From Dan Loeb’s Q3 letter to investors.

See much more exclusive Q3 hedge fund coverage here.

Dear Investor:

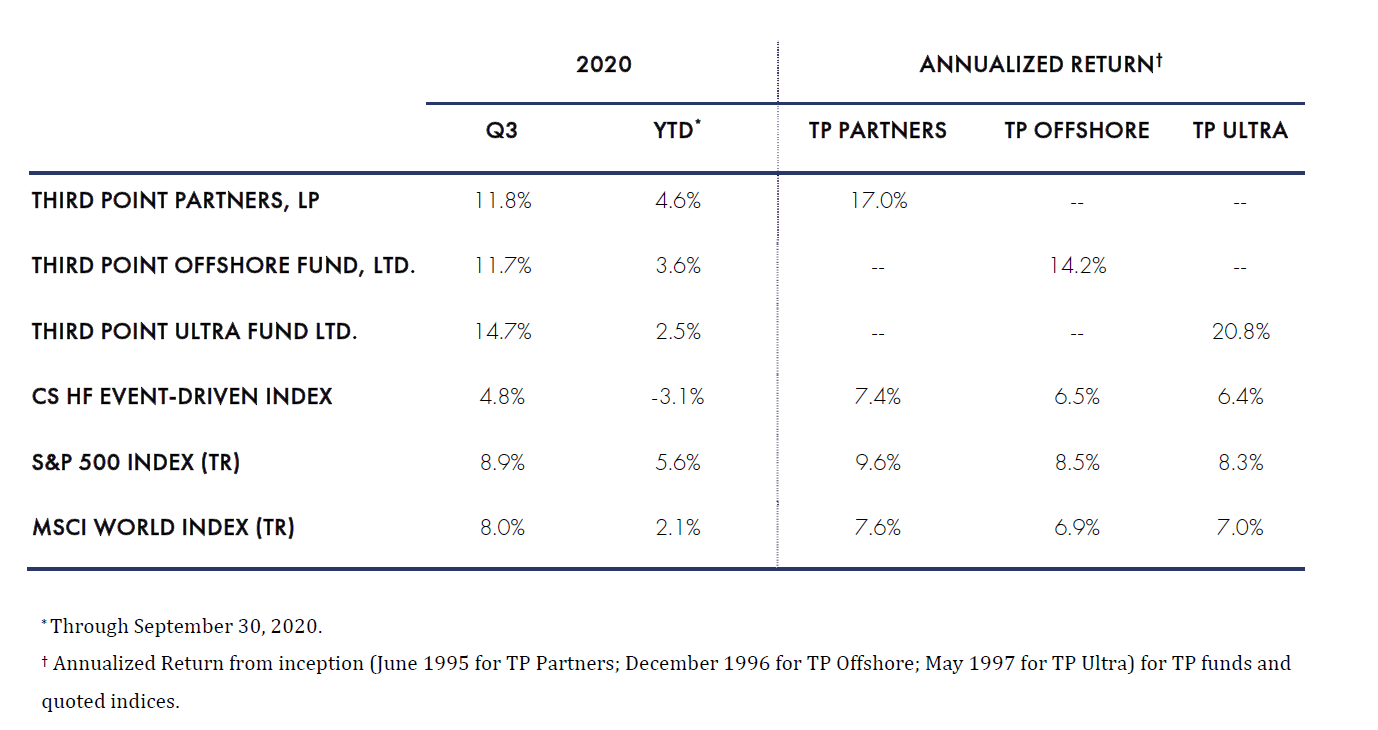

During the Third Quarter, Third Point returned 11.7% in the flagship Offshore Fund and 14.7% in the Ultra Fund, putting us back in positive territory for the year. Assets under management at September 30, 2020 were approximately $13.7 billion, including $700 million in the Third Point Structured Credit Opportunities Fund.1

