In Q1 2018, this figure increased by four transactions and 2.5x in value to 23 transactions worth a collective US$ 1.1bn. For comparison, in Q1 2016, prior to both the US election and the Brexit vote, there were only nine cybersecurity deals, though total deal value did reach US$ 5.5bn, mostly due to US-based Leidos Holdings’ US$ 5bn bid for Lockheed Martin’s Information Systems & Global Solutions

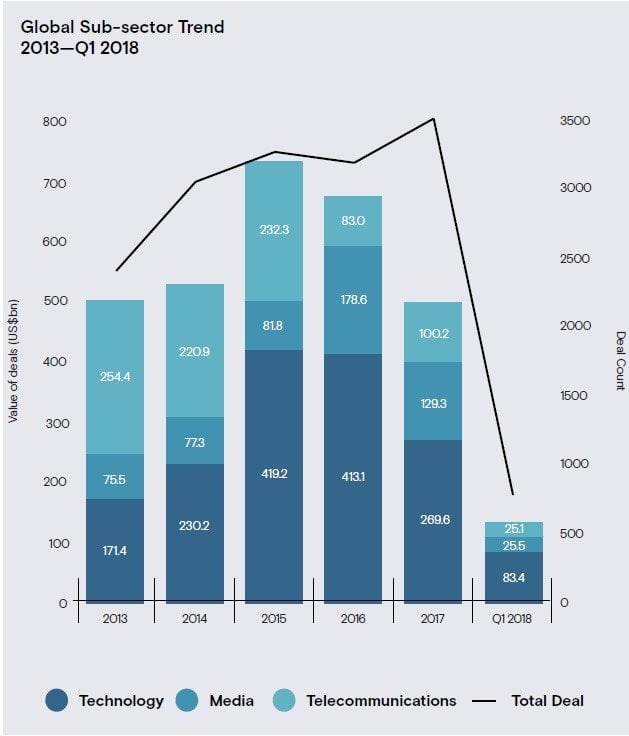

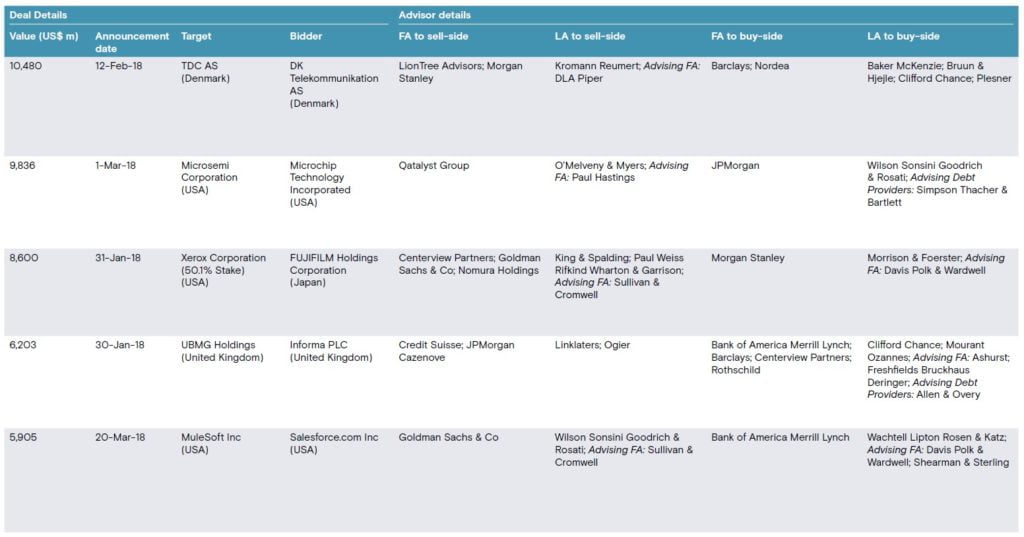

- Overall, global TMT activity was up 87.1% in value in Q1 2018 to US$ 134bn worth of deals compared to US$ 71.6bn announced in Q1 2017. However, deal count fell by 20 transactions from 815 deals in Q1 2017 to 795 in Q1 2018, continuing a downward trend over the last three quarters. The largest transaction, and the only mega-deal (>US$ 10bn) of Q1 2018 was the US$ 10.5bn takeover of Denmark-based TDC, a telecom company providing both traditional and digital services, by a consortium including PKA Pension Funds, Arbejdsmarkedets Tillægspension, and Macquarie’s European Infrastructure and Real Assets Group

Data analysis

Everything Seems Different

The world is different somehow, and not quite what it used to be. Our relative sense of privacy, or the idea of it at least, seems to have been permanently altered by events of late. Information is power, as everyone knows, and data aggregation misuse and hacking are the emerging weapons of choice in the new battle over knowledge.

