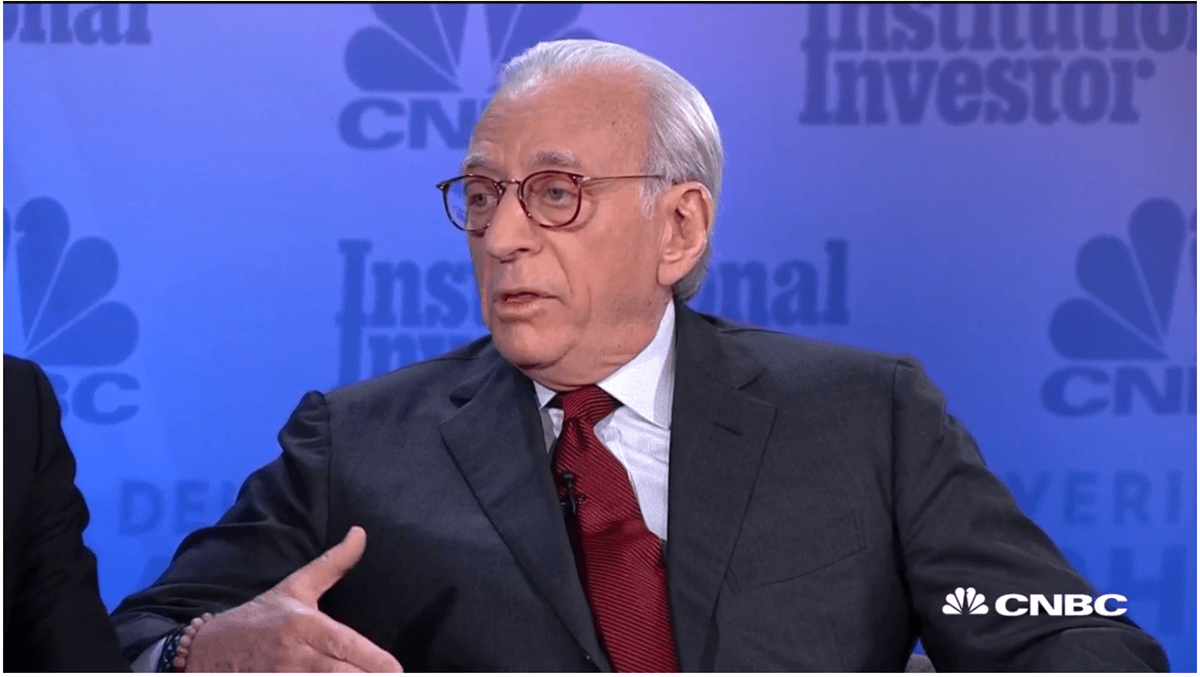

Following are excerpts from a CNBC interview with Trian Partners Founder & CEO Nelson Peltz on CNBC’s “Squawk on the Street” (M-F 9AM – 11AM ET) today, Thursday, January 12, 2023.

Nelson Peltz On Disney Fight: They Want My Input On Operations; They Don’t Want Me To Have A Vote

Nelson Peltz On Disney Fight: We’ve Already Made An Impact, But There Is So Much More We Can Do

Nelson Peltz: Disney Is More Than A Media Company, It’s A Consumer Company

Peltz On His Board Expertise

NELSON PELTZ: If you look at my record, I’ve never gotten rid of anybody. Think about that. I want to say that slowly. Even those who had proxy fights that I won, nobody left. They’re still references for me. David Taylor is a reference for me. Okay. Bill Johnson is a reference for me. Okay. That’s, that’s what everyone who came in as the CEO and chairman of DuPont is a reference for me.

Q4 2022 hedge fund letters, conferences and more

So these are people who I fought with publicly, and then at least two of those examples got on the board. So the fact is, I’m not disruptive. I think I’m constructive. If I wasn’t, they wouldn’t give me references. I can’t put words in their mouth but look at the results.

Look at what happened at P&G, I got on the board. The stock was in the 70s. I got off at the end of ’21, the stock was $160. That wasn’t magic.

PELTZ: You know, I'm friends with a lot of Walt Disney Co (NYSE:DIS) shareholders, a lot of them. A lot of the Disney shareholders have voted for me in the past, a lot of the index funds. There aren't a lot of mutual funds left in the company because they don't, they don't see the future.

Maybe they're coming in now. So I know I know many of the shareholders of Disney and if any, if there's a shareholder of Disney that's happy with what's going on, that guy’s been short the stock so.

Peltz On What He’d Like To See Regarding Disney

PELTZ: Sitting where I'm sitting, not inside the boardroom, not having access to the numbers the way I'd like to, I think they have to, they have to buy Hulu or they have to get out of the streaming business. They must buy Hulu. Unfortunately, that means this company is going to have a debt load going forward for several years.

So that cash has got to come from somewhere. My goal is to reduce corporate overhead to a point that the company gets better. Look what happened with P&G. We got there. There were 11,000 people in corporate. We left there with 4,000. Nobody got fired. They were put inside the businesses, so they were part of somebody's P&L.

I'd like to see this company stop running like a matrix and start running like the companies we've been involved in where they have real CEOs of businesses with real P&Ls, real cash flows, and really, and real projections.

Peltz On Disney Parks

PELTZ: But don't forget what you talked about Covid, you can talk about all that stuff but the fact is that they are getting record profits out of the park, in spite of where the stock is, in spite of where the P&L is. The parks are generating record profits.

DAVID FABER: Well, you say they are over earning, what does that even mean Nelson?

PELTZ: So, we can blame all this stuff on COVID.

FABER: To say that, to say the parks are over earning some somehow implies what? That they're pushing price too hard? That they're going to suffer as a result of that? Because that's what you say in your presentation.

PELTZ: Yeah, I think they probably pressed price, pushed price a bit too hard. Bob has readjusted that a bit. I think the parks, and I'm not an expert here, probably need a little bit more CapEx, but the parks are generating huge profit, huge cash flow, and they want to blame this stuff on Covid? The parks rebounded out of Covid like crazy.