“This morning’s BLS Employment Situation report featured a sizzling household survey side combined with a mixed establishment survey side, resulting in what we think is an overall B/B+,” says, Theodore Littleton, Senior Economist, IFR Markets.

Theodore Littleton, Senior Economist, IFR Markets continues:

Nonfarm payrolls (mkt +200k) were up a better than expected 223k and the unemployment rate (mkt 3.7%) dropped to 3.5%.

Q4 2022 hedge fund letters, conferences and more

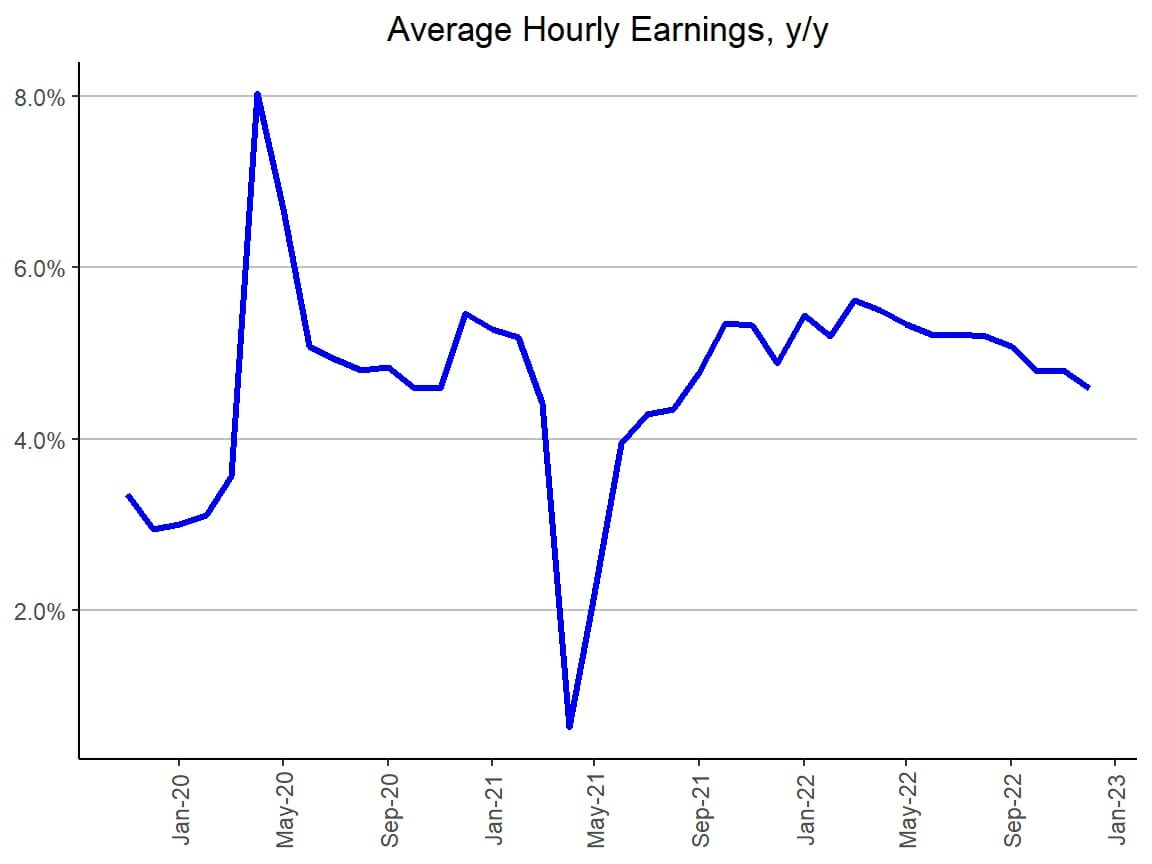

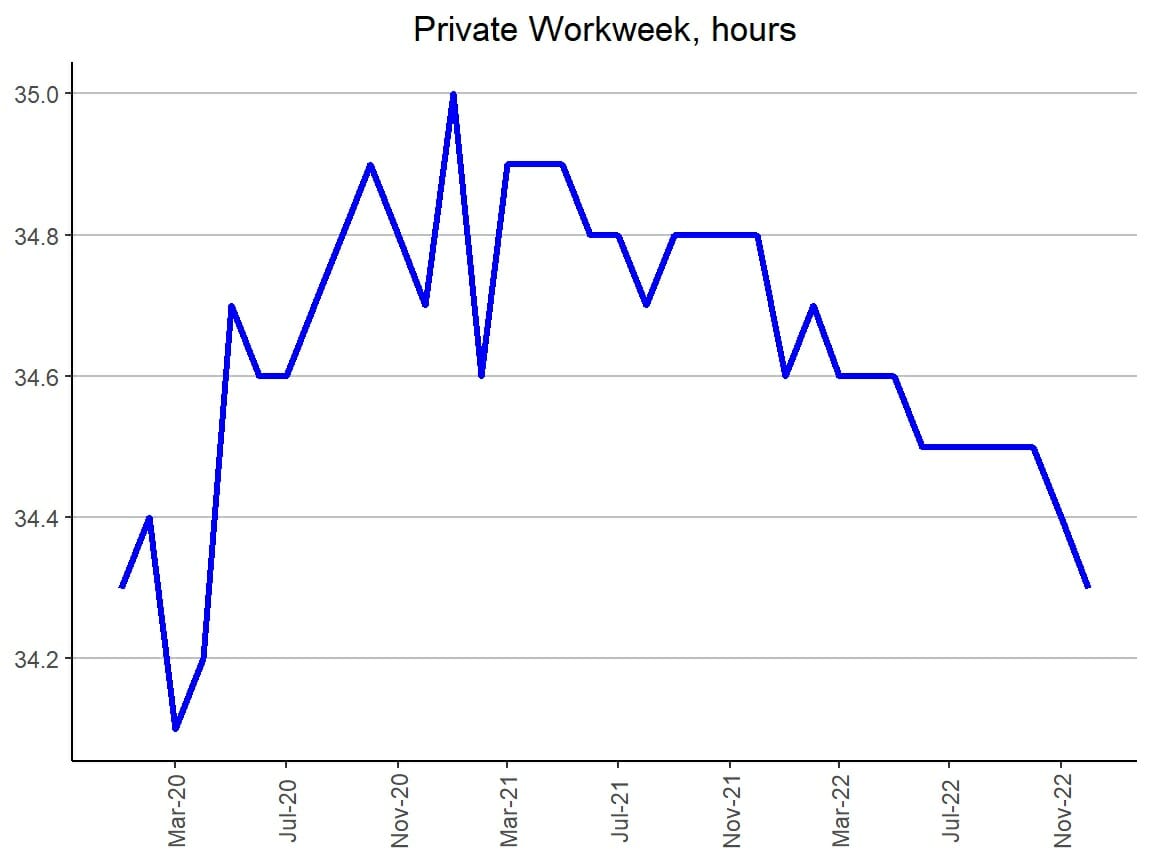

On the other hand, average hourly earnings (mkt +0.4% m/m) were up only 0.3%, with the shocking-at-the-time 0.6% November increase revised down to +0.4%. Also suggesting a little more softness than the job gains numbers, the average workweek (mkt 34.4 hours) ticked down a tenth-hour to 34.3.

The Fed is not going to be able to take a clear lesson from this report, with the job market (something they've repeatedly noted that they'd like to see cool) simultaneously showing signs of stubborn heat but also easing price pressures.

The m/m wage gain was its smallest since February and the y/y earnings growth rate (mkt +5.0%) slipped to +4.6% from a revised +4.8% (was +5.1%), now its lowest since August 2021.

The household employment measure jumped 717k, lowering the unemployment rate even though labor force participation was up a quite healthy 439k. Taken out to more decimal places (3.4686%), the unemployment rate is in fact its lowest since May 1969.

