In 2020, the stock market experienced a lot of volatility due to the COVID-19 pandemic. So far, 2021 has been an interesting year as well, with the market working to recover from the damage done by the pandemic and hitting a new all-time high in February. We also saw an unprecedented situation where small-time investors banded together to put short-sellers in hot water. Regardless of how the market might fluctuate, though, it’s a fact that total hedge fund holdings are massive, around $3 trillion. To put that in perspective, only four countries, including the U.S., have a GDP higher than that. Furthermore, hedge fund managers often earn hundreds of thousands of dollars per year, but there are many who are billionaires.

Q4 2020 hedge fund letters, conferences and more

It makes sense that people pay attention to what hedge fund managers are buying, selling and holding, especially during these times of economic uncertainty. Hedge funds’ quarterly public disclosures, mandated by the Securities and Exchange Commission, give us a window into their recent activity.

To help investors make informed decisions about where to put their money, WalletHub analyzed the filings of over 400 top hedge funds, identifying their biggest holdings, new positions, recent exits and more. You can check it all out below, including a breakdown of the names that billionaire stock pickers – from Warren Buffett to George Soros – prefer these days.

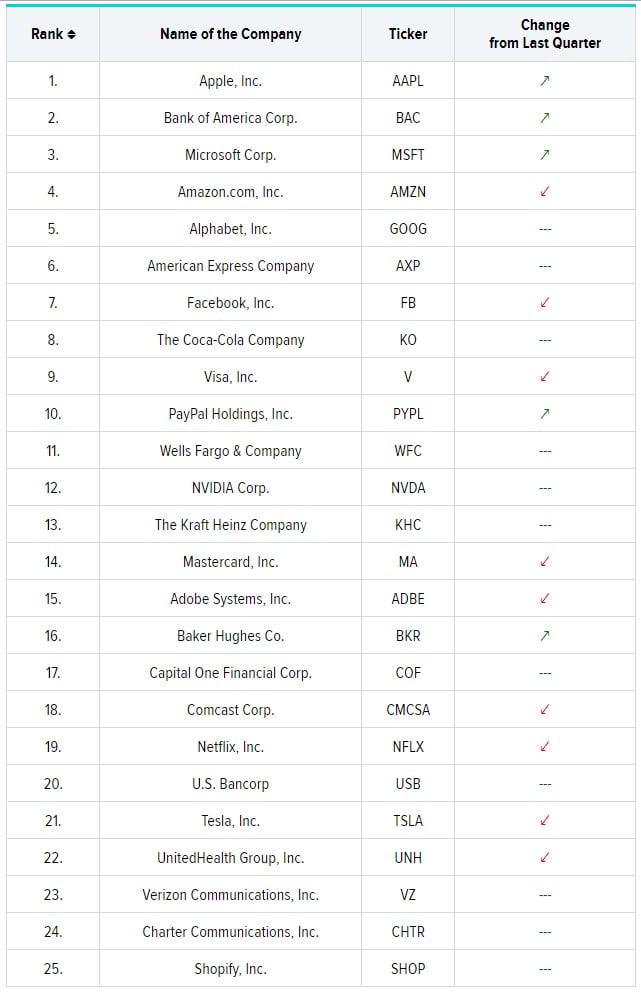

25 Most Popular Hedge Fund Stock Positions

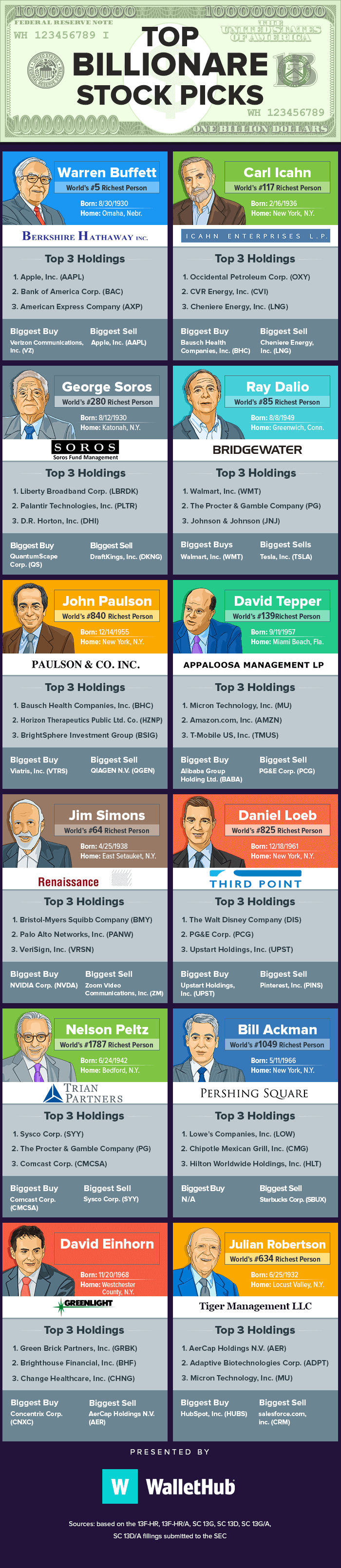

Top Billionaire Stock Picks

Hedge funds have become so popular that the billionaires behind them have celebrity status. Not only are they rich and famous, but they can move markets with just a few words. Investors worldwide follow their every move.

