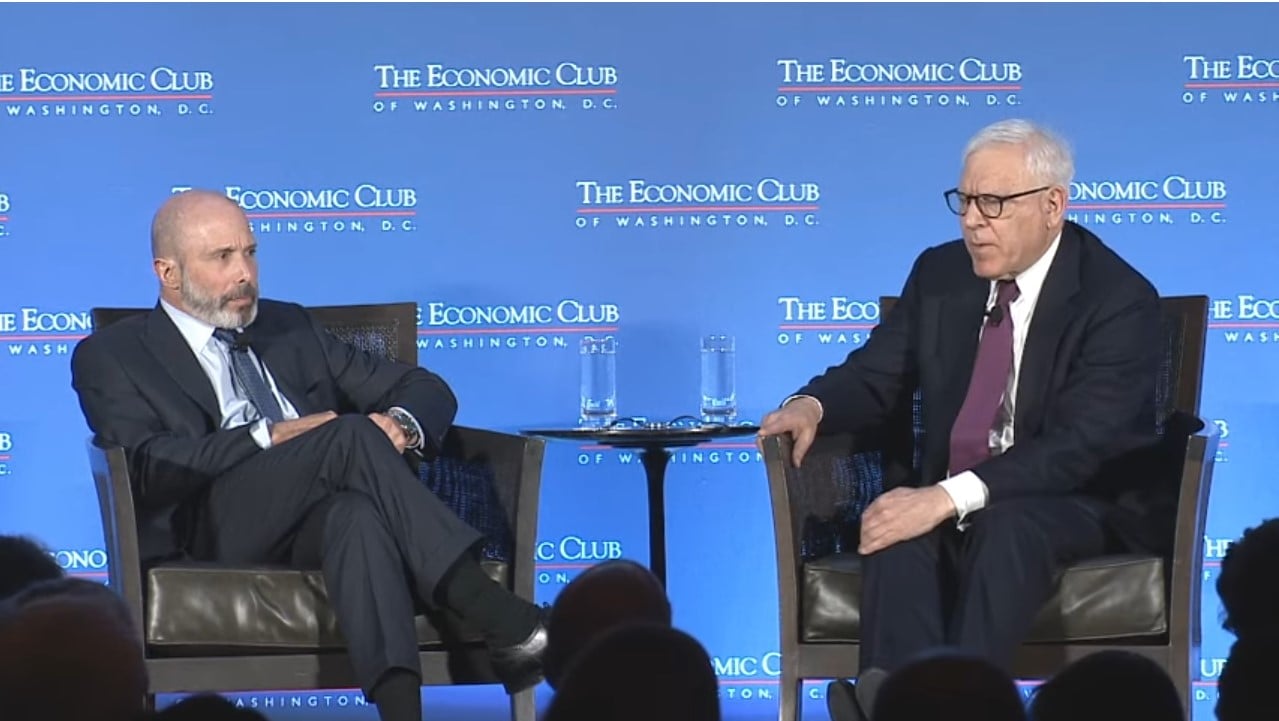

Evan Greenberg, Chairman and Chief Executive Officer, Chubb, speaks with Economic Club president David M. Rubenstein on Wednesday April 24, 2019.

Evan Greenberg, Chairman and Chief Executive Officer, Chubb

Q1 hedge fund letters, conference, scoops etc

Transcript

So Evan let me ask you a question. I hate to bring in my personal situation in these things but. I had a home a house I've lived in for about 30 years and the pipe burst recently and the entire basement was flooded and.

And so Chubb has been my insurer throw everything I have I always I never collected any I paid a lot of things so perfect I've never I never I've never asked for any money back I never got any money back. So I finally I'm going to ask for them back and you know I didn't tell you that.

I got there when you it. If you have enough because the guy had kept my about 20. Why don't we over that. Well see I can tell you I kept my copy of the Magna Carta in the basement. So. So. And. Here.

You're at your insurance adjuster didn't believe it but actually I've had no problems I'm happy I was going to invite the insurance adjuster here tonight to just make sure that he knew that I knew the boss and so maybe he could you know hurry up the check.

But anyway you told me when I talk to you about this actually before we were in China that a lot of people are having problems with their pipes bursting because homes are older and so forth and you haven't you said there's a way to deal with that. What is that.

It's a home. I can't believe we're going to have this conversation all right. It's an automatic water shut off valve. OK. And and the part that's not so humorous this is it's true that there has been over the last couple of years and it persists a problem of flooding in homes not due to weather and that's pipes bursting and that's because so much of the housing stock was renovated 20 25 years ago. And it's it's aging. And at the same time people want to more open floor plans and they move things like washers and dryers upstairs all these things you don't want to make. So there's a lot of there's a lot of flooding and a way to to eliminate that problem is automatic water. Water shut off valve and so when we pay your claim we insist you put one. All right. And if you have the Magna Carta your policy is going to sit on my desk so.

How many people are here have that kind of thing in their house. That water adjuster. Anybody.

OK. And you're who I want to ensure they get the rates lower if people have that they are. They are lower. OK.

So on a very serious note not that that wasn't serious but it was a little trivial.

Climate change is a serious problem for property casual people because of climate change. Many people would say produces more hurricanes more and more storms tornadoes and so forth. How do you deal with the effects of climate change. What do you think as an insurer you can realistically do to mitigate the effects of climate change. And you know climate change with. Warming of oceans and rising. Sea levels.

Much more extreme weather that we've been able to observe. It's not a it's not a fiction it's not speculative but it's a fact and it's it's heat. It's. It's wildfire drought heat flooding. Hurricanes are more intense and for certain kinds of perils we have because of sciences because of technology because of data we can the ability to model these events and to imagine damage ability rates on concentrations of exposure. The sciences have improved with that. And so we can ensure those other kinds. The the science is just evolving wildfires and and flooding. But you know we we were in that business it's a no tears business. At the same time society is changing it's urbanizing. And so you have concentrations of population and people wanting to live in areas where they have no business living. And so when you see the kind of wildfire events that occur there with people living closer into wilderness areas that are more exposed and so you really have the changing of society's behaviors and climate at the same time a big fire in California a few months ago I assume you didn't make any money on that.

No I didn't make any money because that's that wasn't that wasn't a profit making event that was to pay it out of it.

Now for people who are not familiar with the insurance business and I can't say I'm an expert on I I understand there are basically three types of insurers there's life insurers health insurers and property casualty is that more or less right. Correct. And which of those is actually the bigger of industry is that the life insurance industry the health insurance industry or property casualty globally it's the life insurance industry and the property casualty industry. Life insurance is the largest and the way the insurance industry works essentially as people want to insure against risk. They pay a premium to get that insurance and then you have made the calculation that you're likely to make some profit on that premium but then you take.