In his Daily Market Notes report to investors, while commentaing on the real estate sector, Louis Navellier wrote:

Q1 2021 hedge fund letters, conferences and more

Tax Glitch

The only "glitch" that might economic optimism is the fact that the Biden Administration proposed raising both corporate and capital gain taxes. However, Senator Joe Manchin of West Virginia rejected the Biden Administration’s proposal to raise corporate taxes from 21% to 28% (25% is still possible) and I suspect will also reject the Biden Administration’s proposal to raise maximum long-term capital gain taxes from 23.8% (20% plus the 3.8% Obamacare tax) to 43.4%.

As we enter the “bumpy” summer months, investor anxieties naturally rise. June and July are seasonally strong months, but August and the first two weeks of September can be tough. An investor’s best defense remains a strong offense of fundamentally superior stocks.

Real Estate Sector Humming

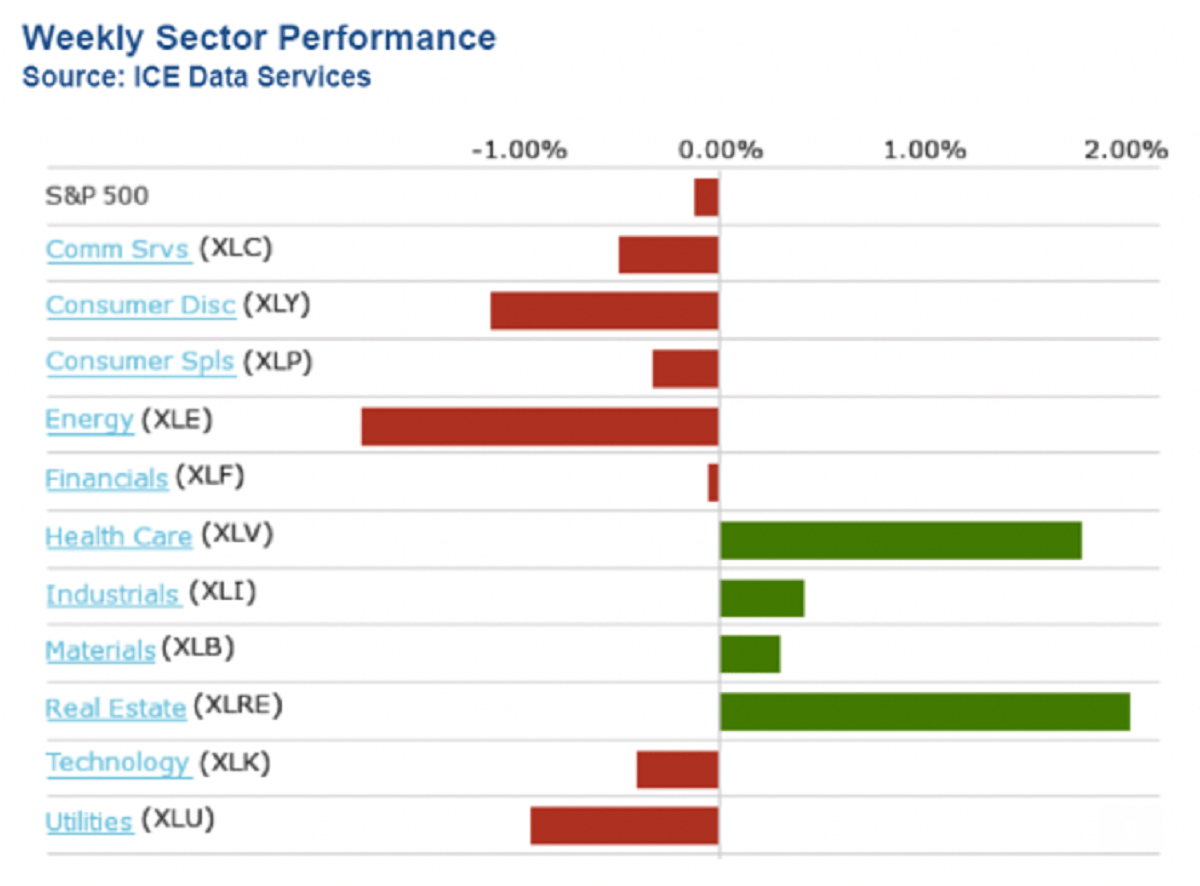

REITs are trading well in the current market landscape. REITs outperformed all sectors last week, giving rise to the notion that adjusted inflation will tick higher, interest rates will remain fairly tame, more emphasis will be on returning to corporate office digs, mall foot traffic will rebound quickly, and strong job growth will result in solid upscale residential apartment occupancy.

Shares of the Real Estate Select Sector SPDR (XLRE) just hit a new all-time high last week!

Real estate sector had the longest green line last week (above)! But just in case the inflation genie rises out of the bottle and rears its ugly head, investors should take a hard look at the recent price action in the gold mining stocks. As Bitcoin (digital gold) has suffered a recent setback in its torrid climb, one of the most compelling charts to pop up on my screens is that of the VanEck Vectors Gold Miners ETF (GDX).