Third Point's Event-Driven Approach

During the quarter, we augmented our event-driven approach with a greater focus on quality businesses with robust end markets, sustainable growth, technological edge, impenetrable market positions, strong cultures, and opportunities to reinvest capital at high rates of return. Our top equity performers for the quarter reflect this mix – three of the four were both event-driven and high-quality businesses: Alibaba Group Holding Ltd, (upcoming IPO of Ant Financial, sum of the parts); IAA Inc, (spinoff from KAR); Danaher Corp, (strong accretion from GE Biopharma acquisition). The fourth was a post-reorg equity, Pacific Gas & Electric Co, and the fifth was a private investment in SentinelOne, which is discussed in more detail below. The top five losers for the quarter were four shorts and Prudential plc, a company in an out-of-favor sector that we expect to appreciate to its intrinsic value as we await the IPO and distribution of its US variable life business. Our valuation case and positive assessment of Prudential’s work towards unlocking value remains unchanged.

The world continues to evolve at an increasingly rapid rate. The behavioral and business changes that surged during the COVID-19 lockdown have, by now, been well-mapped: work (and exercise) from home, online retail, multiplayer gaming, video on demand, online payments, and an explosion in biotech research and drug development. COVID-19 has permanently accelerated fundamental shifts in how we interact with each other and how digital information is turned into value. These shifts were only possible due to an exponential increase in broadband capacity, cloud computing infrastructure, artificial intelligence, VOIP communications, rapid semiconductor innovation, cybersecurity hardening, and the collaborative technology and business tools to bring it all together. The evolution of this ecosystem now underpins almost every business we evaluate. As investors, we must ask ourselves if we wish to engage at the leading edge of this change or end up as roadkill on what was once quaintly called “the information superhighway.”

See much more exclusive Q3 hedge fund coverage here.

To advance our approach, we have added six new members to our equity research team, including three analysts who cover consumer (one of whom will focus on China), others to cover healthcare and industrials (with a focus on automation, renewable energy, and other innovative business models), and a senior professional to lead our efforts in risk arbitrage/special situations. Detailed biographies for the new hires are provided at the end of the letter.

During Q3, the economy continued to recover from the shock recession caused by global lockdowns. Seeking to prevent a depression, global policy makers stepped forward with massive fiscal easing and direct monetary interventions that cushioned the initial blow. Over the five months since the economic bottom, employment in the US has recovered by half, and consumer spending has reversed roughly 80% of its COVID-19 induced plunge. Despite having this big bounce behind us and notwithstanding a near-term backdrop of continued COVID-19 infections, a tumultuous election, and the failure to agree upon a stimulus package, we remain constructive that new treatments are reducing the virus’s severity and that a vaccine will be available in the next few months that will allow further normalization of activity.

Markets reached an all-time high on September 2, before elevated uncertainty about the election and vaccine timing caused a modest sell-off. Sector rotation was evident throughout, as tech cooled after a summer of euphoria, and some excess in the market was wrung out. Many observers have reasonably asked how markets have remained resilient in a time of historic uncertainty and continued economic suffering for many individuals, a puzzling disconnect. Markets usually look ahead and it is critical to understand that this is not a typical recession – one caused by excesses such as over-investment – but a shock recession which, although rare, historically results in faster retracing because there is no “imbalance” to unwind before a recovery can begin. For this reason, comparisons to 2008 are inappropriate. The policy response so far, whether through monetary, fiscal, or public health measures, has been aggressive by historical standards. Assuming a reasonable expectation of a vaccine early next year, we could see the level of US GDP return to its pre-COVID level in the middle of 2021 with a possible fiscal stimulus bill in the first half providing further impetus. A constructive central case notwithstanding, we are attendant to a number of risks: a) political wrangling under a potential gridlock post-election scenario, which could make it harder to enact fiscal support in the event of a faltering recovery; b) a third wave in COVID cases; c) a delay in vaccine distribution timing; d) larger-than-anticipated scarring effects among consumer and businesses, which would be exacerbated by a more protracted recovery; and e) the path of interest rates.

