CNBC Transcript: Former Fed Chairman Ben Shalom Bernanke Speaks with CNBC’s Andrew Ross Sorkin on “Squawk Box” Today

WHEN: Today, Wednesday, March 25, 2020

WHERE: CNBC’s “Squawk Box”

Q4 2019 hedge fund letters, conferences and more

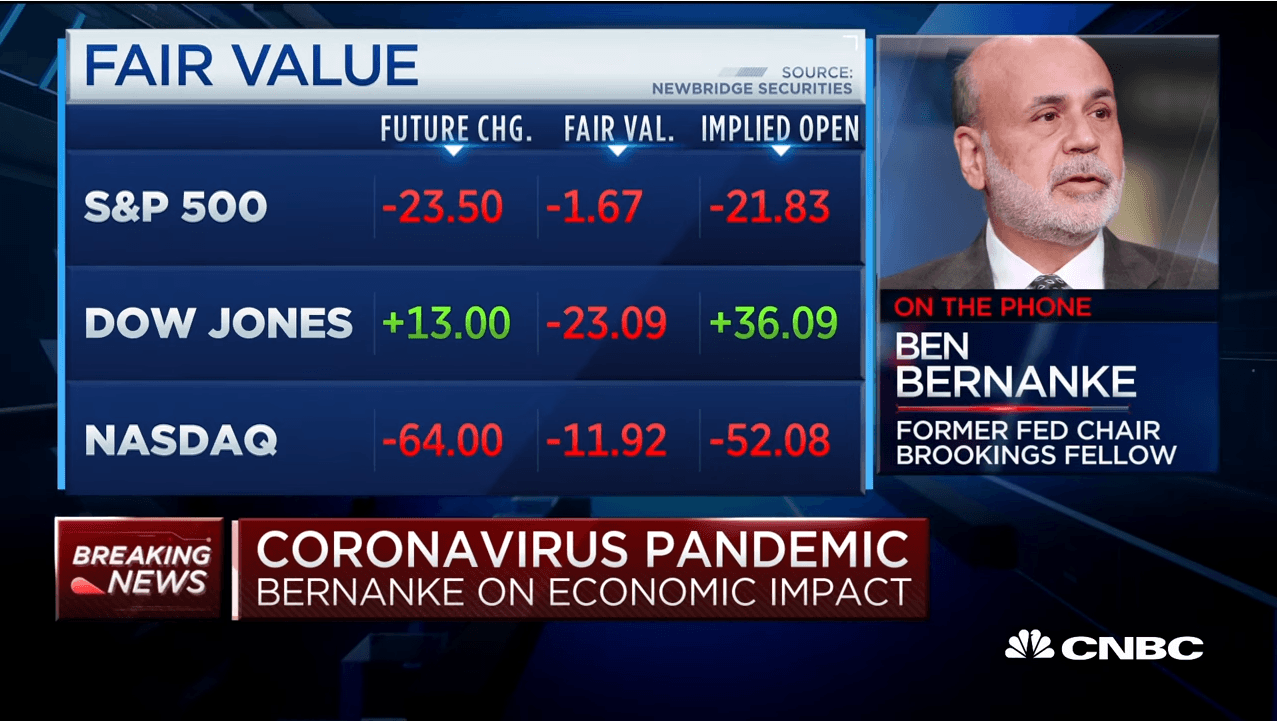

ANDREW ROSS SORKIN: Thanks. The Federal Reserve taking unprecedented series of steps to try to shore up the economy in recent days, from cutting interest rates to near zero, to unveiling an essentially open-ended quantitative easing program. It is all reminiscent of the emergency actions the Fed took during the financial crisis but could also be looked at as even bigger. Joining us right now for some important perspective on all of this is Ben Shalom Bernanke. He’s the Former Fed Chair and Brookings Institution Distinguished Fellow. He’s joining us on the news line. And we appreciate you, Ben, in joining us this morning.

CHAIRMAN BEN SHALOM BERNANKE: Good morning. Good to be here.

ANDREW ROSS SORKIN: Chair Bernanke, if you could, I’ve seen you now say you don’t think this is like the financial crisis, but some of the steps the Fed is taking it looks like it could be even bigger. How do you think about it?

BEN SHALOM BERNANKE: Well, the financial crisis was a collapse of the financial system. That’s where it started, with the subprime mortgages and loss of confidence in the financial system. Credit broke down and then that was what hurt and, you know, really damaged the real economy, the rest of the economy. In this case, it’s kind of the other direction. Of course, the source of the problem is the virus which is shutting down the economy and putting a lot of businesses into hiatus. But that means that the banks who are lending to those firms are, you know, taking losses or will take losses.

And so, the infection, so to speak, is going in the other direction from the economy to the financial system. There’s a lot of stress in the financial system right now. The good news is that we came into this with a much stronger banking system, a much healthier financial system than we had in 2007. So, I’m hopeful that it will stand up under the strain and help us be a positive force in getting back to normal.

