Whitney Tilson’s email to investors discussing that lower stock prices are good news; survey results of where the market bottoms and when it hits a new high; new survey on coronavirus cases and deaths in the U.S.; the bull and bear cases; Goldman Sachs note; support your local restaurants!

Q4 2019 hedge fund letters, conferences and more

Lower Stock Prices Are Good News

1) I know that the market decline has been painful for many people. You have my condolences... Losing money is no fun. I know what it feels like, having experienced – managing other peoples' money no less! – both the bursting of the Internet bubble (when the Nasdaq declined by 78%) and the housing bubble (when the S&P 500 fell 52%). And I was too early starting to put my cash to work in this decline as well.

But it's important for every investor to understand that stocks can be volatile, and that you should only have money in the markets if you can: a) handle the volatility so you don't panic and sell at the bottom... and b) have at least a three-year horizon (ideally much longer).

It's also important to understand that, for the vast majority of people, lower stock prices are good news. Warren Buffett explained why in his 1997 annual letter:

If you plan to eat hamburgers throughout your life and are not a cattle producer, should you wish for higher or lower prices for beef? Likewise, if you are going to buy a car from time to time but are not an auto manufacturer, should you prefer higher or lower car prices?

These questions, of course, answer themselves. But now for the final exam: If you expect to be a net saver during the next five years, should you hope for a higher or lower stock market during that period?

Many investors get this one wrong. Even though they are going to be net buyers of stocks for many years to come, they are elated when stock prices rise and depressed when they fall. In effect, they rejoice because prices have risen for the "hamburgers" they will soon be buying. This reaction makes no sense. Only those who will be sellers of equities in the near future should be happy at seeing stocks rise. Prospective purchasers should much prefer sinking prices.

Where The Market Bottoms And When It Hits A New High

2) Nearly 800 readers filled out the brief two-question survey I sent around last week (it's still open if you want to participate – just click here).

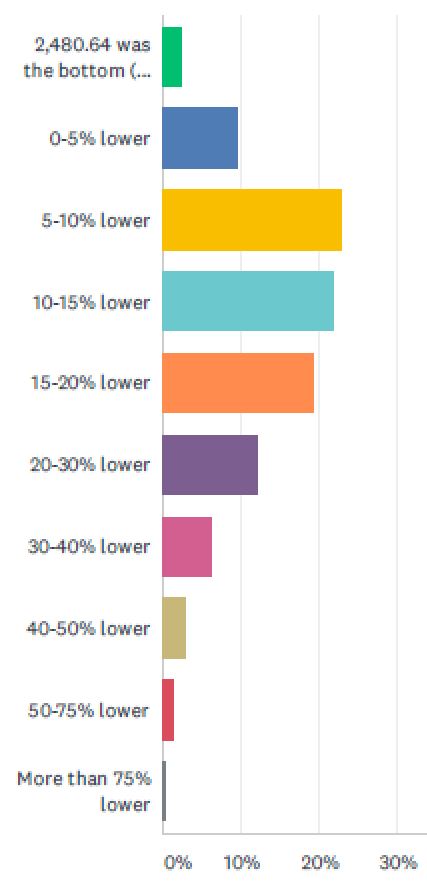

The first question was: "On Thursday, March 12, 2020, the S&P 500 closed at 2,480.64, down 23.2% YTD and 26.7% from its February 19 peak. Where do you think it will bottom?" Here are the results:

