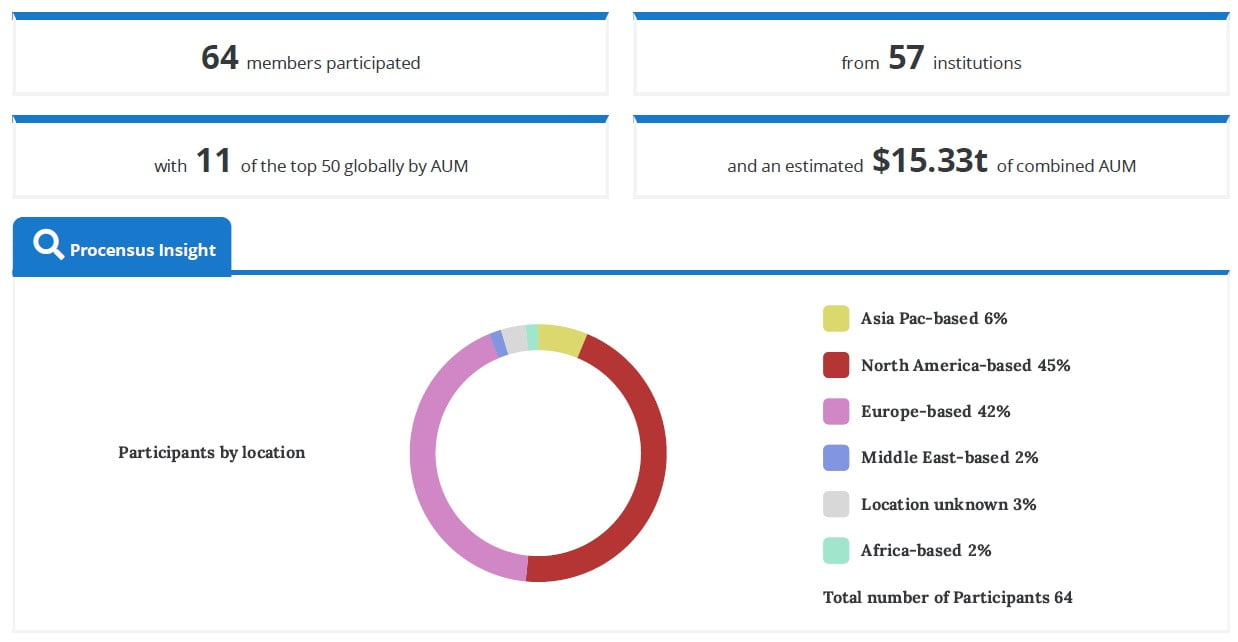

A recent report by Procensus on “The Examination of Inflation: What Do Investors Really Think,” which is based on responses from 64 investors who participated in a poll representing institutions with over $15tn in AUM and encompassing 11 of the Top 50 asset managers by AUM.

Q1 2021 hedge fund letters, conferences and more

Summary Of The Report

Comment from our CEO:

