As many commodities have continued to climb impressively, one stands out like a sore thumb to me: lumber. What can the price of lumber mean, or more importantly, do for you?

[soros]Q1 2021 hedge fund letters, conferences and more

The Current State Of The S&P 500

Before diving into the lumber market, let’s review the current state of the S&P 500.

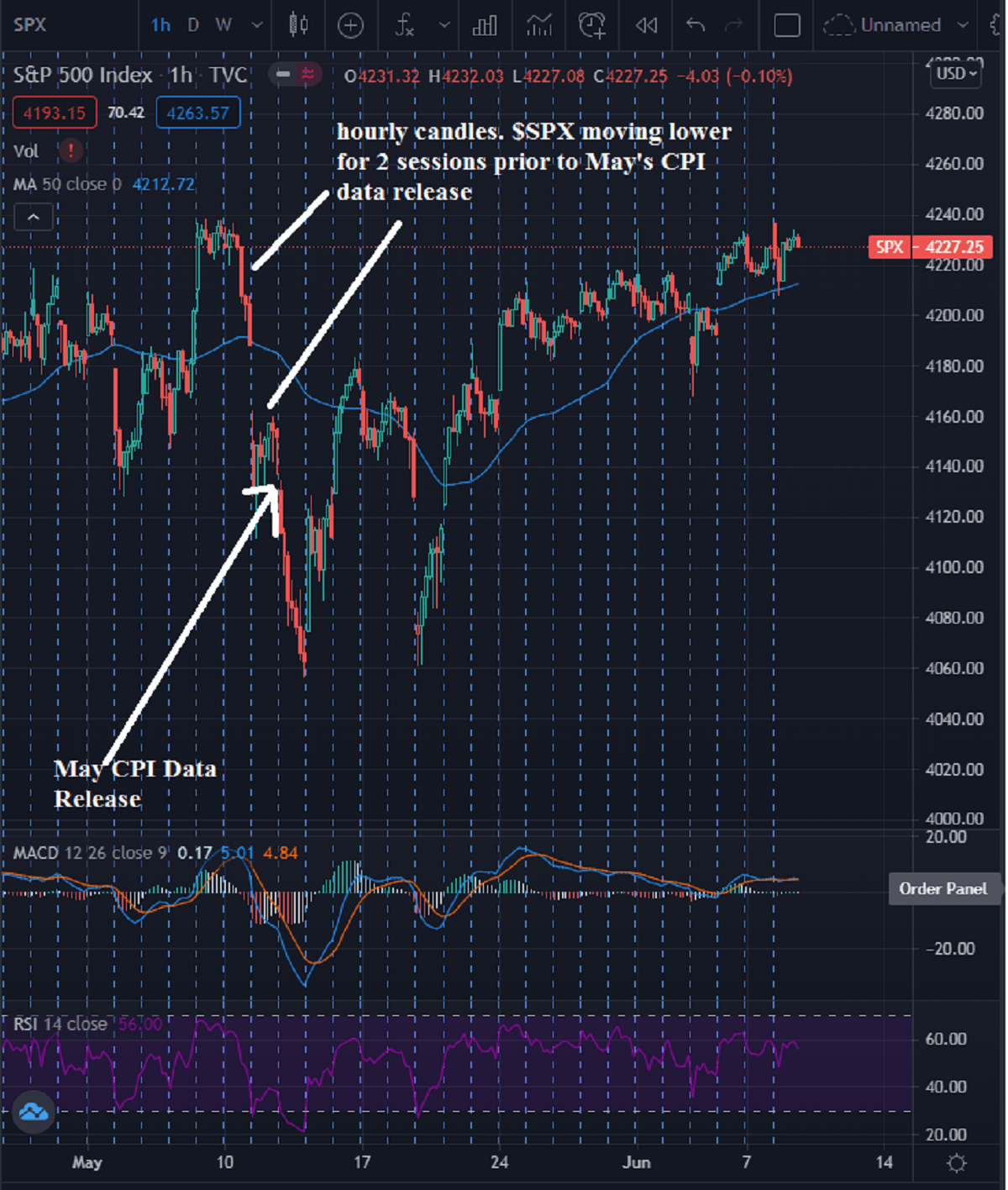

There weren’t too many surprises in the S&P 500 in Tuesday’s cash session, as the $SPX settled practically flat on the day. $SPX is at the higher end of its recent range, as discussed in yesterday’s publication . It will most likely require a catalyst of some sort to push through higher or break lower from here. Will Thursday’s CPI data be the catalyst? I think it could be.

