Marram Investment Management commentary for the first quarter ended March 31, 2021.

[soros]Q1 2021 hedge fund letters, conferences and more

Dear Investors,

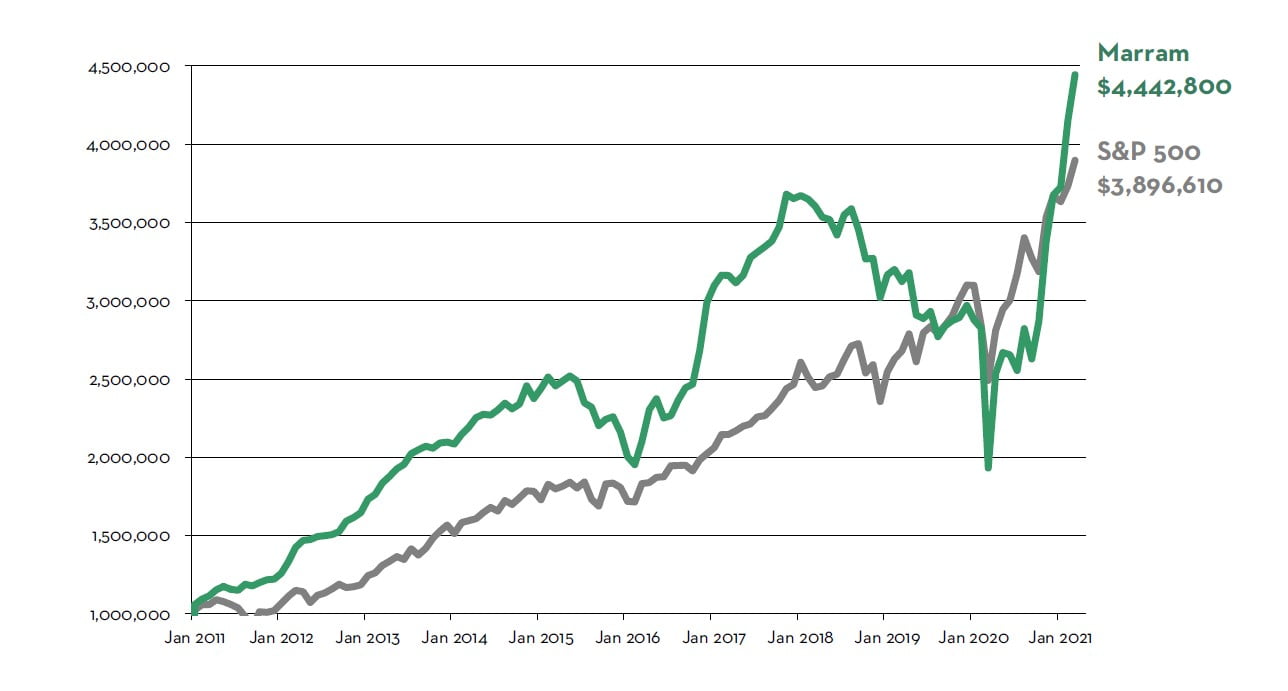

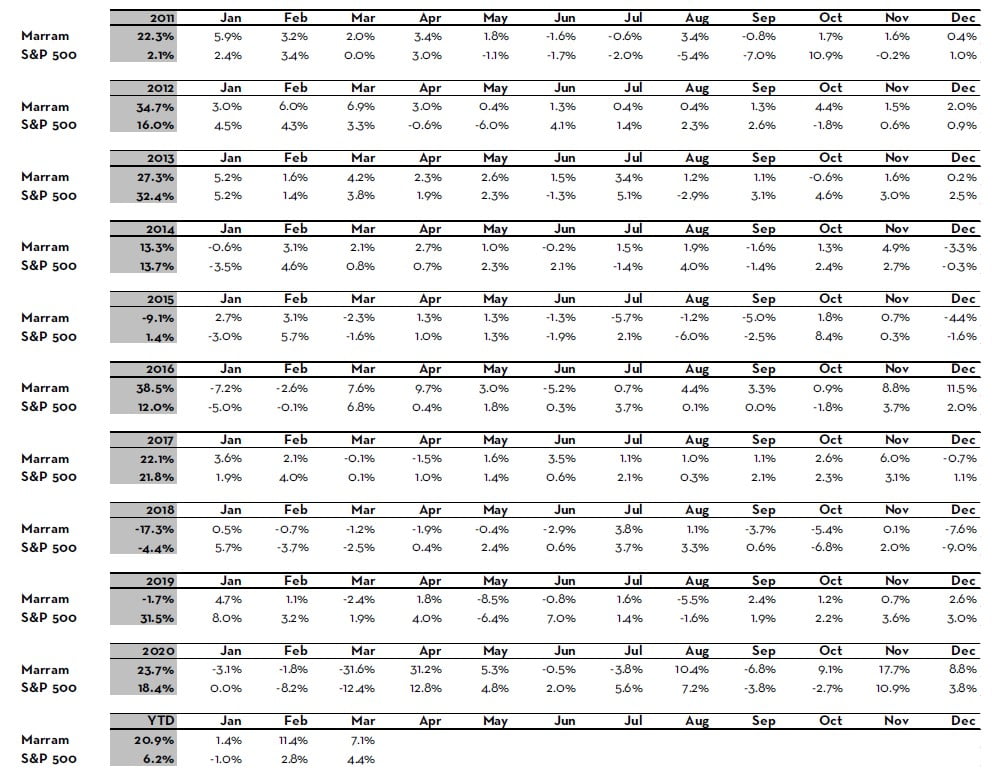

The Portfolio* returned +20.9% (net) year-to-date through 3/31/21. During this same period, the S&P 500 returned +6.2%.

Since inception, Marram Investment Management has generated +344.3% cumulative return and +15.7% annualized return, net of fees, versus +289.7% and +14.2% for the S&P 500, respectively.

For monthly details, see Historical Performance Returns* at the end of this letter. Also, please refer to your separate account statement for exact account return figures.