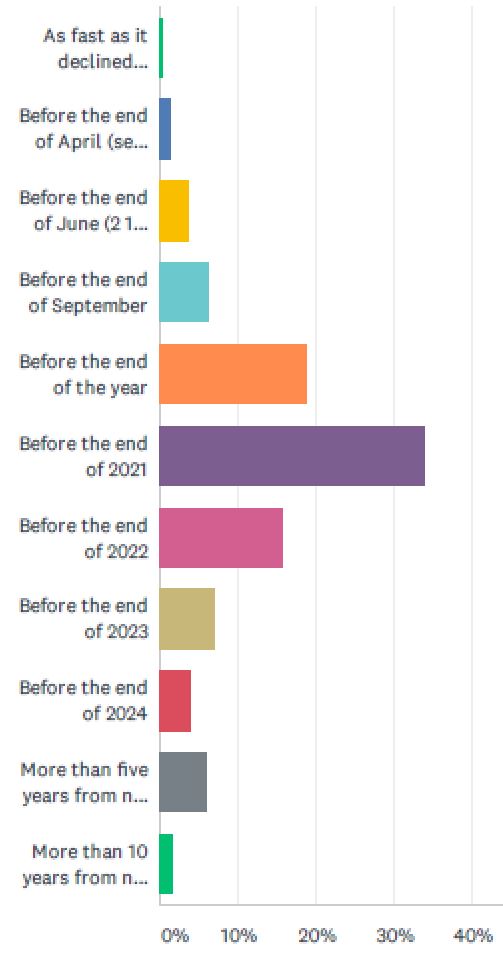

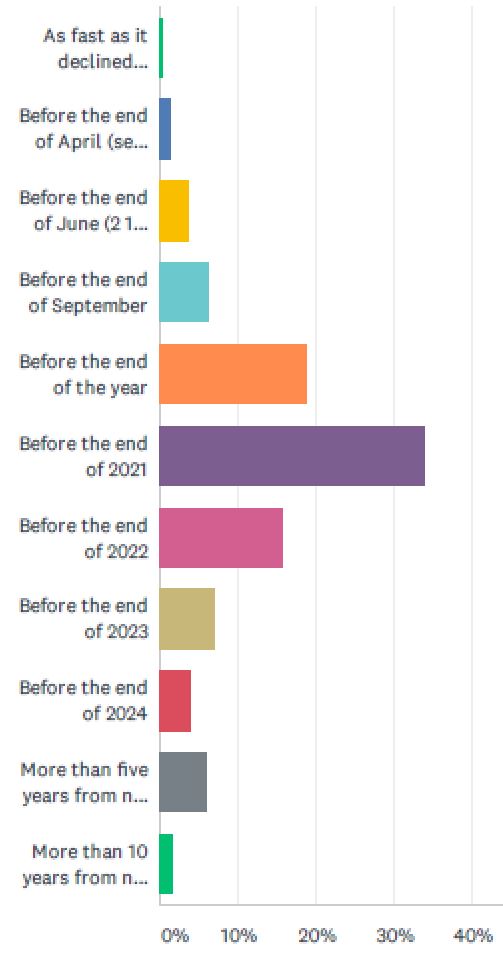

The second question was: "When do you think the S&P 500 will close higher than its February 19, 2020 peak of 3,386.15 (this would require a rise of 36.4% from its close on March 12)?" Here are the results about the expectation for lower stock prices:

The midpoint of the answers is that the S&P will drop roughly 15% – which would be around 2,100 – and wouldn't surpass its old high until sometime in 2021.

For what it's worth, my answers were that the S&P 500 will bottom 5% to 10% below its close last Thursday (i.e., go no lower than 2,232), but will take longer to hit a new high – not doing so until sometime in 2022.

It will be interesting to see how accurate our collective wisdom is!

3) Speaking of surveys, I've put together a new one to measure how bad you think the coronavirus crisis will get in the U.S.

Specifically, it asks you to estimate the total number of coronavirus cases and deaths in the U.S. by three dates: the end of this month (two weeks from now), the end of May (two and a half months from now), and the end of this year.

I'd be grateful if you'd take 30 seconds to fill it out – you can do so here. I'll share the responses later this week.

Thank you!

The Bull And Bear Cases

4) Here is an excellent summary of the bull and bear arguments by my friend Doug Kass of Seabreeze Partners:

...............

The Pros: Reasons to buy or start averaging in...

- The selloff has been deep and swift – relative to previous "crashes" it's in the top five.

- The VIX already ripped to 2008 financial crisis high forcing all sorts of dislocations – doesn't seem VIX can get much worse, hard to imagine a 100 VIX day.

- Unlike 2008, the financial system today seems intact.

- The Fed has moved was much quicker to act to insure the plumbing remained intact (yesterday the primary dealer credit facility was announced – PDCF).

- Rates near zero (for a long time) makes the dividend yield on S&P pretty relatively compelling. Back to TINA (there is no alternative). And obvious financing cost benefit for the real economy.

- Fiscal stimulus coming.

- Has to be a bunch of cash on the sidelines.

- Has to be a much larger short base.

- Many companies with healthy balance sheets and low fixed cost structures.

- Actual COVID-19 data will get worse, but can news flow get worse? People get it, seems a fair bit of voluntary shelter in place.

- When the virus spreads in the U.S. we will have learned a lot from other countries further along in the curve.

- Outside shot of a White Swan event (ergo early experimental anti-virals if they show efficacy could get fast tracked).

- Temperature warming may help.

- Helicopter money.

The Cons: Reasons not to buy or start averaging in...

- Selloff has been sharp but the starting point (as is typical when a rout like this happens) was at nosebleed levels. Market Capitalization to GDP was at 1999/2000 bubble high.

- Unlike the 2008 selloff, market not at a price unambiguously screaming cheap on nearly every metric, unlike 2008. Market Capitalization to GDP after the selloff still above last 20 year average.