Given the economic recovery and generally conducive monetary policies, conditions seem favorable for asset prices currently. Housing remains robust, inventories are rebuilding, and financial conditions remain loose. While employment will take time to fully recover, declining unemployment off a high level is typically good for stocks because earnings growth is supported by rebounding GDP growth and muted wage pressure. In addition, high slack in the labor market means there is room to run for the post-COVID expansion. A Fed that is eager to nurse the economic recovery means that the typical rise in interest rates following recessions may be more muted, which is supportive for P/E multiples, although a rise in long-end rates is still likely, especially in the event of a Blue Sweep. Regardless of which party wins the Presidential election or whether Democrats obtain a majority of Senate seats, we expect that future stimulus spending will likely outweigh increases in taxation and regulation that are assured under a Democratic majority and thus have maintained our positions and exposures as we approach the election.

See much more exclusive Q3 hedge fund coverage here.

Credit Update

In Q3, Corporate Credit and Structured Credit both returned ~6% on average exposure, contributing +0.9% and +1.4% respectively, to the firm’s Q3 gross return. In Corporate Credit, approximately half of our exposure remains in investment grade securities still trading wide to their historic spreads. This valuation gap should close with economic improvement and we expect spreads in these names to tighten even before the businesses return to prior profitability.

Unlike equities, the best opportunities in credit are in “lower quality” capital-intensive or cyclical businesses. Since we are not relying on the business value compounding but the ability of the issuer to pay interest on time and principal in full at maturity, we can focus on areas that offer the highest rates of return, even in industries that are out of favor in the equity market. We own securities in airlines which are either well capitalized or covered by collateral. We are also invested in the aerospace industry, which will be the second derivative of this recovery. The energy complex has been a strong contributor this year, despite some weakness in September. We are particularly excited about natural gas. Natural gas had been suffering in part due to associated or “free” gas produced from oil drilling; however, lower oil prices have dramatically reduced drilling activity, which has led to a much more favorable outlook.

Both the investment grade and high yield markets continue to experience record levels of new issuance as issuers seek to increase their cash buffers or extend their credit runways with refinancing of nearer-dated maturities. While spreads have generally recovered to long-term averages despite this deluge, we continue to see opportunities in both betterquality high yield and lower-quality investment grade credits that are in segments of the economy most directly exposed to the disruption caused by the virus.

Structured credit continues to be attractive. As the sector is closely correlated to the real economy and data is tracked monthly, we see shifts in consumer sentiment and behavior monthly in these assets, which provide an early insight into broader market performance and changes in fund flows. While March’s technical dislocation enabled us to be a liquidity provider, we anticipated that this credit cycle would evolve into a more fundamentally driven one. In previous market cycles, monetary and fiscal stimulus slowly inflated financial assets and enabled the consumer to borrow at lower rates and spend more. In this market cycle, we have seen a shift in consumer behavior. Individuals are making decisions based on health concerns such as moving out of urban areas, buying a car, or avoiding large gatherings in previously sought-after commercial real estate properties.

See much more exclusive Q3 hedge fund coverage here.

Third Point’s structured and corporate credit teams have collaborated on corporate names that have used asset backed securitizations for financing. One of our larger structured credit investments during the quarter was in Hertz ABS. We started investing before the May 22 bankruptcy filing with the assumption that Hertz would need to sell a portion of their fleet at a discount to book value but that the ABS tranches would be well collateralized by the fleet value. The COVID-19 shutdown led to a positive technical dynamic for used car prices, as car supply was constrained with a temporary closure of auto factories and, on the demand side, Americans wanted to rent cars to avoid public transportation and ride share services. As a result, Hertz was able to sell portions of their fleet at a premium to book, negotiate a plan to sell a larger portion of their fleet before year-end, and explore DIP financing thus driving the bonds higher. We continue to like the trajectory of both the company’s ABS and corporate credit.

