On April 3, 2018, the music streaming service Spotify is expected to hit the public markets for the first time.

However, while IPOs are usually large, hype-driven spectacles that involve investment bankers and roadshows to financial institutions, the Spotify IPO is taking quite a different route. For a variety of reasons, this will make the Spotify IPO both an unusual and intriguing event for investors.

Check out our H2 hedge fund letters here.

Here’s what’s interesting about the impending listing of the Sweden-based unicorn.

1. A Rare Breed

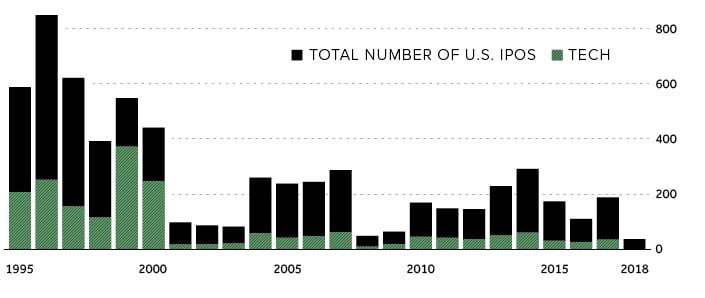

Despite the tech IPO being a legendary exit strategy among startup founders and venture capitalists, the reality is that today tech IPOs are few and far between.

By the same token, IPOs are also traditionally a way for investors to get a handle on market sentiment. With fewer tech IPOs on the books, it means that investors will look even closer to the Spotify IPO to try and gauge market frothiness.

2. An Unusual Listing

However, the Spotify IPO is not conventional in any respect.

The company was forced to IPO as a result of an impending deadline that would have entitled existing holders of convertible debt the option to “unwind” their transactions and get new convertible notes.

Further, the IPO uses an unconventional route to market – instead of the traditional investment bank and roadshow, Spotify is direct-listing its shares on the market from the pockets of existing shareholders. Based on current valuations, Spotify is the largest and highest-profile company to ever try this approach on an exchange in the United States.

On the plus side, Spotify reduces its costs by going this route. On the negative, it could lead to more volatility.

For better or worse, direct-listing shares places the company’s fate solely in the hands of John Q. Public.

3. An Upstream Battle

In 2017, Spotify shares sold for a vast range that places the company’s valuation somewhere between $6.3 billion to $20.9 billion. In a more recent private transaction, it put the valuation at closer to $23 billion.

If the company IPOs at $20 billion, as some experts expect, it’d make the Spotify IPO one of the five biggest tech listings of all-time. However, as today’s chart shows, the company still faces many challenges.

Apple, Amazon, Google, and Pandora will all remain fierce competitors, each with distinct advantages in the music market. Further, while Spotify has seen strong revenue growth, it’s also seen growing losses – and industry experts question whether the slim margins will ever amount to anything significant.

If Spotify can wrangle control of the music market and squeeze out better margins, while keeping its current growth trajectory, the Spotify IPO will be one to remember for a long time.

Article by Jeff Desjardins, Visual Capitalist