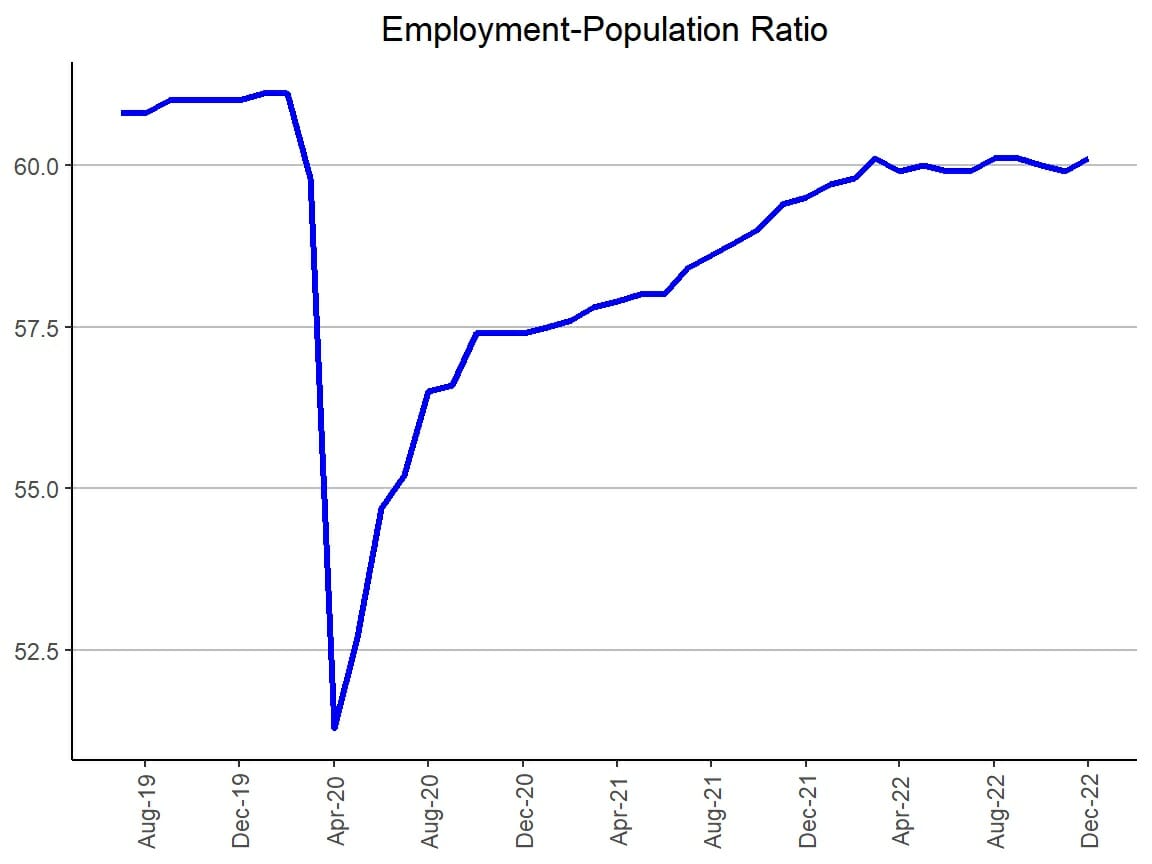

The combination brought the employment-population ratio up 0.2 pp to 60.1%, its highest since February 2020, though it's still down significantly from that month's 61.1%. The labor force participation rate increased from 62.2% to 62.3%, highest since March, and down about the same degree from the pre-pandemic 63.3%

There were a few notable changes from last month in payrolls growth, with positive turns in retail trade (to +9.0k from -16.8k) and transportation/warehousing (to +4.7k from -21.7k), but significant weakening in information (to -5k from +22k) and government (to +3k from +54k).