As news about the Facebook/Cambridge Analytica data scandal broke toward the end of Q1 2018, with approximately 87 million users’ personal info having been lifted without their knowledge, concern over the growing influence of Technology on daily life has skyrocketed. This also followed a series of data breaches that came to light at Yahoo!, Equifax, and Uber, to name just a few of the more high-profile incidents over the past year, in which the personal data of millions was found to be compromised.

Allegations of Russian government interference in the 2016 US presidential election as well as in the Brexit referendum have only added to growing anxiety regarding social media and how it can be manipulated, as well as how such platforms collect data on their users. Reports that the taken Facebook data, retrieved without authorization to surreptitiously build voter profiles, had been sold to a number of political actors seeking to influence elections have also fueled discussion over the unchecked influence and increasing invasiveness of Tech, and whether or not governments should finally intervene. Regulation, however, is not likely to put dealmakers’ minds at ease.

Cybersecurity, unsurprisingly, sees an uptick

As Technology has continued to upend traditional business sectors, it also appears to be capable of disrupting society as a whole. Since the US election, currently the subject of an ongoing special counsel investigation, deals involving companies specializing in cybersecurity have increased. In Q1 2017, the first full quarter following the election, there were 19 transactions worth a total of US$ 437m. In Q1 2018, this figure increased by four transactions and 2.5x in value to 23 transactions worth a collective US$ 1.1bn. For comparison, in Q1 2016, prior to both the US election and the Brexit vote, there were only nine cybersecurity deals, though total deal value did reach US$ 5.5bn, mostly due to US-based Leidos Holdings’ US$ 5bn bid for Lockheed Martin’s Information Systems & Global Solutions.

M&A activity strong just prior to Facebook/Cambridge Analytica

Until the Facebook/Cambridge Analytica data breach became public knowledge in mid-March, Q1 2018 activity within the global Technology, Media & Telecommunications (TMT) sector as a whole was experiencing somewhat of a boost from several large transactions. As players from various industries continue to feel pressure from Tech behemoths such as Amazon to re-think their own survival strategies, the need to consolidate has never seemed greater. Overall, global TMT activity was up 87.1% n value in Q1 2018 to US$ 134bn worth of deals compared to US$ 71.6bn announced in Q1 2017. However, deal count fell by 20 transactions from 815 deals in Q1 2017 to 795 in Q1 2018, continuing a downward trend over the last three quarters. The largest transaction, and the only mega-deal (>US$ 10bn) of Q1 2018 was the US$ 10.5bn takeover of Denmark-based TDC, a telecom company providing both traditional and digital services, by a consortium including PKA Pension Funds, Arbejdsmarkedets Tillægspension, and Macquarie’s European Infrastructure and Real Assets Group.

Other notable transactions for the sector in Q1 2018 approaching mega-deal status were US-based Microchip Technology’s US$ 9.8bn bid for US-based Microsemi Corporation, a maker of analogue and mixed-signal integrated circuits and semiconductors, and Japan-based FUJIFILM Holdings’ US$ 8.6bn bid for a 50.1% stake in seminal US copy machine manufacturer Xerox Corporation.

US continues to account for bulk of value

Regionally, the US was responsible for the largest share of global TMT deal value in Q1 2018 with 40.4% (US$ 54.1bn) of market share. This figure was up from the 38.5% share by value that the US had claimed in Q1 2017 with US$ 27.6bn. Europe, meanwhile, accounted for 33.5% of Q1 2018’s total TMT deal value with US$ 44.9bn, up from a 13.7% market share in Q1 2017 with US$ 9.8bn.

Asia-Pacific was down from its 38.1% market share in Q1 2017 with US$ 27.3bn, and was responsible for 21.9% of total TMT deal value with US$ 29.4bn in Q1 2018.

