Bullish run in stocks is on, driven by tech gains and value swinging higher as well. Throughout the markets, risk-on has been making a return as long-dated Treasury yields retreated, dollar fell and commodities continue their bullish flag formation. As I have tweeted on Thursday, it were the investment grade corporate bonds that signalled the turnaround in yields spreading to TLT next. Given such a constellation, the dollar‘s appeal is taking a dive as the bond market gets its reprieve. When nominal yields retreat while inflation (and inflation expectations) keep rising, real rates decline, and that leads to dollar‘s decline.

Q4 2020 hedge fund letters, conferences and more

Stocks are more focused on the tidal wave of liquidity rather than the tax increases that follow behind. So far, it‘s still reflation – tame inflation expectations given the avalanche of fresh money, real economy slowly but surely heating up (non-farm payrolls beat expectations on Friday), and not about the long-term consequences of tax hikes:

(…) Reduction in economic activity, unproductive moves to outset the effects, decrease in potential GDP? Remember the time proven truth that whatever the percentage rate, the government always takes in less than 20% GDP in taxes. The only question is the degree of distortions that the tax rate spawns.

And as the falling yields were embraced by tech with open arms, the sector‘s leadership in the S&P 500 upswing is back. As you‘ll see further on, the market breadth isn‘t pitiful either – slight non-confirmation yes, but I am looking for it to be gradually resolved with yet another price upswing, and that means more open profits (that‘s 7 winning stock market 2021 trades in a row).

The Fed thus far quite succeeded in passing the inflation threat off as transitory, but the rebalancing into a higher inflation envrionment is underway – just look at the bullish consolidation across many commodities.

The crucial copper to 10-year Treasury yield ratio is slowly turning higher as the red metal defends gained ground, oil rebound is progressing and lumber is moving to new highs. And don‘t forget the surging soybeans and corn either. Apart from having positive influence upon S&P 500 materials or real estate sectors, precious metals have welcomed the turn, rebounding off the double bottom with miners‘ leadership and silver not getting too hot yet. And that‘s positive for the white metal‘s coming strong gains – let alone the yellow one‘s.

Let‘s move right into the charts (all courtesy of www.stockcharts.com).