$1,000,000 Investment in Marram Investment Management vs. S&P 500 (Net Return, Inception to 3/31/2021)*

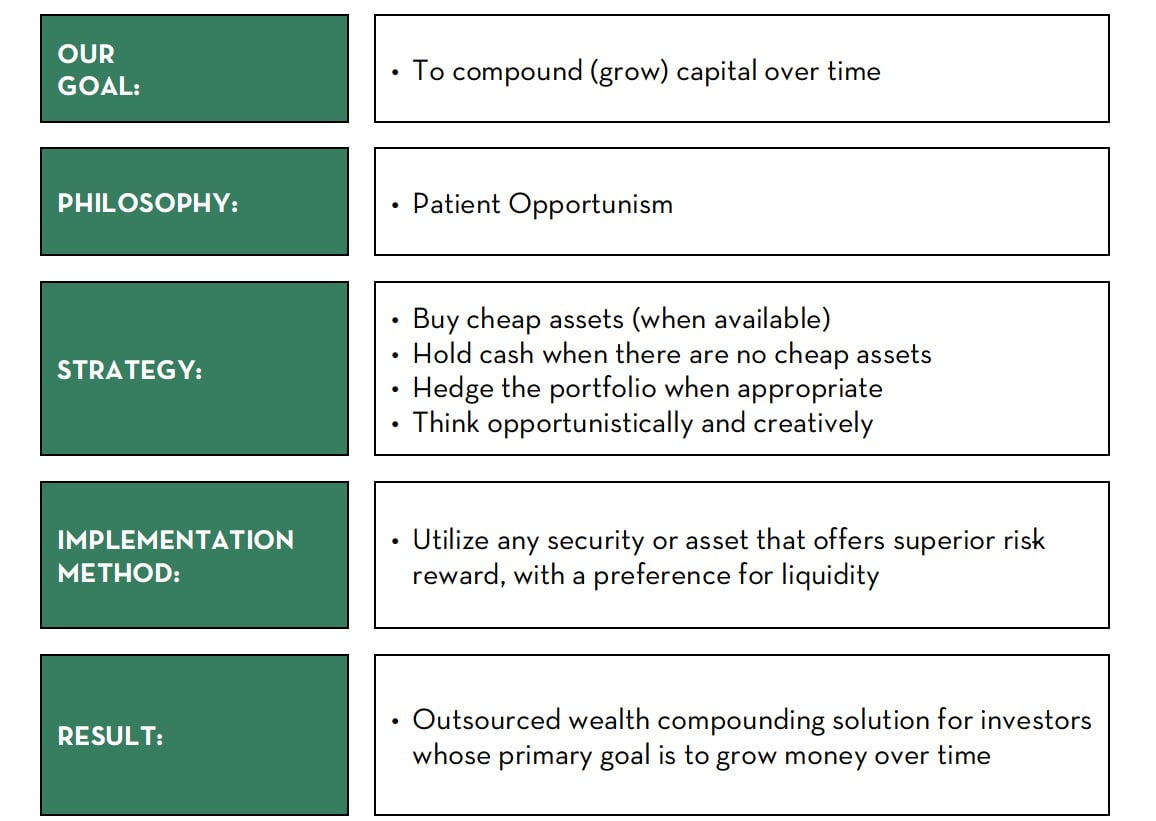

About Marram

Marram Investment Management is an outsourced long-term investment solution focused on growing wealth for retirement or legacy purposes. We began as a service for a small circle of friends and family. Our investor friendly fee structure (lower than most hedge funds), terms (separate accounts, no lock-up), and high standards of care and excellence, reflect those origins. Our portfolio manager has the majority of her family’s liquid net worth invested in the same strategy – we eat our own cooking – ensuring that we shepherd your investment with the utmost care, as we would our own.