ANDREW ROSS SORKIN: Jim Bullard just spoke with us and suggested that we walked into this in a 4% unemployment world. That maybe might spike at some kind of 30% unemployment in the second or third quarter. But he could see us at the end of the year or early 2021, being back at 4%. Does that make sense to you? There are some questions about sort of this snapback idea and whether that’s possible.

BEN SHALOM BERNANKE: Well, it is possible. Could be a very sharp, short, I hope short recession in the next quarter or two. Because everything is shutting down, over course. And, you know, the GDP figures are calculated on an annual basis. So, if activity is 10% lower this quarter than last quarter, you multiply that by four, you say there’s a 40% rate of decline. You can see some really scary numbers. Unemployment will go up although not up to 30%. So, whether or not we’ll snap back depends on a couple of things. Depends first of all on the course of the virus. Will our social distancing strategy work? Will the virus begin to die down?

And will it perhaps be less dangerous in warmer weather? Will we bend the curve enough that the hospital system can handle the number of cases? So, the length of time that we’re shut down will be important. And then the second factor will be can we keep the economy healthy or at least functioning throughout this shutdown period? One of the things you mentioned, the Fed, what the Fed is trying to do is make sure credit is available so lots of businesses which are losing revenue because, you know, they are shut down will still be able to survive and when the all-clear soundly they will be able to start back up again.

So, there’s not too much damage done to the workforce, to the businesses during the shutdown period however long that may be, then we could see a fairly quick rebound. But there’s also the possibility that bankruptcies and people being laid off and, or not finding jobs during this shutdown period, means it takes longer for things to get back to normal.

ANDREW ROSS SORKIN: Chair Bernanke, one of the questions Steve Liesman I think smartly was asking this morning given the bill and some of the steps the Fed anticipates taking is: how does the Central Bank become a commercial bank? Because so much of what’s now being planned effectively puts the Fed in the position of, effectively at least, through banks and intermediaries, but loaning money to nail salons and restaurants and small businesses.

BEN SHALOM BERNANKE: Well, the Federal Reserve has these emergency lending authorities called the 13-3 authorities, which in theory, allow it to lend to anybody assuming that credit markets are broken down and normal credit flows are not available. Now, the Fed does not have the capacity to, you know, decide whether a barbershop deserves a loan or not. So, it’s got to work through other intermediaries. So, for example, presumably, this main street program that I hoped will be up and running soon will work through the banking system where the Fed will provide funding, provide some credit protection to banks, and provide them, therefore, an incentive to extend the credit of their barbershop customers.

The Fed has got to work through other institutions. It can’t really make direct loans to businesses, just as a practical matter. Now, it will buy bonds. It will buy corporate bonds. It will buy Ginnie Mae And Freddie Mae mortgage-backed securities, for example. Those are easily bought in the open market. But the individual loans to companies, it’s going to need some vehicle, some intermediary that’s going to actually work with those borrowers.

ANDREW ROSS SORKIN: I think Joe has a question. Joe.

JOE KERNEN: I do. Chair Bernanke, thank you for coming on this morning. And the markets had a big day yesterday. Part of it was anticipation I guess of the deal, the fiscal deal. But I think some of it had to do with the Fed action. And it ran counter to what we were hearing, that the Fed can’t cure a virus. The Fed can do -- can do a lot, obviously. And then we heard Neel Kashkari, I think you may have seen him, where he said basically, they have infinite capabilities in terms of helping things. I remember -- you heard all these analogies. But I finally remembered it. The Fed at this point is trying to use a wet spaghetti noodle to play pool, as a pool cue, which when I think about that, which do you think is true, infinite ability or pushing on a string?

BEN SHALOM BERNANKE: I would put somewhere in between there. So, monetary policy is part of the mix. The Fed has cut interest rates near zero. It’s starting essentially another quantitative easing program, that will help once the isolation is over, we’re getting back to business, monetary policy will help. But monetary policy is not doing much now. It doesn’t do much to incentivize people to go out and buy when they can’t leave their homes. So what the Fed is using another set of powers, lending powers, which we used in the 2008 crisis as well. And in a world where credit markets are not functioning well, that can be a big help.

And you know, I would just like to say, I can say this now, since I’m six years away from being in the institution, I think the Fed has been extremely proactive and Jay Powell and his team have been working really hard gotten ahead of this and have shown that they can set up a whole bunch of very diverse programs that will keep the economy functioning during the shutdown period so when the all-clear is sounded we’ll see a much better rebound than we otherwise would.

BECKY QUICK: Chairman Bernanke, we’ve been watching the markets, and it seems like just every day we’re quoting some new record we have not seen since 1931. You were a student of the Great Depression. How is this going to be different than what happened back then?

