The price of bitcoin remains volatile today after approaching $9,000 on Monday, although it just didn’t have enough steam to smash through that level. However, even though the bitcoin price continues to swing wildly back and forth, bitcoin miners still see plenty of reason to mine it, but from a financial standpoint, is it really a smart decision to start mining bitcoin? Analysts continue to debate bitcoin mining’s cost structure and whether it’s worth the expense.

JPMorgan analysts Natasha Kaneva and Gregory Shearer recently conducted their own analysis of bitcoin mining’s cost structure to explain the expenses involved. As has been common among analysts at traditional investment banks, they seem rather skeptical about whether it’s worth all the expense and hassle.

Many analysts have debated whether or not cryptocurrencies are a commodity and if not, what type of asset it is. This is where Kaneva and Shearer start their analysis of bitcoin mining’s cost structure. They note that cryptocurrencies in general do have a lot in common with commodities: “they are both yield-less, and have associated tangible, derivable costs of production, a finite supply and an increasingly diminishing production yield.”

They also point out that the jargon employed by bitcoin miners comes directly from the mining industry. Cryptocurrency miners even call the computer systems they use to mine them “rigs,” and typically, they use a system that’s similar to a gaming rig, sometimes utilizing NVIDIA or AMD GPUs. Like mining for precious metals or gems, cryptocurrency mining is very energy-intensive, although the expenses are different.

The JPMorgan team explained that the main variable expense from bitcoin mining is the cost of energy. In addition to actually running the computers, it also takes energy to keep them cool because such high-end systems generate a lot of heat. Kaneva and Shearer add that Bitmain’s S9 Antminer is one of the most popular and efficient rigs used for bitcoin mining.

Assuming that one is using that system to mine, and that about 30% of the total energy that’s consumed in the operation is spent on cooling and other services they estimate that as of Jan. 21, bitcoin miners were consuming about 26TWh of energy on an annualized basis. They estimate this amount of energy at about 0.1% of the power that’s consumed around the world every year.

In fact, they believe that all the world’s bitcoin mining operations combined consume about the same amount of energy as the entire nation of Ecuador every year. However, they also say that this is “likely pretty conservative given its efficiency assumptions.” The cryptocurrency analysis blog Digiconomist estimates the amount of energy consumption at almost 44TWh per year, they add.

The JPMorgan team notes that bitcoin mining’s cost structure is highly correlated to how much each miner pays for electricity because of how much power is consumed to mine it. In fact, they peg energy costs at about 44% of the total needed to run a bitcoin mining operation.

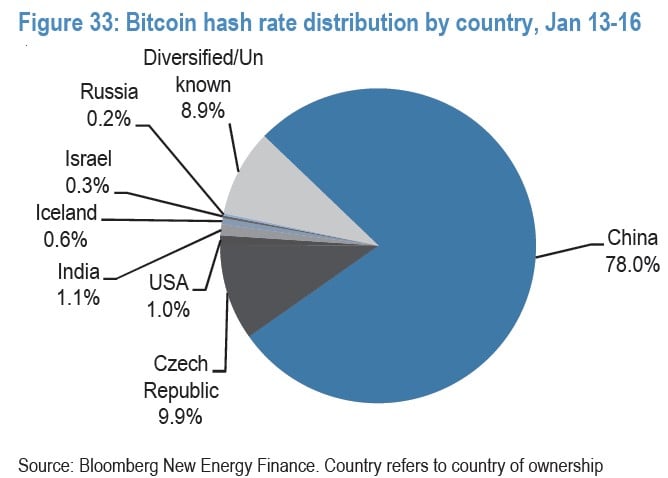

They believe that the bitcoin miners who are turning the largest profit are located in China because they have access to cheap electricity. They estimate that the average Chinese bitcoin miner spends about $3,200 per bitcoin to mine it. Kaneva and Shearer add that almost 80% of the bitcoins mined in the four days ending on Jan. 16 were mined by firms in China, based on data from Bloomberg New Energy Finance.

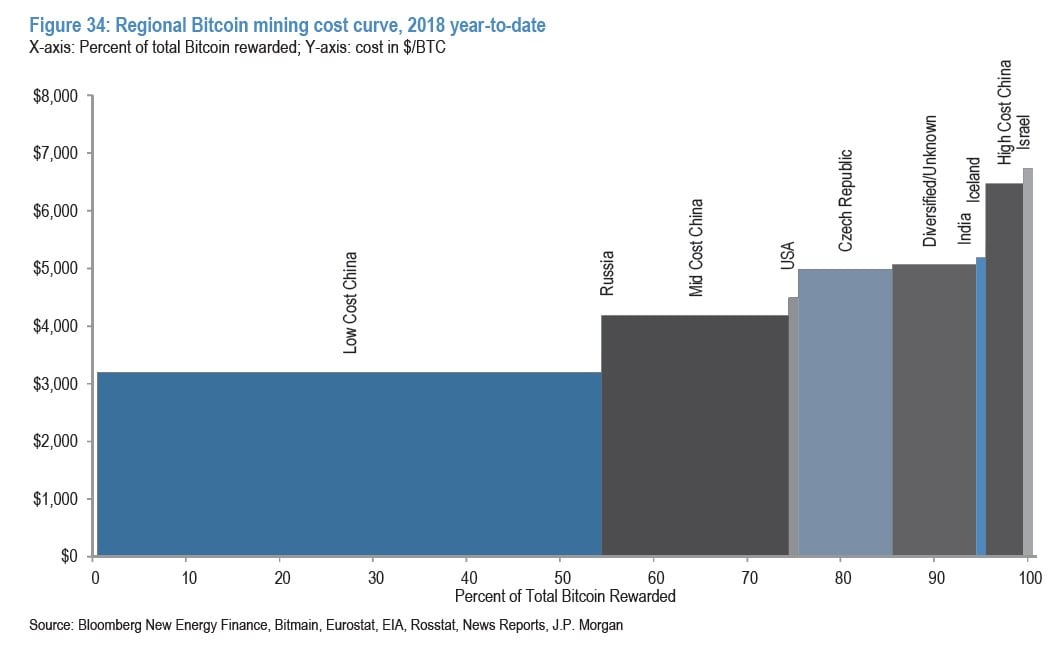

The JPMorgan team estimates the cost of electricity in China at between 3 cents and 13 cents per kWh, separated into three pricing buckets because electricity costs in China vary widely by locale. By comparison, New Yorkers would pay about 19 cents per kWh for electricity, which greatly inflates the costs associated with mining cryptocurrencies.

Looking more broadly at bitcoin mining’s cost structure around the globe, they estimate the production-weighted average cost of mining the cryptocurrency at about $3,920 per bitcoin.

Unfortunately for bitcoin miners, costs are rising fast, driven by energy prices and usage. In fact, they estimate that costs have risen fourfold just over the last year. We would also note that AMD’s and NVIDIA’s latest earnings reports suggest that energy prices aren’t the only component of bitcoin mining’s cost structure that’s been rising. Processor prices also seem to have shifted higher during Q4, and analysts blame demand from cryptocurrency miners. Kaneva and Shearer estimate that miners must replace their rigs about once every two years or so.

Another factor in bitcoin mining’s cost structure is the size of the reward each miner receives for his efforts. Mining the cryptocurrency gets more and more difficult over time due to the nature of the blockchain. The JPMorgan team estimates that miners currently receive a new block of bitcoins about every 10 minutes, but they expect the rewards to gradually fall over time, with the next major drop projected to come in the second quarter of 2020.