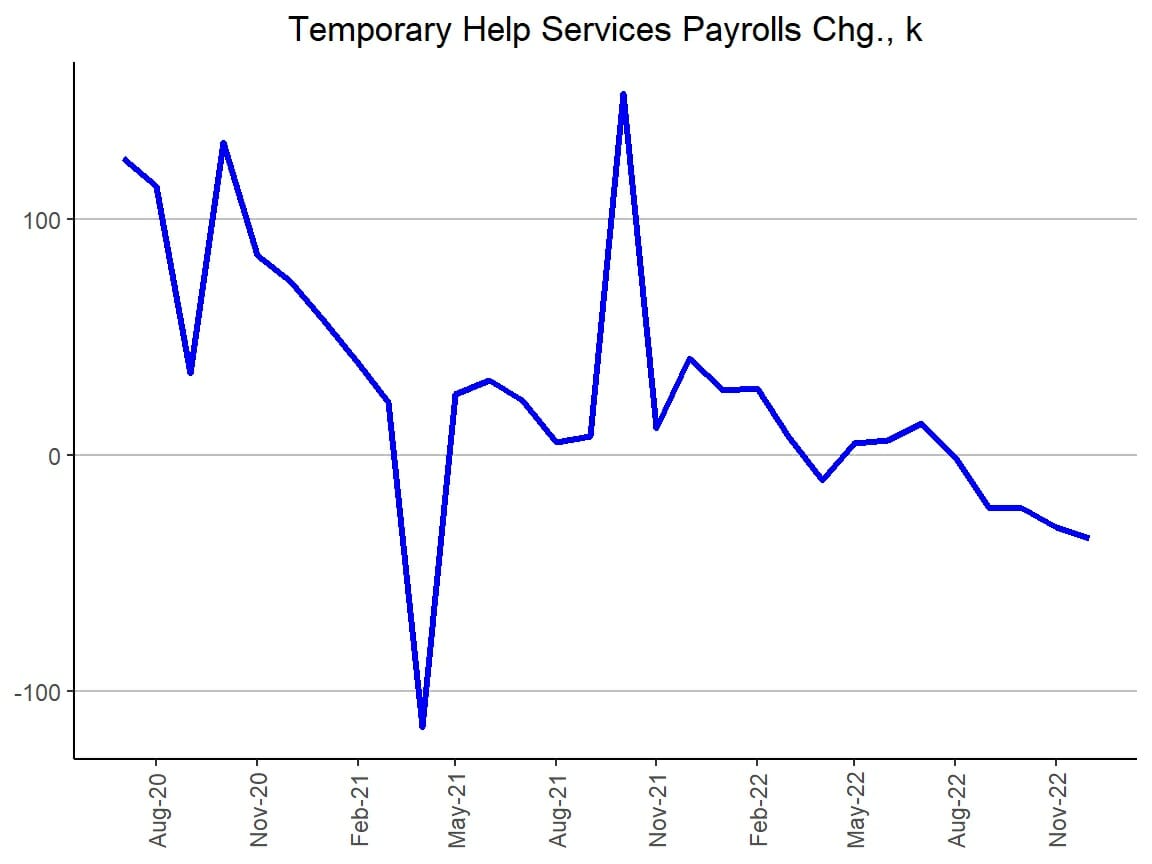

Construction grew 28k, highest since May, while manufacturing remained at a weak +8k. However, possibly the most notable aspect is one that showed little change from last month: temp services payrolls fell 35.0k, down only modestly from November's 30.3k.

That was the fifth negative in a row, and the largest drop since April 2021. Changes in temp services are considered harbingers of broader job market movements.