After last month’s monster CPI print , traders are on their tippy-toes waiting for this data release. It is important to know that the $SPX was already down for two consecutive sessions when last month’s CPI print came out. It then sold off further intraday (May 12) and closed sharply lower.

Figure 1 – $SPX S&P 500 Index April 28, 2021 – June 8, 2021, Hourly Candles Source tradingview.com

The Price Of Lumber

It seems like everyone is talking about inflation, and with good reason! It is real and is impacting lives. All eyes are peeled for Thursday’s CPI data release.

Speaking of inflation, have you noticed the price of lumber lately? We all know that commodities are much higher and that homes are priced ridiculously high across most of the US. What amazes me is the demand and ability for borrowing at such high prices…but that is a subject for another time.

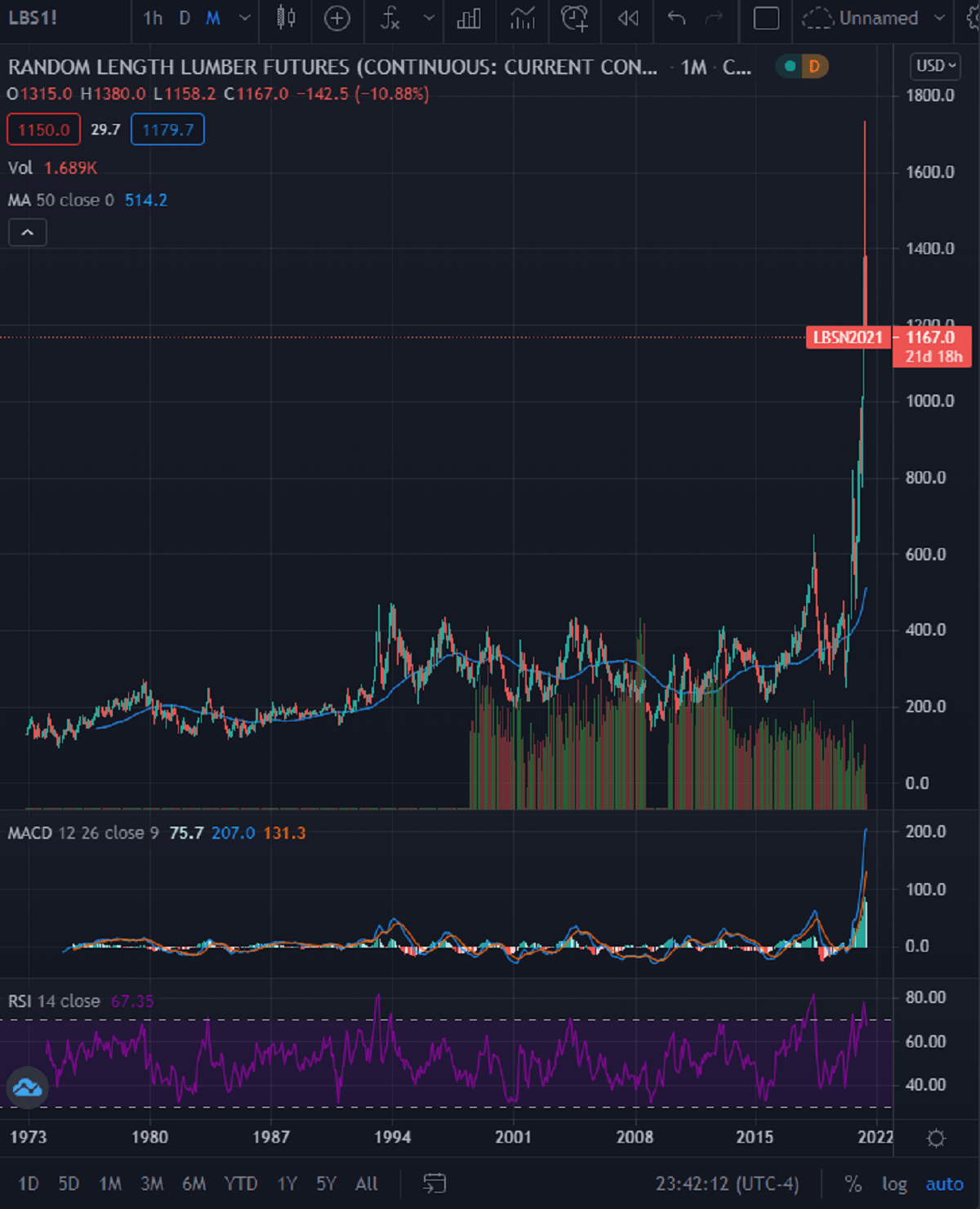

Check out this long-term chart of Lumber Futures (front-month):

