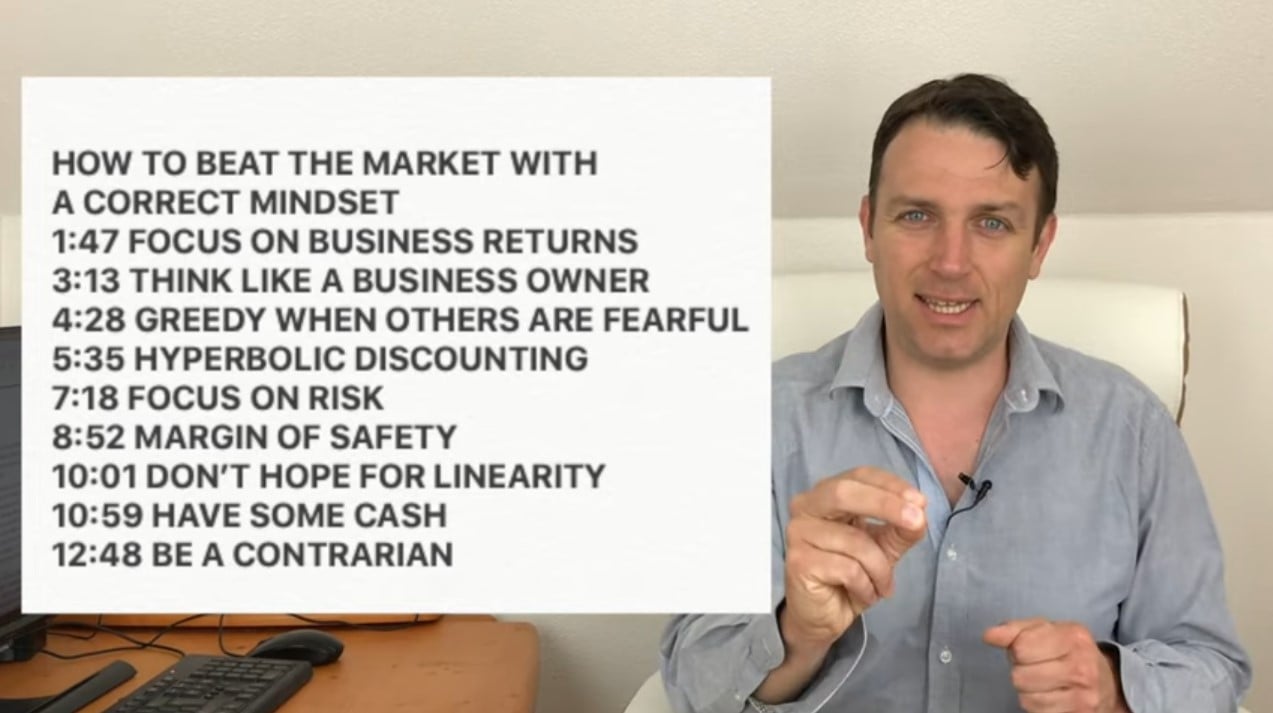

How to beat the market and achieve better investment returns? Just have the right mindset to take advantage of where others go wrong. Especially stock market beginners can get huge advantages by applying the correct mindset.

How To Beat The Market – Stock Market Investing Mindset

Q1 hedge fund letters, conference, scoops etc

Transcript

Good day fellow nvestors. I firmly believe that investing is of course first about the research knowing all the accounting all that's going on following and everything but everybody can get to that. You have data you have everything everything is public today on the Internet. The key then comes to the mindset and Benjamin Graham said that the biggest enemy of each investor is himself. So it's crucial to develop a correct investing mindset so that you can take advantage of what's going on. Increase your long term returns. And today I will share with you 10 mindset tools that you can use that give you an advantage over Wall Street. Wall Street is like the majority of people very short term oriented and therefore if you have a long term orientation a business orientation.

If you're calm if you're ready to buy into panic and sell into exuberance you might do very very well for you and eliminate all the fuss all the hysteria all the irrationality that Wall Street is always offering. You just need to turn on the news and it will be always short term panic and always about something new. We are have the trade wars now we had the Fed interest rates a year ago always something who talks about North Korea anymore but two years ago it shake the markets. So just. Follow these 10 principles and of course the channel if you like them. So please subscribe if you like this mindset style investing and then you will do well over time. Let's start number one focus on the absolute business return. So when you buy let's say you buy a house to let it out and then you say OK I pay one hundred thousand the yearly rent is six thousand. My business return is after costs and everything. Six percent and then you say okay if I'm happy with that business return okay. That's it. You're happy with what the business delivers. And the same should be applied to stock market investing you're buying businesses not stocks. If a stock goes up or if that piece of real estate goes up the better. But those are always free options that you have to buy what you have to buy always is the business. And then if it explodes free bag or for beggar that should be inserted into the price for free. If you focus on buying businesses as an owner then you have a great advantage on Wall Street.

If you look at Wall Street and their analysis they're always comparing to other companies. So they are not absolute investments. They're relative investors because they compare to everything else and then they always give an outlook to quarters ahead. What will happen this will hit their earnings in the next in the next two quarters. Who cares. You have to care where will their their earnings be in the next 10 years and then put that into an absolute birth. Personal perspective. No to think like an owner. So I buy businesses hold the business. I feel like I own the business. A few days ago we discussed Gazprom. OK I feel like I'm not only the stock. I own the pipeline. The power of Siberia. That goes directly to China where they'll start pumping gas in December. That's what I own. However it's boring to own a pipeline. Nothing happens. Perhaps a fire here and there hopefully not. But you just own businesses you accumulate them over the long term like Buffett did he accumulated the American Express Geico and he just holds that lets it go and pound over the long term grow grow grow and that's it. T

here is no excitement and I know that I would have my current business short term would be ten times bigger if I would talk about Tesla. If I would talk about trading short term gains near stocks even on the stocks I cover if I would say oh Gazprom will go up another 20 percent in the next three months. I think I would be at 200000 subscribers but I'm an owner and I know that long term ownership beats stock market trading and that's a proven think no free so much used even overviews but there is a difference between saying it and feeling it be greedy when others are fearful and be fearful when others are greedy Tesla stock. I have seen the greed over the last two years three years everybody was oh yes it will revolutionize everything ever did that. And now I see that greed turning into panic and you have seen what has happened to this stock now it's a much better.