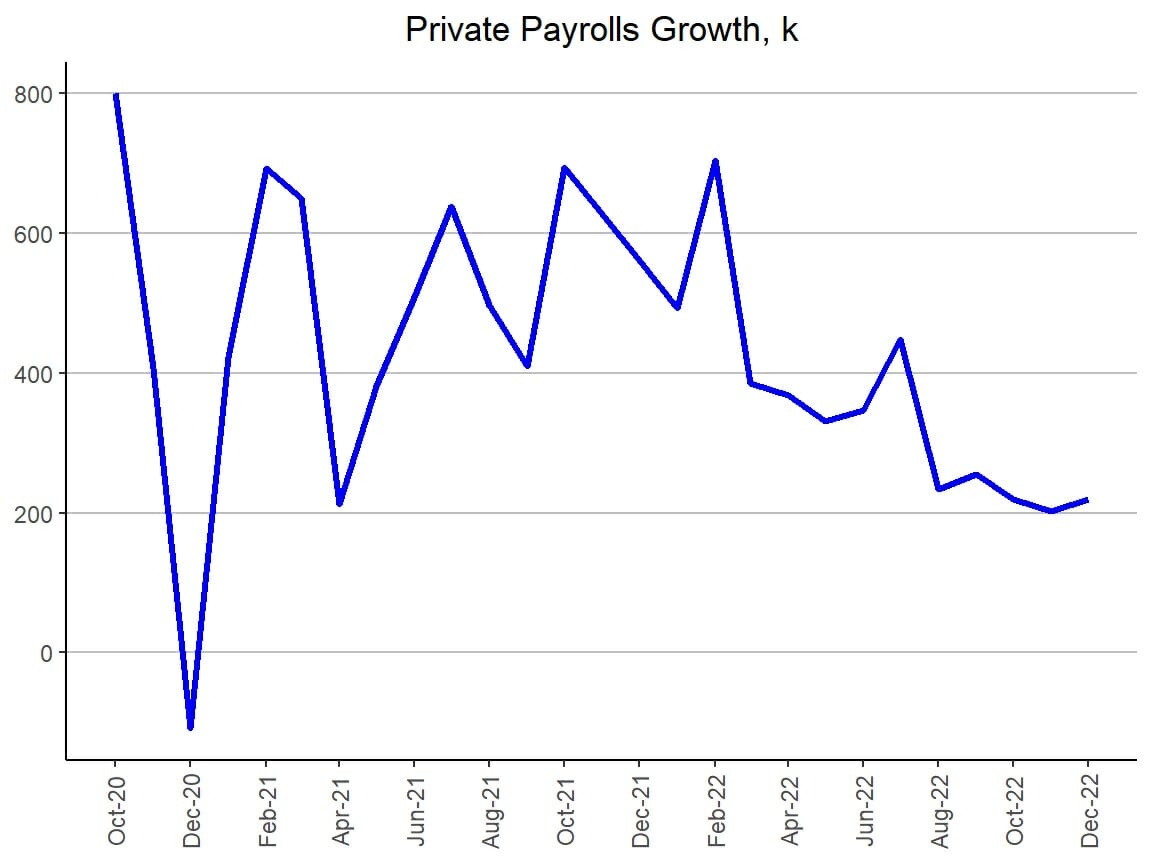

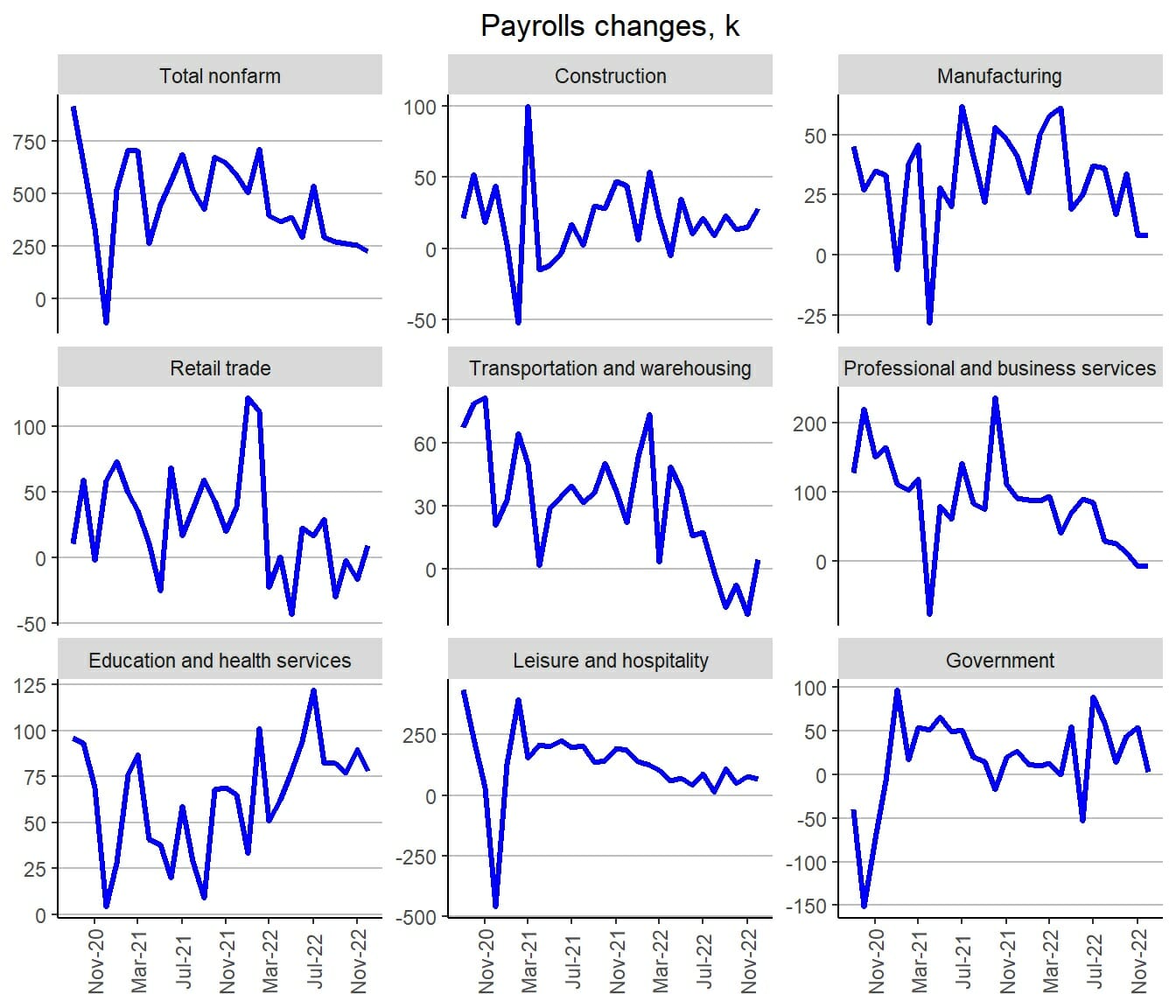

Nonfarm Payrolls Growth

Nonfarm payrolls growth beat the consensus expectation yet again (the ninth time in a row), up 223k versus the median expectation of +200k. After revisions, growth seems to be on a slow and steady cooling path, from +292k in August. Private payrolls were up 220k, however, which not only beat the consensus of +180k but was also a bit better than November’s revised +202k.