Technology accounted for 62.2% of TMT’s total deal value with US$ 83.4bn, down slightly compared to 63.8% in Q1 2017; however, Tech’s total deal value was at the same time 82.5% higher than Q1 2017’s total of US$ 45.7bn. Meanwhile, there were only 621 Technology transactions announced in Q1 2018, seven fewer than during the same period last year.

Media and Telecommunications were on par with each other in the first quarter of the year, reaching just over US$ 25bn each, though the former recorded 141 transactions while Telecom recorded 33.

With anxiety surrounding the culpability and responsibility of the major tech firms now under scrutiny, the rest of the year remains uncertain.

Tech: The Ultimate Battle Axe

Many of these warring attempts at consolidation have been largely driven, as stated previously, by Technology. The resulting spillover effects into other sectors have often rendered them drastically altered. As traditional sector delineations begin to blur and blend, so too does the usual trend analysis. In this report, it is worth taking a look at some of the sectors that have been affected by Tech, in order to understand the latter’s impact on just about everything.

Business Services & Healthcare

By value, one of the top sectors of the year’s first quarter was Business Services, which recorded US$ 129bn and 563 transactions. However, 52.6% of total value was due to Cigna’s US$ 67.9bn bid for US pharmacy benefit manager (PBM) Express Scripts. Much of the catalyst for the transaction, as well as for many others over the past several months, was due to defensive activity stemming from the “Amazon effect” – reports that Amazon would be moving into the pharmacy benefit management (PBM) space, as well as countless other areas, have left PBM and healthcare companies alike worried about how they can, potentially collectively, address such a threat.

Cigna’s bid for Express Scripts was also on par with CVS Health’s US$ 67.8bn bid for US health insurer Aetna last December, which

had itself acted defensively against Amazon’s purported entry into the PBM space. Further, Amazon’s announcement in January that it would team up with Berkshire Hathaway and JPMorgan to form a healthcare company for their own employees has other industry

players on their guard.

Financial Services

Such high-valued activity in the US healthcare industry has in turn had an effect on the overall Financial Services industry. Also feeling the ripple effects of changes in healthcare, the sector saw a shift in large deals from banking toward insurance. Financial Services saw US$ 67.7bn across 298 transactions in Q1 2018, up 4.6% in value with 30 fewer deals compared to Q1 2017.

However, when looking at the seven Financial Services deals in the US and were valued over US$ 1bn announced so far in 2018, five fell under the insurance sub-sector, covering a range of types from title to property to life. By contrast, last year had seen just one such transaction falling under insurance.

Consumer Retail and e-Commerce

While the global Consumer sector reached US$ 78.8bn in Q1 2018, 32.2% was due to activity in the Consumer Retail sub-sector, which recorded US$ 25.4bn. This was down 44.5% in value compared to the US$ 45.8bn recorded in Q1 2017; however, more than half of the latter’s value had been due to Francebased Essilor’s US$ 25.4bn bid for Italybased Luxottica Group.

The top global Retail transaction in the first quarter of 2018 was US-based Albertsons’ bid for US-based retail drugstore chain Rite Aid for US$ 5.5bn, in another response to potential dual threats on both the retail grocery and PBM fronts from Amazon. Albertsons, backed by Cerberus Capital Management, had been eyeing a potential purchase of Whole Foods in 2017 until Amazon swooped in and bought the organic grocery retailer for US$ 13.4bn.

As Retail continues to see consumer preferences shift from brick-and-mortar stores to buying more goods online, from clothing to jewelry to groceries, the e-Commerce industry has only stood to benefit. Global e-Commerce dealmaking reached US$ 18.5bn in Q1 2018, a record value for a first quarter since Mergermarket first began keeping records globally in 2001. This was more than double the deal value in Q1 2017, which had recorded US$ 9.1bn.

The top e-Commerce transaction in the first quarter of the year was Switzerland-based Compagnie Financière Richemont’s US$ 3.2bn bid for a 75% stake in Italy-based online fashion retailer YOOX Net-A-Porter Group. Also notable in space were two high-profile ride-sharing transactions – Singapore-based Grab’s US$ 1.7bn purchase of Uber’s Southeast-Asian ride-sharing and food delivery business and China-based Didi-Chuxing’s US$ 900m purchase of a 70% stake in Brazil-based taxi hailing service 99 Taxis. Both bidders as well as Uber, who had all competed against one another for market share in various regions, are also partially owned by Japan’s SoftBank.