Private Investments

For two decades, as part of a broader private security investment strategy, we have made numerous multi-stage private investments through Third Point Ventures (“TPV”), led by Robert Schwartz out of our Menlo Park office. TPV has carved out a niche investing in companies with exceptional management teams with sustainable technical and IP advantages in areas that draw on Rob and his team’s expertise in Enterprise Software, IT and Networks-related technology, cybersecurity, data analytics, cloud/edge infrastructure, financial technology, mobility and e-commerce.

We plan to launch a dedicated venture fund during the fourth quarter (“TPVC”) to capitalize on our record, proven expertise, and generational opportunities in the space. Two of our investments, Upstart and SentinelOne – companies where Rob sits on the Board and where we were major early investors – have experienced rapid growth, appreciation in value, and we believe they have a clear path to monetization. We are also holding an impressive “farm team” of earlier stage investments including Yellowbrick Data, Aryaka, Kentik, Kumu Networks, and a recently completed Series B in Ushur that show great promise.

We are at a compelling moment to deploy dedicated capital given the acceleration in technological innovation. Today, we are ideally situated with a purview of both public and private markets, a long track record, a strong reputation in helping build businesses, and the rationalization of valuations in the private space. While COVID-19 pulled forward and solidified technological changes such as distributed workforce, enterprise cloud adoption, shift to on-line, and resultant cybersecurity attack surface expansion, valuation momentum peaked in 4Q 2019 and is now rationalizing. By its nature, venture capital investing is long-only, illiquid, and long duration. The best opportunities to invest tend to be counter-cyclical and having the right capital gives us a tactical advantage. We believe dedicated assets will allow us to optimize position size and take advantage of investment opportunity with greater agility at a time when deal flow is extremely attractive.

The new opportunity set we are seeing is driven by transitions within segments comprising our bedrock DNA investing in enterprise, cybersecurity, and infrastructure. We expect to deploy our considerable experience investing in software businesses enabled by artificial intelligence and machine learning, as well as supporting technology infrastructure. We will seek to invest thematically in companies that enable or secure the evolving digital enterprise. The digital enterprise generates massive data, which at scale fuels machine learning, and modern artificial intelligence, which in turn drives automation that creates expansive economic value that drives the opportunity for young companies and their investors. This enterprise data “flywheel” offers excellent fresh investing opportunities for us to pursue with dedicated capital.

See much more exclusive Q3 hedge fund coverage here.

TPV-Tech2 has made 34 tech investments since 2000, with 11 exited via profitable M&A/IPO and 12 still active in the current portfolio. We have funded four companies at Series B that have become Unicorns (i.e. valuations in excess of $1 billion). Information about all of our Ventures investments may be found here. Since our first venture investment in 2000, we have refined our focus, sourcing, process, selection, and post-investment value-add so that our most modern vintage (the 2015 vintage) sets the stage and defines the strategy for the new dedicated fund. Going forward, while we may make some later stage investments, we prefer Series B expansion stage opportunities where we take an active approach in building the company and hold a board seat. These investments represent the optimal intersection between our skill set, attractive valuations, and risk/reward profiles. Since 2015, when we refined this TPV-Tech investment approach, our success ratio (fraction of investments worth more than their value at initiation) has been ~75% (compared to ~54% over the entire twenty years). According to Pitchbook data, TPV-Tech’s 2015 vintage investments have generated returns that place us in the top decile of 2015 venture funds.

TPV also provides an important source of differentiated value for Third Point’s main funds: insights into emerging technology that inform our public investments across multiple sectors, enabling us to invest across a company’s life cycle. TPV is integrated into the TP research discussion and provides useful color in TMT, Consumer, Energy, Industrials, and Financials.

We look forward to growing this part of our business and hope that many investors will take an interest in this new product.

Two examples of core positions driving our current performance are SentinelOne and Upstart, which we discuss in more detail below.

See much more exclusive Q3 hedge fund coverage here.