BEN SHALOM BERNANKE: Well, this is a very different animal than the Great Depression. The Great Depression, for one thing, lasted 12 years. It came from human problems, monetary and financial shocks that hit the system, hit the global system. This has some of the same feel, some of the feel of panic, some of the feel of volatility you’re talking about. But it’s much closer to a major snowstorm or a natural disaster than it is to a classic 1930s style depression. So, it’s quite different. Different tools are necessary. I would just like to emphasize that nothing is going to work the fed won’t help, fiscal policy won’t help if we don’t get the public health right.

If we don’t solve the problem of the virus, of the infections, of making sure that the risk has declined sufficiently before we put people back in the line of fire. So, I think the public health issue is the most important one. If we can get that straight, then we know how to get the economy working again. Monetary and fiscal policy can do their thing. And we won’t have anything like the extended downturn we saw in -- even I don’t think in the Great Recession much less the Great Depression of the ’30s.

ANDREW ROSS SORKIN: Chair Bernanke, on that issue, how much confidence do you have in the administration on the efforts that are being taken around the virus itself, the lockdowns that are place. Bill Ackman put out a letter this morning suggesting that we need to have a national downdown and that the administration wasn’t doing enough.

BEN SHALOM BERNANKE: I’m not a public health expert. Your former guest -- your previous guest was. What he was saying is that it will take a while before we’re sure that the rate of infection and sickness is something that our hospital system can handle. We can address that both by isolation, social distancing, but we can also address it by a really national effort to increase the hospital capacity to make sure there’s enough beds, enough ventilators, enough doctors, enough nurses, enough masks. So, if we can get that part together, you know, that will shorten the period in which we have to, you know, lockdown the economy.

We don’t want to -- we don’t want to put people back to work when the public health situation is still in bad shape because people start getting sick, the hospitals get overflowing, and then people will isolate themselves and the thing will not sustain. It is important that before we put everybody back to work that we feel like we have the public health situation under control.

ANDREW ROSS SORKIN: Ray Dalio made a point on the program last week that he worries about the market for Treasuries, given the fact we’ll be selling lots of Treasuries, you are going to have governments around the world doing that all at the same time, but ultimately maybe the market for treasuries will only be central banks. What do you think about that?

BEN SHALOM BERNANKE: Well, I think the long-run issue is national debt. I think we’ve got--we have to worry about the aging of the population, rising health care costs, those are the things we need to get straight, you know, before -- in the next decade or so, before our national debt begins to rise. At the moment, there’s big demand for Treasuries. Of course, they’re paying low-interest rates. There’s been some dislocation in the market for Treasuries, probably due to deleveraging and other factors. The Fed is buying treasuries in order to stabilize that market. But I think the treasury market will remain the most important financial market in the world. I think there’s a big global demand for treasuries, even if there’s some temporary glitches.

I certainly wouldn’t argue that we should, for fiscal conservativism reasons, not do everything we need to do to address this problem. In World War II, in the 1940s, we had massive deficits, we had to do that. We had to fight a war against Germany and Japan. Eventually, we paid back some of that. But right now, I think that going big is right and I think the markets will absorb the Treasuries. And the Fed will help keep that market working in a smooth way.

ANDREW SORKIN ROSS: Chair Bernanke, Dom Chu sent a question, which I think is a really smart one, he says: does a prolonged age of ultra-low interest rate policy lend itself to more boom and bust cycles? Do you think that’s true?

BEN SHALOM BERNANKE: You know, I think -- it’s something we have to watch out for. You know, it’s not evidently true. If you look for example at Japan, which has had zero interest rates for 30 years, I have not seen, you know, a whole lot of booms and busts in Japan. But I think it’s something you have to watch out for. The other thing I would say is low interest rates are not -- I know some of you will be skeptical, it’s just a fact that low interest rates around the world are not primarily a monetary policy phenomenon. Interest rates around the world have been declining since the ’80s. If you look at the ten-year Treasury yields since 1980, from then until now, 40 years, it looks like a ski slope. The rate just keeps coming down and down and down.

And as I’ve talked about before, I think what we have in the world is a global savings glut. There are longer life spans, rising incomes, and for a variety of reasons, there’s a lot of savings in the world. Any asset manager will tell you that. And it’s hard to find good uses for that money.

Harder to find good capital projects. So, the -- even when monetary policy is at a normal level, and we got pretty close to a normal level when the Fed was raising rates earlier, interest rates are going to be much lower than in the past. So, low interest rates are something we are going to have to live with for a while, very likely. And we have to be alert about financial risk. The Fed is looking at that in much more detail than we used to. But, again, it’s not a monetary policy thing. It’s a long-term trend.

ANDREW ROSS SORKIN: Chair Bernanke, we want to thank you for joining us this morning. We appreciate the conversation. Hopefully, we can continue to have this conversation as this story continues – but of course, we hope it doesn’t continue that long. But we appreciate your perspective this morning, Chairman. Thank you.

BEN SHALOM BERNANKE: Good to talk to you.

JOE KERNEN: That was great. Thanks.