New game in play, new rules needed

Such far-reaching influence on the economy and on society has led legislators and their constituents to question the roles of the world’s largest Tech firms – to what degree should they and the government assume responsibility for the consequences of their platforms? And what might potential regulatory action look like?

Following the Cambridge Analytica leak, Facebook CEO Mark Zuckerberg and COO Sheryl Sandberg stated that the company should be regulated. Shortly after, Zuckerberg testified before Congress about Facebook’s data aggregation practices and plans for addressing user safety and privacy post-leak. Apple CEO Tim Cook also weighed in, criticizing Facebook for its recklessness and renewing Apple’s own pledge for security and privacy for its customers. While such conversations are necessary and a step in the right direction, all of this uncertainty and distress within the Tech industry could spook dealmakers in particular for the remainder of the year.

Top deals

Drivers & Heat chart

based on potential companies for sale

As companies seek to use Technology to improve scale, automation and robotics continue to generate interest among investors. Mapping and software development for various industries from Industrials & Chemicals to Transportation & Logistics to even Pharma, Medical & Biotech all have enormous potential, particularly as most industries, if not all, seek to digitize. Such a trend is likely to continue for some time, and not just be a short-term driver. Consulting on the various types of new Tech tools will also likely be an area to look out for in the near future.

Relatedly, applications for AI technology are all the buzz these days it seems. China in particular has emerged as a potential leader in this space, with dealmakers looking to invest in startups specializing in this area. The race for chip technology that can be used in devices of all sorts, including surveillance, defense, aerospace, security, etc., is far from over as companies seek funding to develop applications for increasingly more areas.

Data management and storage, as well as related security tools, have also been of interest to dealmakers, especially in light of recent data scandals. Corporates as well as strategics have been looking to invest in firms that address needs across various industries, including ConstructionTech, InsureTech, FinTech, etc.

Digital marketing and advertising consolidations could be on the horizon as players in both Europe and the US look to scale in an effort to capture more market share. Smaller players, too, have looked to digital tools to help market their businesses, with companies specializing in website design and social media especially in demand.

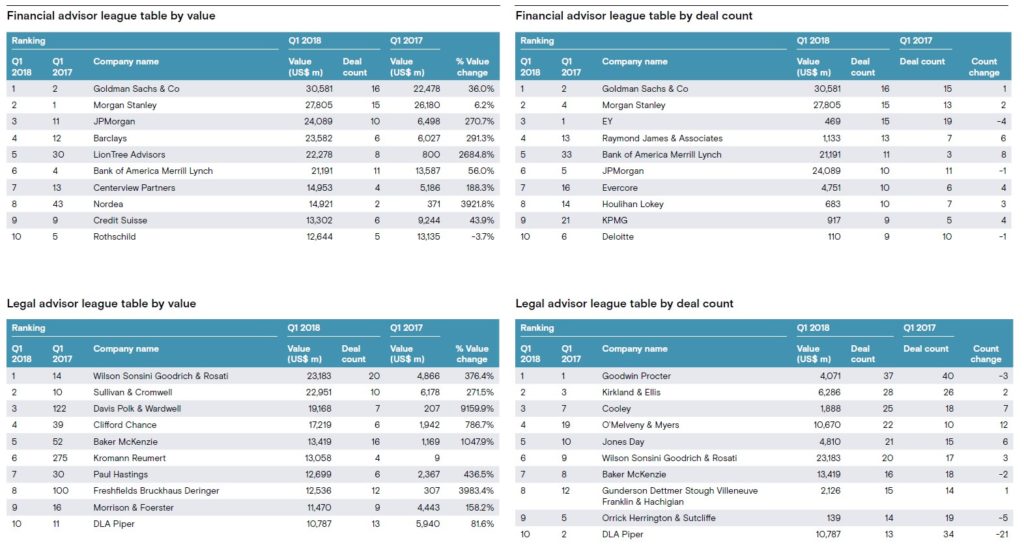

League tables

Article by Merger Market

See the full PDF below.