According to S&P Global Market Intelligence, US equity investor sentiment stuck in the doldrums in September amid stagflation worries.

- Risk appetite worsens and investors’ views towards near-term returns hold near survey low.

- Almost 80% see recession in the coming year, alongside persistent elevated inflation.

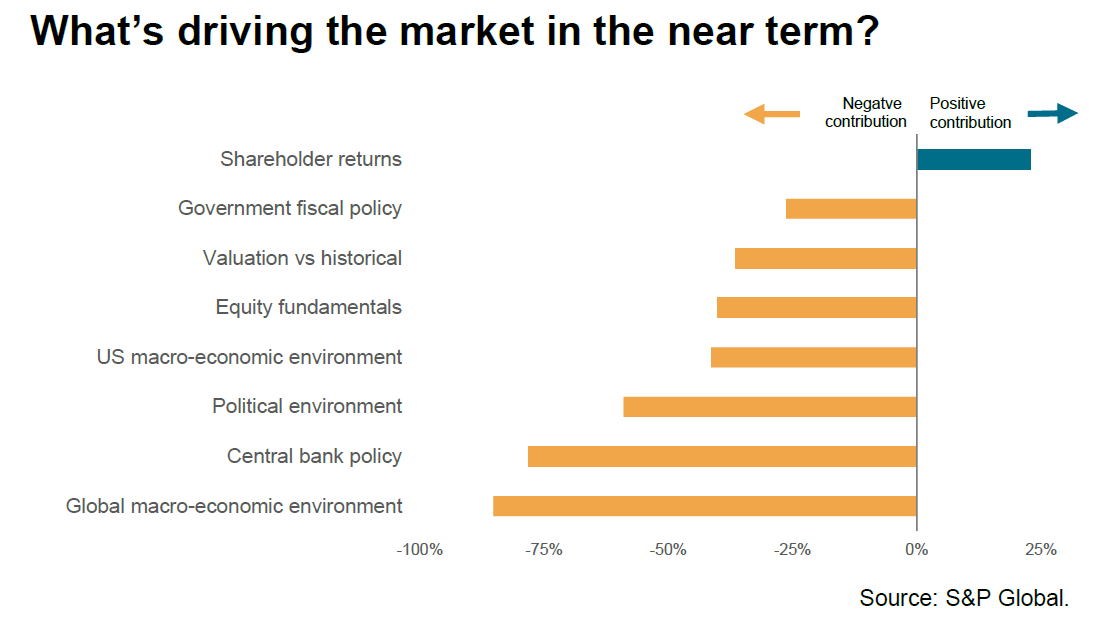

- Hence macroeconomic environment and central bank policy seen as biggest drag on equities.

- Sentiment highest for energy stocks and lowest for consumer discretionary and real estate.

- Sentiment slumps to survey lows for industrials and materials.

Q2 2022 hedge fund letters, conferences and more

Equity Investors Remain Risk Averse

US equity investors remain highly risk averse on average in September and anticipate further near-term market losses amid concerns over the macroeconomic outlook, central bank policy, and earnings growth.

While the ongoing war in Ukraine meant energy was the most-favored sector, consumer discretionary stocks are the least popular for a seventh straight month, followed by real estate.

The Risk Appetite Index from S&P Global’s Investment Manager Index™ (IMI™) monthly survey, which is based on data from around 100 institutional investors operating funds with assets under management of around $845bn, fell from -13% in August to -16% in September, indicating growing risk aversion, albeit not on a scale seen earlier in the year.

Expectations of near-term US equity market returns likewise remain deeply in negative territory, with the degree of pessimism pulling back only slightly from the survey low seen in August to reflect a broad anticipation of further market losses in the month ahead.

The IMI survey’s Equity Returns Index rose from -34% in August but, at -30%, was the second-lowest since data were first compiled in October 2020.

The biggest perceived drags on the US equity market are the global macroeconomic environment and central bank policy, followed by the political environment. While there was a notable easing in the perceived drag from fiscal policy, only shareholder returns remain a perceived support to equities, and even here sentiment has cooled.

The drag from equity fundamentals has meanwhile hit a new survey high, attributable to growing worries over the outlook for earnings, in turn linked to worries over recession and elevated inflation.

Anticipation Of A Recession

Special survey questions asked in September reveal that a recession over the next year is in fact anticipated by 79% of investors, albeit with only one-in-ten expecting the recession to be deep.

However, at the same time, investors see inflation remaining elevated and a concern to the FOMC over this period, despite most seeing inflation at its peak currently, painting a picture of a market that will be struggling with triple headwinds of recession risk, elevated inflation, and high interest rates well into 2023.

Some 80% of investors believe high rates of inflation will persist for the remainder of 2022 and spill over into the coming year. Only 3% believe that inflation will rise further in 2023, while nearly a fifth of the investors surveyed believe that the upward pressure on prices will ease sharply in the months to come, hinting that the worst of inflation has passed.

By sector, energy stocks displaced healthcare as the most favored, with IT/tech also seeing positive sentiment. All other sectors are suffering from negative sentiment for the near-term outlook, with consumer discretionary being the least favored, followed by real estate.

The biggest changes in sentiment are meanwhile seen for industrials and basic materials, where sentiment sank sharply to hit new survey lows. Survey low sentiment is also again recorded for communications stocks.

Commentary

Commenting on the results, Chris Williamson, Executive Director at S&P Global Market Intelligence and author of the report, said:

“Investor sentiment remains heavily negative in September, reflecting heightened risk aversion and the second-lowest expectation of near-term market performance seen over the past two years.

The vast majority of investors surveyed anticipate the coming year to one of recession combined with elevated inflation, meaning the global economy and tightened monetary policy are set to act as ongoing major drags on market performance and corporate earnings.

“The good news is that any recession is generally expected to be mild, and inflation is widely believed to have peaked, but there is clearly much gloom persisting, notably for consumer discretionary and real estate sectors, with survey-high pessimism also now evident for industrials and basic materials as economic headwinds intensify.”