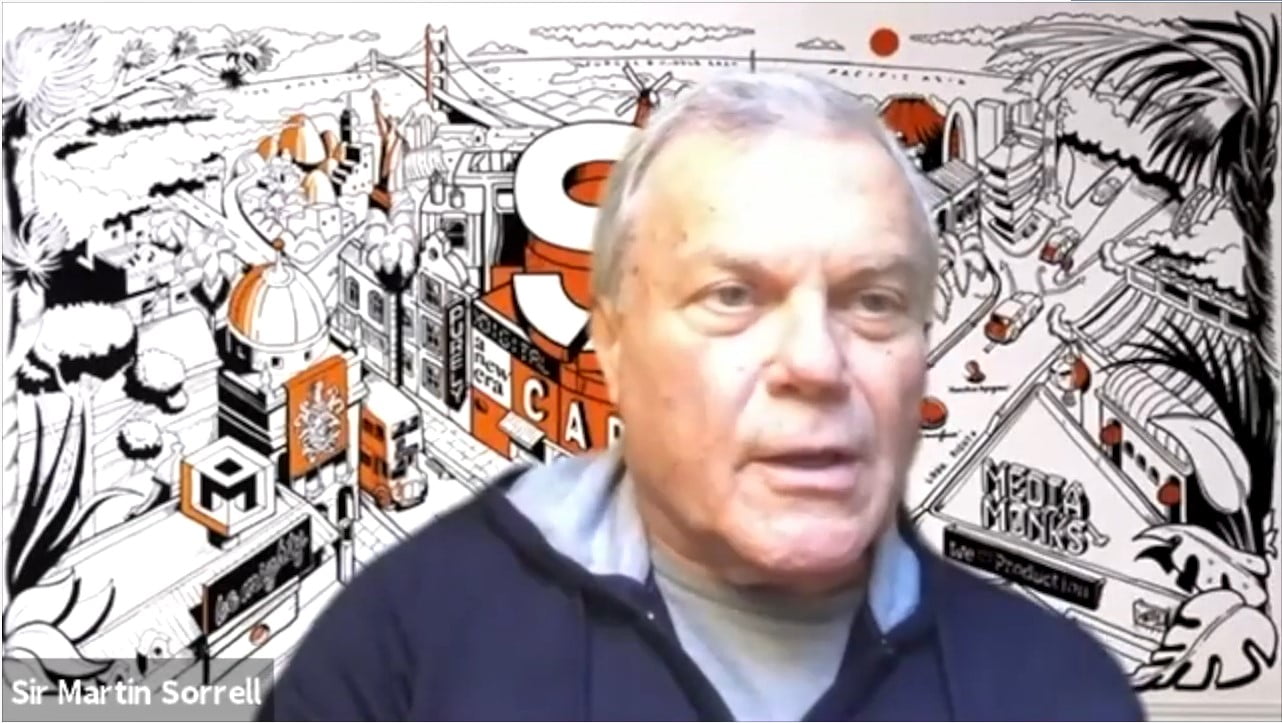

GreenWood Investors’ interview with Sir Martin Sorrell of S4 Capital, titled, “Merging Management & Ownership.”

Q3 2020 hedge fund letters, conferences and more

Interview with Sir Martin Sorrell of S4 Capital

In early December we had a lively chat with legendary Builder Sir Martin Sorrell of S4 Capital, which we’ve owned since March 2020. Almost as if he wanted to front-run our white paper on value creation coming out later this year, this M&A mastermind discussed the fundamental importance of merging management with the ownership of the company. For someone so good at capital allocation, he spends a surprisingly and significantly larger amount of time thinking about culture over capital.

We’ve put together the best parts of the conversation as it relates to merging the management style with the ownership of the company in the 19 minute video below. In it, he tells the candid story of his discussions with Buffett, and why his approach would have been a natural fit for Berkshire.

After watching the video, if you want to dig in more on Sir Martin’s style and the investment case for S4 Capital, we’ve made our November 2020 research on S4 Capital available on our public research page, which you can view here. While shares have certainly run since we purchased shares, Sir Martin and the S4 team have been compounding fair value very quickly and we remain buy-biased on shares.

Click here to check out the full research on S4.