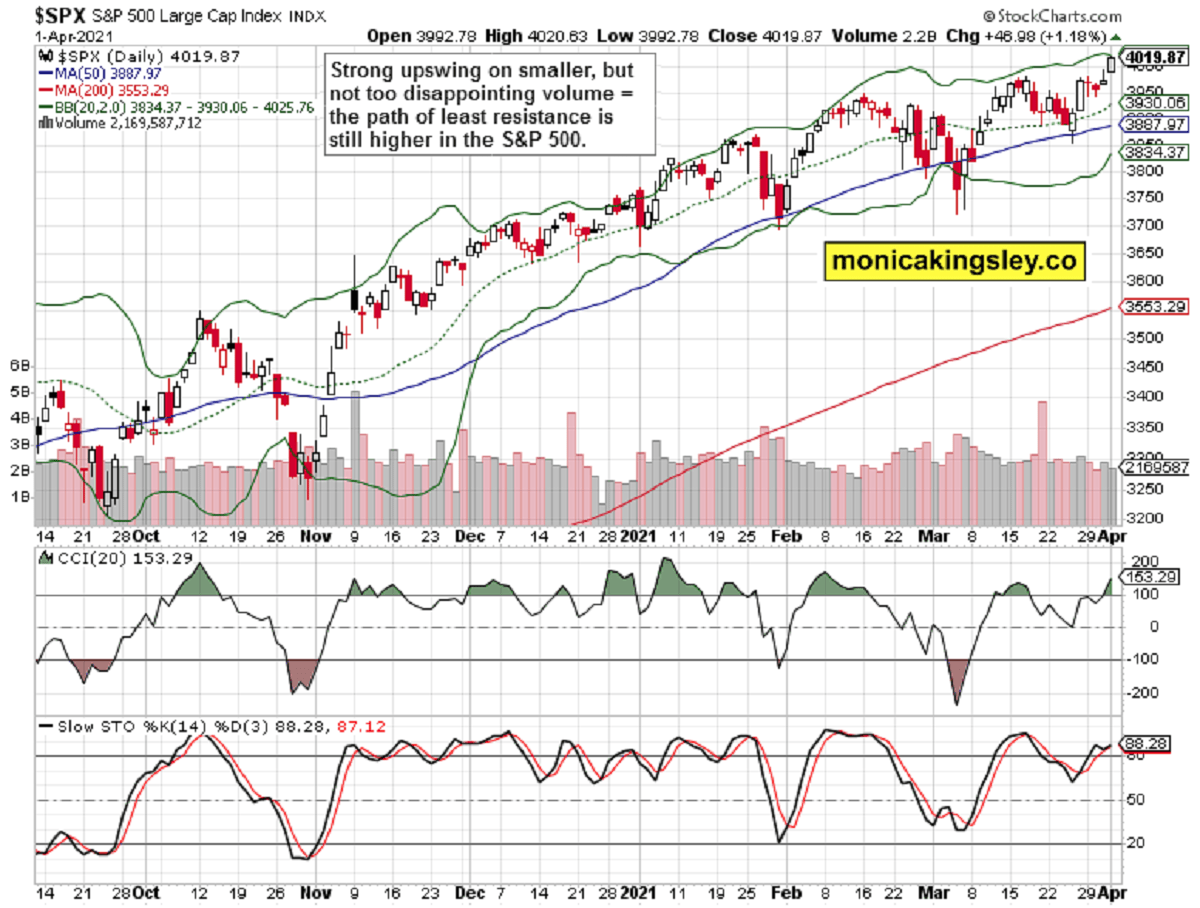

S&P 500 and Its Internals

Slightly lower volume during the whole week and Friday is merely a short-term non-confirmation. It isn’t a burning issue as stocks closed the week on a strong note. The bullish price action on the heels of improving credit markets and technology-led S&P 500 upswing, has good chances of going on.

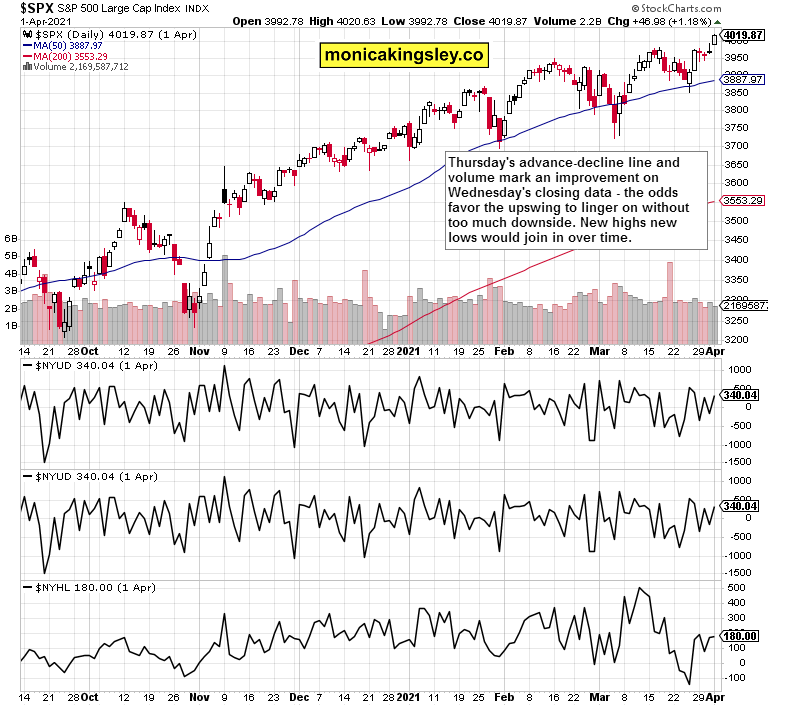

See by how much market breadth improved vs. Thursday – both the advance-decline line and advance-decline volume turned reasonably higher, and given the tech leadership in the upswing, new highs new lows merely levelled off. For them to turn higher, value stocks would have to step to the fore again.

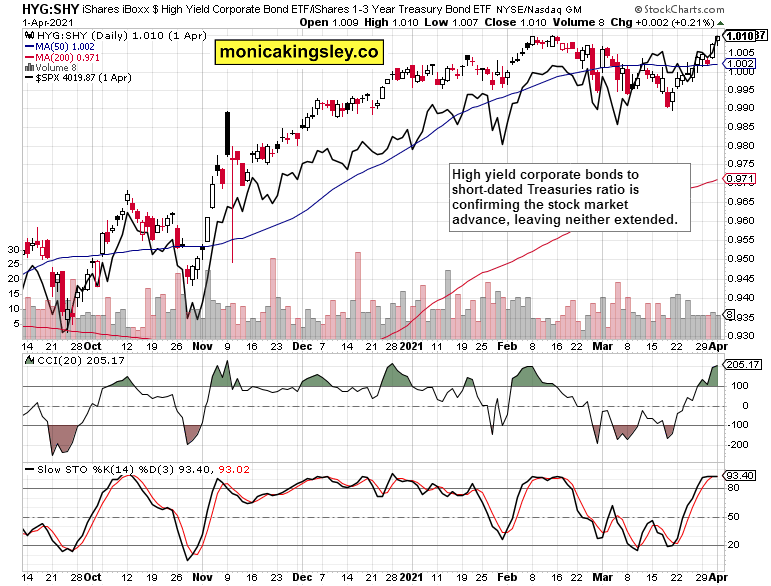

Credit Markets

The high yield corporate bonds to short-dated Treasuries (HYG:SHY) ratio confirmed the stock market upswing with its own bullish move, and the two are overlaid quite nicely at the moment. No whiff of non-confirmation here.