If you, too, are curious to see how billionaire investors such as Warren Buffett, Carl Icahn and Bill Ackman are making their money these days, just check out the following infographic. You’ll find the top three holdings of 12 big-name billionaires, plus an overview of the stocks they’ve been buying and selling lately.

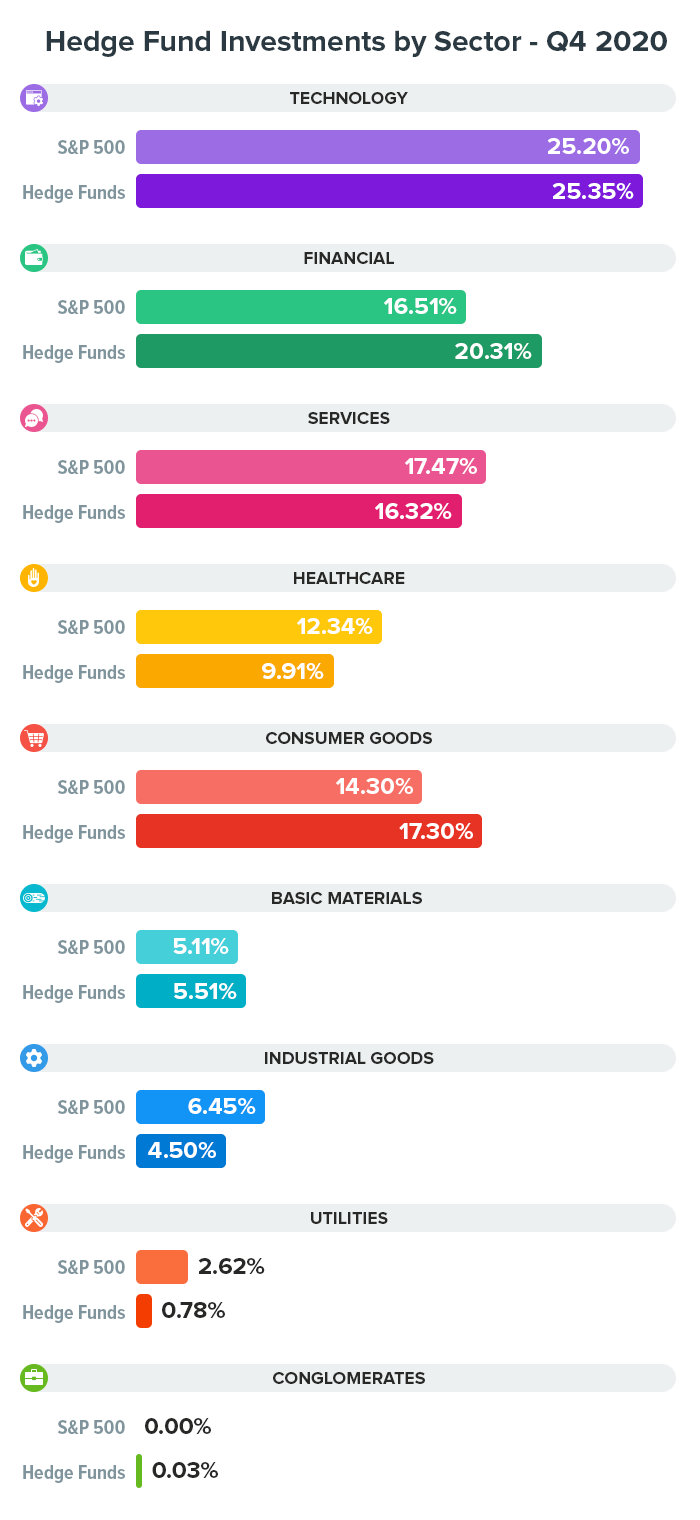

Hedge Fund Holdings by Sector

Diversification is key to investing success. That’s because spreading your chips around reduces risk and allows you to benefit from the broader market’s long-term upward trend. That’s why even the world’s best investors hedge their bets by allocating capital to various segments of the economy.

The investments don’t simply match the economy’s makeup, however. And they’re not always the same year to year, either. That’s why we can learn a lot from the way in which hedge funds diversify their investments. With that in mind, here’s a breakdown of where the money was during Q4 2020.

Methodology

This report is based on information from the latest public disclosures (Form 13F-HR for Q4 2020 and SC amendments from January 1 to February 14) for over 400 of the largest U.S. hedge funds. Data refer only to equities (i.e. not American Depository Receipts, Global Depository Receipts, Notes, Bonds or any other type of tradable securities).

To construct the “Most Popular Stocks” list, we looked at each of the over 400 hedge funds’ positions, added up the positions for the same stock and rank-ordered the stocks by their total holdings value.

To calculate the “Sector Breakdown” of the positions held by the tracked hedge funds, we added up all the positions of the hedge funds from the same sector and then divided by the total amount of the hedge funds’ positions.

Report Disclaimer: The information on this web page is provided as general and impersonalized investment information and is not a recommendation or solicitation to buy or sell any security. Please obtain additional appropriate professional advice as needed in making any investment decisions. Past performance does not guarantee future results.

Article by WalletHub