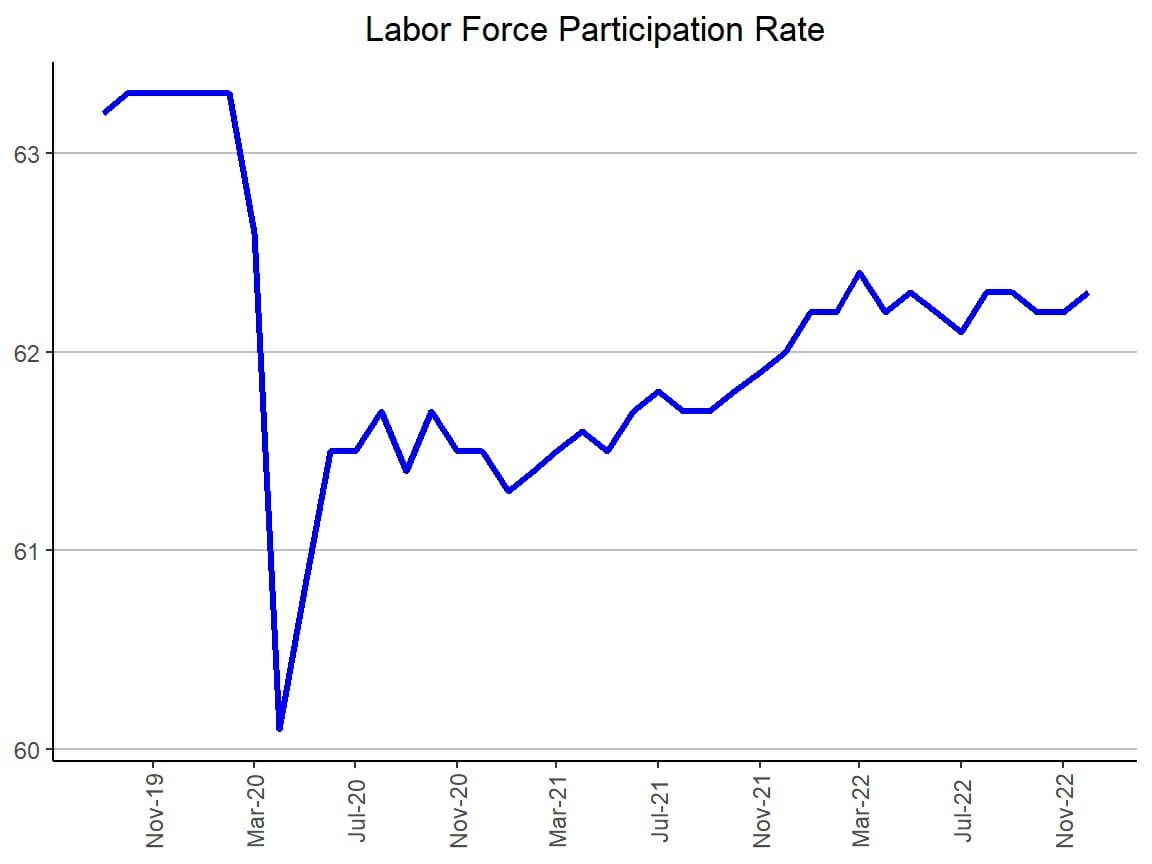

Household Survey Ratios

The unemployment rate was expected to hold steady at 3.7%, but instead came in at 3.5%, down from a revised 3.6%. This time, the decline was based on unqualified good news, as the household survey’s employment measure jumped 717k and labor force participation was up a quite healthy 439k. Taken out to more decimal places (3.4686%), the unemployment rate is its lowest since May 1969.