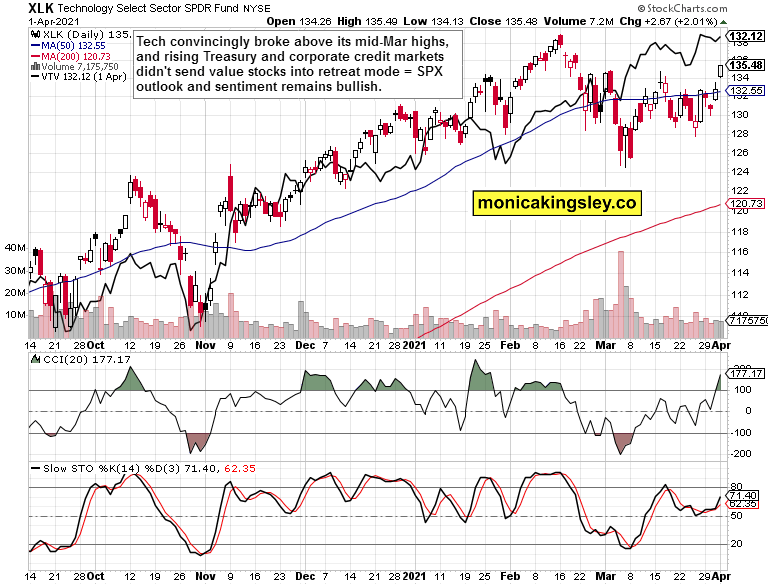

Tech and Value

Tech (XLK ETF) rose strongly, and value stocks (VTV ETF) stocks more than defended prior gains. Even financials (XLF ETF) moved higher, regardless of the rising Treasuries. The breadth of the stock market advance isn‘t weak at all, after all.

Gold in the Spotlight

Let‘s quote the assessment from my Easter update:

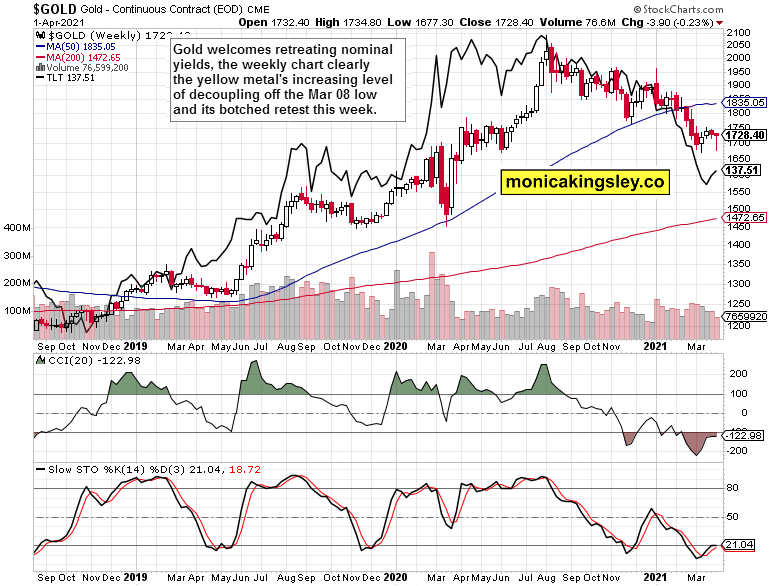

(…) There had been indeed something about the gold decoupling from rising Treasury yields that I had been raising for countless weeks. The rebound off Mar 08 low retest is plain out in the open, miners keep outperforming on the upside, and the precious metals sector faces prospects of gradual recovery, basing with a tendency to trade higher before the awaited Fed intervention on the long end of the curve comes – should the market force its hand mightily enough. Either way for now, given the rising inflation and inflation expectations, a retreat in nominal rates translates into a decline in real rates, which is what gold loves.