Considering GDX

Investors seeking a non-Bitcoin inflation and currency hedge might consider GDX in light of record federal deficit spending and record QE levels, resulting in devalued currencies. Then, consider the mining shares’ leveraged correlation to physical gold, and the fact that it is not a crowded trade by any means.

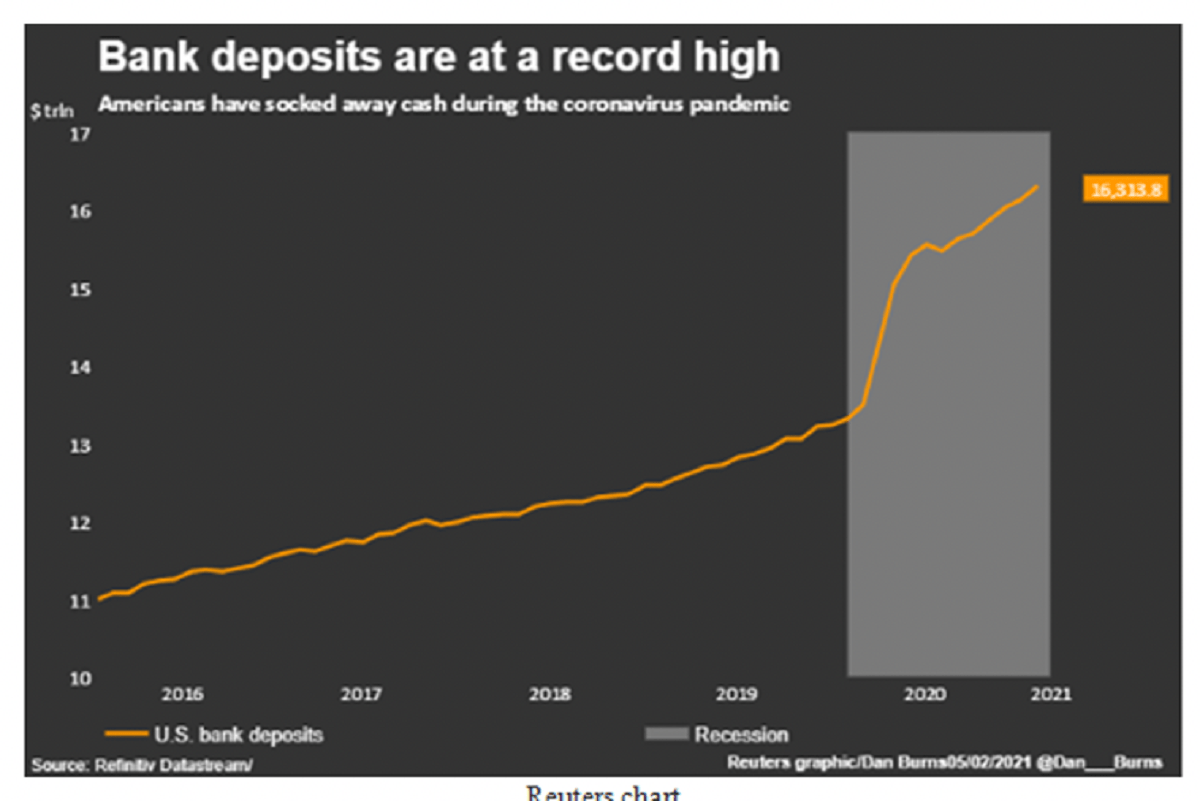

The government has been over-spending on stimulus money. Most of that money (about 75%) is being saved or used to pay down debt, according to a study by The Federal Reserve Bank of New York.

This means that there is still plenty of spending power to fuel a stock market surge along with the record $7.4 trillion (annual rate) we spent during March. That’s up 28% (year-over-year) vs. the $5.8 trillion rate last March – a month split down the middle, pre- and post-lockdown.

Americans have $16.3 trillion socked away in the bank. With so much money on tap, we don’t need to worry too much about a stock market crash, as any normal correction will be met by buying support. After all, where else will our investment dollars go? Bonds aren’t exactly a screaming bargain nor an invitation to riches. Stocks are the main component of most portfolios and likely always will be.

Fed Balance Sheet

The Federal Reserve’s balance sheet has reached $7.82 trillion at last count. Expanding at roughly $120 billion a month, it will be over $8 trillion by the end of this quarter, if the Fed’s bond purchases remain on target.

It is worth pointing out that what goes on in Europe and Japan is more extreme compared to what goes on in the United States. To be more precise, the European Central Bank (ECB) is more extreme than the Fed, relative to the size of the eurozone GDP, while the Bank of Japan (BOJ) is more extreme than either one, relative to the size of Japan’s GDP. Still, ECB operations have pushed the German DAX Index to an all-time high, similar to the Fed vs. the S&P 500 Index, while more extreme BOJ activity has not managed to move the Nikkei 225 to an all-time high.

Some type of shakeout is coming for the broad market indexes, but it will remain limited to around a 10% decline, if that. That’s about the size of the maximum correction we have so far (since the stock market bottomed on March 23, 2020) at this rate of balance sheet expansion. The tech sector may be in for larger (than 10%) volatility when the 10-year yield makes a run for 2%, which may be only a matter of weeks, given the likely further pickup in inflation readings in the next couple of months.