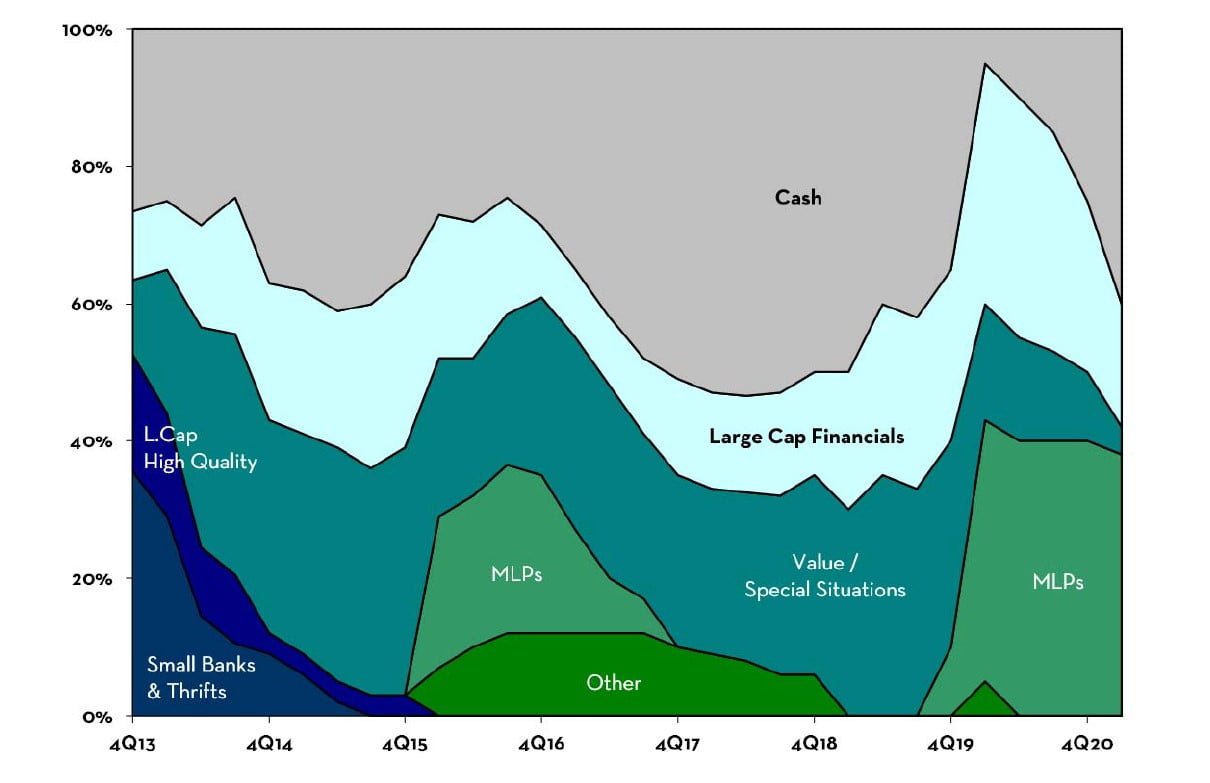

Portfolio Allocations

Below is the target portfolio allocation – the optimal allocation as of the writing of this letter. Investor separate accounts may differ from this allocation due to changes in asset prices, availability to acquire/divest securities in the marketplace, margin & trading capabilities, tax considerations, etc. Over time, all investor separate accounts converge upon the target portfolio allocation.

- Energy Infrastructure / Master Limited Partnerships (MLPs): 38% NAV

Energy infrastructure companies with assets indispensable to the smooth function of modern society. Commodity price volatility, shareholder turnover, forced selling, and uncertainty related to the long-term demand of fossil fuels have driven prices to extremely attractive levels. Our diversified basket of MLPs currently trades, on average, at 8% NOI and 16% Cash on Cash, paying dividends averaging ~8% per year. These figures are based on the low-end of management guidance that do not take into account higher profits from continued vaccination rollout, increased human mobility, activity, and consumption. Our MLPs investments remain attractively priced with significant future upside potential. See our 2019 4th Quarter Letter for a detailed discussion of our MLP investment thesis.

