Tesla Inc (NASDAQ:TSLA) is not only surviving the semiconductor shortage, but in fact, it keeps announcing upcoming models. How does Elon Musk’s company manage such feat amid one of car industry’s darkest days?

Q2 2021 hedge fund letters, conferences and more

Tesla, More Than A Car Manufacturer

The global scarcity of chips is hitting the automotive industry with intensity, and carmakers are stretching themselves thin to keep their launches on schedule and comply with deliveries.

Mercedes-Benz has just stopped production in some of its Germany and Hungary plants until further notice, while Jaguar-Land Rover could sue its microchip supplier due to problems in the supply shortage to parent company, Tata Motors.

However, Tesla seems to keep coming out unscathed, to the point of actually announcing launch after launch.

In forthcoming months, Elon Musk’s company is expected to deliver –or start producing– vehicles like the Cybertruck, the Roadster, the Model YS, the Model S Plaid Plus, and even a more affordable, fully autonomous, $25,000 EV –whose launch date is yet to be determined.

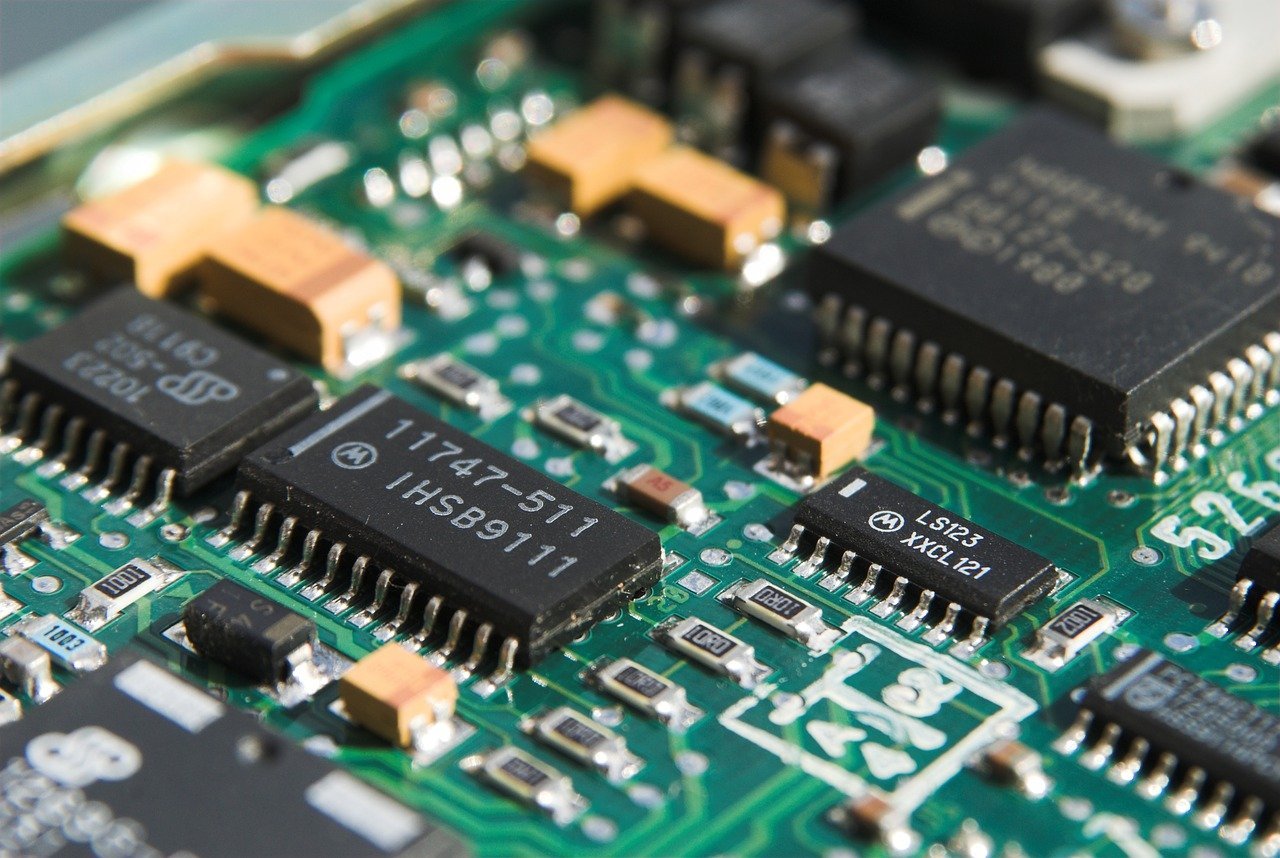

So, how is this possible? Tesla is certainly more than a car manufacturer; it is a technology company, able to muddle through by rewriting its vehicles’ software to allow microchips from several providers.

19 ECU Variants In A Few Weeks

Musk had told investors that the semiconductor shortage was a big problem for Tesla. However, the company has ridden the storm by replacing missing components and rewriting its vehicle’s software in a matter of weeks.

Specifically, the Tesla team has worked hard to design, develop, and validate 19 new variants of electronic control units (ECUs) in response to the crisis.

For instance, a Volvo XC90 has approximately 110 ECUs in addition to software, sensors, cameras, and a myriad of elements that comprise its technological arsenal. Almost the majority come from third-party providers.

It was Elon Musk himself who announced the company’s strategy, amid the smashing second-quarter results this year, which saw the company top $1.1 billion in profit, nearly ten times the $104 million from last year during the same period.

In retrospect, given the company’s stellar performance, it is clear that it has greatly suffered the global microchip crisis, especially when automotive gross margins hit 28.4%, “higher than in any of the last four quarters.”

Still, Musk remains adamant that the situation is “quite dire” and that the company’s growth rate will be determined by bottlenecks in the supply chain.

Tesla is part of the Entrepreneur Index, which tracks 60 of the largest publicly traded companies managed by their founders or their founders’ families.