Alpine Capital Research letter to investors for the month of March 2020, discussing the consequences of an extended economic shutdown.

Q4 2019 hedge fund letters, conferences and more

In times of crisis, years seem to go by in merely days. Although it has only been a few days since our last note, much in the world has continued to change during these surreal times. Below is our latest update.

Economic Shutdown? Investing At Crisis Era Valuations

We believe that we are investing at crisis era valuations. As of yesterday, our EQR Strategy P/E was 6.7x based on estimated normalized cash earnings and our EQR strategy price/value was 0.57i. To put this in perspective, our all-time month-end low was 0.56 on February 28, 2009, and our monthly average has been 0.85. Moreover, in 48 of the 195 months since we have been keeping records, our price/value has been between 0.90 and 1.00. In other words, most of the time we have had better opportunities to sell. Every so often, we get an outstanding opportunity to buy.

The Consequences Of An Extended Economic Shutdown

The biggest economic risk today is not the coronavirus itself, but rather the consequences of an extended economic shutdown. The practice of social distancing, now required by many federal, state, and local governments, imposes a virtual shutdown on a large part of the economy. Steve Fazzari, our macroeconomic adviser, now believes a major contraction of the US economy is very likely. Any numerical forecast at this point is speculative, in part because government responses remain uncertain. But based on Steve’s analysis, I think it safe to say that a 5% to 10% contraction in real GDP is possible. To put these figures in perspective, real GDP during the Great Recession contracted 4.0% from the fourth quarter of 2007 to the second quarter of 2009. We can hope for a faster recovery this time around after the virus runs its course, but the economic outlook remains highly uncertain. The cost of economic shutdown will have to be weighed against the benefit of greater virus containment.

Weathering The Storm

Our current analysis indicates that our portfolio companies have the financial strength to weather the storm. The ACR investment team is hard at work speaking with management, assessing balance sheet capacity, and attempting to understand the unique aspects of this crisis. We are calculating the costs of shutdowns to our various businesses and quantifying what we know, while recognizing there is much that remains unknown. Our acceptance of the unknowns relies upon one all-important assumption: policymakers will not destroy the US economy.

Higher Than Expected Volatility

Volatility in our strategies has been higher than expected, and we fully understand why this may be disappointing. Higher volatility is only acceptable to us for two reasons: (i) the overall capital invested in our strategies remains protected from impairment, (ii) we are capturing more value by accepting greater volatility. We believe both reasons are true today. Price movements have been extreme in recent days with a series of historic one-day declines. Our auto and financials continue to decline at a more rapid pace than the market. As of today, the EQR YTD total return was –24.5% and the S&P 500 YTD total return was –24.7%ii. Since the beginning of the market decline on February 20th, the EQR total return was –24.5% and the S&P 500 was –28.3%. Despite these short-term declines, our valuations give us confidence that we will achieve our return objectives from cost, including long-term market outperformance.

