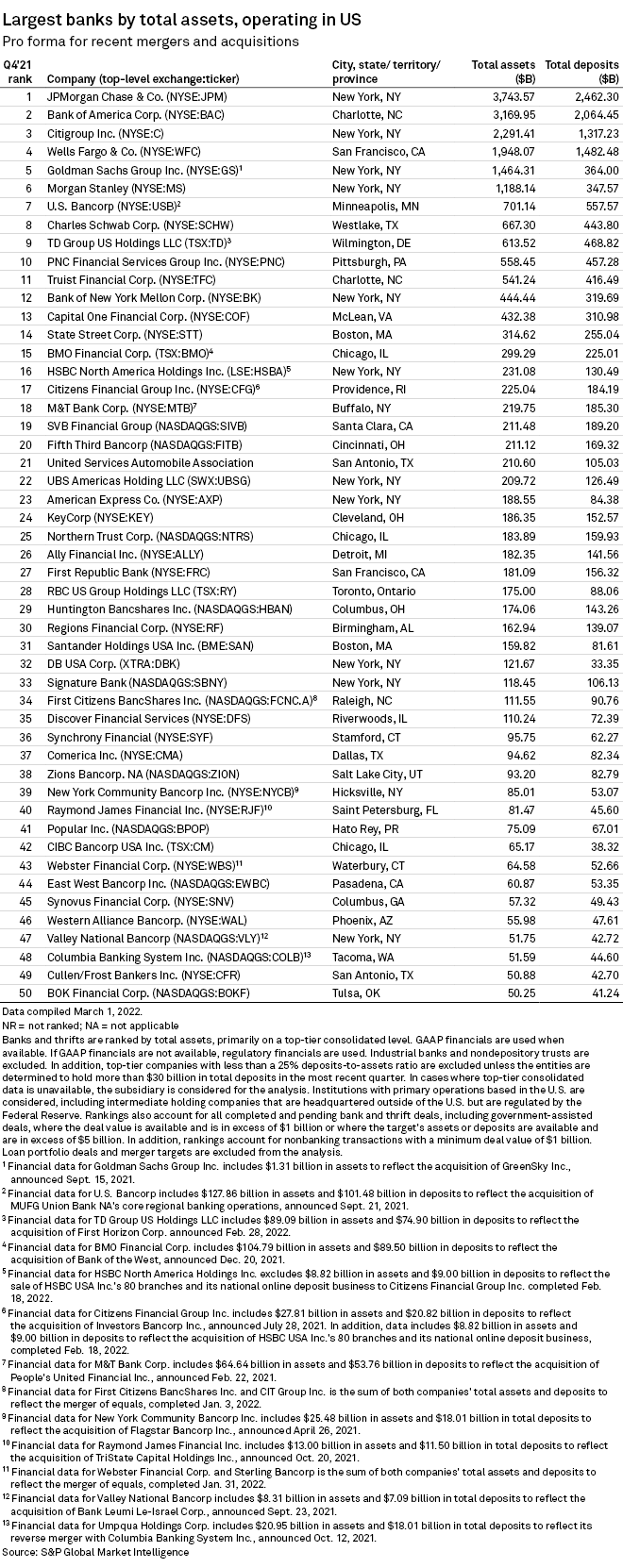

According to S&P Global Market Intelligence’s global bank rankings, thirty-eight of the 50 largest US banks and thrifts reported asset growth in the fourth quarter of 2021.

The Top 50 US Banks

Key highlights from the U.S. bank rankings analysis:

Q1 2022 hedge fund letters, conferences and more

- Three of the 'Big 4' U.S. banks post declines: Citigroup Inc (NYSE:C), JPMorgan Chase & Co (NYSE:JPM) and Wells Fargo & Co (NYSE:WFC) all reported decreases in total assets in the fourth quarter. Citi's assets fell by $70.46 billion, or 3.0%, quarter over quarter, while assets at JPMorgan and Wells Fargo declined by about 0.4% each.

- Canadians go hunting south of the border: Two of Canada's largest banks, Toronto-Dominion Bank and Bank of Montreal, have announced blockbuster deals for U.S. banks over the past three months, adding over $190 billion in assets combined.

- Regulatory M&A scrutiny expected to increase: Large deals like these are expected to face increased regulatory scrutiny as the Biden administration has directed regulators to take a closer look at sizable bank deals, and the Federal Deposit Insurance Corp. is soon expected to create new regulatory hurdles for M&A transactions that involve banks with over $100 billion in assets or that would create a bank above that threshold post-merger.

A link to the full analysis can be found here: Top 50 US banks in Q4'21 | S&P Global Market Intelligence (spglobal.com)