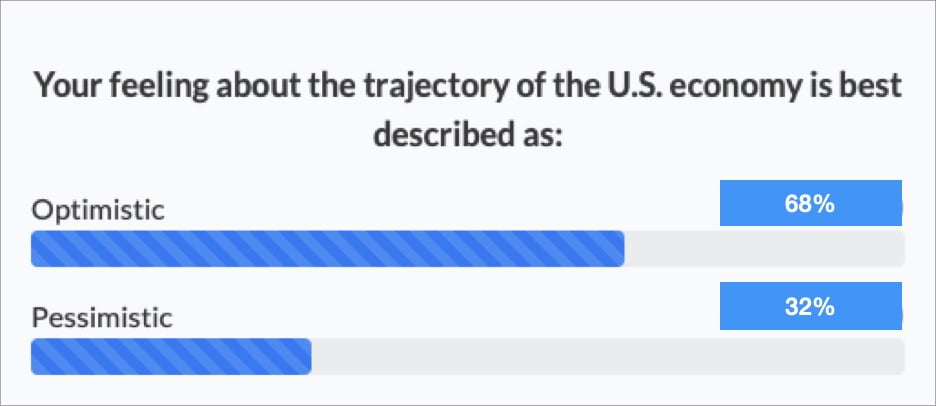

A survey of retail investors who receive weekly market commentary from strategist Louie Navellier found that 67% are optimistic about the trajectory of the U.S. economy, while 33% were pessimistic.

Q2 2021 hedge fund letters, conferences and more

Retail Investors Are Evaluating Fundamental Economic Data

“I find these results encouraging for what they suggest about the market, but also the sophistication of individual investors,” said Louis Navellier. “The proverbial ‘Wall of Worry’ has been particularly steep since the onset of the Delta variant, but these results indicate that retail investors are looking past the headlines and evaluating fundamental economic data as well.”

Mr. Navellier said that economic indicators that augur for optimism about the trajectory of the economy include:

- A cooling of inflationary pressure in the latest Consumer Price Index figures.

- Healthy consumer spending. Commerce Department announced on Thursday that retail sales rose 0.7%

- A continued dovish stance from the Federal reserve bank.

“The Evergrande Property Services Group Ltd (HKG:6666) debt crisis along with modest declines in inflation has given the Fed the cover it needs to continue its quantitative easing.” He added that the most recent economic developments seem to indicate that the Fed’s call on the transitory nature of inflation was the right one.

Though investors are generally optimistic about the economy, they are mixed about its impact on the market. One respondent to the survey said: “The markets will not enjoy the same level of performance as the economy. Excessive valuations [and] exploding debt will eventually derail the markets.”

Said another, "We've got lots of ups and downs but overall there seems to be nothing to indicate financial [performance is] about to collapse.”

Mr. Navellier said he remains optimistic about the trajectory and its impact on the markets. “There’s a lot of capital on the sidelines, and more cash being raised each day in the form of debt to buy stocks. Supply and demand will define the performance of the market over the near-term horizon. As for the markets, never bet against America.”

[Navellier & Associates does not own China Evergrande Group (EGRNF). Louis Navellier does not own China Evergrande Group (EGRNF), personally.]