- Debt crisis is not in the financial system so far, but debt has moved to corporate and consumer balance sheets as opposed to the banking system in 2008. How will debt-holders weather the storm and ultimately it does come back to the banks to be well capitalized enough to work out. But this is a slower process as opposed to an overnight liquidity crisis.

- Actual Covid-19 data will get worse as will disruption.

- Nobody knows degree of earnings downgrades, how long, and the shape of recovery. Bad EPS news, dividend cuts, news of financial distress will hit over the next 3-6 months. Really hard to know what is priced in yet as we have not seen stocks react to company specific news.

- Risk of virus not being controlled in U.S. and Europe like it was in China and South Korea. Base case for many investors is that it will be.

- May not return to the go-go years of the last 30. Was a huge benefit to the investment class from the era of globalization. Low rates, unlimited growth without inflation, huge new markets opening up. That will reverse to some degree as countries, society as a whole is overbuilt and over-levered. At individual, corporate, and country level, everyone got carried away and forgot about risk. Lots of capacity of new things out there already (cars, real estate, TVs, everyone's wardrobe, and now we have $5,000 golf clubs).

- Democrats and the government could take control – serving to raise taxes, focus on environment over economy, etc.

- Central banks after helping navigate the crisis are out of ammo and central bank/country balance sheets already stretched. Realization monetary voodoo is counterproductive over time. Not a move to austerity but a return to more sound central banking policies that pre-dated Greenspan. Look how yields already backed up on announcement of proposed handing people $1,000 checks this week. Maybe bond vigilantes return after 30 year absence?

5) Here are some additional bearish and bearish arguments for how the crisis will play out:

Bearish

- The Sober Math Everyone Must Understand About the Pandemic

- Don't be Italy

- This Is How the Coronavirus Will Destroy the Economy

Bullish

- Coronavirus Perspective

- A fiasco in the making? As the coronavirus pandemic takes hold, we are making decisions without reliable data

- 99% of Those Who Died From Virus Had Other Illness, Italy Says

Ackman warns lower stock prices ahead

7) Bill Ackman of Pershing Square Capital Management has nailed exactly what would happen vis-à-vis the coronavirus crisis – and invested accordingly. That's why the net asset value ("NAV") of his publicly traded fund, Pershing Square Holdings, was up 10.6% in the first nine days of March – bringing his year-to-date return to 2.8%.

This morning on Twitter, he posted the following:

With exponential compounding, every day we postpone the shutdown costs thousands, and soon hundreds of thousands, and then millions of lives, and destroys the economy.

Mr. President, the only answer is to shut down the country for the next 30 days and close the borders. Tell all Americans that you are putting us on an extended Spring Break at home with family. Keep only essential services open. The government pays wages until we reopen.

Mr. President, the moment you send everyone home for Spring Break and close the borders, the infection rate will plummet, the stock market will soar, and the clouds will lift. We need your leadership now!

Goldman Sachs Note

8) A bunch of people have sent me an e-mail that begins:

Just got off a Goldman Sachs Investee call where 1,500 companies dialed in. The key economic takeaways were:

50% of Americans will contract the virus (150m people) as it's very communicable. This is on a par with the common cold (Rhinovirus) of which there are about 200 strains and which the majority of Americans will get 2-4 per year.

70% of Germany will contract it (58M people). This is the next most relevant industrial economy to be [affected].

Peak-virus is expected over the next eight weeks, declining thereafter.

I sent it to a friend at Goldman Sachs (GS) who doesn't recognize it. But he did send me this note that Goldman's Investment Strategy Group published on Sunday night: From Room to Grow to Room to Fall.

Support Your Local Restaurants

9) Last but not least, I sent this e-mail out yesterday:

Dear friends,

With restaurants choosing (or forced) to close their doors, a huge sector of our economy, which provides millions of jobs, is hurting badly.

Many of them will soon go bankrupt unless we step up and order takeout/delivery. Here's an article about it: Restaurants are pivoting to takeout and delivery. Will it be enough to survive?

Grubhub and Uber Eats are suspending the fees (of up to 30%) that they charge independent restaurants.

So, rather than sitting at home and cooking the mountain of food you've no doubt hoarded, support a local business instead!

Best regards,

Whitney

P.S. If you live in NYC, I want to put in a special plug for Pascalou, a fabulous restaurant owned by our dear friend, Lottie Baglan, and her husband, Pascal, who's the chef. You can see the menu and order here. If you want to call in your order at (212) 534-7522, Lottie will probably pick up, so tell her you're a friend of mine!

Best regards,

Whitney