Figure 2 – LBS1! Random Length Lumber Futures Continuous Contract December 1972 – June 2021 Monthly Candles Source tradingview.com

Trading In Lumber Futures

That’s a 48-Year chart for lumber, folks. Again, that is a chart for lumber. There is no Bitcoin or Dogecoin inside the lumber. There isn’t any 24K gold hiding in there. It is wood, and it managed to go ~ 8X from the pandemic lows.

This monster clearly decided that the average prices over nearly half a century just didn’t apply anymore. What a move!

I want to put this in big bold letters here: I strongly suggest against trading in Lumber Futures. They can be illiquid, and experience many limit up and limit down days. You could be stuck in a losing position and not be able to get out. The only traders in Lumber futures should be hedgers that are in the wood business or deep pocket institutional traders that have real money to burn. Futures trading entails unlimited risk. I am sure that many fortunes have been made, and many more have been lost during this insane lumber market. Being on the wrong side of a futures market like that can be brutal.

Now that we have that out of the way, is there another way to participate in this market?

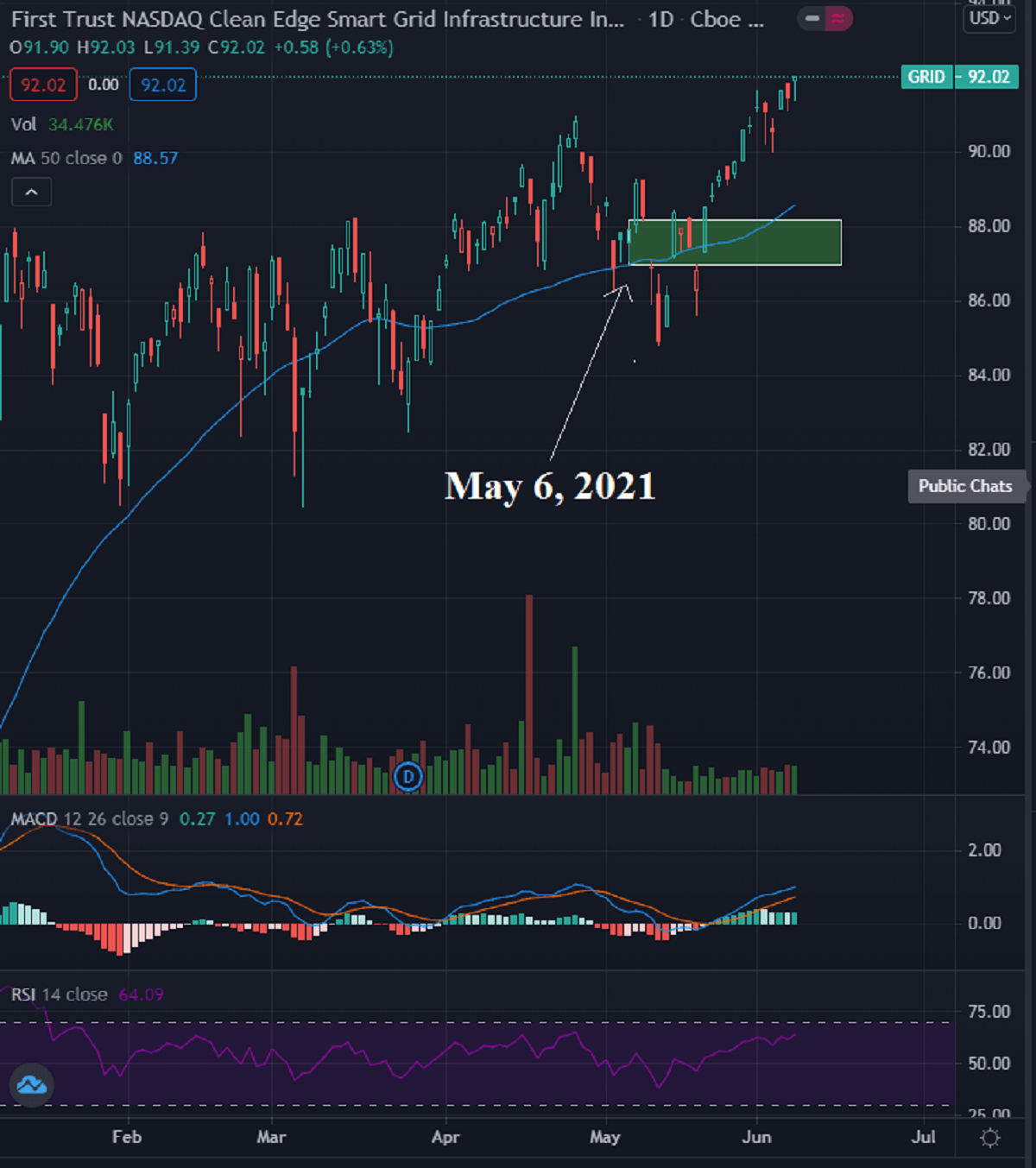

Yes, there is. But first, have you been following along with the GRID ETF trade that was covered in the May 6, 2021 publication? We were targeting an idea buy range of $86.91 – $88.17.

Figure 3 – First Trust NASDAQ Clean Edge Smart Grid Infrastructure Index Fund (GRID) Daily Candles January 7, 2021 – June 8, 2021. Source tradingview.com

Given the infrastructure bill theme that is currently in play in the US, the $100 Billion aimed at upgrading and building out the nation’s electrical grid , and the fact that the new administration is still in its very early days, I don’t think it is too late to get aboard. I like pullbacks, and we will be covering them.

Now, for our premium subscribers, let’s explore a potential opportunity in the lumber sector. Not a Premium subscriber yet? Go Premium and receive my Stock Trading Alerts that include the full analysis and key price levels. For a limited time, there is a 14-day trial available for only $9!

Thank you for reading today’s free analysis. I encourage you to sign up for our daily newsletter – it’s absolutely free and if you don’t like it, you can unsubscribe with just 2 clicks. If you sign up today, you’ll also get 7 days of free access to the premium daily Stock Trading Alerts as well as our other Alerts. Sign up for the free newsletter today!

Thank you.