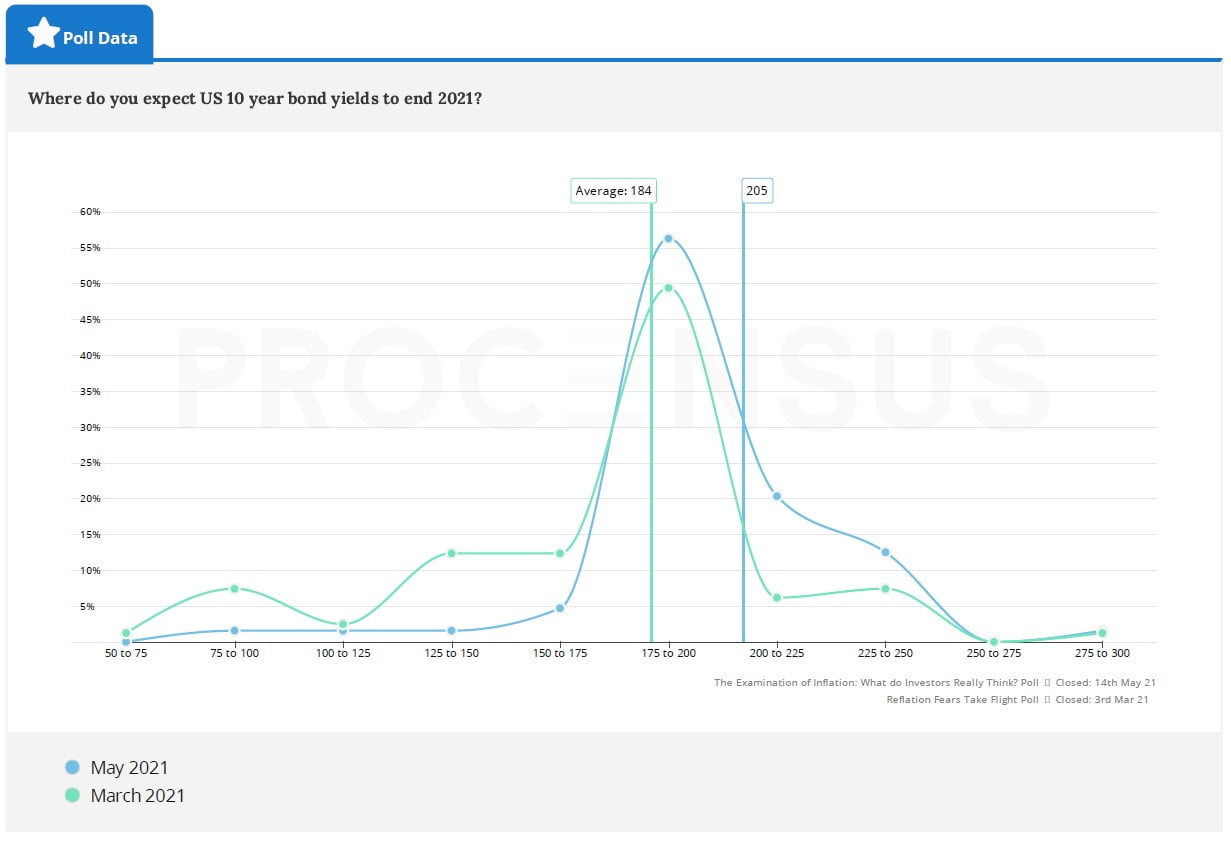

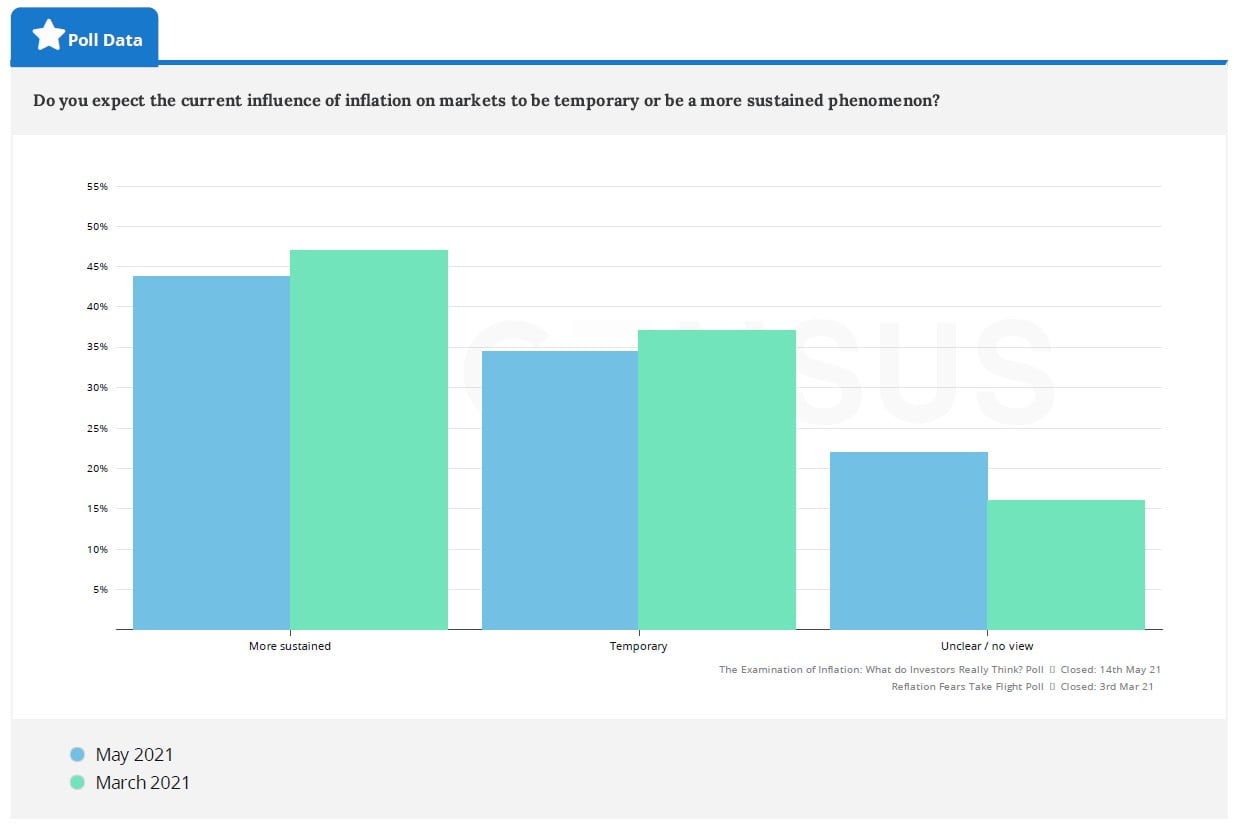

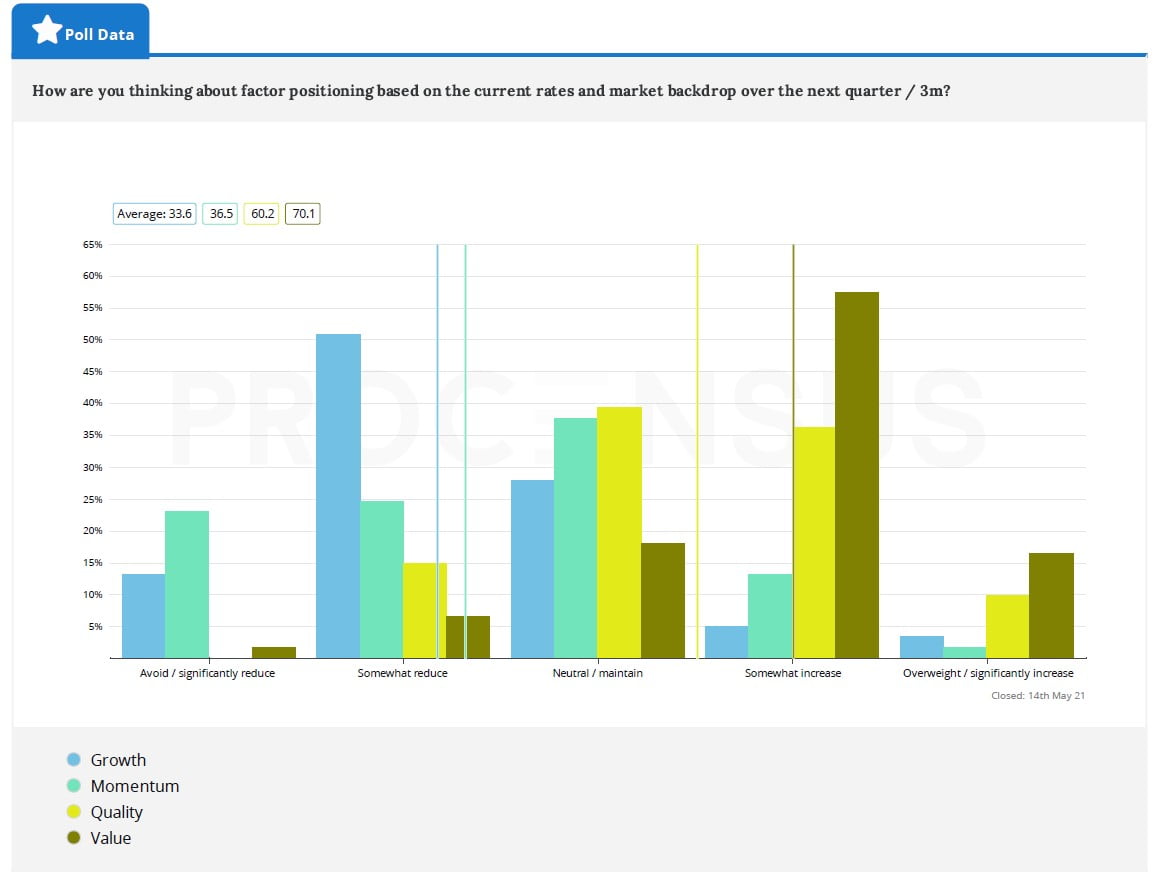

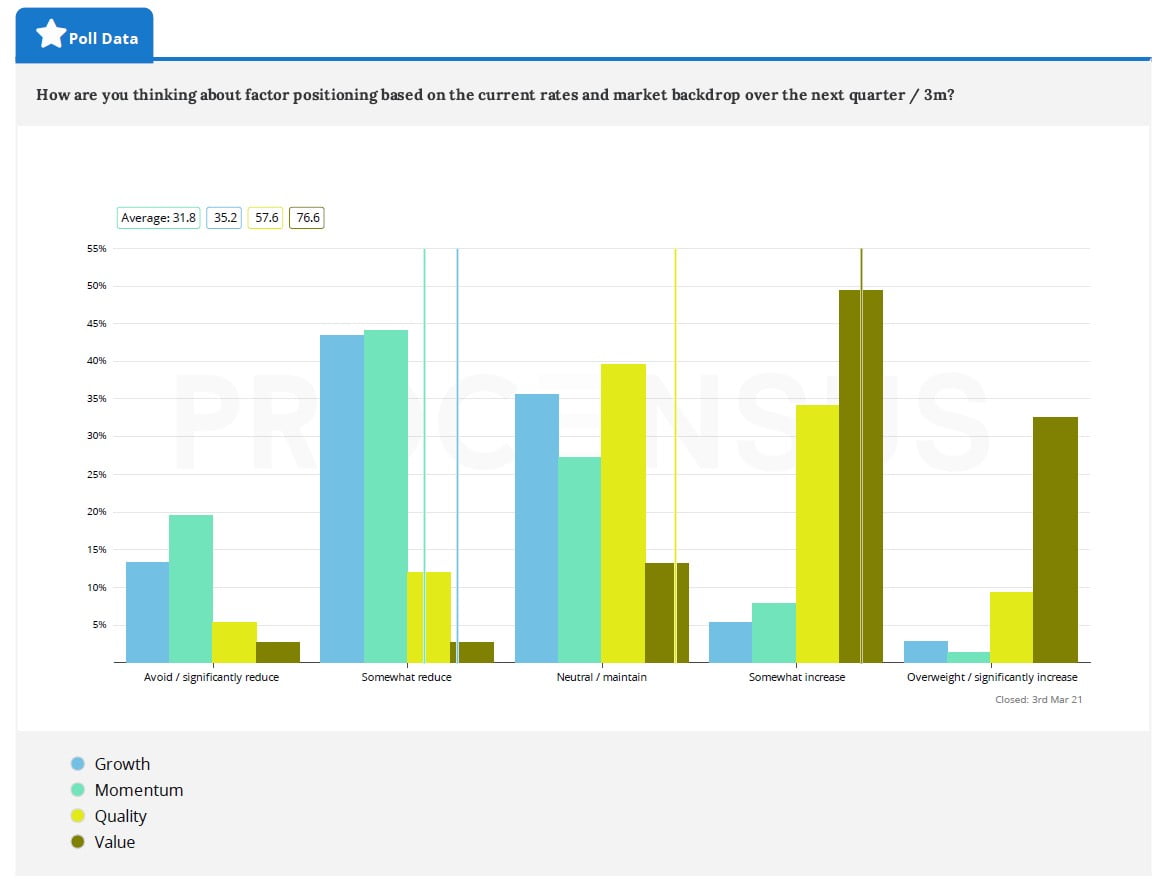

"Investor concern over rising inflation has been top of mind in markets recently but most investors actually believe inflation has already been baked into market valuations and is not a negative issue, according to our poll,” said Alastair Walmsley, CEO of Procensus. “Bond market forecasts of future inflation pressure have increased significantly in recent months. The average expectation for 10 year bond yield levels at the end of 2021 rose from 184bp in March 2021 to 205bp in May 2021 but would need to move to 273bp to shift the strategy of the average portfolio, so there is headroom for investors. In equity markets, significant appetite remains to increase weightings in value and quality stocks in May as we saw in March. However, investors are now more interested in selling down growth names versus momentum stocks, whereas in March momentum stocks were highest on the list to be sold down."

Key findings:

- Poll participants are almost equally split when it comes to whether inflation will drift up slightly from here (50%) or rise materially (45%) - however only 12.5% of poll participants see a material rise in inflation as a negative which is yet to be reflected in market valuations.

- The average expectation for 10yr bond yield levels at the end of 2021 has risen from 184bp in March 2021 to 205bp today.

- US 10 yields will have to move to 273bp to shift the strategy of the average portfolio, giving a lot of headroom to the current 10 yr yield level. It is worth noting however that the mode average is between 220-255bp.

- Investors still have significant appetite to increase their exposure to Value and Quality names, with demand little changed from our March poll. Interestingly, poll participants are now more interested in selling down growth names vs. momentum stocks, whereas in March it was the other way around with momentum stocks highest on the list to be sold down.