The employment-population ratio bounced back from 59.89% to 60.13%, its highest since February 2020.

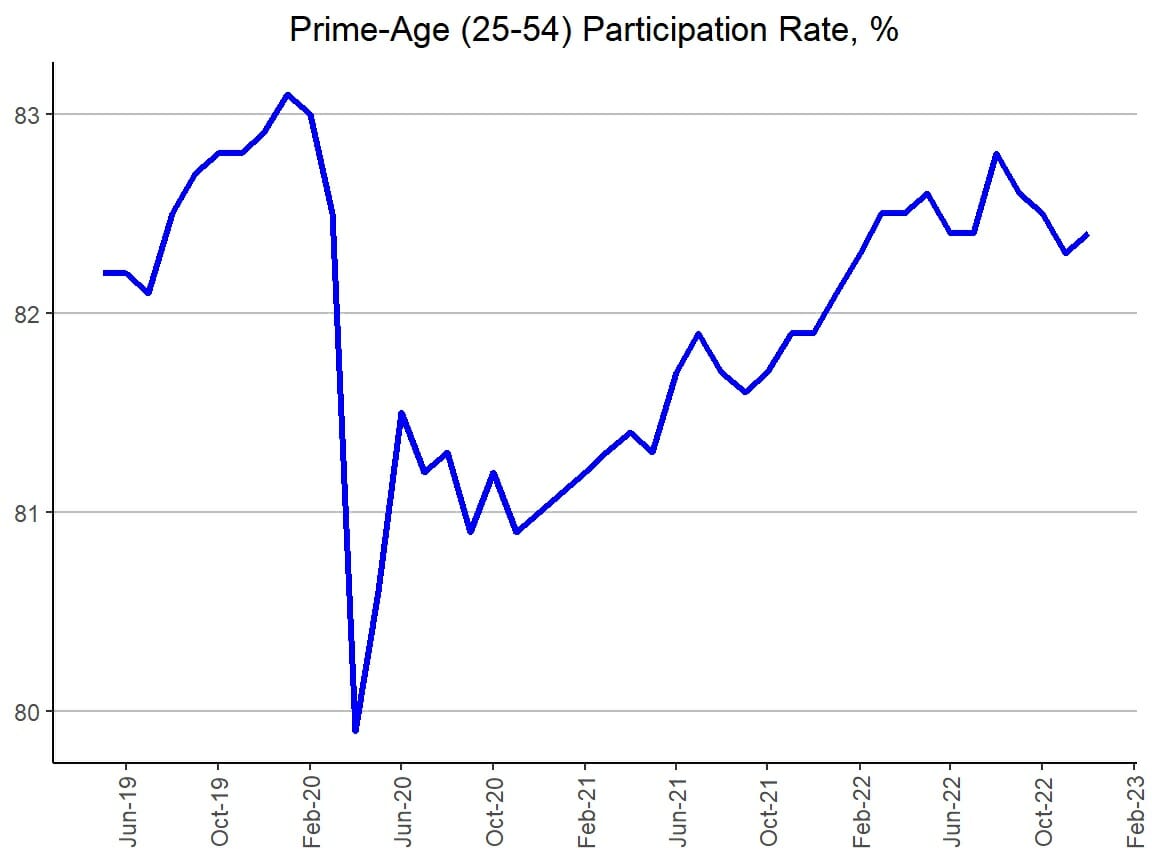

The prime-age (25-54 years) labor force participation rate edged back up a tenth-point to 82.4%.

Sector Change Breakdown

Notable changes from November included positive turns in retail trade (to +9.0k from -16.8k) and transportation/warehousing (to +4.7k from -21.7k), but significant weakening in information (to -5k from +22k) and government (to +3k from +54k).

Construction grew a surprising 28k, highest since May, while manufacturing remained at a weak +8k. Professional and business services (including the aforementioned temp services) remained extremely weak by pandemic-era standards, shedding 6k after last month’s 8k drop.

Education and health remained solid, though at +78k down a bit from November’s +90k. Similarly, leisure and hospitality slipped from +79k to a still decent +67k.

Providing a suggestion of future softness, temp services payrolls fell 35.0k, a little more than last month’s 30.3k drop and the fifth negative in a row.