Rafael Zorabedian

Stock Trading Strategist

Sunshine Profits: Effective Investment through Diligence & Care

This content is for informational and analytical purposes only. All essays, research, and information found above represent analyses and opinions of Rafael Zorabedian, and Sunshine Profits’ associates only. As such, it may prove wrong and be subject to change without notice. You should not construe any such information or other material as investment, financial, or other advice. Nothing contained in this article constitutes a recommendation, endorsement to buy or sell any security or futures contract. Any references to any particular securities or futures contracts are for example and informational purposes only. Seek a licensed professional for investment advice. Opinions and analyses were based on data available to authors of respective essays at the time of writing. Information is from sources believed to be reliable; but its accuracy, completeness, and interpretation are not guaranteed. Although the information provided above is based on careful research and sources that are believed to be accurate, Rafael Zorabedian, and his associates do not guarantee the accuracy or thoroughness of the data or information reported. Mr. Zorabedian is not a Registered Investment Advisor. By reading Rafael Zorabedian’s reports you fully agree that he will not be held responsible or liable for any decisions you make regarding any information provided in these reports. Trading, including technical trading, is speculative and high-risk. There is a substantial risk of loss involved in trading, and it is not suitable for everyone. Futures, foreign currency and options trading contains substantial risk and is not for every investor. An investor could potentially lose all or more than the initial investment when trading futures, foreign currencies, margined securities, shorting securities, and trading options. Risk capital is money that can be lost without jeopardizing one’s financial security or lifestyle. Only risk capital should be used for trading and only those with sufficient risk capital should consider trading. Rafael Zorabedian, Sunshine Profits’ employees, affiliates, as well as members of their families may have a short or long position in any securities, futures contracts, options or other financial instruments including those mentioned in any of the reports or essays, and may make additional purchases and/or sales of those securities without notice. Past performance is not indicative of future results. There is a risk of loss in trading.