That‘s the dynamic of calm days – once the Fed finally even hints at capping yields, expect gold fireworks. Remember, the ECB, Australia and others are in that fight at the long end of the curve already. And with so much inflation in the pipeline as the PPI underscores, an inflationary spike is virtually baked in the cake.

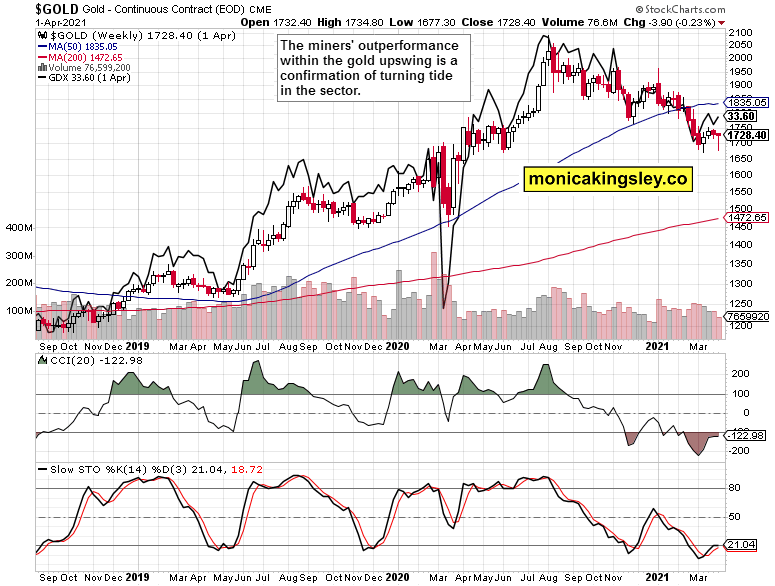

Another weekly gold chart, this time with miners overlaid. Since the Mar 08 bottom, their outperformance has become very apparent, and miners made a higher high as gold approached the bottom last week. Coupled with the waning power of the sellers, these are positive signs for the precious metals sector.

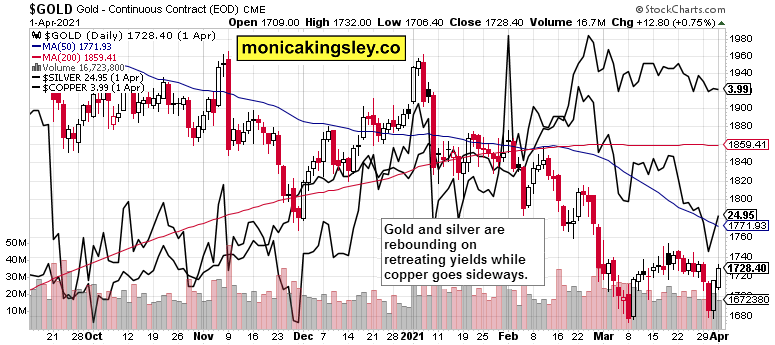

Gold‘s daily chart reveals the rebound‘s veracity – just as sharp as the dive to the second bottom was. Silver moved higher, scoring smaller gains than the yellow metal, which isn‘t however an issue as the white metal tends to outperform in the latter stages of precious metals upswings. We aren‘t there yet, and haven‘t seen it outperform in mid-Mar either.

Summary

S&P 500 has challenged and conquered the 4,000 mark, and the upswing‘s internals keep being aligned bullishly. No sharp correction in sight indeed.

Precious metals rebound lives on, accompanied by the miners‘ outperformance. Copper and many commodities keep consolidating, which is actually bullish given the retreat in yields. Another confirmation of the approaching upleg in commodities and precious metals as inflation starts running hotter and hotter.

Thank you for having read today‘s free analysis, which is available in full at my homesite. There, you can subscribe to the free Monica‘s Insider Club, which features real-time trade calls and intraday updates for both Stock Trading Signals and Gold Trading Signals.

Thank you,

Monica Kingsley

Stock Trading Signals

Gold Trading Signals

All essays, research and information represent analyses and opinions of Monica Kingsley that are based on available and latest data. Despite careful research and best efforts, it may prove wrong and be subject to change with or without notice. Monica Kingsley does not guarantee the accuracy or thoroughness of the data or information reported. Her content serves educational purposes and should not be relied upon as advice or construed as providing recommendations of any kind. Futures, stocks and options are financial instruments not suitable for every investor. Please be advised that you invest at your own risk. Monica Kingsley is not a Registered Securities Advisor. By reading her writings, you agree that she will not be held responsible or liable for any decisions you make. Investing, trading and speculating in financial markets may involve high risk of loss. Monica Kingsley may have a short or long position in any securities, including those mentioned in her writings, and may make additional purchases and/or sales of those securities without notice.