- In terms of sector positioning and expectations for outperformance and underperformance: The top 3 sectors expected to significantly outperform are financials, energy and materials, the same investor view as in March 2021 - although the percentage of participants who expect these sectors to significantly outperform has fallen. At the other end of the spectrum, Tech and Media were voted by the most number of investors as the sectors which will significantly underperform relative to the market (vs. utilities and consumer staples in March).

- Institutional Investors remain positive on global equity markets in general. In addition to the 9.4% of investors who think markets are cheap, 48.4% think that global markets can still outperform other assets from here despite being somewhat/very expensive.

- In terms of how investors see the market dynamics covered in this poll playing out in single stock selection terms: The stock picks in this poll reinforced the Buy signals we have on Bank of America and Microsoft, whereas Tesla and Gamestop were two notable consensus bear picks, and both have Sell signals.

The Examination of Inflation: What Do Investors Really Think?

Stock Pro-Signals

As always, we asked participants how they see the market dynamics covered in this poll playing out in single stock selection terms, with the data feeding into our live measures of single stock sentiment and the BUY / HOLD / SELL Pro-Signals derived from them (click here for details of the methodology we use to calculate these).

The stock picks in this poll have reinforced the Buy signals we have on Bank of America and Microsoft.

Meanwhile, Tesla and Gamestop were two notable consensus bear picks, both have SELL Pro-Signals.

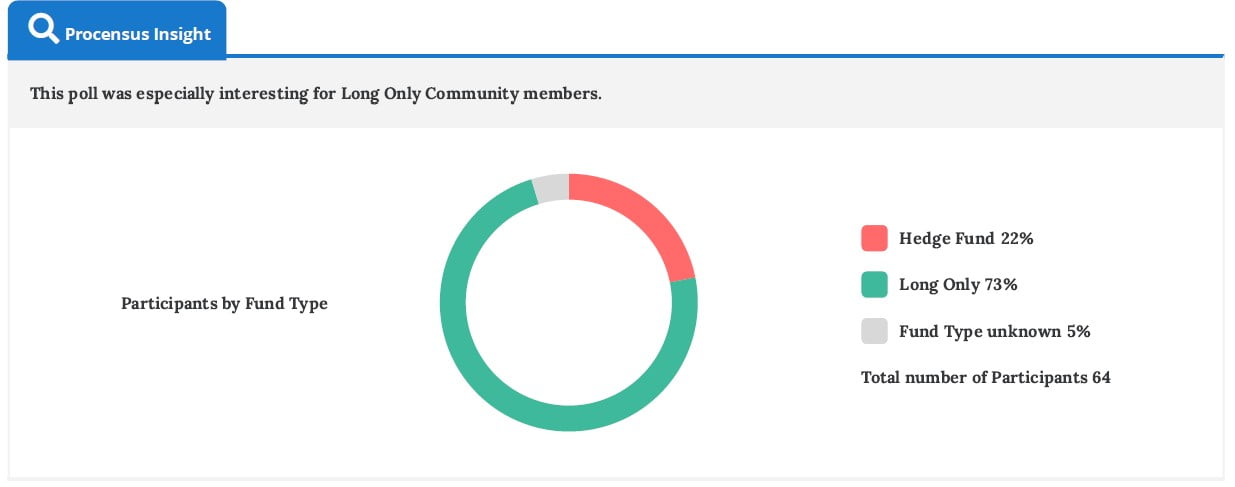

Participant Demographics

All data in the poll results can be filtered or lensed by different investor cohorts using the buttons below each chart.

How expectations for inflation/reflation differ from March...

As was the case in March, more investors are of the view that inflation will be more sustained (44%), than a temporary phenomenon (34%) in 2021.

Expectations for 10yr bond yields to end 2021 have risen ...

And the trigger for a market shift in top down portfolio strategy has moved significantly, leaving a lot of headroom from the current 10yr yield of 1.6%.

Investors still have significant appetite to increase their exposure to Value and Quality names in May, with demand little changed from our March poll. However, poll participants are now more interested in selling down growth names vs. momentum stocks, whereas in March it was the other way around, with momentum stocks highest on the list to be sold down.

Investors' Top Down Positioning Views as of May 2021

Read the full report here by Procensus.

About the data:

- The results are based on a survey of 64 investors representing institutions with over $15tn in AUM and encompassing 11 of the Top 50 asset managers by AUM.

- Investors participating in the survey contributed their opinions anonymously and therefore potentially more openly than they otherwise would.