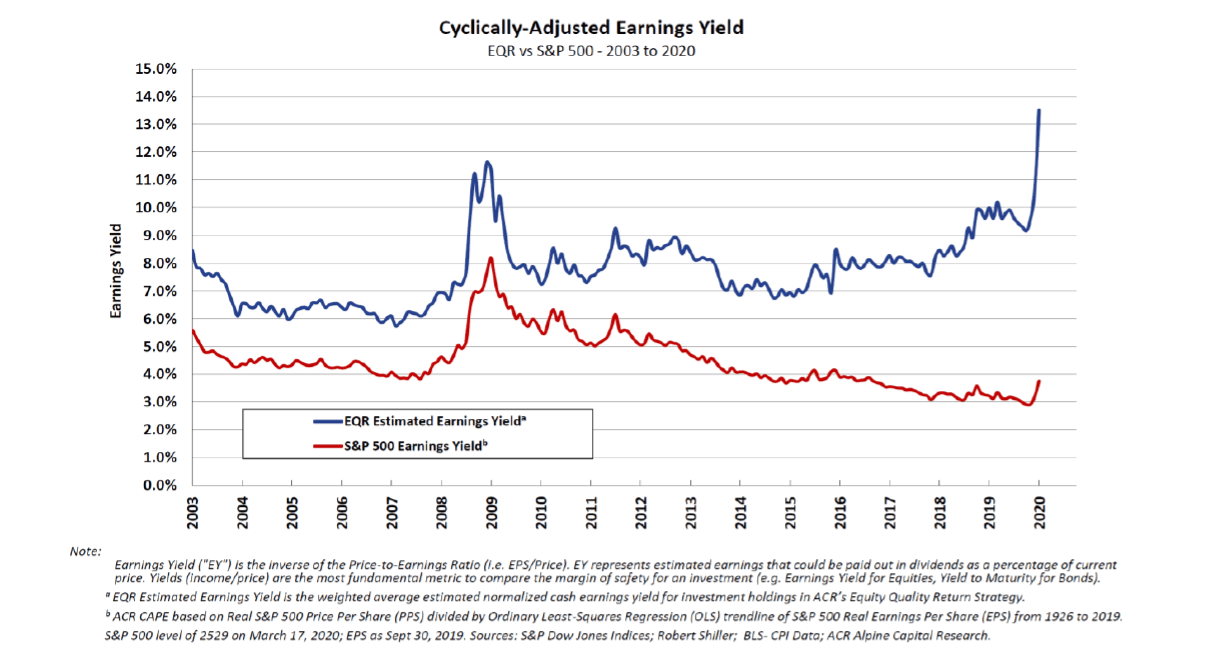

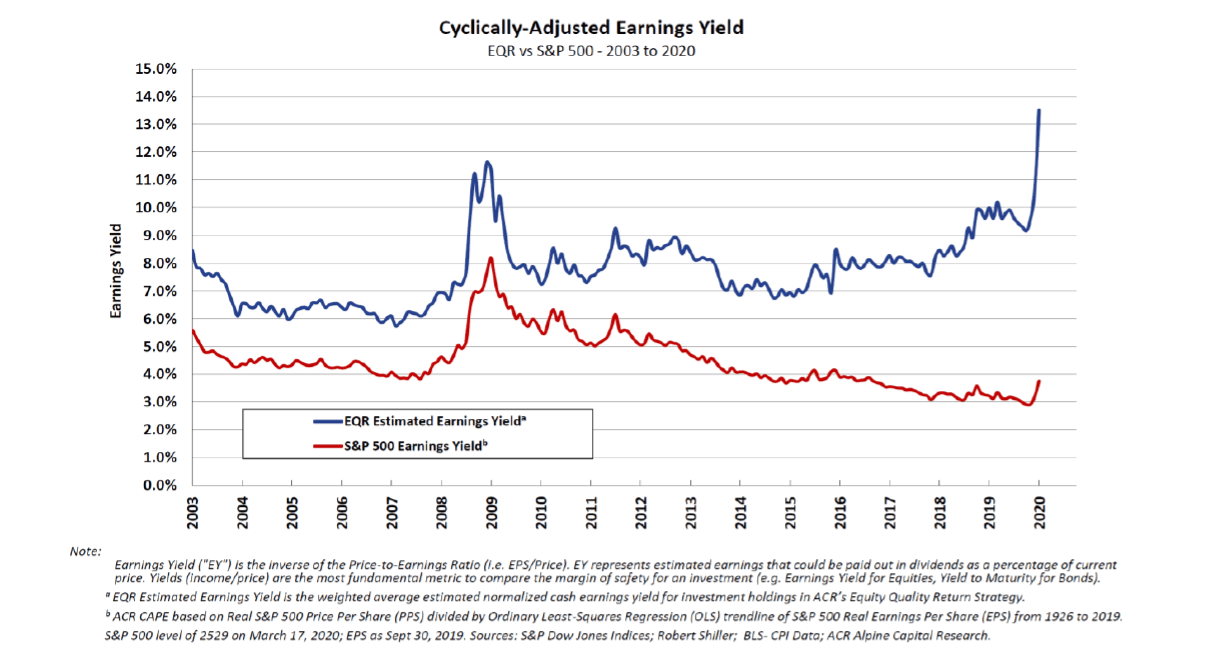

We would like to leave you with a chart which demonstrates one reason why we remain confident in achieving our return objectives. The chart shows the historical earnings yield for the EQR strategy and the market. Recall that the earnings yield can be an excellent metric for forecasting stock returns not including inflation.

Our current earnings estimates for EQR strategy holdings have factored in a recession and are adjusted for numerous other economic and company-specific factors. They represent the amount of money we believe our companies could sustainably pay in dividends while holding current unit output constant. The two remarkable features of this chart are how the EQR strategy diverged from the market from 2016-2019, and how it spiked in 2020.

The anxiety induced by the coronavirus and global economic shutdown is very unsettling to say the least. While we have never faced a pandemic in modern times such as this, the history of our country is one of crisis and perseverance. ACR believes that we will once again triumph over this hardship and that life will return to normal. In the meantime, we greatly appreciate your trust and confidence. Our office remains hard at work, so please do not hesitate to contact us with any questions or concerns.

Best Regards,

Nick Tompras

Alpine Capital Research LLC