Average Hourly Earnings

Average hourly earnings rose 0.3%, a touch below the consensus of +0.3%, but with negative revisions that included bringing the 0.6% increase that shocked analysts in November down to +0.4%. The y/y rate (mkt +5.0%) therefore slipped to +4.6%, lowest since August 2021, from a revised +4.8% (was +5.1%). The Fed is no doubt watching progress here very closely.

Average Workweek

In another sign of softness from the establishment survey, the average workweek edged down a tenth-hour for the second month in a row, to 34.3. That’s again the lowest since the initial months of the pandemic.

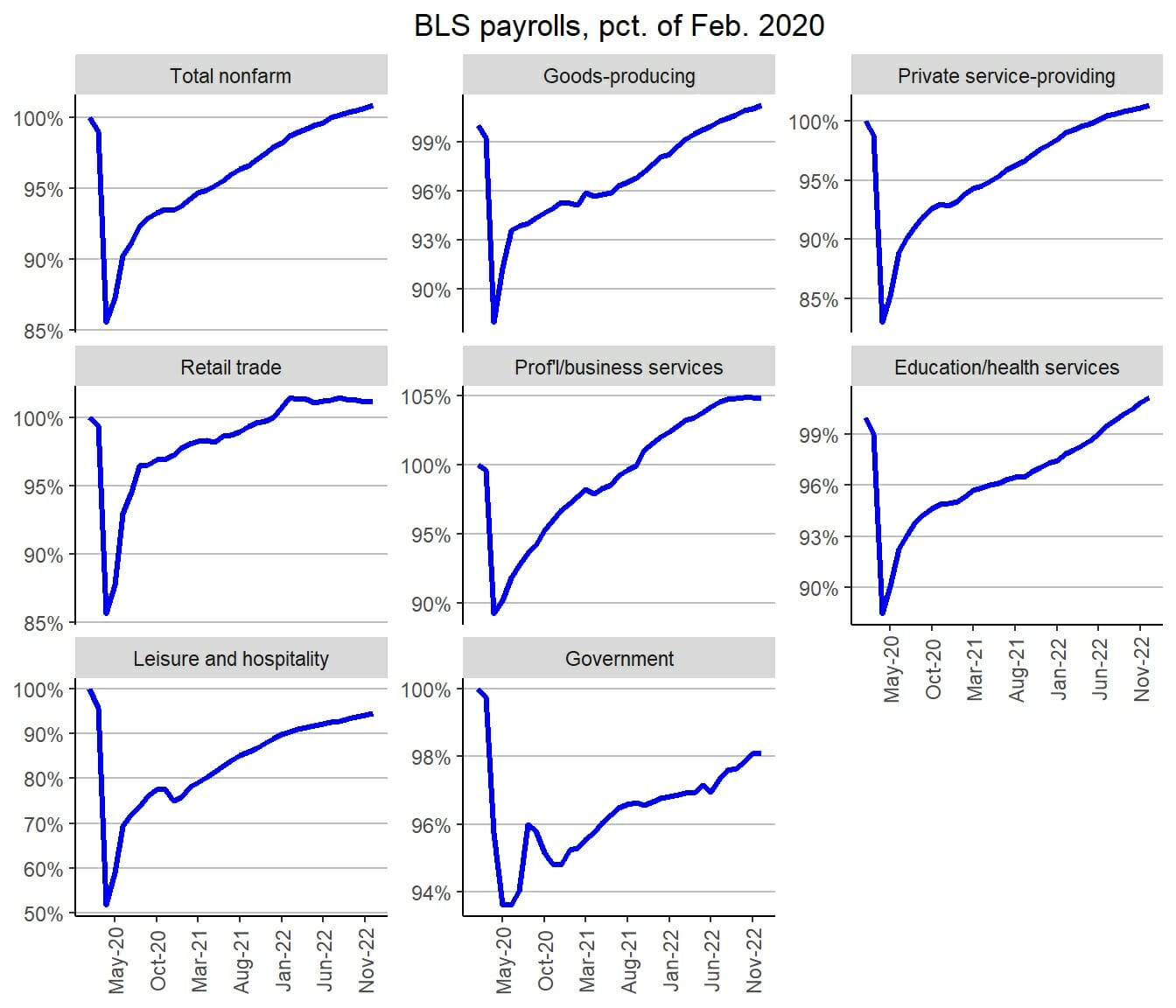

Recovery Breakdown

Sources: Data/Charts - IFR Markets | Commentary - Theodore Littleton, Senior Economist, IFR Markets