SentinelOne

SentinelOne is an Israel-originated cybersecurity firm formed in 2013. Now headquartered in Mountain View, CA, the company provides next generation AI-powered endpoint cybersecurity for the enterprise market. Within the $100 billion worldwide security market, endpoint security represents a rapidly growing $15 billion+ segment. SentinelOne serves over 8,000 clients (including AT&T, Exxon, McKesson, and other Global 50 Enterprises) and competes with providers such as CrowdStrike, Symantec, and McAfee. The company is growing ARR over 110% YoY. We found SentinelOne via our network in CyberSecurity in Tel Aviv after our outreach to all next gen endpoint security vendors. Rob Schwartz joined the Board when Third Point Ventures led Series B for SentinelOne at $97mm valuation in October of 2015. They recently signed a term sheet at $3 billion valuation (30X our entry point) for a substantial raise (with Third Point participating) which is expected to close at

the end of October and should take the company to a possible IPO in the next 12-18 months. Third Point owns approximately 10% of the company.

Upstart

Upstart is an advanced, AI-driven, non-bank lender launched in Palo Alto, CA in 2012 that provides unsecured consumer loans and refinanced auto loans using non-traditional underwriting variables to predict creditworthiness. Founded by ex-Googlers, Upstart is known for its ability to price risk via its superior AI-driven modeling capability. The performance of their lending versus AI-powered model predictions over the last seven years is among the best in the industry. Upstart partners with traditional banks and, critically, does not use its own balance sheet. As an example of the collaboration between TPV and our main funds, our structured credit team has been instrumental in evaluating Upstart’s loan and securitization products.

TPV led the Upstart Series C in 2015 at a $145 million valuation and Rob joined the company’s board. Rob has assisted the company with management strategy, tech focus, and organizational development, while Third Point Credit has helped the company refine its Capital Markets approach as they began to scale. In December 2016, Rakuten led Series C-1 at $200 million valuation, and in December 2018, Progressive Insurance led the Series D at $650 million valuation. TPV currently owns just under 15% of the company.

See much more exclusive Q3 hedge fund coverage here.

Updates

Third Point Reinsurance

In early August, Third Point Reinsurance, Ltd. (“TP Re”) announced it had entered into a merger agreement with Sirius Insurance Group, the former reinsurance arm of White Mountains. The new company, to be named SiriusPoint, Ltd. (“SiriusPoint” or the “Company”), will be led by current TP Re Board Chairman Sid Sankaran, who is currently transitioning from his role as Chief Financial Officer at Oscar Health. He was formerly Chief Financial Officer and Chief Risk Officer of AIG. In connection with the merger, Third Point LLC entered into a new long-term arrangement with the company that solidifies our partnership and re-envisions the relationship between a reinsurance company and an alternative asset manager. We are excited about the opportunities for growth with SiriusPoint. This platform also provides our fund investors with the stability of a longerduration source of capital that supports overall AUM. We look forward to this next chapter

with Sid and what will become the SiriusPoint team.

Main Fund Privates Side‐Pocket Election Offering

In connection with the launch of TPVC, we expect to offer Main Fund investors the ability to opt-in or opt-out of new private investments. Investors will have the ability to change their election annually. While all investors in the Main Funds will continue to have exposure to the current private investments in the portfolio, we expect to monetize most of these investments over the next 1-2 years. Investors who opt-in for future private investments will participate in certain investments made by TPVC as well as other opportunistic private investments sourced by the Third Point investment team. Investors will receive more detailed information on this election offering within the next few weeks.

See much more exclusive Q3 hedge fund coverage here.

Business Updates

As discussed above, we have hired eight new investment professionals, deepening our expertise in event-driven investing and furthering our specialized sector coverage in the consumer, healthcare, and industrials sectors, as well as adding geographic specialization in China. We also added a new data science specialist, and ventures professional. Their biographies are below:

PAUL CHOI: Paul joined the data science team as a Quantitative Data Analyst. Previously, he was a Data Lead and Research Analyst at Point72 Asset Management. Paul also has prior experience working for a fintech startup, YipitData, and in equity research at UBS Investment Bank and Morningstar. He graduated magna cum laude from DePaul University with a B.S. in Finance.