- Large-Cap Financials: 18% NAV

Financial infrastructure companies whose services are essential to the smooth function of modern society. Last year, investors (incorrectly) fearing a repeat of the Great Financial Crisis (“GFC”) of 2008-2009 fled the sector, driving prices down precipitously. We took the opportunity to increase our allocation. Our thesis that strong capital ratios and high-quality loan portfolios would prevent a repeat of the GFC has since proven correct. Our banks have reported low loan losses, released provisions, and higher earnings in recent months. Annual normalized earnings of large banks will remain robust at ~11-12+% ROE even with low or negative interest rates, with additional uplift possible through adoption of technology and automation (lower personnel and real estate occupancy costs). Because we paid bargain prices averaging ~74% of book value, we expect this basket will return ~14-16%+ annualized for many years into the future. See our 2020 2nd Quarter Letter (The Case For Large Banks) for a detailed discussion of our large bank investment thesis.

- Value / Special Situations: 4% NAV

Public securities undergoing spin-offs, recapitalizations, restructurings, liquidations, etc. The share price performance of securities in this category are often not correlated with general market activity, but instead tied to the unique circumstance(s) embedded in each position. Because circumstances such as business strategy decisions take time to implement, and market participants require time to process the implications of these decisions, the timeframes necessary for securities to move from our purchase price to where we believe they are truly worth can range from months to multiple years, making for attractive but lumpy expected returns.

- Cash & Cash Equivalents: 40% NAV

This category will fluctuate depending on attractive investment opportunities available in the marketplace. We are also collecting cash dividends of ~3% each year, which will add to the cash balance over time.

Historical Target Portfolio Allocation %:

Portfolio Return* Analysis & Future Positioning

The Portfolio* returned +20.9% (net) during the 1st Quarter of 2021.

What a difference one year makes! This time last year, the world was only beginning to digest the pandemic’s economic and policy implications. During those dark days, our process guided our cleareyed and aggressive buying of attractive investments at bargain prices. Fast forward one year, our efforts have been rewarded with outsized performance gains. Trough to peak, our portfolio has rebounded ~150%.

The United States is currently administering 3mm+ vaccine doses per day, and ~80% of the most vulnerable population (age 65+) has received at least one dose1 of a COVID vaccine. Given these statistics, we predict personal air travel, indoor dining, social gatherings, etc. will soon, once again, become socially acceptable behavior. Business/corporate travel and events will resume as associated social stigma (and liability potential) fades.

The resulting increase in human mobility, activity, and consumption will translate into higher profits for our MLP, large-cap bank, and other investments. In fact, many of our investments have already experienced significant price appreciation as other market participants have begun to arrive at this same conclusion. During the 1st quarter, on average, our large-cap bank securities appreciated ~23% and our MLP securities appreciated ~37%, vastly outperforming the S&P 500’s 6.5% return.

The price of RICK soared 70%+ this quarter, ending ~8x higher than what we paid for shares a year ago at the start of the pandemic. As a result, we have fully exited our investment in RICK. At today’s price of ~$70/share, in order for future upside to materialize, club and restaurant reinvestment economics would have to remain high AND the availability and cost of bank financing would have to remain favorable. While we have great respect for the capabilities of RICK’s management team, availability and cost of bank financing is not entirely within their control. The current valuation is predicated upon the continuation of a virtuous cycle of abundant and cheap cost of capital invested at high rates of return, which can easily unravel if one or the other disappears. Hence, while additional upside is certainly possible, we would prefer to let others assume that risk-reward.

During the quarter, we also lightly trimmed a few banks and MLPs as prices moved higher (similar in rationale to how, as prices moved lower, we bought more). For example, we trimmed DCP Midstream and Fifth Third Bank which has appreciated ~5x and ~3x, respectively, from when we last purchased shares one year ago. Even so, our exposures to large-cap banks and MLPs remain significant because both areas have ample future upside potential.

Our cash position is now ~40% of NAV, replenished and ready for the next round of future opportunities, for which we are actively preparing. When that day arrives, we intend to strike fast and without hesitation because we will already know what we want to buy and at what price. These preparation efforts are primarily focused on researching investments in areas/sectors adjacent to what we currently own or have owned in the past.

Whatever the future may bring, our portfolio is positioned in such a manner to capitalize. Should economic circumstances continue to improve, our existing investments remain attractively priced and will provide ample performance upside. Should economic circumstances deteriorate, our existing investments are storm-tested to withstand adversity, and we will be well-prepared to deploy our cash into the next round of future opportunities.

We look forward to continuing our capital compounding adventures in the years ahead. As always, thank you for your trust.

Yours very truly,

Vivian Y. Chen, CFA

Portfolio Manager

Marram Investment Management LLC