JIGAR CHOKSEY: Jigar joined the investment team with a focus on healthcare. Prior to Third Point, Jigar spent three years at Highline Capital Management as a Healthcare Analyst. Before joining Highline, he worked at Magnetar Capital covering healthcare. Previously, Jigar was an M&A and Restructuring Associate at Evercore Partners and began his career as a management consultant at Booz & Company. He graduated magna cum laude from Northwestern University with a B.S. in Biomedical Engineering and Economics and an M.B.A. from the Wharton School at the University of Pennsylvania.

TAYLOR COPUS: Taylor joined the investment team with a focus on industrials. Previously, he was an Analyst at Nokota Management investing in cyclicals and industrial tech. Prior to Nokota, he worked as an analyst at Highbridge Capital Management and as an investment banker in the Industrials and Natural Resources group at Goldman Sachs. He graduated cum laude from Princeton University with a B.A in Economics and a Certificate in Finance.

TIMOTHY LIU: Tim joined the investment team with a focus on covering China and Asian-investments with a primary focus on consumer and internet. Prior to Third Point, he spent eight years at Scopia Capital, a long/short equity fund, where he focused on China and consumer investments. He graduated summa cum laude from the University of Pennsylvania with a B.S. in Economics from the Wharton School.

See much more exclusive Q3 hedge fund coverage here.

GREGORY MERVINE: Greg joined the investment team with a focus on consumer. Previously, he was the consumer sector lead at EMS Capital. Prior to EMS, he worked as a Senior Analyst in the consumer group of Maverick Capital and worked in growth equity and venture capital at Bain Capital Ventures. Greg started his career at Bain & Company. He has a B.A. from Washington University in St. Louis and an M.B.A. from Harvard Business School.

DAN MOSKOWITZ: Dan joins Third Point’s Ventures later this month and was previously a Manager in Venture Capital and Corporate Development at Cisco Systems concentrating on cybersecurity and other investments across the enterprise stack including infrastructure, networking, data, developer tools, and applications. Prior to that, Dan held a summer job at Unity Technologies, and interned at Glasswing Ventures and Touchdown Ventures, concentrating on artificial intelligence and machine learning. For the previous five years, Dan was a Software Engineer and Program Manager at Lockheed Martin. Dan holds an MBA from Harvard Business School, a MS in Systems Engineering from University of Pennsylvania, and a BS in Electrical and Computer Engineering from Cornell University.

GABE TSUBOYAMA: Gabe will be joining the investment team in November to lead risk arbitrage and event-driven strategies. Previously, he was a Portfolio Manager at HBK Capital Management, where his responsibilities included risk arbitrage and special situations. Before HBK, Gabe was a Director at Allen & Company and a member of the event driven hedge fund team. Gabe was an A.B. Duke scholar at Duke University and graduated cum laude with a B.S.E. in Mechanical Engineering and Economics.

KATHY XU: Kathy joined the consumer team in September. Previously, she was Director of Corporate Development at Moda Operandi, a New York-based luxury e-commerce business. Prior to joining Moda Operandi, Kathy worked in private equity at Apax Partners, where she covered the internet and tech-enabled services sectors. Kathy started her career at Evercore in its mergers & acquisitions advisory group. She graduated with honors from the Ivey Business School at Western University.

See much more exclusive Q3 hedge fund coverage here.

Quarterly Investor Update Call

Our Q3 2020 Portfolio Review and Business Update will be held on October 21, 2020. A replay of the call will be available for one month following its conclusion upon request from Investor Relations.

Please contact Investor Relations at [email protected] or at 212.715.6707 with questions.

Sincerely,

Daniel S. Loeb

CEO & CIO